Business

P&ID: UK court orders release of $200m Guarantee to Nigeria

A London court has ordered the release of a $200m guarantee put in as security by Nigeria in the execution of the Process & Industrial Developments $10bn Arbitral Claim.

The Central Bank of Nigeria made this known on Tuesday.

The apex bank said, “Nigeria’s Foreign Exchange Reserves was this morning boosted by over $200m when the London Commercial Court ordered the released of the $200n guarantee put in place as security in respect of the execution of the much discredited P&ID $10bn Arbitral Claim.

“The court also awarded a £70,000 cost in favour of Nigeria in addition to an earlier award of £1.5m.”

Speaking on the development, the Governor of the Central Bank of Nigeria, Godwin Emefiele, said, “Due to the substantial evidence of prima facie fraud established before the Court, we are pleased that the Judge has agreed to release the guarantee.

“We are also pleased that the Court has rejected P&ID’s application to increase the guarantee, which was clearly intended to be a diversionary tactic and entirely misconceived. This release which is an accretion into the reserves will further enhance the nation’s management of the exchange rate of its domestic currency, the naira.

“This is a further and significant victory for Nigeria in our ongoing fight to overturn the US$10bn award procured through fraud and corruption by P&ID and former government officials.

“P&ID and its backers, Lismore Capital and VR Advisory, are increasingly seeing their case slip between their fingers. They continue to resort to employing delay tactics, disseminating misleading claims, and taking every step to obstruct our investigations across multiple jurisdictions.

“The Federal Republic of Nigeria will not rest until we secure justice for the people of Nigeria – no matter how long it takes. Investigations are ongoing, and we are confident that more of the truth will be revealed over the coming months.”

P&ID entered a contract with Nigeria to build a gas processing plant, and won a $6.6bn arbitration award after the 2010 deal failed.

The award had been accruing interest since 2013 amounting to $10bn, which if enforced internationally, could lead to the freezing of Nigeria’s assets.

Auto

LSM MD extols founder’s qualities after latter posthumous industry award

LSM MD extols founder’s qualities after latter posthumous industry award

*He left us a good name, says son

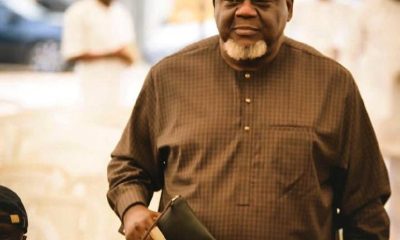

Founder and late Chairman of Lanre Shittu Motors (LSM), Alhaji Olanrewaju Shittu, has been honoured with a Nigerian auto industry posthumous award.

This was announced in Lagos at the 2024 edition of the annual

Nigeria Auto Journalists Association (NAJA) announced this in Lagos at the 2024 recently industry awards.

The prestigious award was received by one of his sons, Mr Taiwo Shittu, who is also the managing director of the auto company.

NAJA said the award was in acknowledgement of the leading role of the LSM founder in the development of the automotive business in Nigeria, describing him as a silent achiever.

Speaking on the honour, Taiwo Shittu, who was also declared the Nigeria’s Auto Personality of the Year, praised his father for painstakingly building the LSM brand and leaving behind a good name to the delight of the children and the entire family members.

He described this as a legacy accounting for the success of the company so far since his father’s demise over a year ago.

He said, “I must thank my late father, Alhaji Razaq Olanrewaju Shittu, for building the brand name. There is nothing like a good name.

“If you don’t leave anything for your children other than a good name, the sky is the limit for them.

“In our own case, he left us money and the good name. We can’t thank him enough for leaving us with a good name.

“You can imagine that everywhere we turn to in the country, once we mention we are Lanre Shittu’s sons, we are ushered in immediately.

“People would say ‘Your father was a good man. He won’t cheat you if you did any business with him. His word was his bond; he never broke his promises’. I have heard this many times. And the only thing we can do is to build on this legacy.”

Taiwo Shittu also noted that the unity existing among the 20 surviving children of the late LSM founder was part of his father’s legacies and something for other family businesses in Nigeria to emulate.

He said, “A lot of businesses collapse after the death of their owners. Once a business founder is dead, the next you hear is that a fight has broken out and while one person is taking the arm, another is claiming the leg, the other is going for the body. And in six months, the whole empire is gone down.

“In our case, we have 20 siblings that are cooperative and believe in my ability to lead the business with my other brothers.

