Business

FG orders agencies to immediately begin 50% remittance of IGR

FG orders agencies to immediately begin 50% remittance of IGR

The Federal Government has directed the Office of the Accountant General of the Federation (OAGF) to immediately implement the presidential directives on 50 per cent automatic remittance of the internally generated revenue of government-owned enterprises.

The directive is contained in a circular issued by Minister of Finance and Coordinating Minister of the Economy, Wale Edun.

The circular obtained on Wednesday, titled, “Re: Implementation of the Presidential Directives on 50% Automatic Deduction from Internally Generated Revenue of Federal Government Owned Enterprises (FGOEs),” was dated December 28, 2023.

It read, “Further to Circulars Ref. Nos. FMFBNP/OTGHERS/lGR/CRF/12/2021 dated 20th December, 2021 on Revenue, Expenditure and IGR Remittances to the Consolidated Revenue Fund (CRF); the following guidelines are hereby issued for immediate compliance by all federal government agencies/parastatals for the collections, utilisation and remittances of IGR:

“All Ministries, Departments and Agencies (MDAs) that are fully funded through the Annual Federal Government Budget (receiving personnel, overhead and capital allocation) and on the schedule of Fiscal Responsibility Act, 2007 and any addition by the Federal Ministry of Finance (FMF) should remit one hundred per cent (100%) of their IGR to the Sub-Recurrent Account which is a sub- component of the CRF.”

The CRF is an account in which revenues from taxes, statutory allocations from federation account, and other federally-collected revenues are deposited and disbursed.

According to the circular, all partially-funded FG agencies/parastatals (receiving capital or overhead allocation from the Federal Government’s budget) should remit 50 per cent of their gross IGR, while all statutory revenues, like tender fees, contractor’s registration, and sales of government assets, among others, should be remitted 100 per cent to the sub-recurrent account.

The circular also directed all self-funded Federal Government agencies/parastatals (receiving no allocation from the FG budget) to remit 50 of their gross IGR, including all statutory revenue, line like tender fees, contractor’s registration, sales of government assets, etc., to the sub-recurrent account.

The circular further directed the OAGF to open new Treasury Single Account (TSA) sub-accounts for all federal agencies/parastatals listed on the schedule of Fiscal Responsibility Act, 2007 and any additions by the Federal Ministry of Finance.

It stated, “For the avoidance of doubt, the OAGF shall open new TSA Sub-Accounts for all federal government agencies/parastatals listed on the schedule of Fiscal Responsibility Act, 2007 and any additions by the Federal Ministry of Finance, except where expressly exempted.

“The new account opened for agencies/parastatal shall be credited with inflows in the old revenue collecting accounts based on the new policy implementation of 50 per cent auto deduction in line with Finance Act, 2020 and Finance Circular, 2021, 50 per cent cost to revenue ratio.”

It noted that the OAGF, subject to the categorisation of agencies, shall map and automatically effect direct deduction of the 50 per cent on gross revenue of self/partially funded agencies/parastatals and 100 per cent for fully-funded agencies/ parastatals as interim remittance of amount due to the CRF.

It said, “This is to improve revenue generation, fiscal discipline, accountability and transparency in the management of government financial resources and prevention of waste and inefficiencies.

“The revenue collection TSA Sub-Accounts currently operated and maintained by Agencies/Parastatals for receiving revenue from the public shall be blocked from access.

“The accounts shall be under the full control of the Honourable Minister of Finance and Coordinating Minister of the Economy and the Accountant-General of the Federation.”

The circular added that to strengthen the implementation of the presidential directives as conveyed via SGF Circular Reference: SGF.50/5.3/C.9/24, dated October 16, 2018 on Approved Revenue Performance Management Framework for GOEs, the Revenue and Investment Department and the Treasury Single Account Department of the OAGF shall supervise, monitor and carry out a monthly review of both the old and new accounts of the agencies/parastatals to ensure that only funds approved by the Minister of Finance and Co-ordinating Minister of the Economy (HMFCME) and the Accountant-General of the Federation (AGF) were credited to the accounts.

The circular explained, “The Federal Ministry of Finance (FMF) and OAGF will recommend appropriate disciplinary actions and sanctions against defaulting accounting officers of agencies/parastatals found culpable of violating the contents of this Finance Circular and in accordance with the fiscal Responsibility Act.

“Each Federal Government self/partially funded agency/parastatal shall not later than three months after the end of its financial year prepare and publish its audited financial statements/management account in accordance with the prescribed rules and forward copies to the OAGF for the review and computation of operating surplus in line with the approved template of the Fiscal Responsibility Commission/OAGF.

