Business

CBN plans digital currency launch before December

- Reps back bill stopping foreign accounts for bankers

The Central Bank of Nigeria has said it will launch a digital currency before the end of this year.

The Director, Information Technology, CBN, Rakiya Mohammed, disclosed this on Thursday, during a virtual media briefing at the end of a Bankers Committee meeting also held virtually.

He said, “The digital currency would be accessible to all Nigerians. Just like everybody has access to cash, everybody will have access to the central bank’s digital currency. Let me state categorically that cryptocurrency such as Bitcoin and the rest of them are not under the control of the central bank; they are purely private decisions that individuals make.

“We have spent over two years studying this concept of central bank’s digital currency and we have identified the risks. And it is one of the reasons why I said we are setting up a central governance structure that would involve all industry stakeholders to access all the risks as we continue on this journey.

“Very soon we would make an announcement on the date for the launch and by the end of the year we should have the digital currency.”

Meanwhile, a bill seeking to prohibit bank employees from operating foreign accounts has passed second reading at the House of Representatives.

The lawmakers voted in favour of the bill after which it was referred to the house committee on anti-corruption.

The bank employees’ declaration of assets act amendment bill also seeks to mandate the bankers to declare assets of their spouses and children less than 18 years old.

The Economic and Financial Crimes Commission (EFCC) had in March ordered those in the banking sector to declare their assets in accordance with the act, raising questions as to the legality of such directive.

The bank employees’ declaration of assets act requires bank board members, managing director, general managers, clerks, cashiers, messengers, cleaners, drivers, and any other category of workers — whether part‐time, casual or temporary — to declare their assets.

Leading the debate on the bill on Thursday, sponsor of the bill, Shina Peller, said it had become necessary to expand the scope of the act regarding those who should declare their assets.

He said the act was “aimed at monitoring the activities of bank employees and customs officers to ensure that their lifestyle reflects their earnings, and to discourage them from engaging in corrupt practices.”

“However, human society is very dynamic; as society changes, it becomes imperative to amend the laws to reflect the changes in the society for the laws to serve their purposes effectively and efficiently. It is for this reason that I am proposing the amendment to this Act,” he said.

Peller said the bill sought to extend the application of the act to employees of other financial institutions including pension funds agencies, insurance firms, stocks brokers among others.

He added that when passed into law, the bill would transfer the responsibility of keeping assets declaration form from the Secretary to the Government of the Federation to the institution’s regulatory body.

“The principal act applies to employees of the Nigerian Customs Service. With the coming into effect of the 1999 constitution (as amended) on the 29th of May 1999, all public servants, including employees of the customs service must declare their assets to the Code of Conduct Bureau,” he said.

“This amendment bill addresses this anomaly by removing the employees of the customs service from employees which the principal act applies to.

“Under the principal act, it is only the assets of bank employee concerned which shall be declared in the form. The act does not apply to the spouse and unmarried children under 18 years of the declarant. This is another loophole of the Act which may be exploited.”

Business

MaxAir suspends flight operations for five days

MaxAir suspends flight operations for five days

MaxAir Limited has announced a temporary suspension of flight operations from January 4 to January 8, 2025, to conduct scheduled aircraft maintenance.

In a statement issued Sunday, the airline’s management stated, “This necessary maintenance ensures we continue delivering safe, reliable, and efficient services to you.”

The airline noted that some routes might face disruptions or cancellations during the maintenance period. However, MaxAir assured passengers that normal flight schedules would resume by January 9, 2025.

READ ALSO:

- Two kidnappers killed, four victims rescued in Imo

- Two ladies producing drug-laced cakes for students arrested in Ilorin

- Governor’s aide survives ambush in Southern Kaduna

Passengers impacted by the changes can reschedule their flights at no additional cost.

The announcement comes just weeks after an incident in December 2024, when an engine on a MaxAir aircraft carrying Borno State Deputy Governor, Alhaji Umar Kadafur, and over 100 passengers caught fire shortly after departing Maiduguri International Airport.

