Insurance

Lasaco Assurance rebrands subsidiaries, announces new leadership for trading & investment

Lasaco Assurance rebrands subsidiaries, announces new leadership for trading & investment

Lasaco Assurance Plc, a leading insurance and financial services provider in Nigeria, has announced the rebranding of its subsidiaries, Lasaco Properties Limited (LPL) and Lasaco Trading and Investment Limited (LTIL) as part of its strategic initiative to enhance operational efficiency and market competitiveness.

This is contained in statement by the company obtained by Newstrends on Sunday.

The Group offers diversified services in real estate and financial investments, underpinned by a commitment to excellence, innovation, and sustainable value creation.

In a key leadership restructuring, Mr. Akinwale Sofile, a seasoned finance and investment expert, has been appointed as the new Managing Director of Lasaco Trading and Investment Limited (LTIL), according to the statement. Mr. Sofile, formerly the Chief Financial Officer (CFO) of Lasaco Assurance Plc, brings a wealth of experience in financial management, investment strategy, and corporate governance. His appointment underscores Lasaco Assurance’s commitment to strengthening its investment arm and driving sustainable growth.

The Board of Lasaco Assurance Plc says it has strong confidence in Sofile’s capability to lead LTIL, considering his extensive financial expertise and haven demonstrated leadership skills within the group which is expected to be harnessed into driving LTIL towards increased profitability and market growth.

READ ALSO:

- Major shake-up in Army, GOCs, other top officers redeployed

- Police arrest gang leader in abduction of Akwa Ibom monarch

- Arsenal record slim victory over Manchester United at Old Trafford

“The board believes that, with his exposure, LTIL will significantly contribute to improving the overall performance of the group,” it stated.

Meanwhile, Lasaco Properties Limited (LPL) will continue under the capable leadership of Mr. Olumide Jayeola, a highly experienced executive with qualifications in Project Management, Estate Management, Law, and Theology. Mr. Jayeola has successfully expanded LPL’s presence in the real estate sector, delivering top-tier services in project development, joint ventures, project management, and property/facility management within Lagos, with plans to extend into other viable urban markets across Nigeria.

The rebranding of LPL and LTIL reflects Lasaco Assurance’s forward-thinking approach to business transformation. The subsidiaries have undergone a comprehensive refresh, including updated branding, service enhancements, process optimization, and the restructuring of the board with a proficient team of directors, to better serve clients and stakeholders.

These restructuring and leadership changes are projected to contribute positively to Lasaco Assurance Plc’s financial performance within a short period of time. With Messrs Olumide Jayeola and Akinwale Sofile at the helms of the subsidiaries and the revitalization of both subsidiaries, the Group anticipates increased revenue streams, improved investment returns, and stronger shareholder’s value.

Speaking on the transformation, Lasaco Assurance reaffirmed its commitment to delivering innovative insurance, financial, and real estate solutions to its clients and stakeholders.

The Group believes that with Messrs. Jayeola and Sofile at the helm of their respective subsidiaries, the company is poised for sustained growth and market leadership.

Lasaco Assurance rebrands subsidiaries, announces new leadership for trading & investment

Insurance

Continental Reinsurance Commissions ₦70m ICT Lab to drive digital learning at CIFM

Continental Reinsurance Commissions ₦70m ICT Lab to drive digital learning at CIFM

Continental Reinsurance has reaffirmed its leadership role in advancing digital transformation and human capital development within Africa’s insurance industry through the inauguration of a ₦70 million ICT facility at the College of Insurance and Financial Management (CIFM) in Lagos.

The new “M.H. Koguna IT Lab”, named in honour of the company’s first Chairman, was conceived in December 2024 by Group Managing Director, Mr. Lawrence Nazare, and completed under the leadership of Managing Director, Dr. F.K. Lawal. The project reflects the company’s ongoing commitment to promoting technology-driven learning and building capacity among future insurance professionals.

Speaking at the commissioning ceremony held on Tuesday, November 4, 2025, Dr. Lawal said the initiative aligns with Continental Reinsurance’s vision to enhance the digital readiness of Nigeria’s insurance sector. He noted that the facility would provide students and practitioners with hands-on exposure to modern ICT tools critical to the industry’s evolution.

