Business

Nigeria’s debt hits N35.5tn, says DMO

Nigeria’s total debt rose to N35.5 trillion at the end of June 2021, the Debt Management Office has said.

The new figure, it stated, was 7.75 per cent higher than the N32.9 trillion recorded at the close of last year.

Director-General of the DMO, Patience Oniha, said on Wednesday that the external debt accounted for N13.7 trillion or 38.7 per cent while approximately N21.8 trillion was sourced from the local market.

She explained that 83.07 per cent of the total debt was held by the Federal Government while the 36 states and the Federal Capital Territory’s borrowings accounted for 16.93 per cent.

The percentage of the FG’s share of the national debt had increased from 81.94 per cent as at December 2020.

Minister of Finance, Budget and National Planning, Zainab Ahmed, had disclosed at a session organised by the African Development Bank that debts of some states were not captured in the figures regarded as national debts.

Oniha said the amount remained within fiscally accepted bound except that not much is done to shore up poor revenue.

She explained that China accounted for about 10 per cent of the external debt (which amounts to approximately N1.37 trillion), while the multilateral organisations had the largest share of 54.9 per cent.

Oniha, in a virtual media chat on Wednesday, said the country risked the debt sustainability issue if it failed to grow the current low revenue profile, which places Nigeria in the poorest category among its peers.

She said, “We should focus on revenue. The good thing about it is that the Minister of Finance, Budget and National Planning has started a programme aimed at growing the revenue profile.

“We must discipline ourselves to follow through to grow our revenue. If we continue to borrow and do nothing about growing our revenue base as other countries have done, we may have a debt sustainability challenge.”

Comparing the tax to gross domestic product of 11 countries, the DG said Nigeria as of 2019 was one the nations with the least ratio.

The selected countries are the United States, United Kingdom, Brazil, South Africa, Kenya and Mexico. Others included Canada, Morocco, Ghana and Angola.

While South Africa had the highest tax to GDP of 26.7 per cent, Nigeria sat at the bottom with 5.68 per cent. Angola, which came after Nigeria from the bottom, recorded 9.4 per cent tax to GDP.

Oniha said it was important to interrogate the reasons the country’s huge GDP has not translated to revenue, and that it was time the authorities aggressively pursued income-yielding policies.

She said Nigeria’s debt to GDP remained considerably low at 21.92 per cent, up from 21.61 per cent last year. She, however, said it could increase to 35 per cent when the ways and means facility (WMF), that is, overdrafts with the Central Bank of Nigeria (CBN), is added to the debt stock.

On the current value of the WMF, the DG said she could only give information on the status at the beginning of the year, when it was estimated at N10 trillion, suggesting that the figure could be higher.

She admitted that the government had overreached the limit set by the CBN Act, stressing that the government was compelled to do so owing to the revenue shortfall.

“We are currently working at converting it to a tenor facility. This is because overdrafts should be cleared when they are due,” the DMO boss started.

Business

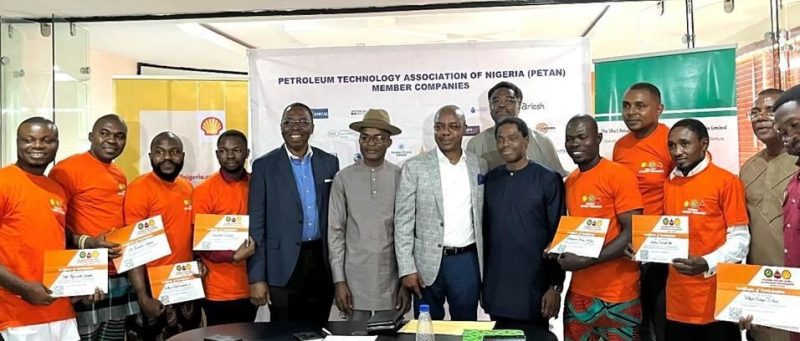

Shell, partners employ 133 young graduates after internship engagement

Shell, partners employ 133 young graduates after internship engagement

Shell Petroleum Development Company of Nigeria Ltd (SPDC) and its partners have offered jobs to 133 young graduates after their engagement in internship programme.

They are part of 170 young graduates that benefitted from the NCDMB/PETAN/SPDC JV Graduate Internship programme attached to indigenous technical oilfield service companies in the upstream and downstream sectors for hands-on experience.

A statement obtained on Monday said the 133 employed by the companies indicated the success of the programme as a talent pipeline for the oil and gas industry in Nigeria.

It disclosed that the latest batch of 49 intakes graduated at a ceremony in Port Harcourt early this month after completing their internship which began in 2022.

Speaking at the ceremony, Chairman of the Petroleum Technology Association of Nigeria (PETAN), Wole Ogunsanya, commended the Shell Petroleum Development Company of Nigeria Ltd (SPDC) Joint Venture for the support for the programme, helping to build local manpower for a critical sector of the economy.

SPDC and PETAN had jointly set up the programme in 2014 whereby young graduates are attached to the over 100 member companies of the organisation with SPDC paying them monthly stipends.

From 2022 when the Nigerian Content Development and Monitoring Board (NCDMB) joined the collaboration, the programme has run for two years with 100 intakes.

The NCDMB/PETAN/SPDC JV Graduate Internship programme has been lauded as a key human capital development initiative which is central to the promotion of Nigerian content in the oil and gas industry.

SPDC’s General Manager Nigerian Content, ‘Lanre Olawuyi, said, “The internship is more than a learning opportunity. It provides fresh graduates with technical expertise, equipping them with the practical skills needed to excel in their careers.

