Business

Customers outraged over excessive bank charges

Hidden and arbitrary charges are now the norm with Nigerian banks, which is giving them a not-so-pleasant reputation. These endless charges have almost become a necessary evil as customers now live with them; having been left without options.

Bank customers in Abuja and other states who spoke with Daily Trust expressed frustration over the numerous non-transactional debits they receive from their various banks without explanations.

While “big-time customers” that transact businesses running into millions of naira rarely complain of deductions by the banks, petty traders whose profit margin is small told our correspondents that they were being exploited.

Some students also said they rather kept their upkeep money in their wallets than in their bank accounts.

“All the new generation and old generation banks are fond of perpetrating illegal deductions,” said Zainab Musa Baba, a housewife and petty trader in Nyanya, Abuja.

“You will always see at least two alerts after every transaction, even if it is for just N1,000, and at the end of the month, you see multiple deductions,” she added.

Nwachukwu Samuel who banks with Access Bank, said he usually saw debit alerts on his account, and that most times, he would not go to the bank to complain.

“Sometimes I would not even do a transaction and I would see N50 charge. I see all manner of debit alerts, and because the money is usually small, and considering the stress one has to go through by visiting a branch to complain, I just let go,” he said.

READ ALSO:

- Why we back FG on petrol subsidy removal by 2022 – IPMAN, others

- Bianca Ojukwu begs Buhari to release Nnamdi Kanu

- Nigerian govt asks all workers to resume December

Samuel further said he was aware that the bank would be making a lot of money from the charges, looking at the volume.

A customer with Guaranty Trust Bank (GTB) who simply identified herself as Agnes, called on the Central Bank of Nigeria (CBN) to intensify surveillance on the banks, saying they were feeding fat on vulnerable customers.

She said although the charges were small, they were illegal and therefore advised CBN to punish erring banks.

Mukhtar Aliyu who spoke with one of our reporters from Kano on phone, said the needless and arbitrary deductions had discouraged customers from embracing the cashless banking policy.

“Whenever I sell a carton of spaghetti, my profit margin is not more than N100, but the banks have a way of getting something from this transaction, somehow,” he said.

“There was a day a customer told me that if he paid me for the bag of rice he bought through bank transfer, his bank would also charge him for that simple transaction,” he added.

Another bank customer, Chukwurah U. Paul said, “It is very pathetic, to say the least. The banks are always devising avenues to put holes in people’s pockets.

“We are charged for depositing cash, withdrawing and text messages. We will soon be charged for breathing the air and receiving sunshine,” he said.

Govt aware of infractions

The CBN recently disclosed that it had so far recovered N89.2bn excess and illegal charges slammed on customers by banks.

The Governor of CBN, Godwin Emefiele, represented by the acting Director, Corporate Communication, Osita Nwanisobi, at a public enlightenment fair in Calabar, Cross River State, said the figure was recovered in June, 2021, based on 23,526 complaints they received from customers bordering on charges and other related matters.

READ ALSO:

- ‘More expensive than subsidy?’ — Is FG’s N5,000 transport grant dead on arrival?

- Bandits demand N99m ransom for 61 Emmanuel Baptist worshippers in Kaduna

- KPOFIRE: Woman leaves her three children in a boat, returns to meet them all burnt

In April this year, the Speaker of the House of Representatives, Femi Gbajabiamila, expressed concern over the way banks charge customers indiscriminately during transactions, saying that apart from known charges, there appeared to be “hidden” charges the banks impose on their customers.

Speaking when he hosted the board and management of the Standard Chartered Bank led by its Chief Executive Officer (CEO), Mr Lamin Manjang, Gbajabiamila said the house was concerned that such practice was making customers helpless; hence that Nigerian banks should come up with ways to address high charges on loans and other facilities they offered.

Some customers who spoke with one of our reporters said there was the need for the CBN to scrutinise all bank charges from time to time.

Some of them called for a forensic audit of the charges rather than waiting for customers’ complaints.

