Business

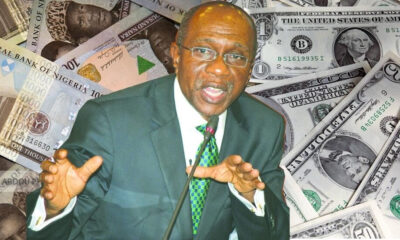

CBN disburses N149.21bn COVID-19 relief loans to 316,869 beneficiaries

The Central Bank of Nigeria has disbursed a total of N149.21 billion to 316,869 beneficiaries through the NIRSAL Microfinance Bank to alleviate the plight of households and businesses and drive economic growth during the COVID-19 pandemic.

The disbursement was part of the N150 billion Targeted Credit Facility (TCF) for affected poor households and Small And Medium Enterprises.

Governor of the CBN, Mr Godwin Emefiele, which stated this also noted that digital economy would help the Federal Government to drive growth in the next few years.

He said that as the pace of technological adoption increased, government and the private sector must find ways to leverage the digital channels to improve access to finance and credit for all Nigerians.

Emefiele spoke at the opening of the 30th CBN seminar for finance correspondents and business editors, themed, “Leveraging Digital Economy to Drive Growth, Job Creation and Sustainable Development in the Midst of a Global Pandemic,” which held simultaneously in Abuja and Lagos.

Emefiele said the country needed robust digital platforms to boost the economic prosperity of the citizens.

Represented by Deputy Governor, Corporate Services Directorate, CBN, Mr. Edward Adamu, Emefiele observed that one of the strongest advantages of technology was its ability to compress time and space and reduce the world to a global village by providing connectivity at the click of a button to anyone anywhere in the world. He said to further drive growth, Nigeria needed to build a solid digital economy, by focusing on the improvement of digital infrastructure, most importantly, Internet connectivity, digital literacy and skills, digital financial services, digital platforms, and digital entrepreneurship.

The CBN governor said as the biggest economy in Africa with one of the largest youth populations in the world, Nigeria was well positioned to develop a strong digital economy. He stressed the need to focus on accelerating improvements across the five fundamental pillars of the digital economy: digital infrastructure, digital platforms, digital financial services, digital entrepreneurship, and digital skills.

He said, “In our effort to drive change and development, the CBN has over the last decade and a half worked to build an effective and efficient payment system.

“The Payment System Vision 2020 strategy document was published in 2007 and the main objective of the strategy was to promote and entrench electronic payments, as the major channel for payment and settlement by all economic agents, away from the current dominance of cash-based transactions.”

Emefiele said the robust regulatory framework put in place by the bank opened up the payment system to innovation with several new players across Payment Service Banks, Payment Terminal Service Providers (PTSP’s), Payment Solution Service Providers (PSSP’s), Mobile Money Operators (MMO’s), Payment Terminal Application Developers (PTSA’s), and agent banking.

He pointed out that a combination of these payment initiatives had helped to create employment opportunities and further the bank’s effort to build a more financially inclusive economy.

“Today, an SME in Ibadan is able to leverage digital channels to sell their products and services to a wider market beyond their immediate environment,” he stated.

He said the CBN regulatory sandbox was available for fintech companies to explore the use of blockchain technology in areas that would be beneficial to the Nigerian economy.

Emefiele said, “Given the resounding success of this programme and its positive impact on output growth, we have decided to double this fund to about N300 billion, in order to accommodate many more beneficiaries and boost consumer expenditure, which should positively stimulate the economy.

“In line with the growing need to go digital, the application process is done online and requires limited paperwork from prospective applicants.”

He added, “The bank continues to improve our remittance infrastructure in order to provide Nigerians in the diaspora with cheaper, convenient and faster channels for remitting funds to beneficiaries in Nigeria.

“In a bid to reduce the cost of remitting funds to Nigeria, the Central Bank of Nigeria on March 8, 2021 introduced a refund of N5 for every $1 of fund remitted into the country through IMTOs licensed by the CBN. We believe this measure would help to support improved foreign exchange inflows and enable Nigerians in the diaspora to use more formal channels relative to informal channels.”

Emefiele explained that these measures were not new, as several countries had adopted similar processes to reduce the cost of remitting fund by their diaspora communities, and it led to surges in remittance inflows through formal channels.

He said following the outbreak of COVID-19, the country was able to benefit from some of the measures put in place by the CBN to develop a robust interoperable payment system.

He said the presence of these digital channels, along with various mobile and web-based channels, helped to support households and the business continuity and remained critical in mitigating the negative effect of the pandemic on GDP growth in 2020.

Emefiele noted that as a result of the CBN interventions, the ICT sector grew by 14.7 per cent in 2020, relative to 10.16 per cent in 2019.

Business

Nigeria Fuel Prices May Rise as Middle East Crisis Deepens

Nigeria Fuel Prices May Rise as Middle East Crisis Deepens

Growing Middle East tensions triggered by ongoing military actions involving the United States and Israel against Iran may soon lead to higher fuel prices in Nigeria, following a surge in global crude oil prices to $72.87 per barrel.