“The remittable portion of the adjusted operating surplus will be determined and paid to the TSA Sub-Recurrent Account after reconciliation.

“The final payment to be made to the TSA Sub-Recurrent Account for the year shall, however, be the higher of the 80 per cent of the adjusted operating surplus and the deducted amount from the TSA Sub-Rec Accounts of the affected agencies/ parastatals.”

It directed that all agencies whose budgets were funded through approved cost-of-collection were expected to submit their annual revenue and expenditure budget for review, adding that any expenditure not approved and or any surplus of revenue over expenditure shall be subjected to the rules guiding the computation of Operating Surplus.

The circular also directed the OAGF to generate auto receipts on direct deductions and remittances made by agencies/parastatals to the TSA Sub-Recurrent Account, which is a sub-component of the CRF.

Immediate past Finance Minister, Mrs Zainab Ahmed, in 2021 pruned the number of agencies under the schedule of the FRA from 122 to 65.

Aviation

Air Peace suspends flights nationwide over NiMet strike

Air Peace suspends flights nationwide over NiMet strike

Air Peace has suspended all its flight operations across the country due to the ongoing strike by the Nigerian Meteorological Agency (NiMet).

The airline said in a statement on Wednesday that it was also suspending operations due to the unavailability of QNH (hazardous weather) reports required for safe landings.

“Due to the ongoing NiMet strike and the unavailability of QNH (hazardous weather) reports required for safe landings, Air Peace has suspended all flight operations nationwide until the strike is over,” Air Peace said.

“Your safety is our top priority. We appreciate your understanding and will share updates as the situation unfolds.”

The airline had earlier announced that the NiMet strike could lead to flight delays and cancellations across its network.

Air Peace added that it was monitoring the situation and working with relevant stakeholders to minimise the impact on customers’ travel plans.

Employees of NiMet commenced a nationwide indefinite strike over welfare issues on Wednesday.

Some of the issues raised involve “NiMet’s refusal to negotiate or implement agreed financial allowances and unresolved entitlements,” including wage awards, peculiar allowances, and outstanding payments from the 2019 minimum wage.

They also accused the management of the agency of withholding important documents, ignoring requests for inclusion of omitted staff in past payments, and neglecting key training programmes in favour of executive retreats.

Business

Nigeria’s gas production increases by 15.6% to 227,931.65 mscf

Nigeria’s gas production increases by 15.6% to 227,931.65 mscf

Nigeria’s gas output has increased 15,6 percent month-on-month, MoM, to 227,931.65 million standard cubic feet, mscf, in March 2025.

But on year-on-year, YoY basis, the nation’s gas output recorded a marginal increase to 227,931.65 mscf in March 2025, from 198,353.62 mscf, recorded in the corresponding period of 2024.

Data obtained from the Nigerian Upstream Petroleum Regulatory Commission, NUPRC, Gas Production Status reports indicated that of the total of 227,931.65 mscf produced in March 2025, 119,552.75 mscf was associated while 108,378.90 mscf was non-associated gas.

Associated gas is extracted in the process of producing crude oil while non-associated gas is produced without crude oil after much investment, exploration and development.

The Ministry of Petroleum Resources (Gas), which is directly involved in the development of policies, targeted at increasing investment in the sector said efforts have been made to increase investment and production of gas in Nigeria.

Similarly, in its recent report obtained by Vanguard, the Nigerian LNG Limited stated: “We are fully committed to expanding our operations with the NLNG Train 7 Project, which will boost our production capacity by 35%, increasing from 22 Million Tonnes Per Annum (mtpa) to 30 mtpa. This project underscores our role as a key player in the global LNG market and positions Nigeria as a top-tier supplier of LNG, leveraging its vast proven gas reserves of 202 trillion cubic feet (the 9th largest globally).

Vanguard

Business

Marketers count losses as NNPC slashes petrol price

Marketers count losses as NNPC slashes petrol price

Petroleum product marketers have expressed frustration over financial losses following the Nigerian National Petroleum Company Limited’s (NNPC) recent reduction in the pump price of Premium Motor Spirit (petrol).

