Business

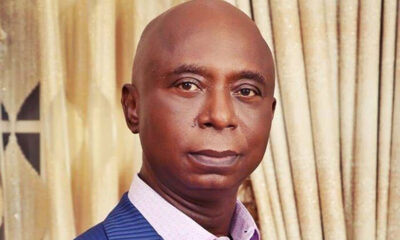

Nigerian economy desperately needs diaspora remittances, says Emefiele

Central Bank of Nigeria (CBN) Governor, Mr Godwin Emefiele, has highlighted the importance of diaspora inflows to the economy, stressing the country will be in a position to reap its benefits if remittance infrastructure improves.

He spoke on the newly introduced “CBN Naira 4 Dollar Scheme,” an initiative aimed at incentivising senders and recipients of international money transfers.

Emefiele spoke at a webinar organised by Fidelity Bank Plc, entitled, “The New FX Policy, Implications and Positive Impact on Diaspora Investments”.

The CBN governor explained that the new policy was expected to attract diaspora remittances through the official foreign exchange channels as well as support forex stability in Nigeria.

The CBN had earlier in a circular dated March 5, 2021, signed by A.S. Jibrin, on behalf of the Director, Trade and Exchange Department, stated that the new initiative would become effective on Monday and Saturday, May 8, 2021.

In line with this initiative, all recipients of diaspora remittances through CBN’s licensed International Money Transfer Operators (IMTOs) shall henceforth be paid N5 for every $1 received as remittance inflow.

The apex bank said in the circular, “The CBN shall through commercial banks, pay to remittance recipients the incentive of N5 for every $1 remitted by sender and collected by the designated beneficiary.

“This incentive is to be paid to recipients whether they choose to collect the United States dollar as cash across the counter in a bank or transfer same into their domiciliary account. In effect, a typical recipient of diaspora remittances will at the point of collection, receive not only the USD sent from abroad, but also the additional N5 per USD received.”

Providing more insight into the new policy, Emefiele said it would offer Nigerians in the diaspora a convenient way to send remittances, adding that it would also aid diaspora investments.

He said, “Our policy on the administration of remittance flows is aimed at increasing the transparency of remittance inflows, reducing rent-seeking activities, and providing Nigerians in the diaspora with cheaper and more convenient ways of sending remittances to Nigeria.

“In addition, we believe that this new policy measure will encourage banks and financial institutions to develop products and investments vehicles geared towards attracting investments from Nigerians in the diaspora. We have no doubt that these changes can help to finance a future stream of investment opportunities for Nigerians living abroad.”

However, Emefiele said, “Yet, the introduction of the new policy presented new challenges, as operators and remittance service providers were initially unable to integrate with the agent banks.” He said the central bank would continue to work to resolve the intermittent interface challenges in the marker.

Emefiele disclosed that the average cost of sending $200 worth of remittance to Nigeria from the US was about 4.7 per cent.

He said, “Countries in South Asia, such as Pakistan and Bangladesh, are aware of this impact and they introduced reimbursement schemes to support inflows.

“In Pakistan, the scheme, which is known as free send, has enabled record amount of inflows of over $2 billion a month even during the COVID-19 pandemic. Bangladesh introduced its own scheme in June 2019, which is a two per cent rebate on remittance inflows. Following this action, they have also seen a 20 per cent boost in remittance inflows.

“On the topic of round tripping, there is a maximum amount that you can remit through an IMTO. You can’t send a $100,000 through an IMTO. The CBN’s action, while it does not go far enough in offering total reimbursements, is a step in the right direction in reducing the cost burden for Nigerians remitting funds to Nigeria.”

Emefiele also disclosed that the central bank had been engaging the IMTOs and the banks to ensure more convenience in fund remittance.

He said, “In an effort to reduce the cost burden of remitting funds to Nigeria by working Nigerians in the Diaspora, the Central Bank of Nigeria has introduced a rebate of N5 for every $1 of fund remitted to Nigeria, through IMTOs licensed by the central bank. This rebate will be provided to the bank accounts of beneficiaries, following receipt of remittance inflows.

