Business

NNPC denies operating secret account, says fuel subsidy gulps N2.6tn

The Nigerian National Petroleum Company Limited (NNPCL) has not remitted any amount to the federation account since the beginning of this year as the company’s deduction for petrol subsidy rose to N2.565 trillion at the end of August 2022.

A new report by the NNPC revealed this even as the company denied any involvement in the operation of any secret bank account, stating that the Office of the Accountant General of the Federation (OAGF) was aware of its financial transactions.

An analysis of NNPC’s monthly presentation to the Federation Account Allocation Committee (FAAC) at the weekend, further showed that the NNPCL has so far spent N2.565 trillion on the controversial subsidy this year.

Information from the FAAC meeting had earlier revealed that the money available for distribution among the three tiers of government for the month slumped by N280.948 billion to N673.137 billion when put aside the N954.085 shared in July.

Of the amount, the Federal Government received N259.641 billion; the states received N222.949 billion, while the local governments got N164.247 billion.

“The sum of N525,714,373,874.60 being federation account share was used to defray value shortfall/subsidy for the month,” the NNPCL stated in a document quoted by TheCable.

According to the national oil firm, in January, February, March, and April 2022, the petrol subsidy gulped N210.38 billion, N219.78 billion, N245.77 billion and N271.13 billion respectively.

Furthermore, in May, June, and July, the country spent N327.07 billion, N319.18 billion and N448.78 billion respectively before the hugest deduction of N525.71 billion in the latest instance.

The NNPCL also on Saturday said it was not involved in the operation of any secret bank account.

It said that the Office of the Accountant General of the Federation (OAGF) was aware of its financial transactions.

In a thread on its verified Twitter handle last night, signed by the spokesman for the national oil company, Mr Garba Muhammad, the company explained that it was unaware of the existence of any such account.

The House of Representatives a few days ago said it was probing the structure and accountability of the joint venture businesses and Production Sharing Contracts (PSCs) of the NNPCL in the last 32 years.

The lawmakers had alleged that they had uncovered a secret account owned by the NNPCL allegedly in breach of due process.

The report stated that an official of the OAGF, Mr Chize Peters, disclosed to the Abubakar Fulata-led Adhoc committee probing the matter.

The committee was said to have directed the Group Chief Executive Officer of the NNPCL, Mele Kyari, to appear before it to offer explanations on the issue.

But in a series of tweets, the spokesman of NNPCL said, “The NNPCL, directly or through its upstream arm, the National Petroleum Investment Management Services (NAPIMS), does not operate secret accounts at all.

“The joint venture cash call accounts denominated in US Dollars and Nigerian Naira are all domiciled with the Central Bank of Nigeria in line with the Treasury Single Account (TSA) policy.

“The Joint Venture Cash Call (JVCC) NGN and USD accounts were created to cater for the funding of cash calls for the various Joint Ventures managed by NNPCL on behalf of the Federal Government,” the company said.

The statement added that the ‘Joint Venture Proceeds Accounts’ were opened for the individual JVs to implement the self-funding strategy which aims at making them be self-reliant.

“The Office of the Accountant-Gen. of the Federation (OAGF) is fully aware of the JVCC accounts as the OAGF regularly sanctions & approves the updates/change of signatories to the accounts.

The NNPCL has documents where these correspondences with the OAGF were acknowledged.

“The NNPC/NAPIMS books of accounts in respect of the federations upstream petroleum activities are audited annually by independent external auditors,” the national oil company said.

According to the NNPCL, a critical part of the independent statutory audit is sending ‘circularisation’ to banks to confirm balances and bank accounts belonging to NNPC/NAPIMS.

It stressed that Audited Financial Statements (AFS) are submitted to all stakeholders including the National Assembly.

In addition, the company stated that the OAGF conducts periodic (yearly) checks on the activities of NNPC/NAPIMS, maintaining that the activities of the NNPCL and NAPIMS are audited yearly by the Nigerian Extractive Industry Transparency Initiative (NEITI).

“NNPCL has documented evidence of the correspondences between the company and the OAGF before the accounts were opened with the @cenbank, in line with the Treasury Single Account (TSA) policy.