READ ALSO:

- Lateef Adedimeji, Tina Mba, Ruby Akubueze shine at 2025 AMAA awards

- Naira trades weaker amid falling dollar inflows, rising demand

- Trump threatens $1 billion lawsuit against BBC over ‘defamatory’ documentary edit

The event drew key figures from the insurance community, including Executive Director, Mr. Emeka Akwiwu; Regional Director (Lagos), Mr. Ogadi Onwuaduegbo; President of the Chartered Insurance Institute of Nigeria (CIIN), Mrs. Yetunde Ilori; and Chairman of the CIFM Board, Mr. Jide Orimolade.

In her remarks, Mrs. Ilori commended Continental Reinsurance for its sustained investment in professional development, describing the ICT lab as “a timely contribution that will bridge the digital skills gap in the industry.”

Mr. Orimolade also lauded the project as a model for corporate–academic collaboration, emphasizing that the lab would help reposition the college as a centre of excellence in insurance and financial management training.

With the M.H. Koguna IT Lab, Continental Reinsurance continues to set the pace in corporate social responsibility, education support, and digital empowerment — reinforcing its vision of a smarter, more innovative African insurance landscape.

Continental Reinsurance Commissions ₦70m ICT Lab to drive digital learning at CIFM

Insurance

Regency Alliance posts strong 2024 earnings, eyes N15bn capital raise

Regency Alliance posts strong 2024 earnings, eyes N15bn capital raise

Regency Alliance Insurance Plc has reported a solid financial performance for the 2024 financial year, with total assets rising by 15.96 per cent to ₦21.86 billion, up from ₦18.85 billion in 2023.

The company’s Chairman, Mr. Clem Baiye, disclosed this while presenting the 2024 financial results at its 31st Annual General Meeting (AGM) held on Thursday.

He attributed the growth to the insurer’s disciplined investment strategy, prudent risk management, and sustained operational resilience amid a volatile economic climate.

L-R: Non-Executive Director, Regency Alliance Insurance Plc, Dr. Sammy Olaniyi; Company Secretary, Mrs. Anu Shobo; Chairman, Mr. Clem Baiye; and Managing Director, Mr. Bode Oseni, at the company’s 31st annual General Meeting in Lagos on Thursday

According to Baiye, shareholders’ funds also recorded a healthy increase of 19.24 per cent, reaching ₦13.97 billion in 2024 compared to ₦11.72 billion in the previous year.

The equity attributable to the company likewise rose to ₦14.04 billion from ₦11.78 billion.

Regency Alliance’s insurance revenue climbed 20.03 per cent to ₦7.30 billion, reflecting improved underwriting performance and business expansion.

READ ALSO:

- Court sacks Zamfara Rep for defecting from PDP to APC

- Kaduna Rep dumps PDP for APC

- Gunmen kill pastor, abduct 20 in Kaduna community raid

However, insurance service expenses — which include claims and other technical costs — rose by 46.37 per cent to ₦4.12 billion, up from ₦2.81 billion in 2023.

Despite higher operating costs, Baiye noted that management expenses increased only modestly by 7.66 per cent, underscoring the firm’s commitment to cost discipline.

Despite higher operating costs, Baiye noted that management expenses increased only modestly by 7.66 per cent, underscoring the firm’s commitment to cost discipline.

The company’s investment income also improved to ₦1.17 billion, compared with ₦923 million in the previous year. A fair value gain of ₦170 million was also recorded from the revaluation of investment property.

These gains lifted Regency Alliance’s profit before tax by 19.49 per cent to ₦2.50 billion, while profit after tax grew by 16.73 per cent to ₦2.25 billion, compared to ₦1.93 billion in 2023.

To reward shareholders, the board approved a bonus issue of one new ordinary share for every three held, while also unveiling plans to undertake a rights issue and private placement to raise the required ₦15 billion minimum capital under the new Insurance Industry Reform Act (NIIRA) 2025.

The Managing Director, Mr. Bode Oseni, assured shareholders that the new shares would be allotted and listed on the Nigerian Exchange upon completion of the capital raising exercise.

