Business

Emefiele: Our decision on cryptocurrency in Nigeria’s interest

- ICPC, SEC back CBN

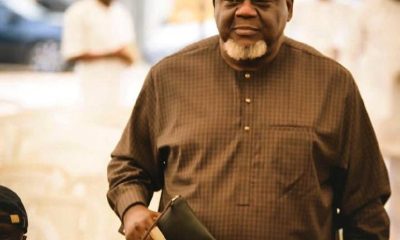

Central Bank of Nigeria, Mr Godwin Emefiele, has defended the apex bank’s ordering of banks, non-banking and other financial institutions not to facilitate trading and dealings in cryptocurrencies is in the nation’s best interest.

He stated this while briefing a joint Senate Committee on Banking, Insurance and Other Financial Institutions, ICT and Cybercrimes, and Capital Market, on its directive banning cryptocurrency trading.

He said the operations of cryptocurrencies were dangerous and opaque.

The Independent Corrupt Practices and Other Related Offences Commission (ICPC) and the Nigerian Financial Intelligent Unit (NFIU), which also addressed the joint committee, said cryptocurrency was being used as a channel for funding violence and terrorism in Nigeria.

Emefiele said the use of cryptocurrency contravened the law, adding that the fact that cryptocurrencies are issued by unregulated and unlicensed entities, made it contrary to the mandate of the CBN, as enshrined in the CBN Act (2007) that empowers it as the issuer of legal tender in Nigeria.

Emefiele also differentiated between digital currencies, which apex banks can issue, and cryptocurrencies issued by unknown and unregulated entities.

He said that the anonymity, obscurity and concealment of cryptocurrencies made them suitable for those indulging in illegal activities such as money laundering, terrorism financing, purchase of small arms and light weapons and tax evasion.

Citing instances of investigated criminal activities that had been linked to cryptocurrencies, he stated that the legitimacy of money and the safety of Nigeria’s financial system were central to the mandate of the CBN.

“Cryptocurrency is not legitimate money because it is not created or backed by any central bank.

“Cryptocurrency has no place in our monetary system at this time and cryptocurrency transactions should not be carried out through the Nigerian banking system,” he said.

Emefiele faulted arguments that the CBN’s actions were inimical to the development of FinTech or a technology-driven payment system.

He stated that the Nigerian payment system, boosted by reforms driven by the CBN had evolved over the past decade, surpassing those of many of its counterparts in emerging frontier and advanced economies.

While urging that the issue of cryptocurrency be treated with caution, the CBN governor assured the committee that the bank would continue its surveillance and deeper understanding of the digital space.

He stated that the ultimate goal of the CBN was to do all within its regulatory powers to educate Nigerians on emerging financial risks and protect the financial system from the activities of currency speculators, money launderers, and international fraudsters.

Director-General of the Securities and Exchange Commission (SEC), Mr Lamido Yuguda, said there was no policy contradiction between the CBN directive and the pronouncements by the SEC on cryptocurrencies dealings in Nigeria.

He said the SEC made its pronouncement at the time to provide regulatory certainty within the digital asset space due to the growing volume of reported flaws.

He added that the CBN, Nigeria Deposit Insurance Corporation (NDIC) and the SEC between 2018 and 2020 had warned on the lack of protection in investments in cryptocurrency.

Yuguda said following the CBN directive, the SEC had suspended the admittance of all persons affected by CBN circular into its proposed regulatory incubatory framework in order to ensure that only operators in full compliance with extant laws and regulations were admitted into the framework for regulating digital assets.

Chairman of the ICPC, Prof. Bolaji Owasanoye (SAN), spoke on the risks of investing in virtual assets and cryptocurrencies in Nigeria.

He said cryptocurrencies posed serious legal and law enforcement risks for Nigeria due to its opaque nature and illicit financial flows.

He added that the current move by the Federal Government to link National Identification Numbers with SIM cards attested to the fact that terrorists, kidnappers, bandits and perpetrators in illegal acts had relied on the shield provided by anonymity to commit crimes.

Auto

FG deploys Lanre Shittu CNG buses as airport shuttle

FG deploys Lanre Shittu CNG buses as airport shuttle

The Federal Government has commenced the deployment of Lanre Shittu Motors (LSM)-branded Compressed Natural Gas (CNG) buses in the nation’s airports for passengers shuttle.

