Business

AfDB disagrees with Buhari, finance minister on Nigeria’s debt challenge

- Says Africa should be producing and not begging for vaccines

African Development Bank has affirmed that Nigeria has a debt challenge, with debt service gulping 73 per cent of government revenue.

President of the AfDB, Dr Akinwumi Adesina, gave the bank’s position, which is completely different from that President Muhammadu Buhari and Minister of Finance, Budget and National Planning, Zainab Ahmed, who interpret the challenge before the nation as revenue generation.

Adesina spoke on Monday at a mid-term retreat for ministers. President Buhari and Vice President Yemi Osinbajo were among the audience.

In his budget presentation to the National Assembly, Buhari in trying to assuage concerns over rising debt said, “Some have expressed concern over our resort to borrowing to finance our fiscal gaps. They are right to be concerned. However, we believe that the debt level of the Federal Government is still within sustainable limits. Borrowings are to specific strategic projects and can be verified publicly…

“Our target over the medium term is to grow our Revenue-to-GDP ratio from about eight per cent currently to 15 per cent by 2025. At that level of revenues, the Debt-Service-to-Revenue ratio will cease to be worrying. Put simply, we do not have a debt sustainability problem, but a revenue challenge which we are determined to tackle to ensure our debts remain sustainable”.

But arguing from a different perspective, Adesina said Nigeria’s debt service to revenue ratio was high at 73 per cent and urged the government to decisively tackle the challenge.

“Nigeria must decisively tackle its debt challenges. The issue is not about debt-to-GDP ratio, as Nigeria’s debt-to-GDP ratio at 35 per cent is still moderate. The big issue is how to service the debt and what that means for resources for domestic investments needed to spur faster economic growth.

“The debt service to revenue ratio of Nigeria is high at 73 per cent. Things will improve as oil prices recover, but the situation has revealed the vulnerability of Nigeria’s economy. To have economic resurgence, we need to fix the structure of the economy and address some fundamentals.

“Nigeria’s challenge is revenue concentration, as the oil sector accounts for 75.4 % of export revenue and 50 % of all government revenue.”

As of June 30, 2021, the country’s external obligations stood at $33.468 billion, according to the Debt Management Office (DMO).Domestic debt was $53.2 billion. In naira terms total national debt was N35.5 trillion.

Akinwumi further stated that what was needed for sustained growth and economic resurgence is to remove the structural bottlenecks that limit the productivity and the revenue earning potential of the huge non-oil sectors.

“Nigeria should significantly boost productivity and revenues from its non-oil sector, with appropriate fiscal and macroeconomic policies, especially flexible exchange rates that will enhance international competitiveness.”

The AfDB President further said Africa should be producing and not begging for vaccines.

According to him, the African Development Bank will invest $3 billion in support of local pharmaceutical industries in Africa, including in Nigeria.

“Nigeria must build quality health care systems that will protect its population, today and well into the future.

“Nigeria must also build world-class local pharmaceutical industries, able to effectively tackle the production of therapeutic drugs and vaccines.

“Nigeria must revamp its local pharmaceutical industry and launch strategic investments for local vaccine manufacturing. Africa should not be begging for vaccines; Africa should be producing vaccines.

Adesina also further stated the government should not be decongesting the ports in Nigeria, rather “we should be transforming the ports.

“This must start with cleaning up administrative bottlenecks, most of which are unnecessary with multiple government agencies at the ports, high transaction costs or even plain extortions from illegal taxes, which do not go into the coffers of the government.

“Nigeria should rapidly modernise and transform its ports. Ports are not there for revenue generation. They are for facilitating business and exports, and stimulating industrial manufacturing, and competitiveness of local businesses and exports,” Adesina said.

Business

Naira opens 2025 on weak note against US dollar

Naira opens 2025 on weak note against US dollar

The Nigerian naira fell to N1,541.36/$ on the first trading day of 2025, marking a 0.36% decline from the closing rate of N1,535.82/$ recorded at the end of 2024, according to NFEM data on the Central Bank of Nigeria’s website.

Some authorised dealers quoted the dollar at N1,545/$, a slight improvement from the N1,550/$ quoted earlier in the week. Others quoted the naira at N1,520/$ at the close of trading on Thursday.

In the parallel market, the naira ended the day at N1,655/$, improving from N1,670/$ quoted on Tuesday.