Approved bank charges

According to records from the CBN, the approved bank charges for various transactions include stamp duty, SMS alert (N4/SMS), using another bank’s ATM (N35/transaction), account maintenance fee/commission on turnover, which is N1/mille (an acronym commonly used in the banking sector. It means per thousand. Thus, in the COT explained above, banks are allowed to charge N1 per N1,000 debit transaction on current accounts).

Others are ATM card maintenance charge (N52.50 monthly), in-branch statement printing (N21.50/page), cash withdrawals/deposits; while users of Unstructured Supplementary Service Data (USSD) services pay N6.98 per transaction.

While these deductions have been approved by the CBN, several others are not categorised. Daily Trust found out that banks now charge 7.5 per cent as Value Added Tax (VAT) per money transfer made on the NIBBS instant transfer platform. There is also a commission by banks for such transfers, among others.

There are also cases of the approved charges being slammed on account holders multiple times on a single transaction, or even when there is no transaction at all. For instance, a transaction could attract several text messages, with each attracting a charge for the customer. The same scenario could apply for commission on turnover charges, account maintenance fees and stamp duty charges.

It is worthy to note that some of these charges are avoidable. For instance, using an ATM that is not your bank’s and opting not to receive text message alert but only email notification on transactions.

READ ALSO:

- Religious Leaders in the North appeal to Davido for help

- Alleged N11.8b scandal: Ayu vows to probe past PDP administrations

- Tinubu visited me to seek support for presidential ambition – Yakasai

When Daily Trust contacted the CBN to speak on these constant complaints, its spokesman, Mr Nwanisobi, said, “What we do is that whenever we get these complaints, they are thoroughly investigated. If they are found to be true, the CBN makes sure that these customers are properly refunded. And we have so far recovered N89bn.”

The recently recovered figure indicates that the apex bank has the will to punish commercial banks for bad behaviour.

However, as Nwanisobi stated, except when customers make formal complaints, the CBN sees no evil.

It’s extortion – Experts

Munir Aliyu, a financial expert who worked with both old and new generation banks, attributed multiple deductions by banks to “laziness to think out of the box to get big money.”

According to him, “Most of the banks are looking for small money from vulnerable customers because they don’t want to give loans to serious investors.

“Instead, they tax their customers dry because if you know the money they make in a month from these needless deductions, you will not take it lightly.

“Many banks don’t want to give loans to farmers or manufacturers; instead they prefer to tax petty customers.”

The arbitrary charges are on top of issues of growing customer dissatisfaction with commercial banks in Nigeria. For instance, a previous poll established that as far back as 2013, “customers have become more intelligent on the range of bank services.”

The poll sought the opinions of banking customers on their relations and service delivery of Nigerian banks. It established that the Federal Competition and Consumer Protection Commission (FCCPC) had received a large number of complaints from bank customers over alleged hidden and unexplained charges.

In March, 2010, FCCPC organised a consumer interactive forum, where the CBN directed commercial banks to fully disclose all rates and charges associated with their products and services to stem all forms of sharp practices. Up till now, the charges keep coming and no bank has been punished.

The survey established that, overall, the majority (61 per cent) agreed that customers were being exploited by banks through “hidden” charges. This was followed by 19 per cent of the respondents, who disagreed, and 16 per cent that neither agreed nor disagreed. 11 per cent strongly agreed that bank customers were being exploited, while a meagre four per cent strongly disagreed.

Daily Trust

Business

Exchange rate ends 2024 at N1,535/$1, marking a 40.9% depreciation

Exchange rate ends 2024 at N1,535/$1, marking a 40.9% depreciation

The exchange rate between the naira and the dollar ended the year at N1,535/$1 representing a 40.9% depreciation for 2024.

The official exchange rate between the naira and dollar closed in 2023 at N907.11/$1 thus depreciating by 40.9% for the year which compares to a 49.1% devaluation at the end of 2023.