The first batch of the CNG-powered buses has been launched at the Murtala Muhammed Airport, Lagos, at a ceremony attended by the Minister of Aviation and Aerospace Management, Festus Keyamo, and Managing Director, Federal Airports Authority of Nigeria (FAAN), Mrs Olubunmi Oluwaseun Kuku.

Speaking during the unveiling at the Lagos airport, the minister said the deployment was in line with the directive of President Bola Tinubu.

He said it was part of Nigeria’s commitment to reducing carbon emissions and meeting global climate targets.

‘’What you see here today is a fleet of CNG buses for FAAN to commence passenger movement at all our airports immediately,” the minister said.

He said the newly acquired CNG-powered LSM buses unveiled at the Lagos airport are eco-friendly with zero emission and designed with accessibility features for persons with disabilities.

The deployment, he added, was in compliance with the President’s goal of reducing reliance on traditional fossil fuels of petrol and diesel and promoting sustainable use of CNG to power vehicles in the country.

The introduction of the CNG to power automobiles is one of the Federal Government’s initiatives to ease the impact of fuel subsidy removal on the masses.

The CNG buses, according to the Managing Director of Lanre Shittu Motors, Taiwo Shittu, come in two specifications: a 31-seater for airport shuttle services and a 54-seater for mass transit city buses.

He said they had been equipped with modern amenities, including air conditioning, viewing screens, and charging stations.

With the introduction of the CNG buses, he said LSM aimed to provide a more sustainable and efficient transportation solution not only to Lagos but other parts of the country.

Auto

LSM MD extols founder’s qualities after latter posthumous industry award

LSM MD extols founder’s qualities after latter posthumous industry award

*He left us a good name, says son

Founder and late Chairman of Lanre Shittu Motors (LSM), Alhaji Olanrewaju Shittu, has been honoured with a Nigerian auto industry posthumous award.

This was announced in Lagos at the 2024 edition of the annual

Nigeria Auto Journalists Association (NAJA) announced this in Lagos at the 2024 recently industry awards.

The prestigious award was received by one of his sons, Mr Taiwo Shittu, who is also the managing director of the auto company.

NAJA said the award was in acknowledgement of the leading role of the LSM founder in the development of the automotive business in Nigeria, describing him as a silent achiever.

Speaking on the honour, Taiwo Shittu, who was also declared the Nigeria’s Auto Personality of the Year, praised his father for painstakingly building the LSM brand and leaving behind a good name to the delight of the children and the entire family members.

He described this as a legacy accounting for the success of the company so far since his father’s demise over a year ago.

He said, “I must thank my late father, Alhaji Razaq Olanrewaju Shittu, for building the brand name. There is nothing like a good name.

“If you don’t leave anything for your children other than a good name, the sky is the limit for them.

“In our own case, he left us money and the good name. We can’t thank him enough for leaving us with a good name.

“You can imagine that everywhere we turn to in the country, once we mention we are Lanre Shittu’s sons, we are ushered in immediately.

“People would say ‘Your father was a good man. He won’t cheat you if you did any business with him. His word was his bond; he never broke his promises’. I have heard this many times. And the only thing we can do is to build on this legacy.”

Taiwo Shittu also noted that the unity existing among the 20 surviving children of the late LSM founder was part of his father’s legacies and something for other family businesses in Nigeria to emulate.

He said, “A lot of businesses collapse after the death of their owners. Once a business founder is dead, the next you hear is that a fight has broken out and while one person is taking the arm, another is claiming the leg, the other is going for the body. And in six months, the whole empire is gone down.

“In our case, we have 20 siblings that are cooperative and believe in my ability to lead the business with my other brothers.

“We had a father who never spoiled us. He taught us sincerity, commitment and accountability.”

He also spoke about the lifestyle of the late father, saying even though he was a car dealer and loved cars, he would only change his main car after every 10 years.

“Yes, he loved cars. He used to have a Rolls Royce. But he no longer had it before he died. What he had was a Mercedes-Benz Maybach. His car garage was not packed full. Even though he was a car dealer, he changed his main car every 10 years.

“He was a very prudent man. At the beginning of his adult life, he had many cars; in the middle, he was prudent. It was at the end that he bought some flashy cars such as Lexus L600, MayBach 650 engine – at that time only he and ex-President Muhammadu Buhari had that car. He bought the car then because the family was preparing for three weddings. By time he died, the MayBach had only run 600 miles.”