The naira’s performance in 2024 saw a significant depreciation of 40.9% compared to its official rate of N907.11/$ at the close of 2023.

READ ALSO:

- 2025 sends off 2024 and its baggage of rubbish

- Jealous husband stabs Bishop to death over allege affair with wife

- Police arrest couple over alleged rape, assault of minor

The decline comes despite various foreign exchange policies introduced by the Central Bank of Nigeria (CBN) to improve market transparency and attract foreign investors.

One of the notable reforms was the December launch of the Electronic Foreign Exchange Matching System, which introduced new guidelines for authorised forex dealers. This initiative brought some stability to the naira towards the end of 2024.

Meanwhile, in the money market, the Nigerian Interbank Offered Rate saw declines across all maturities, indicating liquidity in the banking sector. The Open Repo Rate dropped by 0.61% to 26.69%, while the Overnight Lending Rate fell by 0.55% to 27.25%.

Trading in the secondary market for Federal Government of Nigeria (FGN) bonds remained subdued, resulting in a marginal increase in the average yield to 19.76%. In the sovereign Eurobonds market, buying pressure across various segments of the yield curve led to a 6-basis-point decline in the average yield to 9.62%.

Naira opens 2025 on weak note against US dollar

Auto

Jetour attributes Nigeria’s award to customers loyalty, innovation

Jetour attributes Nigeria’s award to customers loyalty, innovation

Jetour has been declared the fastest growing auto brand in Nigeria.

The award was announced on Wednesday December 11, 2024 in Lagos at an impressive ceremony organised by the Nigeria Auto Journalists Association (NAJA).

Jetour representative in Nigeria, Jetour Mobility Services, has taken to its Facebook page to celebrate its customers for making this to happen, attributing the success to its commitment to innovation in creating remarkable driving experiences.

Jetour known for its luxury offerings is one of China’s most revered auto brands, a marque of Chery Holding Group established in 2018.

It mainly produces crossovers and Sports Utility Vehicles (SUVs).

The recognition of Jetour as the Fastest Growing Auto Brand in the country is coming about a year after its introduction into the Nigerian market.

Jetour arrived in Nigeria in the last quarter of last year. And the SUVs available for this market are X70 – Liberty, X70 Plus – Elegance, X90 Plus – Cruise and Dashing.

Chairman of the NAJA Awards Organising Committee, Mr Theodore Opara, said despite being new in the Nigerian market, the brand was quickly able to secure a prominent place for itself in the highly competitive industry and received considerable attention from new car enthusiasts.

The committee, he added, had no difficulty in picking the brand as the fastest growing in the Nigerian auto market.

The name “Jetour” is a combination of the word “jet” and “tour”, which according to the automaker signifies a “convenient journey”. And its models try to depict this connotation in designs and performance.

Jetour Mobility Services said it considered the award a great honour, adding that it was a validation of its commitment to innovation and creating remarkable driving experiences.

The firm celebrates the award on its Facebook page with the following comments:

“We’re honoured to be named the Fastest Growing Auto Brand of the Year at the prestigious NAJA Auto Awards, powered by the Nigeria Auto Journalists Association.

“This achievement is a testament to our commitment to innovation, quality, and creating unforgettable driving experiences.

“A huge thank you to our amazing customers and everyone who has been a part of the journey — your trust propels us forward! Cheers to more milestones ahead!”

Jetour says its focus is to be a leader in mobility as well as provide reasonable travel solutions for individuals and families.

Its goal is to provide an excellent vehicle that demonstrates individuality for today’s young people, it adds.

As in the global market, the brand users in Nigeria are said to be an uncompromising group of individuals, unwilling to settle for less.

Jetour is not only winning in Nigeria, it is also a toast of a section of the Saudi market. One of its models, Dashing, recently won the Best Midsize Crossover Award for 2023-2024.

National Automotive Supply Company, the authorised distributor of Jetour vehicles in the Kingdom of Saudi Arabia, announced that the new and advanced Jetour Dashing won the “Best Midsize Crossover” award during the awards ceremony of the 11th edition of the “PR Arabia National Automotive Award” in Saudi.

Jetour Dashing was announced as the winner at the ceremony held in mid-November in Jeddah under the patronage of the Saudi Automobile and Motorcycle Federation and in the presence of several princes and VIPs, as well as representatives of regional offices of automotive brands.