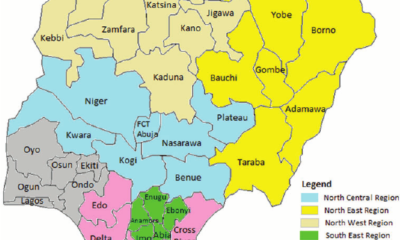

On Easter Monday, NNPC retail outlets across major cities adjusted their pump prices, with Lagos stations dropping from N925 to N880 per litre, while Abuja saw a similar drop to N880. In Kano, the price was revised from N950 to N935 per litre.

The unexpected price cut comes just days after the Dangote Refinery reduced its ex-depot price from N865 to N835 per litre—further intensifying pricing pressure on independent marketers who had stocked up at previous, higher rates.

The $20bn refinery also directed its partners like MRS, Heyden, and Ardova to sell a litre of petrol at the rate of N890 instead of N920 in Lagos, N900 in the South West, N910 in the South-South, and N920 in the North East.

READ ALSO:

- Insecurity: Presidency questions push for state police, accuses govs of not doing much

- Wike’s team warns Falana against ‘misleading his clients’

- Rivers: Fubara’s supporters praise Tinubu’s intervention with emergency rule

This newspaper observes that the new NNPC prices in Kano, Abuja, Port Harcourt and Lagos are N10-N15 lower than that of the Dangote refinery, signalling another price war between the two companies.

Our correspondent reports that some NNPC filling stations are still selling at the old rate. But marketers said these stations were given the liberty to exhaust old stock before adjusting to the new prices.

In an interview with our correspondent, the National Vice President of the Independent Marketers Association of Nigeria, Hammed Fashola, confirmed the price reduction, stressing that filling station operators were losing money.

He told our correspondent that NNPC Retail sent a memo to its outlets to effect the new prices.

“It is confirmed that NNPC has reduced PMS prices. It is now N880 per litre in Lagos. They sent messages to their retail outlets. Some of them have already put the price at N880. However, they allow those having old stock to continue selling at the old rate. Some are still selling at N910.

“Those are the ones that still have their old stock. So, the same thing applies to independent marketers. Those that have their old stock are still trying to see how they can dispense it,” he stated.

While acknowledging that the fluctuation in fuel prices is one part of deregulation, Fashola declared that marketers are losing money.

“The price reduction is a welcome development, but at the same time, it has a negative impact on the side of the marketers. We are losing money. That’s just the truth. We are losing money. That’s the bitter truth,” he said.

READ ALSO:

- UK records over 22,000 asylum-seeking Nigerians

- Driver crushes one-year old boy to death in Ekiti

- Bring your children to compete with mine, MC Oluomo challenges those mocking his spoken English

According to him, the price cuts are good for the masses, but marketers pay the price.

“On the side of the masses, Nigerians are better for it. People are getting cheaper fuel now, which is good. That’s the beauty of deregulation that we are talking about. There’s nothing anybody can do about it. But marketers are the ones bearing the losses, seriously.

Asked if there is any way to reduce the losses, he replied, “On the part of marketers, what we can do is just to try as much as possible to try and sell. We will reduce prices to a level that, at least, our losses will not be too much. So, you will be able to get rid of your old stock before you go to the market to buy at the new rate and start selling at the new rate.

On whether the petrol price could drop to N800 or N700 soon, Fashola refused to make projections.

“I don’t want to predict that. You know, two major factors determine this – the crude oil price and our exchange rate. So, I don’t want to predict the price. All these things have their implications. If the crude oil comes down to something like $50 per barrel, it has its own implications for our economy. It will affect the government revenue. At the same time, inflation and all that are also there. So, I don’t want to predict that,” he stated.

Recall that the Dangote refinery resumed price cuts after the Federal Government directed that the naira-for-crude deal should continue indefinitely.

Marketers count losses as NNPC slashes petrol price

(Punch)

-

metro3 days ago

metro3 days agoRivers: Tinubu meets with Fubara, may lift his suspension

-

metro2 days ago

metro2 days agoI’m not in supremacy battle with Ooni, says new Alaafin

-

Entertainment1 day ago

Entertainment1 day agoP-Square: Jude Okoye freed after two months detention

-

metro3 days ago

metro3 days agoBandits attack Kwara North, kill vigilante, six others

-

Business2 days ago

Business2 days agoNigeria’s gas production increases by 15.6% to 227,931.65 mscf

-

metro1 day ago

metro1 day agoNiger Gov Bago makes U-turn on dreadlocks ban after backlash

-

Entertainment2 days ago

Entertainment2 days agoTuface named technical adviser to Benue governor

-

News1 day ago

News1 day agoJust in: Factional Zamfara assembly leaders want governor to represent budget