“We had a father who never spoiled us. He taught us sincerity, commitment and accountability.”

He also spoke about the lifestyle of the late father, saying even though he was a car dealer and loved cars, he would only change his main car after every 10 years.

“Yes, he loved cars. He used to have a Rolls Royce. But he no longer had it before he died. What he had was a Mercedes-Benz Maybach. His car garage was not packed full. Even though he was a car dealer, he changed his main car every 10 years.

“He was a very prudent man. At the beginning of his adult life, he had many cars; in the middle, he was prudent. It was at the end that he bought some flashy cars such as Lexus L600, MayBach 650 engine – at that time only he and ex-President Muhammadu Buhari had that car. He bought the car then because the family was preparing for three weddings. By time he died, the MayBach had only run 600 miles.”

The LSM chairman, according to him, started the auto business in the late 1970s as a car dealer with three vehicles.

He said he was so creditworthy that many were willing to release their vehicles to him on credit, adding that this helped the business to grow faster.

He recalled how he would travel to Ogbomosho, Oyo State, and Kaduna to buy cars and returned to Lagos with double the number he could readily paid for.

“Sometimes, he would travel as far as Kaduna to buy 12 cars from PAN, he would be the person driving the last vehicle while others were ahead driving all the way to Lagos,” he stated.

Before delving into automobile assembling, he also recalled that Daewoo and Rolls Royce were the two brands that gave the LSM a real breakthrough.

Business

Nigeria remains oil/gas investment destination with $5bn shell FID – TDF

Nigeria remains oil/gas investment destination with $5bn shell FID – TDF

The Democratic Front (TDF) has announced that Shell’s $5 billion Final Investment Decision (FID) for the Bonga North Deep Offshore field further highlights the investment-friendly approach of the Tinubu administration.

This was disclosed in a statement signed by the Chairman, Mallam Danjuma Muhammad, and Secretary, Chief Wale Adedayo.

The group explained that the investment demonstrates how International Oil Companies (IOCs) still see Nigeria as an attractive destination for investments.

“We join President Bola Tinubu in celebrating the Final Investment Decision (FID) by Shell on Bonga North Offshore Field.”

“It is a thing of pride for us that the investment is the outcome of reforms introduced by the President through the Presidential Directives numbers 40, 41, and 42 to fast-track regulatory approvals, reduce operational costs, and promote competitive fiscal incentives in the oil and gas sector.”

READ ALSO:

- Baby freezes to death overnight in Gaza as ceasefire delays

- I was not removed by Tinubu – Ex-Women Affairs minister [VIDEO]

- Ghanaian president approves visa-free entry for all Africans

“We have a conviction that the pertinence of the fresh investment in the sector and indeed the larger Nigeria economy is not only limited to the $5 billion value of the investment but also extends to the field’s potential volume of 350 million barrels of crude oil. It is a development that is bound to further raise the nation’s oil output and revenue as well as bolster its position as Africa’s largest oil producer.”

The group noted that this and other strategic investments, such as TotalEnergies’ $500 million in the Ubeta gas field, are driven by President Tinubu’s fiscal incentives, showcasing the success of his reforms in attracting foreign direct investment to Nigeria’s oil and gas sector.

“The Ubeta upstream field is estimated to produce 350 million standard cubic feet of gas per day when operational and will go a long way to raise the country’s profile as a major gas producer. This remarkable economic feat was unarguably achieved under the economic reform of President Bola Tinubu.”

“It is instructive that since its discovery in 1996, the Bonga deepwater field, located in OML 118, at a water depth exceeding 1000 meters, has not witnessed such a humongous investment as the $5 billion coming from Shell and this is an attestation of President Tinubu’s pro-business approach to governance.”

“Furthermore, this extraordinary display of confidence in Nigeria’s investment ecosystem is a confirmation of the success of the current reforms in eliminating investment encumbrances and the risks of doing business in Nigeria.”

TDF is confident that more IOCs will key into the fiscal incentives introduced by the Tinubu administration to make fresh investments in Nigeria’s oil and gas sector.

Nigeria remains oil/gas investment destination with $5bn shell FID – TDF

Business

Be creative, monarch, others challenge Muslim professionals on economic revival

Be creative, monarch, others challenge Muslim professionals on economic revival

Professionals in different fields of studies, especially Muslims, have a major role to play in turning around Nigeria’s ailing economy through creative research.

