Business

Fuel scarcity: NNPC blames thunderstorm, logistics, marketers disagree

Fuel scarcity: NNPC blames thunderstorm, logistics, marketers disagree

The Nigerian National Petroleum Company Limited (NNPCL) has attributed the current fuel supply shortage to logistics issue and flooding in the coastal part of the country.

But marketers suspect the short supply was due to suspended importation of fuel in anticipation of supply coming this month from Dangote refinery.

The scarcity of Premium Motor Spirit (PMS), commonly known as petrol, has intensified in Abuja, Lagos, and other states, with many filling stations closed and few dispensing having long queues

Many motorists have resorted to buying from the black marketers selling the product in gallons at exhorbitant rate. A 10-litre of petrol was sold between N10,000 and N13,000, about 100 per cent increase.

Giving reasons for the latest shortage, the NNPC Limited in a statement by the Chief Corporate Communications Officer, Mr. Olufemi Soneye, said adverse weather also affected ship-to-ship transfers of the product to the ports.

He said, “The NNPC Ltd wishes to state that the fuel queues seen in the FCT and some parts of the country were as a result of disruption of ship-to-ship (STS) transfer of Premium Motor Spirit (PMS), also known as petrol, between Mother Vessels and Daughter Vessels resulting from recent thunderstorm.

“The adverse weather condition has also affected berthing at jetties, truck load-outs and transportation of products to filling stations, causing a disruption in station supply logistics.

“The NNPC Ltd also states that due to flammability of petroleum products and in compliance with the Nigerian Meteorological Agency (NiMet) regulations, it was impossible to load petrol during rainstorms and lightning.”

Soneye also said, “Adherence to these regulations is mandatory as any deviation could pose severe danger to the trucks, filling stations and human lives.

“Similarly, the development was compounded by consequential flooding of truck routes which has constrained movement of PMS from the coastal corridors to the Federal Capital, Abuja.”

He however stated that the NNPC Ltd was already working with relevant stakeholders to resolve the logistics challenges and restore supply.

“Already, loading has commenced in areas where these challenges have subsided, and we are hoping the situation will continue to improve in the coming days and full normalcy will be restored”, he assured motorists.

He urged them to “avoid panic buying and hoarding of petroleum products”.

But the Public Relations Officer, Independent Petroleum Marketers Association of Nigeria (IPMAN), Chief Chinedu Ukadike, said marketers had not received the product for some time.

He said it was possibly due to the expected delivery of petrol from the Dangote refinery.

He said marketers were threading cautiously in order not to incur losses should the petrol price crash as a result of supply from the refinery.

He said, “Supply has become epileptic again and we have not received adequate supply in recent times, remember we still depend on the importation of products.

“Once there is any shortage in supply or logistic problem or procrastination, then the impact is almost immediate.

“I also believe that since Dangote announced its petrol supply intention, those supplying NNPC are sceptical of bringing in products because they don’t want to incur the losses which they suffered when Dangote entered the market and slashed the price of AGO (Automated Gas Oil popularly known as diesel).”

Business

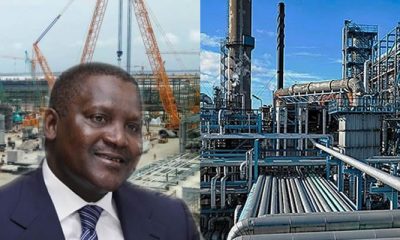

Fresh trouble over supply volume in Dangote refinery petrol

Fresh trouble over supply volume in Dangote refinery petrol

LAGOS — More controversy has emerged in the execution of a sale-purchase deal on premium motor spirit, otherwise known as petrol, between the Nigerian National Petroleum Company Limited, NNPCL, and Dangote Refinery.

NNPCL last weekend said Dangote could only deliver 16.8 million litres out of the 25 million litres it initially agreed with NNPC.

A source at the NNPCL also told Vanguard, yesterday that the refinery is struggling to deliver the 16.8 million litres it promised.

READ ALSO:

- School teachers begin indefinite strike in Abuja

- Police parade suspected ritualists, armed robbers in Osun

- Students can reapply for loans, we’ve resolved BVN verification glitch – NELFUND

But with the latest delivery figure it disclosed, Dangote must have significantly surpassed its promised delivery as well as the national demand put at over 40 million litres per day.

This also means that Dangote can make further petrol importation unnecessary.

But against the backdrop of this latest development, Vanguard learned that importation by NNPCL may have intensified with several consignments, totalling over 135 million litres, within three weeks from September 27, 2024, with the latest import arriving Friday.

This also implies a sudden excess supply of petrol barely a few days after the country was suffocated by acute shortage of the product, resulting in a sharp rise in the price.

Speaking to Vanguard on the development, the Group Chief Branding and Communications Officer of Dangote Refinery, Anthony Chiejina, stated: “We have already loaded 111 million litres of petrol and the exercise is ongoing.

“We are refining and have no reason not to load. So, loading is ongoing and we would continue to provide the product to the market.”

Fresh trouble over supply volume in Dangote refinery petrol

Business

$900m FG bond: United Capital leads with 180% subscription

$900m FG bond: United Capital leads with 180% subscription

United Capital Group has successfully led the issuance of Nigeria’s first-ever Domestic FGN US Dollar Bond, securing more than $900 million in funding with over 180 per cent subscription. The bond program, with a 9.75 per cent yield, attracted significant interest from local and international investors, including Nigerians in the diaspora, institutional investors, and non-resident Nigerians, highlighting confidence in Nigeria’s economic growth potential and financial markets.