“We believe this new measure will help to make the process of sending remittance through formal bank channels cheaper and more convenient for Nigerians in the diaspora. This new policy is expected to take effect on the 8th of March 2021.

“Accordingly, the CBN strives to constantly improve our remittance infrastructure, ease the process of international money transfer and simplify the experience for senders and recipients. In this regard, we note that the efficiency of remittance services, especially as provided by the IMTOs is critical to our aim of boosting inflows. We would constantly seek to fine-tune our policies to mitigate factors that affect the quality of service customers face when using IMTOs.”

Business

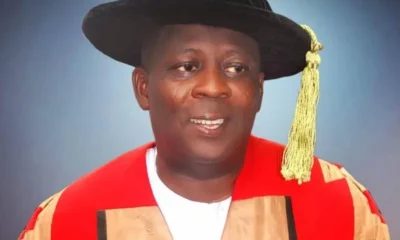

Dangote urges wealthy Nigerians to invest in industries, not luxury cars, private jets

Dangote urges wealthy Nigerians to invest in industries, not luxury cars, private jets

Africa’s richest man, Aliko Dangote, has called on wealthy Nigerians to redirect funds currently spent on luxury cars and private jets into industrial investments that can generate jobs and foster sustainable economic growth.

In a widely shared interview, the Dangote Group chairman warned that the country’s elite have increasingly prioritized lavish spending over productive ventures. “If you have money to buy a Rolls-Royce, you should take that money and put up an industry in your locality or anywhere there is need,” Dangote said.

He expressed concern over the number of private jets parked at local airports, arguing that the resources tied up in such assets could instead create employment opportunities.

READ ALSO:

- Mohamed Salah Slams Liverpool Boss Arne Slot, Hints at Anfield Exit Ahead of AFCON Departure

- Indonesia Flood Disaster: Death Toll Exceeds 900 as Search for Hundreds Continues

- Russia Intensifies Airstrikes on Ukraine as Zelensky, Trump Envoys Advance Peace Talks

Dangote highlighted Nigeria’s growing population, with an estimated 7.8 million births annually, stressing that both government and private sector actors must invest in infrastructure, power, and productive businesses.

Acknowledging the country’s high taxes, he maintained that businesses must still meet their obligations. “For a company like ours, the tax we pay is too much, but we don’t mind… What we are asking for is an enabling environment, but we too must do our civic duties,” he said.

He also urged Nigerians to prioritize domestic investment over foreign capital, noting that attracting investment depends on good policy and rule of law. “We should stop calling for foreign investors because there’s no foreign investor anywhere. What attracts investment is good policy and rule of law,” Dangote added.

Dangote urges wealthy Nigerians to invest in industries, not luxury cars, private jets

Business

Imo Economic Summit: Aliko Dangote Vows to Become State’s Largest Investor

Imo Economic Summit: Aliko Dangote Vows to Become State’s Largest Investor

OWERRI — Africa’s richest man, Aliko Dangote, has assured Imo State Governor Hope Uzodimma that the Dangote Group is prepared to become one of the biggest investors in Imo State, reaffirming the conglomerate’s commitment to expanding its footprint in Nigeria.

Speaking on Thursday during the opening session of the Imo Economic Summit 2025, Dangote called on the state government to specify key sectors requiring investment, promising immediate action once directives are given.

Dangote, who described Governor Uzodimma as a long-time friend, commended him for fostering an enabling environment for business and economic growth in the state.

READ ALSO:

- NSCDC rejects VIP protection requests from senators as demand surges after police withdrawal

- Edo Assembly Moves to Arrest Obaseki, Others Over MOWAA, Radisson Hotel Probe

- Three Top Contenders to Replace William Troost-Ekong as Super Eagles Captain

“We will be one of your biggest investors in Imo. So please tell me the area to invest and we will invest,” he said.

The African industrialist also encouraged Nigerian entrepreneurs to focus on developing their home regions, stressing that sustainable economic growth cannot depend on foreign capital alone.

“What attracts foreign investors is a domestic investor. Africa has about 30 percent of the world’s minerals. We are blessed,” he noted.

