Business

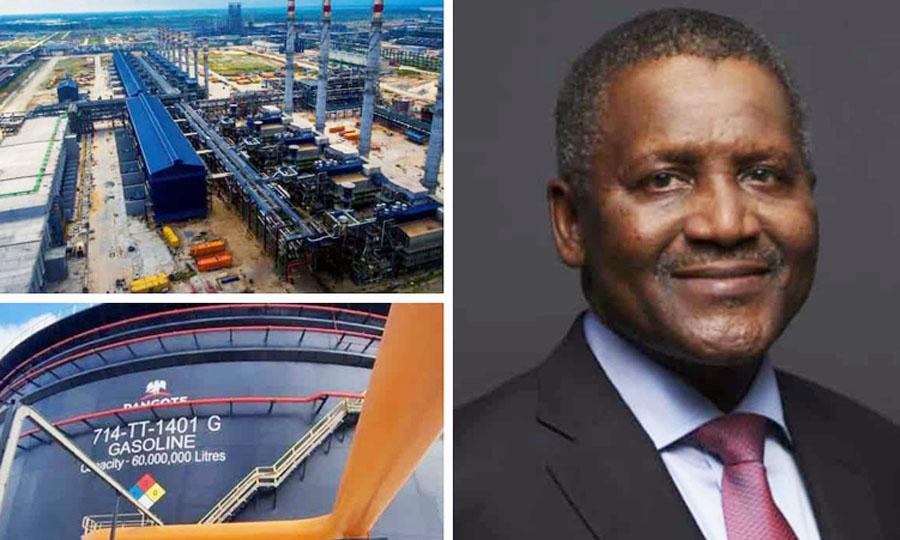

Marketers to Dangote: Be open, we’ll buy your fuel if the price is good

Marketers to Dangote: Be open, we’ll buy your fuel if the price is good

Oil marketers have expressed willingness to buy fuel from the Dangote Refinery if the price is favourable.

The marketers however accused the refinery of not being open by not making its price list public and available for them.

President of the Products Retail Outlets Owners Association, Billy Gillis-Harry and the President of the Independent Petroleum Marketers Association of Nigeria, IPMAN Abubakar Maigandi, disclosed this in an interview.

He was reacting to the report by Dangote on Thursday that the marketers were not patronising its refinery and it might be forced to export 97 per cent of the Premium Motor Spirit (petrol) it produces.

Recall that Dangote had on Thursday disclosed that marketers in the country are not patronising its refinery and it may be forced to export 97 percent of the Premium Motor Spirit it produces.

Newstrends.ng recalls Vice President of Dangote Industries Limited, Devakumar Edwin, as disclosing that local marketers were boycotting Dangote Refinery petrol for imported ones despite its lower prices.

Gillis-Harry in an interview with DAILY POST, said that marketers are not privy to the price of Dangote Refinery’s petrol because the company has not made it public.

READ ALSO:

- Marketers to Dangote: Be open, we’ll buy your fuel if the price is good

- Customs officer dies rescuing flood victims in Maiduguri

- Edo poll: PDP demands removal of ‘biased REC, partisan CP’

According to him, petroleum marketers in Nigeria are willing to patronise Dangote Refinery Petrol based on a fair and reasonable price.

“Why don’t Dangote Refinery give us a price list of what his price is? They cannot tell the price of Dangote Refinery’s PMS which they claim is cheaper than imported petrol. What is the price of DRL petrol?

“How come they are saying marketers are boycotting their petrol? We don’t know how much Dangote is selling its petrol.

“We are willing to partner with him but we partner on the basis that we would be able to sell with a human face”, he said.

On his part, Madigan said Edwin’s claim that that local marketers are boycotting Dangote Refinery’s petrol is false.

He also echoed the assertion of Gillis-Harry that oil marketers were yet to know the price of Dangote Refinery’s petrol.

According to him, petroleum marketers are ready to buy Dangote Refinery petrol provided the price is not more than the price they are currently buying

“We don’t know the price of Dangote Refinery’s Petrol. We are ready to buy Petrol from Dangote Refinery in any condition provided the price is not more than the price we are getting from other places”, he said.