This, they said, was necessary for sustainable wealth creation and balanced prosperity.

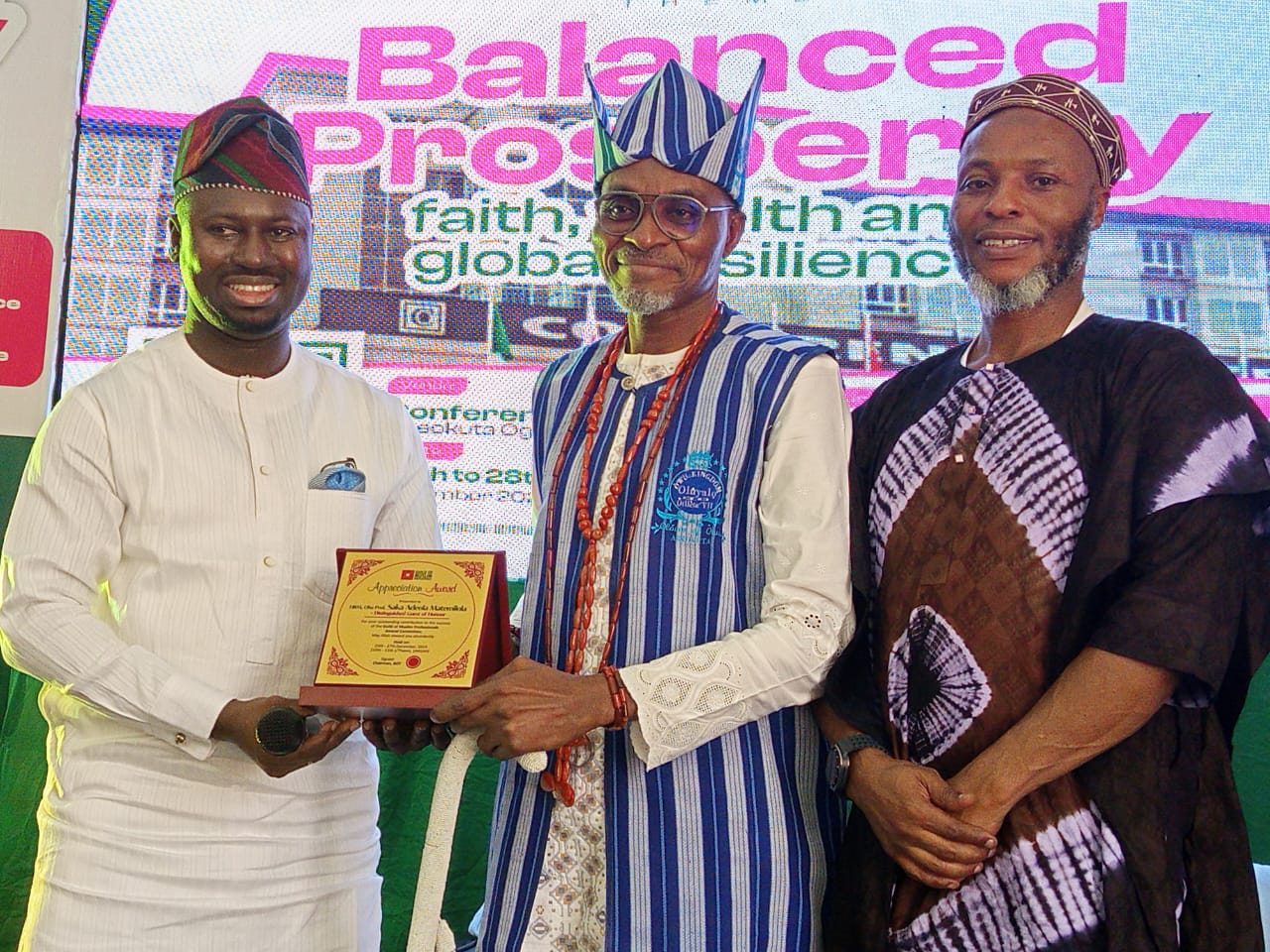

This is the general view canvassed by some Muslim leaders and a monarch at the opening session of the 2024 Guild of Muslim Professionals (GMP) Convention held in Abeokuta, Ogun State, on Wednesday.

