Business

With Almost 700,000 Daily Under-production, Nigeria, Angola Account for Half of OPEC’s Oil Supply Gap

Almost half the shortfall in planned oil supply by the Organisation of Petroleum Exporting Countries (OPEC) and its allies is down to Nigeria and Angola, Reuters has indicated.

It reflects a number of factors which have combined to hobble crude production on the continent, including moves by Western oil majors away from African projects.

OPEC and its allies, known as OPEC+, pumped 1.45 million barrels per day (bpd) – equal to 1.5 per cent of world supply – below its target in March, the OPEC+ figures showed.

According to the figures, Angola was responsible for almost 300,000 bpd of the OPEC+ supply shortfall while Nigeria was pumping almost 400,000 bpd below target. The war in Ukraine has also hit Russia’s oil trading and its output was about 300,000 bpd short of its March supply target.

The OPEC+ shortfall is one of the reasons global oil prices hit a 14-year high in March above $139 a barrel and it has prompted calls by the United States and other consumers for producers to pump more.

But OPEC has repeatedly rebuffed the calls and one contributing factor is simply that some of its members don’t have oil available to pump.

In OPEC’s view, investment cuts after oil prices collapsed in 2015-2016, due to oversupply, along with a growing focus by investors on economic, social and governance (ESG) issues, have led to a shortfall in the spending needed to meet demand.

READ ALSO:

- Native doctor, others held for kidnapping

- SERAP Sues Buhari, Wants Court to Declare Pardon for Dariye, Nyame Illegal

- Senior Police Officer accused of running fraud syndicate in Lagos

“There was massive underinvestment in the industry over the years, further complicated by the effect of ESG (Environmental, Social and Governance,” OPEC Secretary General, Mohammad Barkindo told Reuters.

“There was a contraction of 25 per cent in 2015 and 2016 – unprecedented. There was no significant recovery before 2020, when we registered a 30 per cent contraction in investments in the industry,” he added.

Figures from the International Energy Agency (IEA) show there was no significant increase in investment in global oil and gas exploration and production during 2017-2019 – followed by a 32 per cent plunge in 2020.

International oil companies are gradually pulling out of Nigeria’s onshore oil production, although they continue to invest in its vast offshore oil and gas resources, where costs remain competitive.

Shell which has been heavily involved in Nigeria’s oil and gas industry did not immediately respond to a request for comment about investment and the reasons for the decline in Nigerian output.

OPEC’s Gulf producers led by Saudi Arabia are largely meeting their OPEC+ targets, and OPEC sources say their relative lack of dependence on outside investors has helped.

“The investment shortfall affected more the countries where reliance on foreign investment is more prominent,” an OPEC+ source from a Gulf producer told Reuters.

IEA figures show that in 2019, Final Investment Decisions (FIDs) affecting over eight times more crude reserves in the Middle East were taken than those affecting African reserves. Middle East approvals were also consistently higher from 2011 through 2018.

“Saudi Arabia, the United Arab Emirates and Kuwait are increasing investment and that to some extent can help offset declines elsewhere,” said Audun Martinsen, analyst at Rystad Energy.

“It also highlights why OPEC is not intervening more because it is quite hard for OPEC to increase production overnight,” Martinsen added.

Angolan state oil company Sonangol and Nigeria’s state oil firm the Nigerian National Petroleum Corporation (NNPC) did not immediately respond to Reuters requests for comment on their production decline or the reasons for it.

According to a 2021 report from the Arab Petroleum Investments Corporation or APICORP, Middle East and North African producers were still expected to boost energy investment to $805 billion in 2021-2025 – up $13 billion on the previous year’s five-year outlook, despite the impact of the pandemic.

In February, Saudi Arabia-based APICORP said it expected rising oil and gas prices to further support energy investment in the region.

THISDAY

Auto

FG deploys Lanre Shittu CNG buses as airport shuttle

FG deploys Lanre Shittu CNG buses as airport shuttle

The Federal Government has commenced the deployment of Lanre Shittu Motors (LSM)-branded Compressed Natural Gas (CNG) buses in the nation’s airports for passengers shuttle.

The first batch of the CNG-powered buses has been launched at the Murtala Muhammed Airport, Lagos, at a ceremony attended by the Minister of Aviation and Aerospace Management, Festus Keyamo, and Managing Director, Federal Airports Authority of Nigeria (FAAN), Mrs Olubunmi Oluwaseun Kuku.

Speaking during the unveiling at the Lagos airport, the minister said the deployment was in line with the directive of President Bola Tinubu.

He said it was part of Nigeria’s commitment to reducing carbon emissions and meeting global climate targets.

‘’What you see here today is a fleet of CNG buses for FAAN to commence passenger movement at all our airports immediately,” the minister said.