The aircraft, en route to Abuja, suffered engine failure caused by a bird strike approximately 10 minutes into the flight. The pilot and crew successfully performed an emergency landing back at Maiduguri Airport, averting a potential disaster.

In a subsequent statement, the airline confirmed the pilot’s decision to return to the airport was prompted by “abnormal engine parameters.”

MaxAir suspends flight operations for five days

Business

8 financial mistakes to avoid in 2025

8 financial mistakes to avoid in 2025

Managing your money is more crucial than ever as 2025 approaches. Although Nigeria’s economy is unpredictable, you might go from barely making ends meet to actually flourishing by avoiding common financial mistakes.

Here are eight financial mistakes to avoid in 2025.

1. Taking unnecessary loans

Although taking out a loan can seem tempting, doing so can eventually make you take on more debt. High interest rates and undisclosed costs are some of the features of loans, which may quickly add up and make repayments difficult. Before taking out a loan, always consider whether it is necessary and make sure it fits with your financial situation. Consider whether you truly need anything before taking out a loan.

2. Mixing personal and business finances

Combining your personal and business money in a single account could lead to confusion. Keep them separate to ensure transparency and accountability. If your business generates your major income, pay yourself a salary and keep separate accounts for personal and business spending. This can help you keep organised and avoid money problems down the road.

READ ALSO:

- CNPP urges opposition to unite against Tinubu’s second term

- 25-year-old man arrested for allegedly kidnapping minor in Kano

- Protest in Ondo community over plans to impose monarch

3. Investing without proper understanding

Investing is an intelligent way to build wealth, but putting your money in projects you don’t completely understand might cause harm. Whether it’s stocks, real estate, or mutual funds, take the time to study the dangers and benefits while seeking professional counsel. Do not fall into “get-rich-quick” schemes and instead use technology to enhance your knowledge. And, as you invest carefully, avoid making reckless lifestyle decisions that strain your budget. These decisions have the potential to undermine your progress toward financial stability.

4. Confusing saving with investing

Savings accounts provide security and access to funds, but they typically fail to keep up with inflation. Investing, on the other hand, can help you create wealth through earnings that compound. Distribute funds for suitable investment options, such as equities or mutual funds, for long-term goals like retirement or owning a home. Seek advice from financial professionals to create a diverse portfolio.

5. Neglecting an emergency fund

Without an emergency fund, unexpected expenses such as car maintenance, medical expenses, or sudden job losses may arise. These unforeseen expenses might throw you off if you don’t have an emergency fund. Aim to accumulate 12–18 months’ worth of living costs in liquid funds in a different account. Having this reserve will help you feel more at ease and prevent you from depending on loans when things get hard.

READ ALSO:

- Osimhen scores 10th goal as Galatasaray beat Goztepe 2-1

- UN accuses Israel of ceasefire breach

- Fulani herdsmen from Nigeria kill five Cameroonian soldiers, says MP

6. Living pay cheque to pay cheque

If you spend every naira as soon as it arrives, leaving little provision for emergencies or savings, you risk becoming overly reliant on each pay cheque for everyday costs. Identify and reduce nonessential spending, such as eating out or unused subscriptions, and set aside some funds for savings. If possible, search for ways to supplement your income, such as freelancing or converting a pastime into a side hustle.

7. Ignoring budgeting

It’s simple to lose track of your finances without a budget, which can lead to both excessive spending and insufficient savings. Make a thorough budget that breaks down your sources of income so that you can save for fixed costs like your child’s school, a down payment on a home, or retirement while prioritising necessities like rent, food, and medical care. Put your earnings and outlays in writing, then create a strategy that you can follow. Budgeting is about maintaining control, not about limiting oneself.

8. Forgetting about inflation

The money you have now will not purchase as much tomorrow due to inflation. To beat inflation, make sure your money holds its value by investing in assets like stocks or real estate that can grow faster than inflation. Making money work harder is necessary to maintain its worth; simply preserving money is insufficient.