The escalation followed a coordinated strike across multiple locations in Iran, including Tehran, significantly heightening geopolitical instability and fuelling fears of supply disruptions in global oil markets.

For Nigeria—where crude oil accounts for over 85 percent of export earnings and nearly half of government revenue—the implications are far-reaching. While higher oil prices could boost government income, analysts warn that Nigerians may soon face increased petrol (PMS) prices, especially in the current post-subsidy era.

Energy experts say the oil price surge presents a mixed outlook. Oil and gas analyst Ayodele Oni explained that while Nigeria could benefit from increased foreign exchange inflows, higher crude prices typically lead to higher landing costs for petrol, which are eventually passed on to consumers.

Similarly, energy expert Kelvin Emmanuel noted that Nigeria’s 2026 budget benchmark of $64.85 per barrel means the government stands to earn more revenue from rising oil prices. However, he warned that refineries will be forced to adjust fuel prices in line with market realities.

This includes domestic refiners such as the Dangote Refinery, which operates in a deregulated downstream environment where petrol prices are tied to crude oil costs, exchange rates, and operational expenses.

READ ALSO:

- ICPC Says It Found Wiretapping Devices in El-Rufai’s Abuja Residence

- Lagos Announces Traffic Diversions for Ogunnusi Road Reconstruction in Ikeja

- Global Crude Hits $73 as Middle East Tensions Escalate

Economic analyst Dr. Muda Yusuf, Chief Executive Officer of the Centre for the Promotion of Private Enterprise (CPPE), said geopolitical conflicts in the Middle East often trigger oil price spikes due to fears of supply disruptions—particularly around key shipping routes such as the Strait of Hormuz.

According to Yusuf, Nigeria could benefit from:

- Higher crude export earnings

- Improved foreign exchange inflows

- Stronger external reserves

- Increased FAAC allocations

However, he cautioned that Nigeria’s current oil production level of about 1.4–1.6 million barrels per day remains below capacity and is constrained by oil theft, pipeline vandalism, underinvestment, and infrastructure challenges. Without resolving these issues, the country may fail to fully capitalise on higher oil prices.

Yusuf also warned of inflationary pressures, noting that rising fuel costs could increase transport fares, food prices, manufacturing costs, and logistics expenses, worsening the cost-of-living crisis for Nigerian households.

Offering a more cautious outlook, energy economist Professor Wumi Iledare said the current oil rally may be temporary, explaining that modern oil markets operate on real-time data and rational expectations. He noted that unless the Middle East crisis leads to a sustained disruption in oil supply, prices may stabilise.

Energy law expert Professor Dayo Ayoade echoed this view, stating that many countries maintain strategic crude oil reserves, which could limit extreme price spikes. He added that even if prices approach $80 per barrel, Nigeria must remain cautious due to its debt obligations and oil-backed loans.

Ademola Henry Adigun, Chief Executive Officer of AHA Consultancies, said the crisis could further destabilise global energy markets, simultaneously boosting government revenue while raising petroleum product prices domestically.

Analysts stressed that to maximise potential benefits and minimise economic pain, Nigeria must:

- Strengthen anti-oil theft and pipeline protection measures

- Boost upstream oil production and investment

- Expand domestic refining capacity

- Save excess oil revenue during price surges

- Protect vulnerable households from inflation shocks

- Accelerate economic diversification beyond oil

Ultimately, experts describe the deepening Middle East crisis as a double-edged sword for Nigeria—offering short-term fiscal gains while posing serious risks of fuel price hikes, inflation, and economic hardship if not carefully managed.

Nigeria Fuel Prices May Rise as Middle East Crisis Deepens

Business

Global Crude Hits $73 as Middle East Tensions Escalate

Global Crude Hits $73 as Middle East Tensions Escalate

Global oil prices jumped to around $73 per barrel following fresh U.S. military strikes on Iran, heightening fears of supply disruptions in the Middle East and sparking volatility in global energy markets. The increase reflects growing geopolitical risks in a region that accounts for a significant portion of the world’s crude exports.

The surge affected major crude benchmarks. Nigeria’s Bonny Light crude rose to about $72.90 per barrel from $70.80, while Brent crude increased to $72.87 per barrel from $71.10. Murban crude, widely used as a benchmark for Middle East oil, climbed to $74.24 per barrel from $71.50, highlighting market sensitivity to regional tensions.

Geopolitical Concerns Drive Price Spike

Analysts attributed the surge to fears that ongoing conflict could affect production facilities, export terminals, and key maritime routes such as the Strait of Hormuz, a crucial corridor for global oil shipments. The potential for disruption in these areas has intensified market anxiety, pushing prices higher.