He added that marketers buy Petrol at various prices depending on location.

Marketers to Dangote: Be open, we’ll buy your fuel if the price is good

Business

CBN permits BDCs to buy up to $25,000 FX weekly from NFEM

CBN permits BDCs to buy up to $25,000 FX weekly from NFEM

The Central Bank of Nigeria (CBN) has granted Bureau de Change (BDC) operators temporary permission to purchase up to $25,000 weekly in foreign exchange (FX) from the Nigerian Foreign Exchange Market (NFEM).

The Central Bank of Nigeria (CBN) has granted Bureau de Change (BDC) operators temporary permission to purchase up to $25,000 weekly in foreign exchange (FX) from the Nigerian Foreign Exchange Market (NFEM).

This move, detailed in a circular dated December 19, 2024, is designed to meet seasonal retail demand for FX during the holiday period.

The circular was signed by T.G. Allu, on behalf of the Acting Director of the Trade and Exchange Department.

The arrangement will be in effect from December 19, 2024, to January 30, 2025.

Under the directive, BDCs may purchase FX from a single Authorized Dealer of their choice, provided they fully fund their accounts before accessing the market.

Transactions to occur at the prevailing NFEM rate

The transactions will occur at the prevailing NFEM rate, and BDCs are required to adhere to a maximum 1% spread when pricing FX for retail end-users.

READ ALSO:

- Badenoch’s negative portrayal of Nigeria Police unfair-PCRC

- Bitcoin price crashes to $95,000 as market continues to react to Federal rate cuts

- Bauchi high court dismisses blasphemy, cybercrime charges against Rhoda Jatau

All transactions conducted under this scheme must be reported to the CBN’s Trade and Exchange Department.

The circular read in part:

“In order to meet expected seasonal demand for foreign exchange, the CBN is allowing a temporary access for all existing BDCs to the NFEM for the purchase of FX from Authorised Dealers, subject to a weekly cap of USD 25,000.00 (Twenty-five thousand dollars only).

This window will be open between December 19, 2024 to January 30, 2025.

“BDC operators can purchase FX under this arrangement from only one Authorized Dealer of their choice and will be required to fully fund their account before accessing the market at the prevailing NFEM rate. All transactions with BDCs should be reported to the Trade and Exchange department, and a maximum spread of 1% is allowed on the pricing offered by BDCs to retail end-users.”

The CBN assured the general public that PTA (Personal Travel Allowance) and BTA (Business Travel Allowance) remain available through banks for legitimate travel and business needs.”

These transactions are to be conducted at “market-determined exchange rates” within the NFEM framework.

This initiative reflects the CBN’s strategy to stabilize the FX market and manage seasonal surges in demand.

CBN permits BDCs to buy up to $25,000 FX weekly from NFEM

Business

Bitcoin price crashes to $95,000

Bitcoin price crashes to $95,000

The cryptocurrency market experienced sharp declines after the United States Federal Reserve announced a 25-basis point rate cut.

Bitcoin’s price dropped from its record high of $108,267 to a multi-day low of $95,000 within 36 hours.

Amid this turmoil, Paper-hand traders are rushing to sell their assets while the experienced ones are taking advantage of the dip to increase their portfolios.

Bitcoin price drops after Federal Reserve announces rate cut

Bitcoin experienced a sharp decline after the Federal Reserve cut interest rates by 25 basis points for the third time this year.

- The announcement led to Bitcoin’s price falling to a multi-day low of $95,000, marking a $13,000 drop within 36 hours.

- This pullback followed a recent record high of $108,268 earlier in the week.

- Federal Reserve Chair Jerome Powell suggested the central bank may halt further rate reductions due to recent Consumer Price Index (CPI) data.

“Today was a closer call, but we decided it was the right move,” Powell said during a press conference. While rate cuts typically benefit cryptocurrencies due to their risky asset status, this decision appears to have introduced caution among buyers.