“We also have evidence of reconciliations carried out with the @cenbank for the year ended 31-12-2021 in respect to the JV Cash Call Accounts.

“Thus, with such multiple layers of checks and balances, it is impossible for @nnpclimited to operate secret accounts until the ad hoc Committee, with due respect to its competencies, discovers it.

“If such ‘secret account’ does exist, then @nnpclimited certainly is not aware of, and has absolutely nothing to do with it,” the statement concluded.

Auto

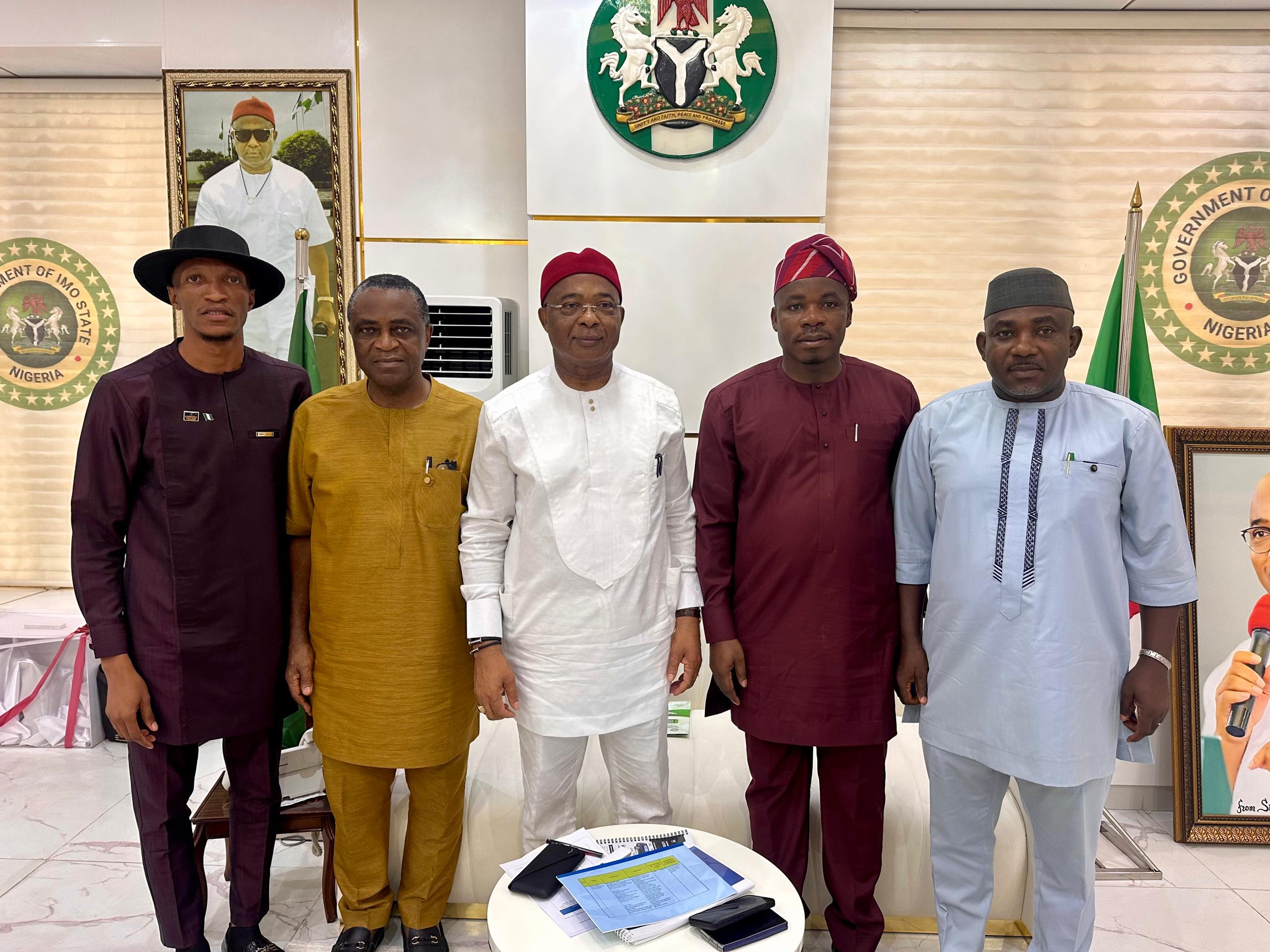

NADDC DG hails Kojo Motors for establishing CNG conversion centre in Owerri

NADDC DG hails Kojo Motors for establishing CNG conversion centre in Owerri

Kojo Motors has partnered the National Automotive Design and Development Council (NADDC) in setting up the vehicle Compressed Natural Gas conversion centre in Owerri, lmo State.

