BREAKING: National Assembly extends lifespan of 2024 budget

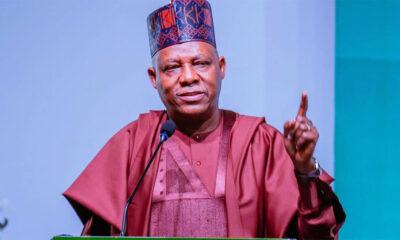

President of the Senate, Godswill Akpabio, has explained that the impressive performance of the 2024 national budget encouraged members of the National Assembly to extend the lifespan of the 2024 budget beyond December 31 this year.

Akpabio gave the explanation Wednesday in his welcome address during the presentation of the 2025 national budget to the joint session of the federal parliament.

He said, “We have noted the 2024 budget performances of 50% for capital expenditure and 48% for recurrent expenditure respectively.

“Given these great achievements, we have deemed it necessary to extend the life of the 2024 budget to June 30, 2025.

“The enabling law for this extension has already been put in place by this patriotic Assembly, as a testament to our appreciation for the great performance of the budget, ensuring we build upon your momentum.

“We commend your steadfast commitment to collaborate, cooperate and work with the National Assembly to achieve your grand vision for Nigeria.”

As the red chamber planned to start deliberations on the budget proposals, Akpabio warned heads of the various ministries, departments and agencies of the Federal Government to make themselves available for the budget defence.

He said: “Let me take this opportunity to stress the importance of the honourable ministers and heads of extra-ministerial departments being prepared to respond promptly to requests for them to come and defend their sectoral allocation in the exercise of our legislative oversight.

“We have observed concerning the behaviour from some ministers and heads of extra-ministerial departments, who sometimes neglect their duty to promptly submit to legislative oversight, sometimes even disregarding invitations from relevant committees of the legislature.

“It is imperative they understand that we will not condone such breaches of the constitution going forward.”

Akpabio noted that under the President Bola Tinubu administration, Nigerians has “witnessed remarkable strides in economic reforms, aimed at enhancing our nation’s stability and growth”.

READ ALSO:

According to him, “The courageous decision to remove fuel subsidies, though challenging, showcases your (Tinubu’s) unwavering commitment to redirecting resources to critical sectors such as education and healthcare.

“Your collaboration with the Central Bank has cultivated an environment ripe for investment, and your focus on infrastructure development reflects a visionary commitment to improving the connectivity that fuels our economy.

“Furthermore, your initiatives to strengthen our security framework stand as a testament to your resolve in tackling the pressing challenges of our time.“

The chairman of the National Assembly commended Tinubu’s efforts in the era of security.

“We commend your tireless efforts, along with those of our brave men and women in uniform, for liberating our lands from the grip of terror.

“Today, no community is under the threat of terrorism, a monumental achievement we celebrate together.

“The reduction in kidnapping incidents and the neutralization of over 11,000 terrorists and insurgents is a testament to patriotism, strength and determination,” Akpabio said.

The Senate President said Tinubu’s dedication to fostering international relations paves the way for fruitful partnerships that will propel the nation forward.

He said: “We are witnessing a resurgence in foreign direct investment, made possible by your visionary directives that ease the visa processes for Nigerians travelling to other countries, and at the same time welcome investors and tourists alike to our country.

“Your innovative approaches in our embassies and the Ministry of Foreign Affairs have opened new doors for Nigeria and its people. For this we thank you.”

He said the introduction of social welfare programmes embodies the president’s unwavering belief in uplifting the living standards of our citizens.

“You remind us that our nation is not merely constructed of bricks and mortar, but of the resilience and determination of its people.

“Nigerians are taking notice of your remarkable achievements. You have doubled aggregate government revenues to over NGN 18.32 trillion, reduced debt servicing expenditures from 97% to 68%, fulfilled $7.5 billion in foreign exchange obligations, increased oil production to 1.8 million barrels per day, and launched the Compressed Natural Gas initiative.

READ ALSO:

“Your administration has processed over N45.6 billion for student payments, signed the National Minimum Wage Law, and raised the national minimum wage to N70,000 a month, all while providing over N570 billion in financial support to the 36 states,” Akpabio said.

He commended the groundbreaking tax reform initiative including the four tax reform bills, namely the Joint Revenue Board of Nigeria (Establishment) Bill, 2024; Nigeria Revenue Service (Establishment) Bill, 2024; Nigeria Tax Administration Bill, 2024; and the Nigeria Tax Bill, 2024.

He said the tax reform bills represented a monumental shift in the country’s fiscal landscape and that its critics haven’t read the proposed legislations.

The Senate President said: “It is disheartening that those who have not taken the time to understand these bills are the loudest critics.

“I urge all Nigerians, especially those in public office, to engage with these vital reforms thoughtfully.

“This initiative marks the first comprehensive tax reform since Nigeria’s independence, presenting a transformative opportunity for rejuvenating small and medium enterprises and enhancing the livelihoods of ordinary Nigerians.

“These reforms will not only improve Nigeria’s revenue profile but also create a more conducive and internationally competitive business environment, transforming our tax system to support sustainable development.”

Akpabio said the infrastructure renaissance has paved the way for many roads, including the coastal road and crucial arteries in the Abuja capital city and other parts of the country.

“These developments are not merely about concrete and asphalt; they represent the lifeblood of our economy, connecting our people and fostering growth,” he added.

He urged Nigerians to bear with the president whose economic reforms had imposed hardship on Nigerians but noted that: “We are light-years away from where we began, though some rivers remain to be crossed.

“The pains we feel are not merely the pains of hardship; they are the pains of childbirth. When that season arrives in Nigeria, when this administration births that season, we will rejoice for the struggles endured.

“For now, I ask for your patience and urge all Nigerians to cooperate with the president and maintain faith in his vision.

“Mr. President, while you cannot be everywhere, you have eyes everywhere. We, the distinguished senators and honourable members of the House of Representatives, are your eyes in our constituencies and every corner of Nigeria.

“When our constituents struggle to afford rice, they come to us. When their shoes pinch, they seek our assistance. When the economic alarm sounds, they turn to us.

“Therefore, we are committed to ensuring that you touch the hearts and pulse of Nigerians through these appropriation bills resonating with the sounds of hope and signalling the dawn of Nigeria’s economic rebirth,” he added.

Akpabio ended his speech by leading the members of the National Assembly to sing for the president as they all chorused, “On your mandate we shall stand” to the admiration of the legislatures and the guests.

BREAKING: National Assembly extends lifespan of 2024 budget