News

DHQ, police, 22 other govt agencies face power disconnection over debt

DHQ, police, 22 other govt agencies face power disconnection over debt

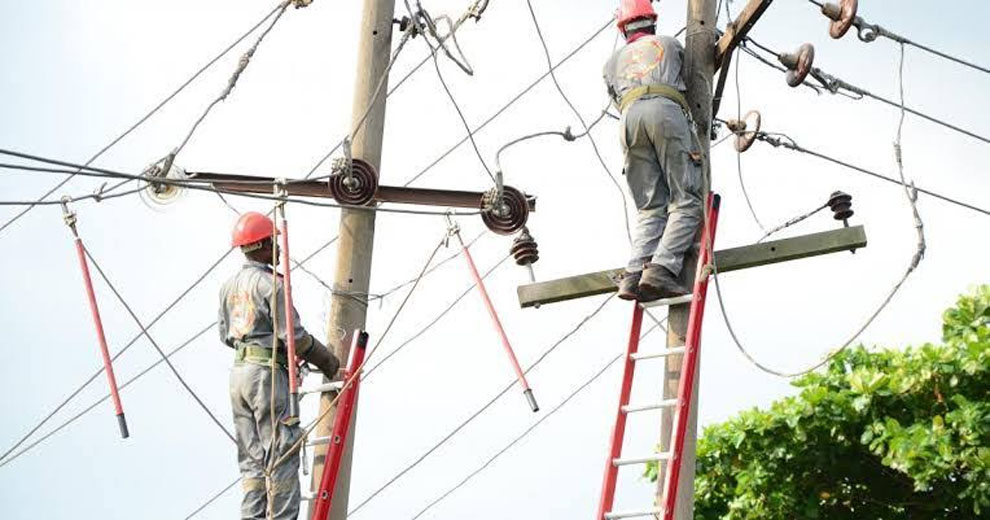

The Abuja Electricity Distribution Company (AEDC) has announced its decision to disconnect 24 federal government establishments.

The ministries, departments and agencies as well as facilities belonging to Kogi and Niger state governments are due for disconnection tomorrow over unpaid electricity bills amounting to about N100 billion.

The electricity company, in a statement issued in Abuja yesterday, emphasised the importance of timely payment of bills to maintain and improve its infrastructure, which it said is essential for delivering reliable electricity services.

The AEDC’s statement reads: “This is to inform the general public that AEDC will disconnect all customers with outstanding electricity bills on June 3, 2024.

“Timely payment of electricity bills is crucial for the continued operation and enhancement of AEDC’s infrastructure, ensuring we can deliver efficient and reliable service to our community.

“We therefore urge all customers with debts to pay all outstanding bills before the deadline to avoid service interruption.”

READ ALSO:

- Majority of those seeking our support are Nigerian UK students – Food charity manager

- Killing of soldiers, enforcing sit-at-home orders treasonable – Tinubu

- Israeli ministers threaten to quit over ceasefire plan

The organisations facing disconnection on Monday include Nigeria Army; Nigeria Air Force; Defence Headquarters; Federal Capital Development Authority; Kogi State Government; Niger State Government; Nigeria Police Force Headquarters and Nigerian Army Barracks.

Others are Power House; Secretary to the Government of the Federation (SGF) House I; Head of Service; Federal Ministry of Education; Federal Ministry of Women Affairs; Federal Ministry of Industry, Trade and Investment; Federal Ministry of Interior; Federal Ministry of Water Resources.

Also penciled down for the Monday disconnection exercise are the National Stadium Abuja; Goodluck Jonathan Athletics Hall; Federal Ministry of Finance; Federal Ministry of Education; Federal Ministry of Budget and Economic Planning; Federal Ministry of Works; Federal Airports Authority of Nigeria (FAAN) Abuja and all other customers owing AEDC

The AEDC reiterated its call for all customers with outstanding debts to settle their bills before the Monday deadline to avoid disconnection.

READ ALSO:

- Armed robbers take off, drop ammunition in Enugu after sighting police

- Violence breaks out in Rivers community, one killed [VIDEOS]

- Real Madrid rule European football again, triumph over Dortumond 2-0

The situation remains tense as Nigerians wait to see if government would settle the debts or the major institutions aforementioned will face power outage.

