News

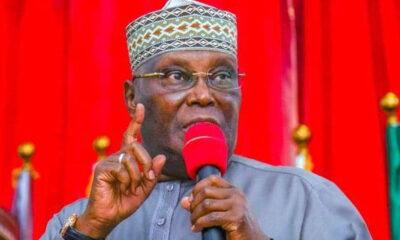

Chicago University: Tinubu urges US judge to release only his certificate to Atiku

Chicago university: Tinubu urges US judge to release only his certificate to Atiku

President Bola Tinubu has reluctantly allowed a federal judge in the United States to give his university certificate to his political opponent Atiku Abubakar.

But the Nigerian leader pleaded with Judge Nancy Maldonado to block all other details, especially the gender and admission records, among others, of the person who owns the certificate from being disclosed.

Mr Tinubu’s prayers on Monday morning came as part of the ongoing legal battle unfolding at the United States District Court for the Northern District of Illinois in Chicago.

The case was brought by Mr Abubakar, who has been on a judicial quest to establish that Mr Tinubu was not eligible to be Nigerian president despite his election in February 2023.

He won the election by 36 per cent of the vote after Mr Abubakar and Peter Obi, who was his running mate in the 2019 election, fell out, subsequently dividing their potential votes into at least two parts, paving the way for Mr Tinubu’s victory with the slimmest margin in Nigerian presidential election history.

Mr Tinubu’s acceptance that his certificate could be released came after he narrowly escaped full disclosure on September 21 by pleading severe harm to his life in order to obtain a stay of a magistrate judge’s order on September 19.

READ ALSO:

- (BREAKING)Eil-ul-Maulid: FG declares Wednesday public holiday

-

Police arrest Adedayo, Council Chairman who accused Gov Abiodun of funds diversion

-

Troops rescue 15 kidnap victims in Zamfara

“There is harm in allowing discovery on issues and documents outside the diploma,” Mr Tinubu’s lawyers said in their full briefing to the court seeking a review of Judge Jeffrey Gilbert’s order by Ms Maldonado, a district judge.

The identity of who was admitted into Chicago State University in the 1970s has been a hot issue after college transcripts emerged that indicated the school admitted a female Bola Tinubu from Southwest College Chicago in 1977.

Whereas Mr Tinubu’s lawyers, led by Victor Henderson and Christopher Carmichael, insisted that the documents Mr Abubakar sought wouldn’t be admissible at the Supreme Court, they nonetheless appeared to anticipate the potential for an unfavourable ruling and consequently gave the judge an alternative direction of giving only an order for the school to certify strictly the certificate the president tendered to run for election.

Mr Gilbert’s ruling last week required CSU administrators to confirm under oath whether or not the certificate Mr Tinubu tendered in Nigeria was genuine. Additionally, the officials were mandated to show a certificate issued to a CSU graduate in 1979, with the person’s identification redacted, and to also turn over communications relating to a letter the school issued to Mr Tinubu in 2022.

Mr Tinubu feared that allowing the deposition of CSU officials to go forward could inflict severe, irreparable damage to his life, saying Mr Abubakar was only on a fishing expedition to fuel online conspiracy theories.

In today’s filing, a man, who identified himself as Olajide Adeniji, submitted an affidavit saying he attended school with Mr Tinubu from 1977 to 1979.

Chicago university: Tinubu urges US judge to release only his certificate to Atiku

(PeoplesGazette)

News

Afenifere Calls for Immediate Take-Off of State Police as Terror Threats Rise in Yorubaland

Afenifere Calls for Immediate Take-Off of State Police as Terror Threats Rise in Yorubaland

The pan‑Yoruba socio-political group Afenifere has warned that escalating terrorist attacks in states bordering the South-West are heightening fears of a full-scale incursion into Yorubaland, calling on governors to urgently implement robust security measures and push for the take-off of state police.

