Business

Top 5 crypto apps that work with Nigerian Bank accounts

Top 5 crypto apps that work with Nigerian Bank accounts

Nigeria is the number one country by crypto adoption in Africa and the second largest in the world.

Cryptocurrency is a revolutionary idea in the country and resonates well with the country’s large demographic of young people.

Despite mixed signals from the Nigerian authorities as regards crypto regulation, the sector is still thriving in the country and cryptocurrency is fast becoming an everyday means of transaction.

Earlier this year, Nigerian authorities led a crackdown on crypto entities accusing them of currency manipulation and other unregulated activities.

The highlight of the era was the prolonged dispute between Nigerian authorities and Binance Limited which led to the detention of a Binance executive for 7 months.

The crackdown led to an investor flight in the crypto space with Binance closing down its Peer to Peer feature and Kucoin and OKX pulling out of the Nigerian market.

The investor flight led to a shortage of crypto apps that the Nigerian crypto community can use for their day-to-day transactions.

Despite the vacuum, some crypto apps and resources are filling in the gap in the market while ensuring a smooth experience for Nigerian traders and crypto enthusiasts.

Some of these apps work with Nigerian banks making their services more tailored and relative to the Nigerian end user.

READ ALSO:

- UK announces 45,000 seasonal worker visas for 2025

- Nigerian railway adds extra train to Friday, Saturday trips on Lagos-Ibadan route

- Belgium University offers scholarship up to €12,000 for Master’s students

In this Nairametrics article, we are going to look at the Top 5 crypto apps that directly work with Nigerian bank accounts

Yellow Card

Yellow Card is a pan-African crypto exchange that allows users to buy, sell, and Trade cryptocurrencies. The crypto exchange supports Nigerian Banks in its services and users can sell their crypto assets and withdraw them in Naira into the Nigerian banks.

The exchange has an instant transfer feature where sold cryptocurrencies can be sent to your Nigerian bank account directly. This makes for convenient use amongst Nigerian and African users.

Quidax

Quidax is another cryptocurrency exchange that supports Nigerian bank accounts. The exchange allows users to buy cryptocurrencies with Nigerian bank accounts.

This process occurs via Bank transfers or a Quidax Bank Account number which is usually the User’s bank account number.

Quidax is one of the two crypto exchanges to receive a full license from the Nigerian Securities and Exchange Commission under Emomotimi Agama.

Busha

Busha is a cryptocurrency exchange platform that allows users to buy and sell cryptocurrencies with the naira. The Indigenous crypto exchange supports Nigerian bank accounts for payouts.

Busha Users can make deposits to Merchant’s Nigerian Bank accounts through their Naira wallet on the platform.

Busha is the second of the two crypto exchanges to receive a full license from the Nigerian SEC.

Local Traders

Local Traders is a P2P crypto exchange platform gaining some popularity in the Nigerian crypto space. The platform offers over 750 payment options including traditional Nigerian bank accounts.

Nigerians using the platform for P2P transactions can send money directly to their Nigerian Bank accounts through Bank transfer and Paystack.

The P2P sector in Nigeria took a hit following the discontinuation of Binance Naira P2P. platforms like local traders are filling the void.

Koyn

Koyn is a crypto app that facilitates the sale of major cryptocurrencies like Bitcoin, Litecoin, Ethereum, and Tether. The app is gaining ground in the Nigerian crypto market due to its ease of use.

The crypto app supports Nigerian bank accounts and readily converts crypto naira which can be easily withdrawn to Nigerian bank accounts.

The app has a dedicated rate calculator which varies according to the given market price for the day.

Koyn is patronized mostly by Nigerians who don’t want to go through the hassle of direct P2P.

The crypto industry in Nigeria is still lagging in much-needed infrastructure to meet up with the demand in the Nigerian market. This is partly due to an unclear regulatory framework from relevant Nigerian authorities for investors and crypto end users in the country.

The issuing of Full licenses to Busha and Quidax marks a significant step forward in the Nigerian crypto space as regards regulation and its role in creating an enabling environment for growth.

Top 5 crypto apps that work with Nigerian Bank accounts

Business

Nigeria remains oil/gas investment destination with $5bn shell FID – TDF

Nigeria remains oil/gas investment destination with $5bn shell FID – TDF

The Democratic Front (TDF) has announced that Shell’s $5 billion Final Investment Decision (FID) for the Bonga North Deep Offshore field further highlights the investment-friendly approach of the Tinubu administration.

This was disclosed in a statement signed by the Chairman, Mallam Danjuma Muhammad, and Secretary, Chief Wale Adedayo.

The group explained that the investment demonstrates how International Oil Companies (IOCs) still see Nigeria as an attractive destination for investments.