READ ALSO:

- Lagos govt clears traders from rail tracks at Bolade, Oshodi

- Four countries that won’t celebrate New Year

- Social media abuzz over Fayose claim of N50m donation to VeryDarkMan’s NGO

Nigeria introduced several foreign exchange policies in 2024 as the central bank expanded on market-friendly forex policies to attract foreign investors.

Meanwhile, on the parallel market where the exchange rate is sold unofficially, the naira exchanged for N1,660 to the dollar when compared to N1,215/$ according to Nairametrics tracking records. This represents a 26.8% depreciation.

Exchange rate ends 2024 at N1,535/$1, marking a 40.9% depreciation

Business

Warri refinery: Marketers hopeful of further petrol price drop

Warri refinery: Marketers hopeful of further petrol price drop

There was excitement on Monday as the Warri Refining and Petrochemical Company (WRPC) commenced partial production.

This is coming after nearly a decade of dormancy as the 125,000 barrels per day refinery was confirmed to be working at 60 per cent capacity, according to the Nigerian National Petroleum Company Limited (NNPCL).

The refinery, inactive since 2015 due to prolonged repairs, reportedly began refining activities last Saturday at its Area 1 plant, where crude oil was successfully pumped into the system.

This was coming about a month after the commencement of operations at the 60,000-barrel-per-day-old Port Harcourt Refinery.

The NNPCL Group Chief Executive Officer, Mele Kyari, announced the resumption of operation at the Warri Refinery during a tour of the facility on Monday.

Kyari was seen in a video posted by Channels TV addressing a tour team, which included the Chief Executive Officer of the Nigerian Midstream and Downstream Petroleum Regulatory Authority, Farouk Ahmed.

READ ALSO:

- Catholic priest sentenced to 11 years for criticising his president

- Warri refinery now operational, doing 125,000bpd – NNPCL boss

- Kwankwaso says no power-sharing agreement with Atiku, Obi

Earlier, Kyari explained that the inspection aimed to show Nigerians the level of work completed so far.

He said though the repairs on the facility were not 100 per cent complete, operations had commenced.

He said, “We are taking you through our plant. This plant is running. Although it is not 100 per cent complete, we are still in the process. Many people think these things are not real. They think real things are not possible in this country. We want you to see that this is real.”

With the addition of Warri Refinery, Nigeria’s refining capacity has further increased with marketers anticipating a further reduction in price of premium motor spirit (PMS).

The 650,000-barrel Dangote Refinery has commenced production in addition to the Port Harcourt Refinery with a total capacity of 210,000 barrels per day (bpd) comprising 60,000 bpd for the old plant and 150,000 bpd for the new plant.

It’s good for business, prices may reduce – Marketers

Major Energy Marketers’ Association of Nigeria (MEMAN) and the Independent Marketers Association of Nigeria (IPMAN) welcomed the revival of the Warri refinery, saying it would deepen competition, diversify supply and ultimately resort to price reduction.

Executive Secretary of MEMAN, Clem Isong in a chat with our correspondent stated that the Warri Refinery is the shortest route to the North, describing its revival as good news.

“The market becomes more competitive and we are diversifying supply,” he said.

On whether it would lead to price reduction, he stated, “There are many factors that affect price, competition is always good and you can always get your product at the best price.”

National Public Relations Officer of IPMAN, Alhaji Olanrewaju Okanlawon in a chat with our correspondent said, “If there is excess supply, it will keep bringing down the price. We now run a free market and it is about demand and supply. It will continue bringing down the price. It will decongest Lagos.”

Energy expert, Dr. Ayodele Oni said the resumption of Warri Refinery would boost the local refining capacity in addition to enabling the country to sell to other neighbouring countries.

“We can refine more and even have some to sell. We now stop being hewers of wood and drawers of water. We add value to what we produce and can make/ do more with our base resources. This is very pleasant news,” he said.