In a statement by its National Publicity Secretary, Jare Ajayi, Afenifere expressed deep concern over repeated attacks in Kwara, Kogi, and Niger states, as well as kidnappings in Ondo, Ekiti, and Oyo states. The group cited the recent Woro and Nuku attacks in Kwara State, where nearly 200 people were reportedly killed and several others abducted, as a warning of the growing threat.

“This is a very disturbing development as cases of abduction seem to be on the increase in Yorubaland. Terror acts are no longer confined to rural areas; even cities like Ibadan have witnessed incidents,” the statement read. Afenifere highlighted the broad-daylight abduction of a schoolgirl in Ibadan’s Challenge area as a chilling example of the insecurity affecting urban centres.

Ajayi urged governors of the six South-West states — Oyo, Ogun, Osun, Ekiti, Ondo, and Lagos — as well as neighbouring states including Kwara, Kogi, Edo, and Delta, to implement practical security arrangements that will allow residents to “sleep with their two eyes closed.”

READ ALSO:

- CAF Confirms 2027 AFCON Dates, Reveals Host Cities, Stadiums Across East Africa

- Ronaldo Returns From Absence to Score in Al‑Nassr’s 2‑0 Win Over Al‑Fateh

- One Dead as Hausa, Benue Communities Clash at Port Harcourt Market

The group recalled that during a November 24, 2025, meeting in Ibadan, the South-West governors had agreed to strengthen regional security through measures such as the South-West Security Fund and the creation of monitoring centres to track potential terrorist activity. Afenifere noted that recent steps, such as Ogun State’s inauguration of CCTV monitoring centres, are commendable but insufficient.

Ajayi stressed that the persistence of banditry and terrorism is not due to a lack of intelligence, but rather the failure to effectively utilize available information. He insisted that state police should take off immediately, while communities must be empowered to develop local security arrangements, including support for the Amotekun Corps and other regional security initiatives.

“It is high time governors in Yorubaland went beyond sermonisation and swung into decisive actions that will make the region truly secure,” Ajayi said.

Afenifere’s warning comes amid growing concerns over security across southern Nigeria, where the spread of banditry, kidnappings, and terrorist attacks is increasingly threatening both rural and urban communities. The group’s call reinforces longstanding advocacy for state-level policing as a critical measure to combat rising insecurity.

Afenifere Calls for Immediate Take-Off of State Police as Terror Threats Rise in Yorubaland

News

UN Chief Calls Africa’s Security Council Exclusion Unfair, Outdated

UN Chief Calls Africa’s Security Council Exclusion Unfair, Outdated

The Secretary-General of the United Nations, António Guterres, has described Africa’s continued exclusion from permanent membership of the UN Security Council as “indefensible”, calling for urgent reforms to reflect today’s global realities.

Guterres made the remarks while addressing world leaders, stressing that Africa—home to more than 1.4 billion people and a major focus of the Council’s peace and security agenda—remains without a single permanent seat in the UN’s most powerful decision-making body.

According to him, the current structure of the Security Council no longer reflects geopolitical realities of the 21st century and undermines the credibility and legitimacy of the United Nations.

“Africa is dramatically under-represented. This is not only unfair, it is indefensible,” Guterres said.

READ ALSO:

- Tragedy on Enugu–Port Harcourt Highway as 11 Die in Road Accident

- Kwara Govt, Security Agencies Analyse Terrorists’ Video to Identify Kidnap Victims

- 26 Killed as Bandits Attack Niger Communities, Burn Police Station, Homes

He noted that while Africa accounts for a significant proportion of issues discussed by the Council—including peacekeeping operations, sanctions, and conflict resolution—it remains excluded from permanent decision-making power, including the veto.

The UN chief reiterated his support for long-standing African demands for at least two permanent seats and additional non-permanent seats on the Council, in line with the African Union’s Common African Position on UN reform.

Guterres also warned that failure to reform the Security Council risks eroding trust in multilateral institutions at a time when global cooperation is most needed to address conflicts, climate change, terrorism, and humanitarian crises.