“We join President Bola Tinubu in celebrating the Final Investment Decision (FID) by Shell on Bonga North Offshore Field.”

“It is a thing of pride for us that the investment is the outcome of reforms introduced by the President through the Presidential Directives numbers 40, 41, and 42 to fast-track regulatory approvals, reduce operational costs, and promote competitive fiscal incentives in the oil and gas sector.”

READ ALSO:

- Baby freezes to death overnight in Gaza as ceasefire delays

- I was not removed by Tinubu – Ex-Women Affairs minister [VIDEO]

- Ghanaian president approves visa-free entry for all Africans

“We have a conviction that the pertinence of the fresh investment in the sector and indeed the larger Nigeria economy is not only limited to the $5 billion value of the investment but also extends to the field’s potential volume of 350 million barrels of crude oil. It is a development that is bound to further raise the nation’s oil output and revenue as well as bolster its position as Africa’s largest oil producer.”

The group noted that this and other strategic investments, such as TotalEnergies’ $500 million in the Ubeta gas field, are driven by President Tinubu’s fiscal incentives, showcasing the success of his reforms in attracting foreign direct investment to Nigeria’s oil and gas sector.

“The Ubeta upstream field is estimated to produce 350 million standard cubic feet of gas per day when operational and will go a long way to raise the country’s profile as a major gas producer. This remarkable economic feat was unarguably achieved under the economic reform of President Bola Tinubu.”

“It is instructive that since its discovery in 1996, the Bonga deepwater field, located in OML 118, at a water depth exceeding 1000 meters, has not witnessed such a humongous investment as the $5 billion coming from Shell and this is an attestation of President Tinubu’s pro-business approach to governance.”

“Furthermore, this extraordinary display of confidence in Nigeria’s investment ecosystem is a confirmation of the success of the current reforms in eliminating investment encumbrances and the risks of doing business in Nigeria.”

TDF is confident that more IOCs will key into the fiscal incentives introduced by the Tinubu administration to make fresh investments in Nigeria’s oil and gas sector.