Themed, ‘Balanced Prosperity: Faith, wealth and global resilience’, the three-day conference is a gathering of Muslim professionals all over Nigeria in an effort to discuss pressing topical issues facing the Muslims and other people in Nigeria

Chairman, Board of Trustees, Dr Akeem Oyewale, in his welcome address spotlighted the reasoning behind the theme of the 2024 edition of the conference emphasizing that the complexity of the modern world creates an urgency for its discourse.

He said, “As professionals, we are in a privileged position to ensure that wealth creation and distribution are ethical, inclusive and beneficial to the society. Whether through entrepreneurship or public service. We must prioritise transparency, support charitable initiatives and create opportunities for others to thrive.”

The Olowu of Owu Kingdom, Oba Saka Matemilola, urged the professionals to always proffer solutions to the myriads of challenges facing the nation.

This, the monarch said, would make a difference in the society.

Oba Matemilola challenged the Muslim professionals to engage their innovative minds in creating noteworthy accomplishments in their various fields.

He said, “No matter how much resources we have, if not properly managed, it is nothing. We cannot continue to remain docile. I want to charge my fellow Muslims out there to manage our resources properly to translate to prosperity.”

He also spoke on the theme of the event and the benefit it would create when the discourse is established.

“This conference’s theme is a befitting one for the event and I think it is something we need to discuss more as a sect.

“The theme is talking money, physical assets and knowledge, our influence and reach as Muslims and how we use all of these to create prosperity for the general community. When we do that, we also give the non-Muslims an opportunity to see the beauty of Islamic systems,” he added.

Professor of Risk Management and Insurance, University of Lagos, Prof Tajudeen Yusuf, stated that Muslims generally should think individually and act collectively.

While expanding on his address about Takafur, an Islamic alternative to insurance, Prof Yusuf highlighted risk sharing, usury-free transactions and transparency as the major benefits of the Takafur concept.

He said, “Takaful, derived from the Arabic root word ‘Kafala’(guarantee), is an Islamic alternative to conventional insurance. It is a mutual guarantee built on the principles of Ta’awun (mutual assistance) and Tabarru’ (donation). Takaful is distinct in its structure, objectives, and compliance with Shariah principles.”

Using Quranic citations, thought-provoking questions, and case studies of different countries that have successfully used Takafur as a financial aid model during crisis, he further established the balance of the model in meeting demands of economies while adhering to Islamic values.

Linking his address to the theme, the professor added: “Balanced prosperity is not merely a goal; it is a responsibility, faith and wealth. When aligned with ethical principles, can drive resilience and sustainability. Takaful exemplifies this balance, offering a Shariah-compliant model that meets the demands of modern economies while adhering to Islamic values.”

Rector of Yaba College of Technology, Dr Ibraheem Abdul, in his goodwill message enjoined the muslims to embrace the teachings of the holy Qur’an in deciphering actionable strategies to guide their lifestyle.

Executive Director/Chief Finance Officer (CFO) MTN, Module Kadri, echoing the royal father, urging participants to stop shying away from making their voices heard and start taking actions based on their learnings in the program.

The GMP convention is an annual convergence of muslim professionals in Nigeria to engage in thought provoking discussions, dialogues, workshops and panel sessions by renowned speakers from diverse backgrounds.

From left: Rector, Yaba College of Technology (YABATECH) Dr Ibraheem Abdul; Head to Agency Banking at Remita Dr Hafis Bello, and Summit University Vice Chancellor, Prof Musa Aibinu, during formal opening of Guild of Muslim Professionals (GMP) Convention at the Conference Hotel, Abeokuta, Ogun State…on Wednesday December 25, 2024.

-

metro3 days ago

metro3 days agoINTERPOL declares 14 Nigerians wanted for drug, human trafficking

-

metro1 day ago

metro1 day agoJigawa State governor loses son 24 hours after mother’s death

-

metro3 days ago

metro3 days agoIbadan stampede: She was treated like a terrorist, Queen Naomi’s sister says about her condition

-

Business2 days ago

Business2 days agoNNPCL launches production monitoring centre

-

Business2 days ago

Business2 days agoBe creative, monarch, others challenge Muslim professionals on economic revival

-

Entertainment21 hours ago

Entertainment21 hours agoMultiChoice announces free access to all DSTV channels for 3 days

-

metro15 hours ago

metro15 hours agoHeavy security in Ilesa as ex-Osun deputy gov emerges new Owa-Obokun

-

Auto17 hours ago

Auto17 hours agoLSM MD extols founder’s qualities after latter posthumous industry award

You must be logged in to post a comment Login