Calls for reform of the Security Council have intensified in recent years, with African leaders, alongside countries from Latin America and Asia, arguing that the current structure—largely unchanged since 1945—reflects post-World War II power dynamics rather than present-day global realities.

Despite widespread agreement on the need for reform, progress has been slow due to disagreements among UN member states, particularly the five permanent members who hold veto power.

UN Chief Calls Africa’s Security Council Exclusion Unfair, Outdated

News

INEC May Adjust 2027 Election Dates Over Ramadan Concerns

INEC May Adjust 2027 Election Dates Over Ramadan Concerns

The Independent National Electoral Commission (INEC) has acknowledged growing concerns over the timing of the 2027 general elections, which currently coincide with the holy month of Ramadan, and said it may seek legislative intervention if necessary to ensure full electoral participation.

In a statement released on Friday, INEC National Commissioner and Chairman of the Information and Voter Education Committee, Mohammed Kudu Haruna, said the commission is sensitive to public concerns and is consulting with stakeholders on possible adjustments to the election timetable.

The commission explained that the current schedule, developed in strict compliance with the Constitution of the Federal Republic of Nigeria, 1999 (as amended), the Electoral Act, 2022, and INEC’s own Guidelines and Regulations for the Conduct of Elections, 2022, sets Saturday, February 20, 2027, for the presidential and National Assembly elections, and Saturday, March 6, 2027, for the governorship and State Houses of Assembly elections. Party primaries are slated for May 22 to June 20, 2026.

READ ALSO:

- Man Allegedly Kills Brother in Rivers Over Witchcraft Accusation

- Regina Daniels Gifts Mother Two Luxury SUVs in Emotional Surprise

- El-Rufai Alleges Ribadu Ordered Arrest, Says Intercepted Calls Exposed Plot

However, INEC noted that these dates overlap with Ramadan, a period of fasting, prayer, and religious observances for Muslims, which could affect voter turnout and participation, particularly in predominantly Muslim areas. The commission emphasized that any adjustment to the timetable will remain consistent with constitutional and statutory requirements.

“The commission wishes to assure the public that it remains sensitive to all legitimate concerns that may impact electoral participation and the overall conduct of elections. In view of these representations, INEC is currently undertaking consultations and may, where necessary, seek appropriate legislative intervention,” the statement read.

Several political figures have already expressed concerns. Former Vice President Atiku Abubakar called on INEC to reconsider the February 20 date, citing potential disruption of voting during Ramadan. Former presidential aide Bashir Ahmad also urged the commission to review the schedule to avoid disenfranchisement of Muslim voters.

The commission reaffirmed its commitment to conducting transparent, credible, and inclusive elections. It promised to keep the public informed of any adjustments to the election timetable arising from consultations with political parties, civil society, and religious stakeholders.

The debate over the 2027 election schedule highlights the challenges of balancing constitutional timelines with religious and cultural sensitivities, underscoring the importance of ensuring accessible and fair elections for all Nigerians.

INEC May Adjust 2027 Election Dates Over Ramadan Concerns

-

metro3 days ago

metro3 days agoIKEDC Sets Feb 20 Deadline for Customers to Submit Valid IDs or Face Disconnection

-

Education3 days ago

Education3 days agoSupreme Court Affirms Muslim Students’ Right to Worship at Rivers State University

-

News2 days ago

News2 days agoAso Rock Goes Solar as Tinubu Orders National Grid Disconnection

-

metro2 days ago

metro2 days agoLagos Police Launch Manhunt for Suspect in Brutal Ajah Murder

-

International3 days ago

International3 days agoTrump Halts Minnesota Immigration Crackdown After Fatal Shootings, Protests

-

metro3 days ago

metro3 days agoArmy University Professor Dies in Boko Haram Captivity After Nearly One Year

-

Education4 hours ago

Education4 hours agoCheck Your Name: UNILORIN Releases Updated NELFUND Refund List for 2024/2025 Students

-

Sports2 days ago

Sports2 days agoLookman Shines as Atlético Madrid Hammer Barcelona 4-0