He said the newly acquired CNG-powered LSM buses unveiled at the Lagos airport are eco-friendly with zero emission and designed with accessibility features for persons with disabilities.

The deployment, he added, was in compliance with the President’s goal of reducing reliance on traditional fossil fuels of petrol and diesel and promoting sustainable use of CNG to power vehicles in the country.

The introduction of the CNG to power automobiles is one of the Federal Government’s initiatives to ease the impact of fuel subsidy removal on the masses.

The CNG buses, according to the Managing Director of Lanre Shittu Motors, Taiwo Shittu, come in two specifications: a 31-seater for airport shuttle services and a 54-seater for mass transit city buses.

He said they had been equipped with modern amenities, including air conditioning, viewing screens, and charging stations.

With the introduction of the CNG buses, he said LSM aimed to provide a more sustainable and efficient transportation solution not only to Lagos but other parts of the country.

Auto

LSM MD extols founder’s qualities after latter posthumous industry award

LSM MD extols founder’s qualities after latter posthumous industry award

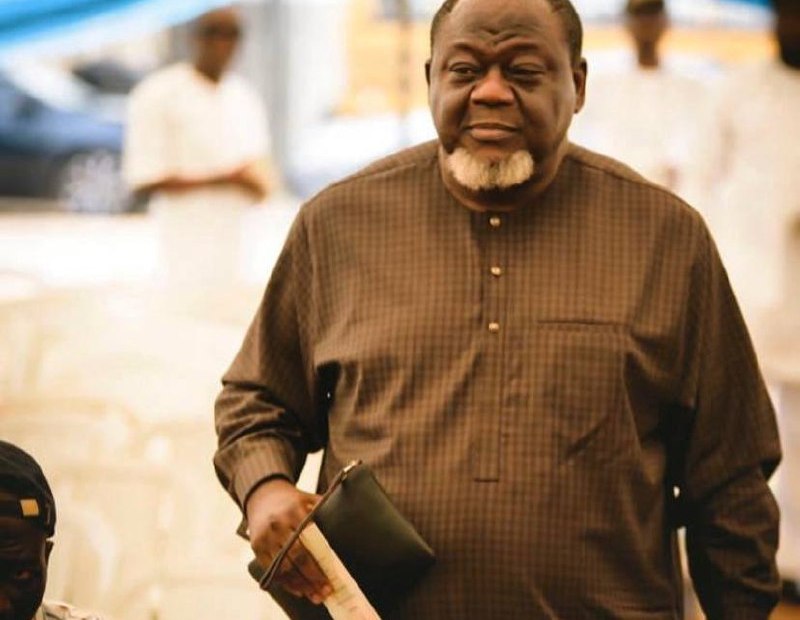

*He left us a good name, says son

Founder and late Chairman of Lanre Shittu Motors (LSM), Alhaji Olanrewaju Shittu, has been honoured with a Nigerian auto industry posthumous award.

This was announced in Lagos at the 2024 edition of the annual

Nigeria Auto Journalists Association (NAJA) announced this in Lagos at the 2024 recently industry awards.

The prestigious award was received by one of his sons, Mr Taiwo Shittu, who is also the managing director of the auto company.

NAJA said the award was in acknowledgement of the leading role of the LSM founder in the development of the automotive business in Nigeria, describing him as a silent achiever.

Speaking on the honour, Taiwo Shittu, who was also declared the Nigeria’s Auto Personality of the Year, praised his father for painstakingly building the LSM brand and leaving behind a good name to the delight of the children and the entire family members.

He described this as a legacy accounting for the success of the company so far since his father’s demise over a year ago.

He said, “I must thank my late father, Alhaji Razaq Olanrewaju Shittu, for building the brand name. There is nothing like a good name.

“If you don’t leave anything for your children other than a good name, the sky is the limit for them.

“In our own case, he left us money and the good name. We can’t thank him enough for leaving us with a good name.

“You can imagine that everywhere we turn to in the country, once we mention we are Lanre Shittu’s sons, we are ushered in immediately.

“People would say ‘Your father was a good man. He won’t cheat you if you did any business with him. His word was his bond; he never broke his promises’. I have heard this many times. And the only thing we can do is to build on this legacy.”

Taiwo Shittu also noted that the unity existing among the 20 surviving children of the late LSM founder was part of his father’s legacies and something for other family businesses in Nigeria to emulate.

He said, “A lot of businesses collapse after the death of their owners. Once a business founder is dead, the next you hear is that a fight has broken out and while one person is taking the arm, another is claiming the leg, the other is going for the body. And in six months, the whole empire is gone down.

“In our case, we have 20 siblings that are cooperative and believe in my ability to lead the business with my other brothers.

“We had a father who never spoiled us. He taught us sincerity, commitment and accountability.”

He also spoke about the lifestyle of the late father, saying even though he was a car dealer and loved cars, he would only change his main car after every 10 years.