“It aligns with SPDC’s broader educational initiatives, contributing significantly to the actualisation of the UNESCO ‘Education for All’ agenda and the Sustainable Development Goals in Nigeria, particularly in the Niger Delta.

“We owe the success of the programme to the untiring support of our JV partners, the Nigerian National Petroleum Company Limited (NNPCL,) TotalEnergies and Nigerian Agip Oil Company Limited for which we’re grateful.”

Business

Warri refinery now operational, doing 125,000bpd – NNPCL boss

Warri refinery now operational, doing 125,000bpd – NNPCL boss

Warri Refining and Petrochemicals Company (WRPC) in Delta State has commenced production after a major rehabilitation of the facility.

Group Chief Executive Officer (GCEO) of the Nigerian National Petroleum Company (NNPC) Limited, Mele Kyari, disclosed this on Monday.

Kyari said the refinery is not fully completed but is producing 125,000 barrels per day.

He spoke to journalists during a tour of the facility on Monday, attended by key stakeholders.

The announcement is coming about a month after the old Port Harcourt refinery idle for five years resumed full operations, producing petrol, kerosene and diesel.

There are also expectations that the other state-owned Kaduna Refining and Petrochemicals Company (KRPC) currently undergoing rehabilitation would bounce back soon.

The NNPCL in April promised restore the Kaduna refinery to 60 percent of its production capacity by the end of this year.

Business

Real reason Dangote, NNPC drop petrol price — IPMAN

Real reason Dangote, NNPC drop petrol price — IPMAN

Independent Petroleum Marketers Association of Nigeria, IPMAN, has attributed the fierce competition between Nigeria’s two refineries owned by Dangote and NNPC Limited for the recent drop in the pump price of premium motor spirit, PMS, also known as petrol.

Checks by Vanguard yesterday showed that most petrol retail outlets have reduced their pump prices in response to a drop in ex-depot prices by Dangote Refinery and the Port Harcourt Refinery.

Findings showed that while NNPC Retail reduced its price from N1,030 to N965 per litre, other retailers, such as AA Rano and AYM Sharfa, dropped their pump price from N1,070 to N1,020 per litre.

However, despite these reductions, it was observed that pump price at Conoil remained at N1,090 per litre, the same as it was in November.

Speaking to Vanguard, Public Relations Officer, IPMAN, Chief Chinedu Ukadike, said competition between the local refineries and the smooth flow of the product have resulted in the reduction in prices.

He said: “It is a good development for independent marketers and for consumers too. Now, because of increased demand, price normally goes up during this period but right now the opposite is the case. ‘’Availability has been taken care of and we are now seeing price war among the gladiators, NNPC and Dangote.

READ ALSO:

- Umahi beats Obi, others to emerge Ohanaeze’s Igbo Man of the Year

- Saraki betrayed me after helping him become Senate president – Ndume

- Atiku demands probe into ‘military’ parade for Tinubu’s son, Seyi

“By next year when the Warri and Kaduna refineries are expected to come onstream, things will even be more interesting”.

Ukadike noted that independent marketers were now able to buy directly from both refineries because “there is a slight increase in turnover. When the price was around N1,300/litre most of our members barely sold 5,000 litres daily but we are doing far better than this.

“We are also now able to get products directly. NNPC portal is open now for marketers to take as much product as they want. Dangote has also heeded our call and reduced the volume for bulk purchase eligibility.

“Initially it was limited to 10 million litres but now they sell at two million litres which is about N2 billion. This is more bearable for independent marketers who are now able to come together to place orders for the product.’’

There were indications that the coming on stream of the Port Harcourt Refinery and Dangote Petroleum Refinery would impact Nigeria’s foreign exchange rate in 2025.

The old Port Harcourt refinery and Dangote Petroleum refinery have the capacity to process 560,000 barrels per day, bpd and 60,000 bpd of crude oil respectively.

Before the coming on stream of the two refineries, Nigeria used to depend on the international market for its petroleum products.

However, the Director/CEO, Centre for the Promotion of Private Enterprise, CPPE, Dr. Muda Yusuf, who expressed the optimism in his Outlook, yesterday, said: “The Import substitution effect of the Dangote and Port Harcourt refineries with the consequential easing of demand pressure on the forex market.”

Marketers adjust pump prices

Meanwhile, checks by Vanguard, weekend indicated that oil marketers continued to adjust pump prices following the provision of new ex-depot prices by both NNPCL and Dangote Refinery at N899 per litre and N899.50 per litre, respectively, last week.

Further checks by Vanguard showed that both NNPCL and MRS filling stations involved in marketing Dangote Petroleum Refinery have started adjusting the pump prices.

Real reason Dangote, NNPC drop petrol price — IPMAN

-

Africa3 days ago

Africa3 days agoNiger’s president faces fire at home over attack on Nigeria

-

International3 days ago

International3 days agoBashar Assad relatives arrested while trying to fly out of Lebanon

-

Opinion3 days ago

Opinion3 days agoTinubu’s Buharization of NNPC By Farooq Kperogi

-

metro1 day ago

metro1 day agoFarotimi to pursue disbarment over arrest, defamation allegations

-

Politics1 day ago

Politics1 day agoGbajabiamila speaks on his rumoured Lagos governorship ambition

-

metro2 days ago

metro2 days agoWe’re not aware of VeryDarkMan’s missing N180m — Police

-

metro2 days ago

metro2 days agoNDDC empowers Niger Delta young entrepreneurs with N30bn

-

metro3 days ago

metro3 days agoFG pays N1.1bn professional fees to Afe Babalola, other top lawyers – Report