Director-General of the NADDC, Joseph Osanipin, during an empowerment and awareness summit on Wednesday, March 19, 2025, commended the auto firm for the monumental project.

“Today, we are gathered here for Compressed Natural Gas (CNG) Empowerment and Awareness Summit 2025 with the theme ‘Building a youth-based nation through cleaner energy’,” he said.

Osanipin said that the the purpose of the summit was to create awareness and sensitize the public to safety, standards and regulation in the use of the CNG as a better alternative source of energy for mobility.

NADDC, he said, was equipping technicians with the knowledge, skills and competencies required to safely and efficiently convert vehicles to run on CNG.

“The Council is a parastatal of the Federal Government under the Federal Ministry of Industry, Trade and Investment,” he added.

“It has the regulatory oversight on the Nigerian Automotive Industry to initiate, recommend, supervise and regulate policies and programmes for locally manufactured vehicles and components in Nigeria.

The NADDC boss noted that the Council had worked tirelessly to ensure the survival and growth of this sector with a view to enhancing its contribution to the national economy.

As part of the CNG conversion programme, 60 technicians will be receiving hands-on training in converting vehicles to run on CNG which would run for five days from the March 17 to 21,2025.

Osanipin emphasized the importance of using certified conversion kits and specialized workshops to ensure safety during the process.

“The cylinders used in CNG vehicles are fortified, making them safer than traditional vehicle fuel tanks,” he said.

Also speaking during the event, Professor Anoka Njan, representative of the Minister of Industry Trade and Investment, praised the NADDC and Kojo Motors efforts, stating that the ministry fully supported the initiative as part of broader efforts to alleviate challenges in the auto industry and empower the youth.

Imo State Commissioner for Youth Development, Dr. Emeka Mandela Ukaegbu, who spoke at the summit on behalf of Governor Hope Uzodinma, emphasised the immense potential of the CNG in easing Nigeria’s transportation challenges and improving the economy.

“CNG offers a safer, cleaner, and cheaper alternative to the hardships many face in the country,” Dr. Madela said.

The administration is partnering with NADDC and automotive industry bodies to establish conversion workshops and CNG refilling stations across Imo State, ensuring that the state plays a key role in this important shift toward greener energy solutions.

The event marks a significant step in NADDC’s ongoing efforts to transform Nigeria’s automotive industry, making it more sustainable while creating new opportunities for skilled technicians and local communities.

Chinedu Oguegbu, Managing Director of OMAA, which is the vehicle brand promoting the petrol-powered to CNG conversion project, highlighted the economic benefits of running vehicles on CNG instead of petrol.

He listed the economic advantages to include savings up to 60 percent in the cost of fuel relative to dirtier options like diesel and petrol.

According to him, there is up to 90 percent reduction in knocks and carbon emission, and it is found to be healthier, cleaner and more environmentally friendly.

Besides savings in foreign exchange (FX) with abundance of gas locally, there is also massive resources in-country over 203 tcf of proven reserves that requires no refining and relatively lower investment for processing.

Nigeria has an estimated 15-20 million vehicles in operation that can be converted to dual-fuel or bi-fuel.

The OMAA boss reiterated the crucial need to provide an alternative to existing fuel system with the abundance of CNG as an option.

Delivering his goodwill message, Chino Ogwumike, the National Sales Manager at Kojo Motors, thanked the DG of NADDC for partnering with Kojo in this laudable project in Owerri, the heartland of the South-East of Nigeria and the government of Imo State for accepting to provide the land for building the CNG hub in the state capital.

Ogwumike stated that the flourishing automotive dealership with branches spread across the country under the visionary leadership of the founder and Executive Chairman, Ikenna Oguegbu, is strongly committed to contributing its quota towards the progress and development of Nigeria’s automotive sector and the economy.