This move by the AEDC underscores the financial strain unpaid bills have place on utility providers, potentially affecting the quality and reliability of essential services.

The electricity company urged all indebted customers to act swiftly to ensure uninterrupted electricity supply.

Last week, the Chairman of Transnational Corporation (Transcorp Group, part owners of the AEDC), Mr. Tony Elumelu, pleaded with the federal government to prevail on the Nigerian Bulk Electricity Trading Plc (NBET) to repay the over N2 trillion it owes power generation companies (GENCOs).

Elumelu explained that despite the substantial debts, GENCOs continue to produce electricity, thereby effectively subsidising the sector.

“This situation hampers their ability to pay gas suppliers, leading to reduced and unreliable gas supplies, which are crucial since 80 per cent of Nigeria’s power comes from gas-fired plants,” he said.

DHQ, police, 22 other govt agencies face power disconnection over debt

News

Agege Council Announces Free 3kg Cooking Gas Refill for 4,000 Residents

Agege Council Announces Free 3kg Cooking Gas Refill for 4,000 Residents

The Chairman of Agege Local Government Area, Abdulganiyu Obasa, has announced a free 3kg cooking gas refill programme for 4,000 residents of the council area.

Obasa made the announcement via a post on X on Friday, stating that the initiative is aimed at reducing household energy costs and providing immediate relief at the grassroots amid rising prices of Liquefied Petroleum Gas (LPG).

According to the council chairman, beneficiaries will be selected from the seven wards in Agege, with equal allocation across all wards to ensure fairness, accessibility, and inclusiveness.

“As part of our continued commitment to easing the daily burdens faced by our people, I am pleased to announce a free cooking gas refill programme for 4,000 residents across the seven wards in Agege,” Obasa said.

He explained that designated gas refill stations have been assigned to each ward, adding that the distribution would run on a first-come, first-served basis. Residents are required to bring their personal gas cylinders, as only refill services will be provided.

READ ALSO:

- Tinubu Summons Aiyedatiwa Over APC Congress Violence, Monarch’s Murder

- FCT Polls: S’Court, A’Court Defy Wike’s Public Holiday, Continue Judicial Activities

- Lassa Fever Deaths in Nigeria Rise to 51 After 15 Killed in Early February – NCDC

Obasa warned that once the allocated slots for any ward are exhausted, the exercise would be concluded in that location.

The council boss said the intervention is part of measures to cushion the impact of rising gas prices, support vulnerable households, and promote the use of cleaner and safer cooking energy.

“This is one of several people-focused programmes we are implementing to improve quality of life, encourage clean energy adoption, and demonstrate that governance must be felt where it matters most — in our homes and communities,” he stated.

Obasa is the son of the Speaker of the Lagos State House of Assembly, though the council stressed that the initiative is part of its local social intervention programmes.

The announcement has attracted mixed reactions on social media, with many residents welcoming the scheme as timely relief amid economic pressure.

However, some critics questioned the sustainability of the intervention, arguing that job creation, empowerment programmes, and small business support would provide more long-term economic solutions.

As of the time of filing this report, no official response had been issued by Obasa to the criticisms, though council officials said further details on distribution dates and locations would be communicated through official channels.

Agege Council Announces Free 3kg Cooking Gas Refill for 4,000 Residents

News

UniAbuja Student Sadiya Usman Found Safe After Two Days Missing

UniAbuja Student Sadiya Usman Found Safe After Two Days Missing

The University of Abuja (UniAbuja) has confirmed that 100-level student Sadiya Usman has been found safe after being reported missing earlier this week. The university expressed relief and gratitude to the public and security agencies for their assistance in locating the student.

Sadiya Usman, who is enrolled in the Department of Accounting, was last seen leaving her residence at Kontagora Estate, Gwagwalada, Abuja, on Tuesday, 18 February 2026, at around 8:00 a.m. She was on her way to the university’s Main Campus to sit for her Computer-Based Test (GST 111) but did not arrive for the exam.