Nigeria remains oil/gas investment destination with $5bn shell FID – TDF

Business

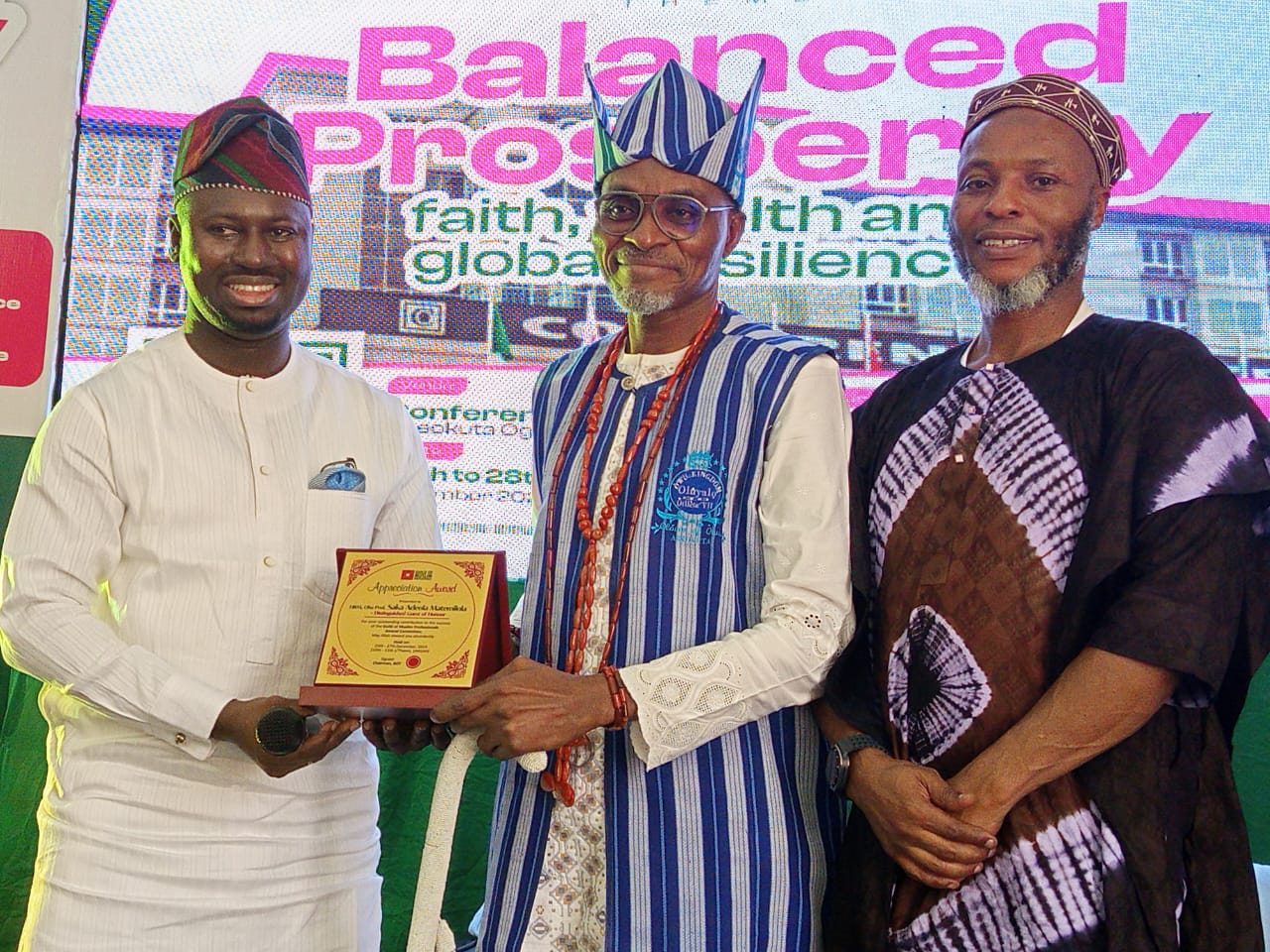

Be creative, monarch, others challenge Muslim professionals on economic revival

Be creative, monarch, others challenge Muslim professionals on economic revival

Professionals in different fields of studies, especially Muslims, have a major role to play in turning around Nigeria’s ailing economy through creative research.

This, they said, was necessary for sustainable wealth creation and balanced prosperity.

This is the general view canvassed by some Muslim leaders and a monarch at the opening session of the 2024 Guild of Muslim Professionals (GMP) Convention held in Abeokuta, Ogun State, on Wednesday.

Themed, ‘Balanced Prosperity: Faith, wealth and global resilience’, the three-day conference is a gathering of Muslim professionals all over Nigeria in an effort to discuss pressing topical issues facing the Muslims and other people in Nigeria

Chairman, Board of Trustees, Dr Akeem Oyewale, in his welcome address spotlighted the reasoning behind the theme of the 2024 edition of the conference emphasizing that the complexity of the modern world creates an urgency for its discourse.

He said, “As professionals, we are in a privileged position to ensure that wealth creation and distribution are ethical, inclusive and beneficial to the society. Whether through entrepreneurship or public service. We must prioritise transparency, support charitable initiatives and create opportunities for others to thrive.”

The Olowu of Owu Kingdom, Oba Saka Matemilola, urged the professionals to always proffer solutions to the myriads of challenges facing the nation.

This, the monarch said, would make a difference in the society.

Oba Matemilola challenged the Muslim professionals to engage their innovative minds in creating noteworthy accomplishments in their various fields.

He said, “No matter how much resources we have, if not properly managed, it is nothing. We cannot continue to remain docile. I want to charge my fellow Muslims out there to manage our resources properly to translate to prosperity.”

He also spoke on the theme of the event and the benefit it would create when the discourse is established.

“This conference’s theme is a befitting one for the event and I think it is something we need to discuss more as a sect.

“The theme is talking money, physical assets and knowledge, our influence and reach as Muslims and how we use all of these to create prosperity for the general community. When we do that, we also give the non-Muslims an opportunity to see the beauty of Islamic systems,” he added.

Professor of Risk Management and Insurance, University of Lagos, Prof Tajudeen Yusuf, stated that Muslims generally should think individually and act collectively.

While expanding on his address about Takafur, an Islamic alternative to insurance, Prof Yusuf highlighted risk sharing, usury-free transactions and transparency as the major benefits of the Takafur concept.

He said, “Takaful, derived from the Arabic root word ‘Kafala’(guarantee), is an Islamic alternative to conventional insurance. It is a mutual guarantee built on the principles of Ta’awun (mutual assistance) and Tabarru’ (donation). Takaful is distinct in its structure, objectives, and compliance with Shariah principles.”

Using Quranic citations, thought-provoking questions, and case studies of different countries that have successfully used Takafur as a financial aid model during crisis, he further established the balance of the model in meeting demands of economies while adhering to Islamic values.

Linking his address to the theme, the professor added: “Balanced prosperity is not merely a goal; it is a responsibility, faith and wealth. When aligned with ethical principles, can drive resilience and sustainability. Takaful exemplifies this balance, offering a Shariah-compliant model that meets the demands of modern economies while adhering to Islamic values.”