READ ALSO:

- Bauchi high court dismisses blasphemy, cybercrime charges against Rhoda Jatau

- Suspected notorious kidnap leader arrested in Rivers

- Unsolicited messages: Appeal Court fines MTN N15m

Crypto analysts predict that Bitcoin could face increased volatility in the short term. On-chain data reveals selling pressure has eased since November, but caution remains high. Buyers are closely monitoring Bitcoin’s support levels, particularly around the $100,000 mark, with potential resistance seen at $110,000 in the coming weeks.

Some buyers anticipate a “Santa Rally” a term used to describe the Bullish performance of bitcoin during the Christmas holidays. Historical data on this notion has given mixed outcomes.

In previous halving years, Bitcoin often surged during Christmas week, with price moves of 11% to 25% recorded in 2017, 2020, and 2024.

However, analysts warn that current market conditions, including macroeconomic uncertainty and a cautious Fed, could dampen such expectations.

United States Bitcoin strategic reserve in doubts

Aside from the federal rate cuts announced by Powell. He also mentioned that the Central Bank is not allowed to hold Bitcoin unless approved by Congress.

- This statement cast shadows of doubt on the proposed Bitcoin reserve by Donald Trump during his campaign days.

- The President-Elect last week confirmed that his administration hopes to set up a strategic Bitcoin reserve and pilot the dominance of the US in the Global crypto space.

- The FOMC chairman’s speech about the Central Bank not being able to hold Bitcoin cast doubts on the proposed Goal by the Donald Trump administration.

Bitcoin price crashes to $95,000

Business

Dangote reduces petrol price to ₦899.50/litre

Dangote reduces petrol price to ₦899.50/litre

Dangote Petroleum Refinery has slashed the price of its petrol t to ₦899.50 per litre.

Making this known in a statement on Thursday was Anthony Chiejina, Chief Branding and Communications Officer of the Dangote Group.

He said, “Africa’s first privately-owned oil refinery, which previously lowered the price to N970 per litre on November 24, has now announced a new price of N899.50 per litre. This reduction is designed to ease transport costs during the festive period.”

Adding, Chiejina said, “In addition to the holiday discount, Dangote Petroleum Refinery is allowing consumers to purchase an additional litre of fuel on credit for every litre bought on a cash basis.”

READ ALSO:

- Shekarau-led Northern group seeks amendements to Tinubu’s tax reform bills

- BREAKING: Explosions rock Niger community

- Google issues security warning to 2.5 billion Gmail users

“To alleviate transport costs during this holiday season, Dangote Refinery is offering a holiday discount on PMS. From today, our petrol will be available at N899.50 per litre at our truck loading gantry or SPM. Furthermore, for every litre purchased on a cash basis, consumers will have the opportunity to buy another litre on credit, backed by a bank guarantee from Access Bank, First Bank, or Zenith Bank.”

The statement said the refinery was committed to making sure Nigerians have access to premium quality petroleum products that are competitively priced which are also environmentally and engine friendly.

Dangote reduces petrol price to ₦899.50/litre

-

metro1 day ago

metro1 day agoCourt stops customs from seizing imported rice in open market

-

metro3 days ago

metro3 days agoCourt orders Minister, NIS to pay N3m compensation, issue passport to complainant

-

metro2 days ago

metro2 days agoFG transfers electricity market regulatory oversight in Lagos to LASERC

-

metro1 day ago

metro1 day agoAfe Babalola: Court grants Dele Farotimi bail, barred from media interviews

-

News1 day ago

News1 day agoAdebayo Ogunlesi, 2 other Nigerians make Forbes 50 wealthiest Black Americans list 2024

-

metro2 days ago

metro2 days agoAbuja demolition: Soldiers attack FCTA officials, seize vehicles

-

metro1 day ago

metro1 day agoIbadan stampede: Tinubu orders probe as death toll hits 40

-

metro1 day ago

metro1 day agoNAFDAC seizes N5bn fake rice, seals factory in Nasarawa