“The board is convinced that our company has the potential to become a leading force in the non-life insurance space,” Oseni stated.

Regency Alliance posts strong 2024 earnings, eyes N15bn capital raise

Insurance

Lasaco Assurance sustains growth momentum with ₦13.19bn claims payment, 25% revenue increase in 2024

Lasaco Assurance sustains growth momentum with ₦13.19bn claims payment, 25% revenue increase in 2024

Despite Nigeria’s challenging macroeconomic landscape, Lasaco Assurance Plc has posted a strong financial performance for 2024, reaffirming its commitment to policyholder trust and prudent management.

Speaking at the company’s 25th Annual General Meeting (AGM) in Lagos, the Chairman, Mrs. Maria Olateju Phillips, disclosed that Lasaco paid out a total of ₦13.19 billion in claims during the year, reflecting its dedication to fulfilling obligations to customers even in difficult times.

“Our ability to settle ₦13.19 billion in claims despite prevailing economic headwinds underscores the strength of our balance sheet, disciplined risk management, and customer-first approach,” she said.

The company’s insurance revenue rose by 25 percent to ₦22.82 billion in 2024, compared to ₦18.29 billion in 2023, while Profit After Tax grew by 18 percent to ₦1.54 billion from ₦1.31 billion a year earlier.

READ ALSO:

- Truck flees after killing varsity lecturer in Lokoja accident

- FG announces applications for new job scheme, targets 20,000 Nigerians (How to apply)

- Tinubu swears in Prof. Amupitan as new INEC chairman

Phillips attributed the performance to deeper market penetration, stronger customer engagement, and effective cost optimization strategies.

She added that Lasaco’s total assets climbed 13 percent to ₦30.94 billion, further strengthening its liquidity and capacity to meet policyholder commitments.

To enhance competitiveness and strengthen its capital base, Lasaco successfully raised ₦11.1 billion through a private placement, issuing an additional 9.25 million shares to investors.

Looking ahead, Phillips said the company’s 2025 strategy would focus on innovation, digital transformation, and sustainability.

According to her, Lasaco is investing in advanced software systems and omnichannel customer engagement tools to enhance service delivery and expand its retail insurance portfolio through targeted products and partnerships.

“We are not merely adapting to the future; we are defining it,” she declared. “With a strong financial base, clear vision, and commitment to excellence, Lasaco Assurance Plc is poised to set new benchmarks in Nigeria’s insurance industry.”

She expressed appreciation to shareholders, regulators, employees, and clients for their continued trust and support, assuring that the company remains steadfast in its mission to create sustainable value and deliver on its promises.

Lasaco Assurance sustains growth momentum with ₦13.19bn claims payment, 25% revenue increase in 2024

-

metro3 days ago

metro3 days agoSenate Launches Emergency Probe into Widespread Lead Poisoning in Ogijo, Lagos/Ogun

-

News3 days ago

News3 days agoBREAKING: Tinubu Sends Fresh Ambassadorial Nominations to Senate, Names Ibas, Ita Enang, Dambazau

-

Auto3 days ago

Auto3 days agoCourt of Appeal Affirms Ruling Barring VIO from Seizing Vehicles or Fining Motorists

-

Sports1 day ago

Sports1 day ago2026 FIFA World Cup Draw: England Draw Croatia as Brazil Face Morocco in Tournament Opener

-

News3 days ago

News3 days agoUS authorities arrest Nigerian CEO Cashmir Chinedu Luke for alleged $7m VA fraud

-

metro3 days ago

metro3 days agoFG secures release of three Nigerians detained in Saudi Arabia

-

metro3 days ago

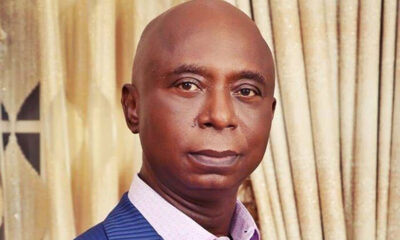

metro3 days agoNed Nwoko vows legal action against rising online harassment, criminal defamation

-

metro3 days ago

metro3 days agoBuratai Defends Nigeria’s Resilience, Says Nation Is “Rising, Not Failing” Despite Insecurity