The bond will be listed on the Nigerian Exchange Limited (NGX) and FMDQ Securities Exchange and proceeds from the issuance will be used to fund key infrastructure projects in critical sectors of the economy.

Commenting on the achievement, Chief Executive Officer of United Capital Group, Peter Ashade, said, “The successful issuance of Nigeria’s inaugural Domestic FGN US Dollar bond is a significant milestone for both the country and United Capital. This transaction aligns perfectly with our vision of transforming the African financial landscape. By providing access to innovative investment opportunities, we are empowering investors and contributing to Nigeria’s economic growth.”

READ ALSO:

- UK invests £1.9m in West African economies

- Another boat capsizes in Zamfara, Four children dead, 12 hospitalised

- Third Mainland Bridge vandal arrested in Lagos with 21 railings

On his part, the Managing Director of Investment Banking at United Capital Gbadebo Adenrele, described the transaction as a “landmark moment for Nigeria’s capital market.” He added, “As a pioneer in this class of transactions, United Capital has laid the foundation for more significant capital raises by the Nigerian Government, other African sovereigns, and major corporate issuers.”

United Capital was the Lead Issuing House and Coordinator for the transaction, with Africa Finance Corporation serving as the Global Coordinator. Other firms involved include Meristem Capital, Stanbic IBTC Capital, Vetiva Advisory, and several other financial institutions and legal advisers.

This bond issuance reinforces United Capital’s position as a leading player in Africa’s financial markets, following recent successes like the listing of Transcorp Power on the Nigerian Exchange Limited and the issuance of Sierra Leone’s first local currency corporate bond.

$900m FG bond: United Capital leads with 180% subscription

Business

Naira loses N100 to US dollar at official market

Naira loses N100 to US dollar at official market

The Naira lost more than N100 against the U.S. dollar at the official window, despite a slower headline inflation rate in August.

Data from the Nigerian Autonomous Foreign Exchange Market (NAFEM) highlighted that the local currency was sold at N1,656/$1, higher than the N1,546/$1 recorded on Monday.

However, in the parallel market, the Naira appreciated by N5, trading at N1,660/$1 compared to the previous rate of N1,665/$1.

This marks the second consecutive month of lower headline inflation, attributed to reduced food prices during the harvest season.

According to the Nigerian Bureau of Statistics (NBS), headline inflation for August was 32.15%, down from 33.40% in July. Food inflation also decelerated, reaching 37.52% compared to 39.53% in July 2024.

U.S. Dollar Index Gains Momentum Ahead of Fed Meeting

On Tuesday, the U.S. dollar appreciated against most currencies, including the Naira, as higher-than-expected U.S. retail sales data was released, raising the possibility of a less aggressive Federal Reserve.

READ ALSO:

- Crypto: Binance gives two conditions to register under Nigeria’s SEC

- Police recover 111 stolen vehicles in one month, arrest 271 murder suspects

- Abdulsalami to FG: Hardship getting out of control in Nigeria

The U.S. Dollar Index, which tracks the dollar against a basket of six currencies, showed a slight increase, recovering from earlier lows this year. While some market pricing suggests a 50-basis point rate cut, most analysts predict a more modest 25-basis point cut.

The U.S. labor market continues to strengthen, suggesting that further relaxation of monetary policy could support economic growth. However, this high optimism may indicate that the Federal Reserve might continue raising interest rates, albeit at a slower pace.

The U.S. Commerce Department reported a modest 0.1% rise in retail sales in August, fueling hopes that the economy has stabilized through much of the third quarter.

Investors are now awaiting the Federal Reserve’s decision on interest rates, expected at the conclusion of its policy meeting later today. The last time the Fed cut rates was in response to the COVID-19 pandemic in March 2020.

While Nigeria is expected to see foreign capital inflows later in the year, it is unlikely the Federal Reserve will make aggressive rate cuts, given the current market conditions.

The dollar index, which measures the dollar against major currencies like the yen and euro, increased by 0.199% to 100.90 on Tuesday.

Fed funds futures currently reflect a 63% chance of a 50-basis point rate cut, up from 30% a week ago, while the likelihood of a 25-basis point cut is at 37%. These probabilities have shifted after reports reignited discussions of potential aggressive easing measures.

Other U.S. economic data released on Wednesday suggest that the Federal Reserve may find it challenging to implement aggressive rate cuts. U.S. business inventories increased by 0.3% in July, and factory production rebounded in August.

Present fundamentals indicate that the market is already pricing in some rate cuts over the next several months, though some analysts warn that the market may be moving ahead of itself.

Naira loses N100 to US dollar at official market

-

Business2 days ago

Business2 days agoDangote refinery to transport 75% of fuel locally by sea

-

metro1 day ago

metro1 day agoFour burnt to death, eight others injured in Ore-Ijebu Ode road crash

-

Politics2 days ago

Politics2 days agoWhy I’ll work against Obi as running mate – Aisha Yesufu

-

Business3 days ago

Business3 days agoJUST IN: Northern regions to pay more for petrol after NNPC announces Dangote price

-

Business2 days ago

Business2 days agoNNPC hints petrol may rise above N1,000/litre, releases fresh price list

-

metro2 days ago

metro2 days agoUpdated: Controversial church testimony occurred in a dream, says Lord’s Chosen

-

Business3 days ago

Business3 days agoDangote Refinery: Tinubu committee to announce petrol price on October 1

-

metro1 day ago

metro1 day agoLady laces food with laxatives to know those eating it