READ ALSO:

- Four Die in Katsina Stampede During Ramadan Alms Distribution

- ISWAP Fighter’s Female Relative Surrenders to Troops in Borno

- Gunmen Abduct Father of Former Ebonyi Deputy Governor on Way to Church

OPEC+ Announces Gradual Return of Production

Amid rising prices, OPEC+ members reaffirmed their commitment to stabilizing markets. In a virtual meeting on March 1, 2026, eight countries — Saudi Arabia, Russia, Iraq, United Arab Emirates, Kuwait, Kazakhstan, Algeria, and Oman — reviewed market conditions and announced a plan to gradually return 1.65 million barrels per day (bpd) of voluntary production cuts previously implemented in 2023.

Under the latest agreement, 206,000 bpd will be added back to the market in April 2026, with the remainder phased in gradually based on evolving market conditions. The alliance emphasized continued monitoring of market fundamentals, including global demand, oil inventories, and geopolitical developments, to ensure a balanced and stable market.

The countries also reiterated compliance with the Declaration of Cooperation, ensuring any excess production would be accounted for and corrected through future adjustments. Monthly meetings will continue to assess market trends, with the next session scheduled for April 5, 2026.

Market Outlook and Analyst Predictions

Analysts warned that the combination of geopolitical tensions and the gradual return of OPEC+ supply could result in volatile crude prices in the coming weeks. Traders are balancing potential risks to supply against incremental increases in production, creating uncertainty in both crude and refined fuel markets.

Some experts indicated that if the conflict escalates or disrupts key oil transit points, prices could surge further, potentially exceeding $75 per barrel in the short term. The recent uptick has already sparked expectations of higher gasoline prices at the pump in major consumer markets.

The energy market continues to closely monitor developments in the Middle East, OPEC+ output decisions, and global demand patterns as key indicators for near-term price movements.

Global Crude Hits $73 as Middle East Tensions Escalate

Auto

Ex-CIG Motors GM Jubril of Lagos floats Hybrid Motors Nigeria

Ex-CIG Motors GM Jubril of Lagos floats Hybrid Motors Nigeria

A former General Manager of CIG Motors, Jubril Arogundade, popularly known as “Jubril of Lagos,” has unveiled a new automotive venture, Hybrid Motors Nigeria, with a bold ambition to reshape access to hybrid, compressed natural gas (CNG), and electric vehicles across the country.

Arogundade announced the launch on his birthday, Saturday, February 28, describing the company as a response to Nigeria’s growing appetite for cleaner and more flexible mobility options. He said Hybrid Motors Nigeria aims to build “a unicorn brand in the automobile industry” within five years by bridging gaps in vehicle availability, service capacity, and supporting infrastructure.

According to him, the company’s strategy will rest on seven core pillars: local assembly of hybrid and electric vehicles; nationwide distribution of petrol, hybrid and EV models; establishment of aftersales service and training centres; spare parts supply and distribution; deployment of EV charging systems and stations with what he described as “energy intelligence”; auto asset financing; and vehicle leasing services.

He disclosed that the company’s physical rollout would be phased, with an official showroom scheduled to open in June, while plans are underway to commence factory operations next year. Although he alluded to strategic partnerships that would accelerate market entry and industry transformation, he did not name the partners.

The launch comes at a time when hybrid and alternative-fuel vehicles are attracting increasing interest in Nigeria, driven by rising fuel costs, demand for lower operating expenses, and a broader shift towards cleaner transportation. Fleet operators and private motorists alike are exploring options that offer fuel flexibility and more predictable maintenance.

Hybrid Motors Nigeria said its model goes beyond vehicle sales, combining product supply with service readiness through technical training, parts availability, and charging infrastructure to prevent post-purchase support gaps that often slow adoption.

Further details on the company’s initial vehicle lineup, partnership framework, and rollout timeline are expected ahead of the showroom inauguration.

Arogundade’s announcement follows his recent exit from CIG Motors.

While the company’s Chairman, Diana Chen, had announced the termination of his appointment after an investigation reportedly indicated alleged financial misappropriation and abuse of office, Arogundade has maintained that he voluntarily resigned on December 2, 2025, in line with his contractual and internal corporate obligations.

-

International2 days ago

International2 days agoAyatollah Ali Khamenei, Iran’s Supreme Leader, Dies After U.S.–Israeli Strikes

-

International2 days ago

International2 days agoIran: US, Israel launch another strikes, Commander, Defence leader, five other top officials killed

-

International3 days ago

International3 days agoMiddle East on Edge as Iran Retaliates Against Israel, U.S Bases

-

International3 days ago

International3 days agoTrump Urges Iranians to Overthrow Government Amid US-Israeli Attacks

-

International2 days ago

International2 days agoKamala Harris Slams Trump for Dragging U.S. Into ‘Unwanted War’ in Iran Conflict

-

International3 days ago

International3 days agoReports: US Forces Join Israeli Offensive Against Iran

-

metro2 days ago

metro2 days agoHajj, Umrah Are for Muslims Only – Scholar Urges NAHCON to Tighten Screening

-

International1 day ago

International1 day agoIran Retaliates: Gulf States Allied With US Hit by Missiles, Drones