Business

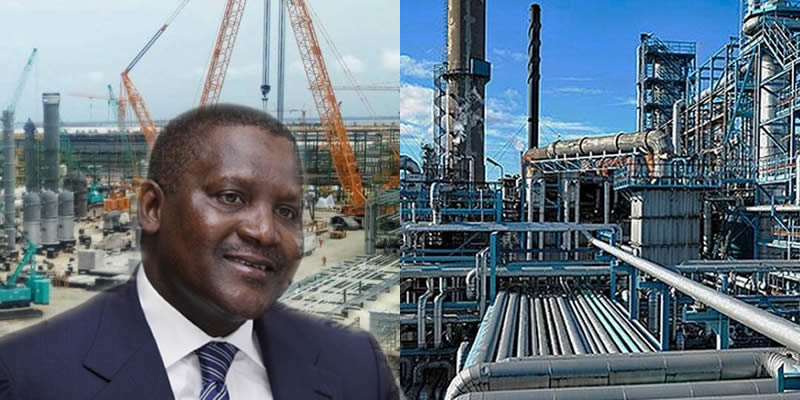

NNPC supplies insufficient crude to us – Dangote

NNPC supplies insufficient crude to us – Dangote

Amid lingering crisis, Dangote Refinery has revealed that the Nigerian National Petroleum Company Limited (NNPC) is supplying insufficient crude oil for its production demand, hence, its decision to look towards Brazil and America.

The President of Dangote Group, Aliko Dangote and the Nigerian Midstream and Downstream Petroleum Regulatory Authority, NMDPRA, alongside NNPCL, had been locked in a dispute, ranging from monopoly allegations to supply of crude for the refinery, substandard fuel imports and ownership of blending plants in Malta.

However, Dangote, in a new revelation, said for the $20 billion refinery to meet its production demand, must look for other sources of crude oil supply overseas as the NNPCL allocation is insufficient.

He said the refinery, which has the capacity of refining 650,000 per day, could not defend on short supply from the Nigeria’s oil company.

Rabiu A. Umar, Group Chief Commercial Officer, Dangote Industries Limited, told newsmen in Kano that NNPC supplies only 33 percent of of crude to the refinery, disclosing that it had to look elsewhere to source the remaining 67 percent to meet its production capacity.

According to Umar, the refinery had concluded plans to supply crude oil from Brazil and America by August.

“First of all the refinery is here in Nigeria. We have the crude oil here in Nigeria. We thought we would get the crude oil here and refined it here in our refinery for the benefit of the country and the citizens.

“Ironically, the country takes the crude oil overseas for refining while we have a refinery, one of the biggest in the world.

READ ALSO:

- PDP lawmakers, supporters in Kebbi defect to APC

- Lagos Govt revokes all building permits, orders revalidation of ongoing constructions

- Catholic bishops condemn ‘mockery of Christianity’ at Olympics ceremony

“So, we will not stay idle. We have to look for other sources to meet our production capacity. If we get the crude oil supply here in the country we have no reason to go overseas.

“Even now, we are planning to supply crude oil from countries like Brazil and USA,” he said.

He said the refinery had commenced supplies to foreign countries since February, disclosing that they receive orders from different countries for supply, especially aviation fuel.

The Chief Commercial Officer also revealed that the refinery needs 15 cargos of crude oil in September but NNPCL promised only 5 to it, lamenting that they see the government’s lackadaisical actions towards the refinery as sabotage.

According to him, the refinery should be celebrated and embraced by the government rather than painting it black as it is the biggest employer of labour with over 50,000 workers at the moment.

He emphasized that against the government’s false narratives, the refinery had started on a positive note as the quality of its refined products are would standard.

He said even the House of Representatives, under the leadership of the its speaker, visited the refinery, saw the difference and was satisfied with the quality of the products.

The official also said, “we are here to defend ourselves and all the government narratives are not true. We urge the people to take samples of our products to ascertain their quality.

“We will not be deterred by the government’s criticism. We will continue until we reach the promised land.

A business analyst in Kano, Abdussalam Kani, on his part demanded for apology to Dangote by the federal government and the National Assembly.

NNPC supplies insufficient crude to us – Dangote

Auto

Yuletide: Chisco deploys new luxury, mini buses, top quality services

Yuletide: Chisco deploys new luxury, mini buses, top quality services

…hails Tinubu for 50% fare rebate

Nigeria’s Transport Company of the Year, Chisco Transport Ltd, has deployed in various routes nationwide its newly procured new luxury and mini buses with the latest innovative features in the industry.

It assured the travelling public of safe and top quality services on all its routes this Christmas/New Year season, and beyond.

It stated this in a statement released on Tuesday, adding that the company, which had been one of the country’s front runners in long distance passenger transportation and logistics for over 45 years, recently inaugurated about four new branches in order to bring its services closer to its teeming customers.

It listed some of the new branches that had helped to boost service delivery this Yuletide season as in Awka, Enugu, and on Okota Road (near Cele Bus Stop on Oshodi-Apapa expressway), Lagos.

It stated, “This is in addition to embarking on a comprehensive maintenance of the existing fleet of buses in order to ensure they are in roadworthy shape for trips across Nigeria and the Lagos-Cotonou-Lome-Accra international route.