The LSM chairman, according to him, started the auto business in the late 1970s as a car dealer with three vehicles.

He said he was so creditworthy that many were willing to release their vehicles to him on credit, adding that this helped the business to grow faster.

He recalled how he would travel to Ogbomosho, Oyo State, and Kaduna to buy cars and returned to Lagos with double the number he could readily paid for.

“Sometimes, he would travel as far as Kaduna to buy 12 cars from PAN, he would be the person driving the last vehicle while others were ahead driving all the way to Lagos,” he stated.

Before delving into automobile assembling, he also recalled that Daewoo and Rolls Royce were the two brands that gave the LSM a real breakthrough.

Business

Nigeria remains oil/gas investment destination with $5bn shell FID – TDF

Nigeria remains oil/gas investment destination with $5bn shell FID – TDF

The Democratic Front (TDF) has announced that Shell’s $5 billion Final Investment Decision (FID) for the Bonga North Deep Offshore field further highlights the investment-friendly approach of the Tinubu administration.

This was disclosed in a statement signed by the Chairman, Mallam Danjuma Muhammad, and Secretary, Chief Wale Adedayo.

The group explained that the investment demonstrates how International Oil Companies (IOCs) still see Nigeria as an attractive destination for investments.

“We join President Bola Tinubu in celebrating the Final Investment Decision (FID) by Shell on Bonga North Offshore Field.”

“It is a thing of pride for us that the investment is the outcome of reforms introduced by the President through the Presidential Directives numbers 40, 41, and 42 to fast-track regulatory approvals, reduce operational costs, and promote competitive fiscal incentives in the oil and gas sector.”

READ ALSO:

- Baby freezes to death overnight in Gaza as ceasefire delays

- I was not removed by Tinubu – Ex-Women Affairs minister [VIDEO]

- Ghanaian president approves visa-free entry for all Africans

“We have a conviction that the pertinence of the fresh investment in the sector and indeed the larger Nigeria economy is not only limited to the $5 billion value of the investment but also extends to the field’s potential volume of 350 million barrels of crude oil. It is a development that is bound to further raise the nation’s oil output and revenue as well as bolster its position as Africa’s largest oil producer.”

The group noted that this and other strategic investments, such as TotalEnergies’ $500 million in the Ubeta gas field, are driven by President Tinubu’s fiscal incentives, showcasing the success of his reforms in attracting foreign direct investment to Nigeria’s oil and gas sector.

“The Ubeta upstream field is estimated to produce 350 million standard cubic feet of gas per day when operational and will go a long way to raise the country’s profile as a major gas producer. This remarkable economic feat was unarguably achieved under the economic reform of President Bola Tinubu.”

“It is instructive that since its discovery in 1996, the Bonga deepwater field, located in OML 118, at a water depth exceeding 1000 meters, has not witnessed such a humongous investment as the $5 billion coming from Shell and this is an attestation of President Tinubu’s pro-business approach to governance.”

“Furthermore, this extraordinary display of confidence in Nigeria’s investment ecosystem is a confirmation of the success of the current reforms in eliminating investment encumbrances and the risks of doing business in Nigeria.”

TDF is confident that more IOCs will key into the fiscal incentives introduced by the Tinubu administration to make fresh investments in Nigeria’s oil and gas sector.

Nigeria remains oil/gas investment destination with $5bn shell FID – TDF

-

Business2 days ago

Business2 days agoBe creative, monarch, others challenge Muslim professionals on economic revival

-

Auto1 day ago

Auto1 day agoLSM MD extols founder’s qualities after latter posthumous industry award

-

Entertainment2 days ago

Entertainment2 days agoMultiChoice announces free access to all DSTV channels for 3 days

-

metro2 days ago

metro2 days agoJigawa State governor loses son 24 hours after mother’s death

-

News1 day ago

News1 day agoNigeria Customs Service begins 2025 recruitment [How to apply]

-

metro1 day ago

metro1 day agoHeavy security in Ilesa as ex-Osun deputy gov emerges new Owa-Obokun

-

metro1 day ago

metro1 day agoLagos Imam to Tinubu: You haven’t disappointed us

-

metro1 day ago

metro1 day agoDangote, Tinubu, Lookman named among 100 most influential Africans in 2024 (Full list)

You must be logged in to post a comment Login