READ ALSO:

- Lassa Fever Deaths in Nigeria Rise to 51 After 15 Killed in Early February – NCDC

- Mob Kills Injured Motorcycle Rider After AK‑47 Rifles, Ammunition Found in Crash Scene

- Tacha Condemns False Rape Allegations After Mirabel Admits Fabrication

After her disappearance, her guardian reported her missing when all attempts to reach her by phone were unsuccessful. The university promptly activated internal safety protocols and collaborated with security agencies, campus authorities, and the public to ensure her safe recovery.

The student was eventually located late on Thursday, 20 February 2026, around 11:49 p.m., and is reported to be safe, unhurt, and in stable condition. Authorities confirmed that coordinated efforts between the university, law enforcement, and concerned members of the public were instrumental in her recovery.

The university reaffirmed its commitment to student safety and welfare, promising continuous updates as necessary. It also thanked those who responded to the public appeal for information and urged students and parents to remain vigilant about safety.

This incident highlights the importance of campus security measures, timely reporting of missing persons, and the role of community involvement in safeguarding students.

UniAbuja Student Sadiya Usman Found Safe After Two Days Missing

News

Police to Arrest TikToker Mirabel After She Recants False Rape Claim

Police to Arrest TikToker Mirabel After She Recants False Rape Claim

The Ogun State Police Command has confirmed plans to arrest and prosecute TikTok user Mirabel after she admitted that her viral rape allegation was false, authorities and investigative reports indicate.

Mirabel, a social media influencer, first sparked national attention after posting videos alleging she had been sexually assaulted in her home in Ogijo, Ogun State. The posts quickly went viral, drawing widespread outrage, calls for justice, and prompting the police to launch an immediate investigation.

An audio recording of a phone conversation, shared online by social media personality VeryDarkMan (VDM), reportedly captures Mirabel acknowledging that parts of her story were fabricated. In the recording, she apologises and admits creating a threatening TikTok account to support her narrative, claiming she had been taking drugs at the time and “was not thinking clearly” when posting the videos.

READ ALSO:

- Again, Early Morning Blaze Destroys Dozens of Shops in Kano Market

- Suspected Terrorists Warn Kebbi Residents: Pay ₦100 Million or Face Attack

- ICPC Searches El-Rufai’s Abuja Home Amid Multi-Agency Corruption Investigation

A police source said senior officers, including the Divisional Police Officer, were at the hospital where Mirabel was receiving medical care. Once she is discharged, she will be taken into custody and formally charged under provisions of Nigeria’s Criminal Code relating to false reporting of sexual offenses. “The essence is to serve as a deterrent to others,” the source added.

The Ogun State Police had earlier ensured that Mirabel received medical treatment and support, following procedures to protect her health while the investigation continued. The Lagos State Domestic and Sexual Violence Agency (DSVA) confirmed that the incident fell outside its jurisdiction and forwarded all relevant information to the Ogun authorities.

This development has sparked public debate about the responsible use of social media, the impact of false allegations, and the importance of evidence-based reporting. Legal experts warn that fabricating sexual assault claims can carry serious criminal penalties and may undermine the credibility of genuine victims.

Authorities continue to urge the public to avoid spreading unverified claims and to cooperate with law enforcement in ongoing investigations. Updates on the case will be issued by the Ogun State Police Command as formal legal proceedings begin.

-

International2 days ago

International2 days agoCanada Opens New Express Entry Draw for Nigerian Workers, Others

-

Politics22 hours ago

Politics22 hours agoPeter Obi Launches ‘Village Boys Movement’ to Rival Tinubu’s City Boys Ahead of 2027

-

News3 days ago

News3 days agoKorope Drivers Shut Down Lekki–Epe Expressway Over Lagos Ban (Video)

-

News1 day ago

News1 day agoPolice to Arrest TikToker Mirabel After She Recants False Rape Claim

-

International1 day ago

International1 day agoEpstein, Ex-Israeli PM Named in Alleged Profiteering From Boko Haram Crisis

-

metro2 days ago

metro2 days agoOsun Awards 55.6km Iwo–Osogbo–Ibadan Road Project to Three Contractors

-

Politics2 days ago

Politics2 days agoUpdated: Rivers Senator Mpigi Barinada dies at 64

-

metro2 days ago

metro2 days agoOndo Monarch Killed as Bandits Strike Akure North