Rector of Yaba College of Technology, Dr Ibraheem Abdul, in his goodwill message enjoined the muslims to embrace the teachings of the holy Qur’an in deciphering actionable strategies to guide their lifestyle.

Executive Director/Chief Finance Officer (CFO) MTN, Module Kadri, echoing the royal father, urging participants to stop shying away from making their voices heard and start taking actions based on their learnings in the program.

The GMP convention is an annual convergence of muslim professionals in Nigeria to engage in thought provoking discussions, dialogues, workshops and panel sessions by renowned speakers from diverse backgrounds.

From left: Rector, Yaba College of Technology (YABATECH) Dr Ibraheem Abdul; Head to Agency Banking at Remita Dr Hafis Bello, and Summit University Vice Chancellor, Prof Musa Aibinu, during formal opening of Guild of Muslim Professionals (GMP) Convention at the Conference Hotel, Abeokuta, Ogun State…on Wednesday December 25, 2024.

Business

NNPCL launches production monitoring centre

NNPCL launches production monitoring centre

The Nigerian National Petroleum Company Limited (NNPCL) has unveiled the Production Monitoring Command Centre, an initiative designed to revolutionise hydrocarbon operations and drive increased production.

The initiative, led by NNPC Upstream Investment Management Services, aims to improve monitoring, operational efficiency, and production, building on the success of the Command and Control Centre.

Olufemi Soneye, Chief Corporate Communications Officer of NNPC Ltd., stated that the PMCC aligns with President Bola Tinubu’s policy to increase efficiency and boost production in the industry.

A text and video statement were also published on the company’s website on Wednesday.

“The PMCC serves as a unified platform for monitoring hydrocarbon molecules from production to export terminals, covering Joint Ventures (JVs) and Production Sharing Contracts (PSCs).

“By consolidating real-time data from various operators, the PMCC provides a comprehensive overview of production activities. This ensures timely identification of anomalies, minimises unplanned disruptions, and supports seamless operational continuity.

“With advanced analytics and integrated data, the PMCC empowers stakeholders with actionable insights for proactive decision-making.

“This capability enhances planning, resource allocation, and risk management, enabling operators to meet production targets efficiently and maintain high operational standards.

READ ALSO:

- Israel army presence led to six Gaza hostages killing – Report

- BREAKING: Fighter jet targeting Lakurawa terrorists hits Sokoto communities

- Ibadan stampede: She was treated like a terrorist, Queen Naomi’s sister says about her condition

“A standout feature of the PMCC is its support for predictive and preventive maintenance. By monitoring equipment performance and coordinating maintenance activities, the system ensures the reliability and longevity of assets,” Soneye explained.

He went on to say that the PMCC encourages stakeholder engagement by offering a safe platform for data sharing and communication, enabling effective problem-solving and continual development throughout the sector.

Soneye stated that the PMCC’s involvement in reducing downtime and optimising maintenance directly correlates with higher production and income.

“Under Mele Kyari’s leadership, NNPC Ltd. has achieved a production increase to 1.8 million barrels per day (bpd) and is working towards a target of two million bpd.

“The PMCC is integral to achieving this goal by driving efficiency and enhancing production capabilities.

“The PMCC operates 24/7, staffed by trained professionals, and utilises cloud-based solutions to ensure seamless data exchange with internal and external stakeholders.

“With direct communication links to the Industry-Wide Security Command and Control Centre, the PMCC also enhances the security of production operations,” he added.

As NNPC Ltd. continues its modernisation journey, the PMCC shows its dedication to innovation and excellence in the oil and gas sector.

This program not only matches with national aims but also strengthens Nigeria’s position in the global energy market, assuring long-term growth and profitability for stakeholders.

NNPCL launches production monitoring centre

-

metro2 days ago

metro2 days agoIbadan stampede: Court sends Ooni’s ex-Queen, Hamzat, other to prison

-

metro3 days ago

metro3 days agoIbadan stampede: Ooni’s ex-queen, Oriyomi, others face arraignment today

-

metro3 days ago

metro3 days agoBREAKING: Dele Farotimi released from Ekiti prison

-

metro2 days ago

metro2 days ago[UPDATED] I never lied, truth is my weapon against injustice – Dele Farotimi declares after release

-

metro1 day ago

metro1 day agoINTERPOL declares 14 Nigerians wanted for drug, human trafficking

-

metro2 days ago

metro2 days agoArrest Abuja, Anambra palliative organisers or set those in Ibadan free — MURIC

-

metro1 day ago

metro1 day agoIbadan stampede: She was treated like a terrorist, Queen Naomi’s sister says about her condition

-

metro5 hours ago

metro5 hours agoJigawa State governor loses son 24 hours after mother’s death