Business

Binance delists five cryptocurrencies

Binance delists five cryptocurrencies

Binance, the world’s largest cryptocurrency exchange, has announced the delisting of five digital assets after a routine review of their adherence to industry standards.

According to a statement released by Binance, the affected cryptocurrencies include Aergo (AERGO), AirSwap (AST), BurgerCities (BURGER), COMBO (COMBO), and Linear Finance (LINA).

The decision was based on several key factors, including trading volume, security, liquidity, the commitment of project teams, and compliance with regulatory requirements.

READ ALSO:

- Akpabio told me I’d make good movements with my waist – Natasha

- Supreme Court declares Wike’s ally Anyanwu as PDP National Secretary

- Why we want Natasha out of Senate – Kogi Central constituents

The company said this step, aimed at maintaining a robust and transparent trading environment, shows Binance’s commitment to ensuring that all listed assets align with the platform’s evolving criteria.

“These projects no longer meet the platform’s listing requirements,” Binance noted in its internal review. As a result, these tokens will be removed from all spot trading pairs starting March 28, 2025, at 3:00 a.m. UTC.

The exchange has advised users holding these assets to take appropriate steps to manage their portfolios ahead of the delisting deadline.

Key delisting details and user guidelines

Binance provided additional clarity on how the delisting process will impact its users:

- Binance Futures: Positions for AERGO, LINA, and COMBO will be automatically closed and settled by March 27, 2025, at 9:00 a.m. UTC.

- Binance Simple Earn & Investment Products: The affected tokens will no longer be available across these services after March 27, 2025.

- Binance Convert & Trading Bots: Support for the delisted tokens will cease by March 28, 2025.

Binance also mentioned that in some instances, delisted tokens might be converted into stablecoins on behalf of users after delivery. However, the exchange clarified that this would only apply if explicitly announced.

Looking ahead, Binance revealed plans to launch a Vote to Delist feature, enabling the public to suggest assets for delisting in the future. However, the tokens mentioned in this announcement will not be eligible for the feature.

Binance delists five cryptocurrencies

Business

Air Peace slashes Nigeria-London fare by N600,000

Air Peace slashes Nigeria-London fare by N600,000

Air Peace has announced a ₦600,000 reduction in its Nigeria-London airfare for all travelers flying from Nigeria.

In a statement released on Wednesday in Lagos, the airline’s Head of Corporate Communications, Dr. Ejike Ndiulo, stated that the discount is part of Air Peace’s latest promo offer.

Passengers departing from any Nigerian city to London can enjoy significant savings, along with an exclusive one-free extra luggage allowance.

READ ALSO:

- Tinubu’s state of emergency prevented Fubara from impeachment – AGF

- FG blames Fubara for bombing of oil pipeline

- Over 90% Nigerian land not registered, says Housing minister

According to Ndiulo, the airline rewarded five lucky winners of a raffle draw at the Silverbird Man of the Year Awards held on Sunday in Lagos.

He said that three winners won return economy tickets to any of Air Peace’s domestic destinations, while two won economy return tickets to London.

He said that the Chairman/Chief Executive Officer of Air Peace, Dr Allen Onyema, emphasised the airline’s commitment to driving Nigeria’s socio-economic development through its corporate social responsibility initiatives.

Air Peace slashes Nigeria-London fare by N600,000

-

Auto2 days ago

Auto2 days agoLanre Shittu Motors offers support for EV bus design competition in universities

-

International1 day ago

International1 day agoUK announces new passport application fees starting April 2025

-

metro2 days ago

metro2 days agoIbas: 18 things to know about Rivers administrator

-

metro3 days ago

metro3 days agoSoldiers take over Rivers Government House after state of emergency declaration

-

metro3 days ago

metro3 days agoPipeline explosion hits Bayelsa amid Rivers state emergency declaration

-

metro1 day ago

metro1 day agoCourt lifts order stopping Senate probe on Natasha Akpoti

-

metro2 days ago

metro2 days agoTanker explodes on Abuja bridge, many feared dead, 30 vehicles burnt

-

metro2 days ago

metro2 days agoMohbad’s brother, Adura, arrested by police in Lagos