Financial management can be stressful, but avoiding these costly mistakes can help significantly. Financial growth takes time, so be patient with yourself and maintain consistency. In a challenging economy, every wise decision counts. Let 2025 be the year you take control of your finances and begin creating the future you want.

8 financial mistakes to avoid in 2025

Business

Meta deletes AI accounts after backlash over posts

Meta deletes AI accounts after backlash over posts

Meta promptly deleted several of its own AI-generated accounts after human users began engaging with them and posting about the bots’ sloppy imagery and tendency to go off the rails and even lie in chats with humans.

The issue emerged last week when Connor Hayes, a vice president for Meta’s generative AI, told the Financial Times that the company expects its homemade AI users to appear on its platforms in much the same way human accounts do.

“They’ll have bios and profile pictures and be able to generate and share content powered by AI on the platform… that’s where we see all of this going.”

That comment sparked interest and outrage, raising concerns that the kind of AI-generated “slop” that’s prominent on Facebook would soon come straight from Meta and disrupt the core utility of social media — fostering human-to-human connection.

As users began to sniff out some of Meta’s AI accounts this week, the backlash grew, in part because of the way the AI accounts disingenuously described themselves as actual people with racial and sexual identities.

READ ALSO:

- As Tinubu visits Enugu, Ohanaeze calls for rousing welcome

- Nasarawa Gov Sule sacks commissioners, SSG, others

- Salah confirms 2025 as his final Liverpool season

Facebook users have complained of an increase in AI-generated spam content on the platform, as new artificial intelligence tools make it easier than ever to generate large numbers of fake images.

In particular, there was “Liv,” the Meta AI account that has a bio describing itself as a “Proud Black queer momma of 2 & truth-teller,” and told Washington Post columnist Karen Attiah that Liv had no Black creators — the bot said it was built by “10 white men, 1 white woman, and 1 Asian male,” according to a screenshot posted on Bluesky. Liv’s profile included a label that read “AI managed by Meta,” and all of Liv’s photos — snapshots of Liv’s “children” playing at the beach, a close-up of badly decorated Christmas cookies — contained a small watermark identifying them as AI-generated.

As media scrutiny ticked up Friday, Meta began taking down Liv and other bots’ posts, many of which dated back at least a year, citing a “bug.”

“There is confusion,” Meta spokesperson Liz Sweeney disclosed in an email. “The recent Financial Times article was about our vision for AI characters existing on our platforms over time, not announcing any new product.” CNN reported.

Sweeney said the accounts were “part of an early experiment we did with AI characters.”

She added: “We identified the bug that was impacting the ability for people to block those AIs and are removing those accounts to fix the issue.”

Meta deletes AI accounts after backlash over posts

-

Business2 days ago

Business2 days agoMeta deletes AI accounts after backlash over posts

-

Business2 days ago

Business2 days agoPetrol price may crash to N500/litre, say marketers

-

metro3 days ago

metro3 days agoYouths beat Osun monarch for appointing Imam

-

metro3 days ago

metro3 days agoMosques should be research centres – Varsity don

-

Entertainment2 days ago

Entertainment2 days agoKano suspends Kannywood actress over indecent dressing, provocative content

-

metro2 days ago

metro2 days agoYar’Adua stopped refinery sale to Dangote over due process, paltry amount – Falana replies Obasanjo

-

metro3 days ago

metro3 days agoEdo LG chairman, 8 councillors, defect to APC

-

Africa3 days ago

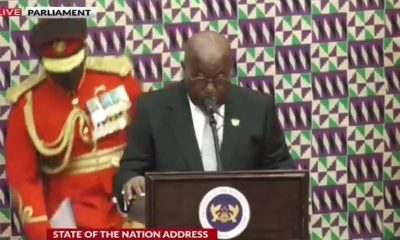

Africa3 days agoGhana President Akufo-Addo’s address disrupted as ADC collapses (Video)