Warri refinery: Marketers hopeful of further petrol price drop

Business

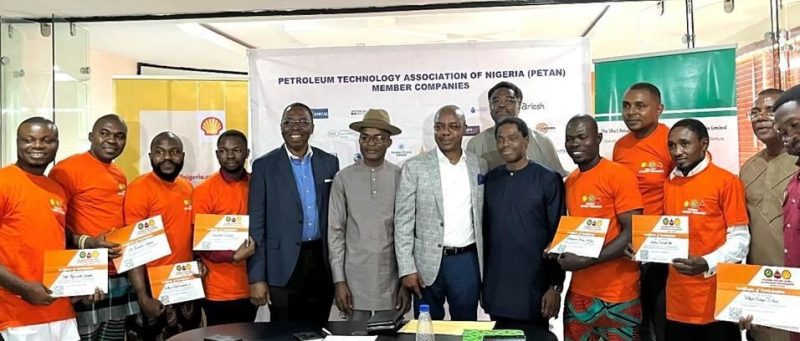

Shell, partners employ 133 young graduates after internship engagement

Shell, partners employ 133 young graduates after internship engagement

Shell Petroleum Development Company of Nigeria Ltd (SPDC) and its partners have offered jobs to 133 young graduates after their engagement in internship programme.

They are part of 170 young graduates that benefitted from the NCDMB/PETAN/SPDC JV Graduate Internship programme attached to indigenous technical oilfield service companies in the upstream and downstream sectors for hands-on experience.

A statement obtained on Monday said the 133 employed by the companies indicated the success of the programme as a talent pipeline for the oil and gas industry in Nigeria.

It disclosed that the latest batch of 49 intakes graduated at a ceremony in Port Harcourt early this month after completing their internship which began in 2022.

Speaking at the ceremony, Chairman of the Petroleum Technology Association of Nigeria (PETAN), Wole Ogunsanya, commended the Shell Petroleum Development Company of Nigeria Ltd (SPDC) Joint Venture for the support for the programme, helping to build local manpower for a critical sector of the economy.

SPDC and PETAN had jointly set up the programme in 2014 whereby young graduates are attached to the over 100 member companies of the organisation with SPDC paying them monthly stipends.

From 2022 when the Nigerian Content Development and Monitoring Board (NCDMB) joined the collaboration, the programme has run for two years with 100 intakes.

The NCDMB/PETAN/SPDC JV Graduate Internship programme has been lauded as a key human capital development initiative which is central to the promotion of Nigerian content in the oil and gas industry.

SPDC’s General Manager Nigerian Content, ‘Lanre Olawuyi, said, “The internship is more than a learning opportunity. It provides fresh graduates with technical expertise, equipping them with the practical skills needed to excel in their careers.

“It aligns with SPDC’s broader educational initiatives, contributing significantly to the actualisation of the UNESCO ‘Education for All’ agenda and the Sustainable Development Goals in Nigeria, particularly in the Niger Delta.

“We owe the success of the programme to the untiring support of our JV partners, the Nigerian National Petroleum Company Limited (NNPCL,) TotalEnergies and Nigerian Agip Oil Company Limited for which we’re grateful.”

-

Politics3 days ago

Politics3 days agoGbajabiamila speaks on his rumoured Lagos governorship ambition

-

metro2 days ago

metro2 days agoFarotimi to pursue disbarment over arrest, defamation allegations

-

Business2 days ago

Business2 days agoReal reason Dangote, NNPC drop petrol price — IPMAN

-

Health2 days ago

Health2 days agoABU Teaching Hospital will begin kidney transplant in 2025 – CMD

-

Sports23 hours ago

Sports23 hours agoAnthony Joshua prostrates before Governor Abiodun during Ogun visit

-

International3 days ago

International3 days agoBREAKING: Plane skids off runway in South Korea, killing at least 120

-

metro3 days ago

metro3 days agoEl-Rufai accuses Tinubu govt of Yoruba agenda, Reno Omokri reacts

-

metro2 days ago

metro2 days agoNigerian govt urged to intervene in Mozambique post-election violence