Dangote further highlighted progress at the Dangote Refinery, announcing that the facility is on track to achieve a 1.4 million barrels-per-day production capacity, making it the largest single-train refinery in the world.

The assurance marks a significant boost for Imo State’s investment outlook as the government continues efforts to strengthen its economy and attract large-scale private sector participation.

Imo Economic Summit: Aliko Dangote Vows to Become State’s Largest Investor

Auto

Court of Appeal Affirms Ruling Barring VIO from Seizing Vehicles or Fining Motorists

Court of Appeal Affirms Ruling Barring VIO from Seizing Vehicles or Fining Motorists

The Court of Appeal, Abuja, on Thursday, upheld a previous Federal High Court judgment prohibiting the Vehicle Inspection Officers (VIO) and the Directorate of Road Traffic Services (DRTS) from confiscating vehicles or imposing fines on motorists without lawful authority.

A three-member panel of appellate justices, led by Justice Oyejoju Oyewumi, dismissed the appeal filed by the VIO, describing it as lacking merit and affirming the October 16, 2024 ruling of the high court.

The original suit, marked FHC/ABJ/CS/1695/2023, was filed by public interest lawyer Abubakar Marshal, who alleged that he was unlawfully stopped and had his vehicle confiscated by VIO officials at Jabi District, Abuja, on December 12, 2023. He contended that the action was a violation of his fundamental rights.

READ ALSO:

- FG secures release of three Nigerians detained in Saudi Arabia

- Groups Reject Senator’s Call for Removal of NSA Nuhu Ribadu

- US authorities arrest Nigerian CEO Cashmir Chinedu Luke for alleged $7m VA fraud

Justice Nkeonye Maha of the Federal High Court had declared that no law empowers the VIO to stop, seize, impound, or fine motorists, and granted a perpetual injunction restraining the agency and its agents from further violating citizens’ freedom of movement, presumption of innocence, and right to own property.

The court held that only a court of competent jurisdiction can impose fines or sanctions on motorists. It further ruled that the actions of the Respondents violated Section 42 of the 1999 Constitution and relevant articles of the African Charter on Human and Peoples’ Rights.

Although the applicant had sought N500 million in damages and a public apology, the court awarded him N2.5 million. Respondents included the Director of the Directorate of Road Traffic Services, the Abuja Area Commander, the team leader, and the Minister of the Federal Capital Territory.

The appellate court’s decision confirms that the VIO and DRTS cannot legally harass motorists, reinforcing citizens’ constitutional rights on the road.

Court of Appeal Affirms Ruling Barring VIO from Seizing Vehicles or Fining Motorists

-

metro3 days ago

metro3 days agoSenate Launches Emergency Probe into Widespread Lead Poisoning in Ogijo, Lagos/Ogun

-

Sports1 day ago

Sports1 day ago2026 FIFA World Cup Draw: England Draw Croatia as Brazil Face Morocco in Tournament Opener

-

News1 day ago

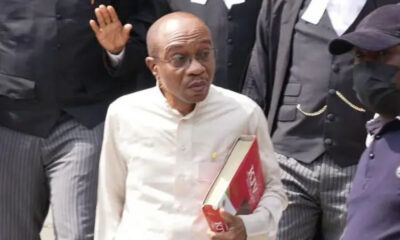

News1 day agoAkpabio sues Natasha for ₦200bn over sexual harassment allegations

-

metro3 days ago

metro3 days agoNed Nwoko vows legal action against rising online harassment, criminal defamation

-

metro2 days ago

metro2 days agoTinubu Govt Eliminates More Terrorists Than Previous Administrations — Fani-Kayode

-

metro1 day ago

metro1 day agoNigerian woman sparks outrage for refusing chemotherapy despite ₦30 million donations over religious Beliefs

-

metro1 day ago

metro1 day agoFour Teenagers Killed in Banki Explosion as Borno Police Probe Deadly IED Blast

-

Opinion2 days ago

Opinion2 days agoSiyan Oyeweso: Lessons in virtue and vanity

You must be logged in to post a comment Login