“Apart from advanced safety features like real-time GPS tracking and efficient safety systems, the new-look Chisco Transport fleet, featuring state-of-the-art buses, has all it takes to guarantee that passengers travel in style with their comfort and safety prioritised this season.”

It stated that the updated fleet had enhanced the popular Chisco 24 to 48-hour nationwide mail and parcel services.

All these, the leading transport solutions and logistics provider said, are part of deliberate efforts to ensure seamless and comfortable bus and logistic services to the customers during the 2024 Yuletide season and thereafter.

Chisco’s Head of Business Operations, Mr Buchi Ochuba, in the statement explained that the same commitment to ensuring safe and comfortable trips out of major cities and towns before Christmas, would also be deployed to return journeys in the new year.

He said that the management was aware that the huge investments the company had been making towards upscaling its services recently earned it the Transport Company of the Year at the recent Nigeria Auto Journalists Association (NAJA) Awards in Lagos.

Ochuba reiterated Chisco Transport’s resolve to sustain the high standards that earned the company an enviable reputation, as well as continue investments in safety and comfort of travellers that have earned it the confidence of the travelling public and the auto journalists’ award.

“We appreciate the fact that in adjudging Chisco Transport the Transport Company of the Year, NAJA must have taken into consideration the high standards of our services, the over 50 new air-conditioned buses we procured recently, the new branches we inaugurated, our customer reward scheme and other investments we made to enhance passenger transportation and logistics,” Ochuba stated.

According to him, everything is in place to make certain that the teeming Chisco Transport customers all over Nigeria and on the international route enjoy top quality services, adding “We wish them a wonderful Christmas and a highly prosperous 2025.”

Chisco Transport also applauded President Bola Tinubu for the gesture of subsidising inter-state luxury bus transport fares by 50 percent this Christmas season.

Drawing attention to the importance of infrastructure to the road transportation business, the statement further commended the President for the appreciable allocations for the sector in the 2025 budget.

“We, therefore, wish to urge members of his cabinet to put in more deliberate efforts to help the President attain his vision with speedy and prudent execution inspired by patriotism.”

On the current sharp increase in fares across the routes, the award-winning transport company blamed the situation on rising costs of maintaining the buses, as well as on the high pump prices of diesel and petrol.

The Head of Operations, however, added that at the peak of every Christmas season, long distance buses are almost empty during return trips, which leads to a situation whereby the fares for the first journeys are raised to cushion the losses incurred during reverse trips.

Business

Naira exchanges N1,650/$ in parallel market

Naira exchanges N1,650/$ in parallel market

Yesterday, the Naira appreciated N1,650 per dollar in the parallel market, compared to N1,655 on Monday.

Similarly, the Naira appreciated to N1,535 per dollar in the official foreign exchange market.

Data published by the Central Bank of Nigeria, CBN, showed that the exchange rate for the Nigerian Foreign Exchange Market (NFEM) fell to N1,535 per dollar from N1,537 per dollar on Monday, indicating N2 appreciation for the naira.

READ ALSO:

- Tension as Anambra community union asks monarch to stop Ofala Festival

- Exchange rate ends 2024 at N1,535/$1, marking a 40.9% depreciation

- Lagos govt clears traders from rail tracks at Bolade, Oshodi

Consequently, the margin between the parallel market and NFEM rate narrowed to N115 per dollar from N118 per dollar on Monday.

Naira exchanges N1,650/$ in parallel market

Business

Exchange rate ends 2024 at N1,535/$1, marking a 40.9% depreciation

Exchange rate ends 2024 at N1,535/$1, marking a 40.9% depreciation

The exchange rate between the naira and the dollar ended the year at N1,535/$1 representing a 40.9% depreciation for 2024.

The official exchange rate between the naira and dollar closed in 2023 at N907.11/$1 thus depreciating by 40.9% for the year which compares to a 49.1% devaluation at the end of 2023.

READ ALSO:

- Lagos govt clears traders from rail tracks at Bolade, Oshodi

- Four countries that won’t celebrate New Year

- Social media abuzz over Fayose claim of N50m donation to VeryDarkMan’s NGO

Nigeria introduced several foreign exchange policies in 2024 as the central bank expanded on market-friendly forex policies to attract foreign investors.

Meanwhile, on the parallel market where the exchange rate is sold unofficially, the naira exchanged for N1,660 to the dollar when compared to N1,215/$ according to Nairametrics tracking records. This represents a 26.8% depreciation.

Exchange rate ends 2024 at N1,535/$1, marking a 40.9% depreciation

-

Politics3 days ago

Politics3 days agoGbajabiamila speaks on his rumoured Lagos governorship ambition

-

metro3 days ago

metro3 days agoFarotimi to pursue disbarment over arrest, defamation allegations

-

Business2 days ago

Business2 days agoReal reason Dangote, NNPC drop petrol price — IPMAN

-

Health2 days ago

Health2 days agoABU Teaching Hospital will begin kidney transplant in 2025 – CMD

-

Sports1 day ago

Sports1 day agoAnthony Joshua prostrates before Governor Abiodun during Ogun visit

-

metro3 days ago

metro3 days agoEl-Rufai accuses Tinubu govt of Yoruba agenda, Reno Omokri reacts

-

metro3 days ago

metro3 days agoNigerian govt urged to intervene in Mozambique post-election violence

-

metro1 day ago

metro1 day agoN180m not missing from my account, it was all a plan – Verydarkman