Business

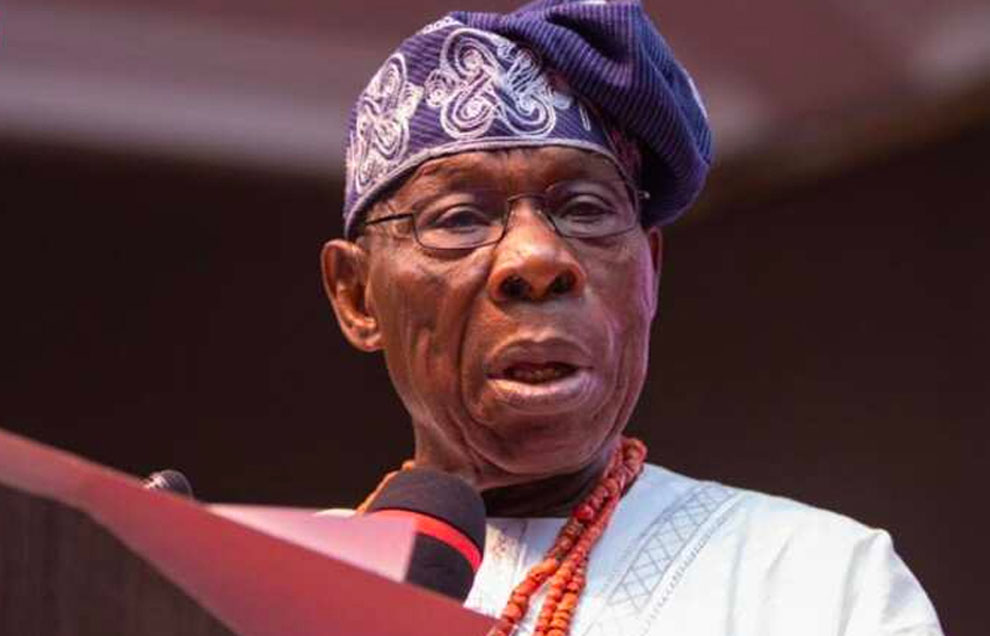

NNPC rejected Dangote $750m offer to manage Nigeria’s refineries, days Obasanjo

NNPC rejected Dangote $750m offer to manage Nigeria’s refineries, days Obasanjo

Former President Olusegun Obasanjo has disclosed that the Nigerian National Petroleum Corporation (NNPC) rejected a $750 million offer from billionaire businessman Aliko Dangote.

In an exclusive interview with Channels TV, former President Olusegun Obasanjo revealed that in 2007, Dangote offered a staggering $750 million to manage the Port Harcourt and Kaduna refineries.

Obasanjo explained that the Nigerian National Petroleum Corporation (NNPC), now rebranded as NNPCL, rejected the offer due to its inability to operate the refineries effectively.

READ ALSO:

- Why I persuaded Tinubu to reject Yar’adua’s finance minister offer – Senator Ojudu

- Fubara replies Wike: Odili right face, image of Rivers

- Why smoking cigarettes, taking alcohol not sins – Pastor Damina

He said, “Aliko got a team together and they paid $750m to take part in PPP (Public–public-private partnership) in running the refineries.

“My successor refunded their money and I went to my successor and told him what transpired. He said NNPC said they wanted the refineries and they can run it. I now said but you know they cannot run it.

“But I was told not too long ago that since that time, more than $2 billion have been squandered on the refinery, and they still will not work,” he added

NNPC rejected Dangote $750m offer to manage Nigeria’s refineries, days Obasanjo

-

metro1 day ago

metro1 day ago‘Deepen Shariah knowledge to curb misinformation’

-

metro1 day ago

metro1 day agoIlorin: Retired works controller murdered on New Year’s Day

-

metro1 day ago

metro1 day agoJealous husband stabs Bishop to death over allege affair with wife

-

metro1 day ago

metro1 day agoTinubu’s refusal to honour Seyi’s pact with us disappointing – Nnamdi Kanu’s family

-

Politics3 days ago

Politics3 days agoHow Tinubu outsmarted Buhari to become president – Ojudu

-

metro16 hours ago

metro16 hours agoMosques should be research centres – Varsity don

-

metro3 days ago

metro3 days agoHorror in Ogun as twin brothers kill, dismember sex worker

-

metro3 days ago

metro3 days agoFire razes police station, buildings in Lagos