“Yes, he loved cars. He used to have a Rolls Royce. But he no longer had it before he died. What he had was a Mercedes-Benz Maybach. His car garage was not packed full. Even though he was a car dealer, he changed his main car every 10 years.

“He was a very prudent man. At the beginning of his adult life, he had many cars; in the middle, he was prudent. It was at the end that he bought some flashy cars such as Lexus L600, MayBach 650 engine – at that time only he and ex-President Muhammadu Buhari had that car. He bought the car then because the family was preparing for three weddings. By time he died, the MayBach had only run 600 miles.”

The LSM chairman, according to him, started the auto business in the late 1970s as a car dealer with three vehicles.

He said he was so creditworthy that many were willing to release their vehicles to him on credit, adding that this helped the business to grow faster.

He recalled how he would travel to Ogbomosho, Oyo State, and Kaduna to buy cars and returned to Lagos with double the number he could readily paid for.

“Sometimes, he would travel as far as Kaduna to buy 12 cars from PAN, he would be the person driving the last vehicle while others were ahead driving all the way to Lagos,” he stated.

Before delving into automobile assembling, he also recalled that Daewoo and Rolls Royce were the two brands that gave the LSM a real breakthrough.

Business

Nigeria remains oil/gas investment destination with $5bn shell FID – TDF

Nigeria remains oil/gas investment destination with $5bn shell FID – TDF

The Democratic Front (TDF) has announced that Shell’s $5 billion Final Investment Decision (FID) for the Bonga North Deep Offshore field further highlights the investment-friendly approach of the Tinubu administration.

This was disclosed in a statement signed by the Chairman, Mallam Danjuma Muhammad, and Secretary, Chief Wale Adedayo.

The group explained that the investment demonstrates how International Oil Companies (IOCs) still see Nigeria as an attractive destination for investments.

“We join President Bola Tinubu in celebrating the Final Investment Decision (FID) by Shell on Bonga North Offshore Field.”

“It is a thing of pride for us that the investment is the outcome of reforms introduced by the President through the Presidential Directives numbers 40, 41, and 42 to fast-track regulatory approvals, reduce operational costs, and promote competitive fiscal incentives in the oil and gas sector.”

READ ALSO:

- Baby freezes to death overnight in Gaza as ceasefire delays

- I was not removed by Tinubu – Ex-Women Affairs minister [VIDEO]

- Ghanaian president approves visa-free entry for all Africans

“We have a conviction that the pertinence of the fresh investment in the sector and indeed the larger Nigeria economy is not only limited to the $5 billion value of the investment but also extends to the field’s potential volume of 350 million barrels of crude oil. It is a development that is bound to further raise the nation’s oil output and revenue as well as bolster its position as Africa’s largest oil producer.”

The group noted that this and other strategic investments, such as TotalEnergies’ $500 million in the Ubeta gas field, are driven by President Tinubu’s fiscal incentives, showcasing the success of his reforms in attracting foreign direct investment to Nigeria’s oil and gas sector.

“The Ubeta upstream field is estimated to produce 350 million standard cubic feet of gas per day when operational and will go a long way to raise the country’s profile as a major gas producer. This remarkable economic feat was unarguably achieved under the economic reform of President Bola Tinubu.”

“It is instructive that since its discovery in 1996, the Bonga deepwater field, located in OML 118, at a water depth exceeding 1000 meters, has not witnessed such a humongous investment as the $5 billion coming from Shell and this is an attestation of President Tinubu’s pro-business approach to governance.”

“Furthermore, this extraordinary display of confidence in Nigeria’s investment ecosystem is a confirmation of the success of the current reforms in eliminating investment encumbrances and the risks of doing business in Nigeria.”

TDF is confident that more IOCs will key into the fiscal incentives introduced by the Tinubu administration to make fresh investments in Nigeria’s oil and gas sector.

Nigeria remains oil/gas investment destination with $5bn shell FID – TDF

-

Business2 days ago

Business2 days agoBe creative, monarch, others challenge Muslim professionals on economic revival

-

Auto2 days ago

Auto2 days agoLSM MD extols founder’s qualities after latter posthumous industry award

-

Entertainment2 days ago

Entertainment2 days agoMultiChoice announces free access to all DSTV channels for 3 days

-

metro2 days ago

metro2 days agoJigawa State governor loses son 24 hours after mother’s death

-

News1 day ago

News1 day agoNigeria Customs Service begins 2025 recruitment [How to apply]

-

metro1 day ago

metro1 day agoHeavy security in Ilesa as ex-Osun deputy gov emerges new Owa-Obokun

-

metro1 day ago

metro1 day agoLagos Imam to Tinubu: You haven’t disappointed us

-

metro1 day ago

metro1 day agoDangote, Tinubu, Lookman named among 100 most influential Africans in 2024 (Full list)