Business

Pandora Papers: How Governor Bagudu allegedly stole billions, stash in foreign accounts

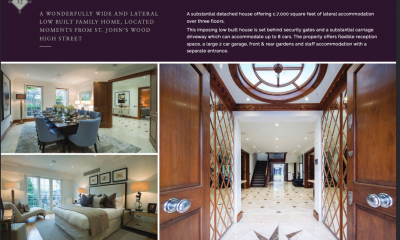

Eleven years ago, Abubakar Bagudu, the current governor of Kebbi State, but then a senator, dispatched a delegation to Singapore in search of a new haven to shelter his controversial wealth, which is a target of ongoing forfeiture proceedings by the United States Department of Justice.

Investigators say the huge funds, warehoused offshore, is part of billions of dollars Bagudu helped the Sani Abacha family to steal from Nigeria in the 1990s.

Referred by Farrer and Co., a prestigious centuries-old London law firm that has represented the British royal family, Bagudu’s choice of secrecy provider in Singapore was Asiaciti Trust, an entity notorious for helping clients hide behind opaque offshore trusts to launder dirty money across borders.

The Monetary Authority of Singapore, MAS, imposed a fine of one million and a hundred thousand dollars on Asiaciti in July 2020 for “serious breaches” of Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) regulations between 2007 and 2018.

When on February 23, 2010, Bagudu’s delegation – comprising his brother, Ibrahim Bagudu, and London lawyer, Ben Davies, from Byrne and Partners, now a part of PCB Byrne – met with Asiaciti’s officials, they registered his preference for a new structure of secrecy to oil the flow of his dirty wealth for the benefits of himself and his family.

In 1997, some 13 years earlier, Bagudu had structured offshore holdings Ridley Trust and Ridley Group in notorious tax and secrecy havens, Guernsey and the British Virgin Islands, positioning himself as the unseen but ultimate beneficiary. But in 2010, he wanted to terminate the Ridley structure and transfer his assets into another structure, hence the need for Asiaciti’s service in Singapore.

The reason, according to a 2010 Asiaciti memo, was control. As noted in the memo, Ibrahim told the February 2010 meeting that his brother, Mr Bagudu – “the client” – had become “disillusioned” with institutional and independent trustees (of the Ridley Trust) as they (he and his brother) had no control over their action or inaction and suggested they feared they could lose the hidden assets.

He then insisted that any new trustee arrangements to be erected in Singapore “must ensure that the family cannot lose ‘control’ of the assets.”

In the months that followed, 99 million euros in cash and securities was then transferred from Ridley to a new structure enabled by Asiaciti, which brushed aside red flags about Mr Bagudu’s controversial background and source of his wealth. Asiaciti acted with advice from Farrer and Co. and Byrne and Partners, now a part of PCB Byrne, documents showed.

Bagudu is long known to have played an instrumental role in the Abacha conspiracy to steal and launder billions of dollars belonging to Nigeria. But how he set up complicated structures of secrecy to hide stolen money as well as the role of his enablers, including prestigious British law firms and Serious Organised Crimes Agency (SOCA) the predecessor of the National Crimes Agency (NCA), has never been crystal clear.

Pandora Papers investigation – led by the International Consortium of Investigative Journalists, including more than 600 journalists, including some from PREMIUM TIMES, and about 150 news organisations around the world – uncovered financial secrets, including those of politicians, former and serving public officials, including known and suspected kleptocrats such as Bagudu. Involving 11.9 million leaked records, which journalists sifted through for two years, the Pandora Papers project is the biggest collaborative transnational investigation in the history of journalism.

The leaked records came from 14 offshore services firms from around the world who help clients set up shell companies and design opaque structures to conceal their financial dealings.

The Bagudu Blue structure

As documents showed, Asiaciti helped Mr Bagudu to set up a multi-layered structure with footprints in at least three countries, namely Singapore, Cook Islands, and the United Kingdom. At the head of the structure is Blue Holdings Trust, registered in Cooks Island as a “purpose trust” to “wholly” own a Singapore-incorporated private trust company, Blue PTC Pte Ltd., with Mr Bagudu’s brother, Ibrahim, and an Asiaciti nominee as directors.

The Blue PTC Pte Ltd is in turn the trustee of two family trusts – Blue Family Trust (1) and Blue Family Trust (2). Under each trust, then, is a Singapore family-owned investment holding company, FHIC, Blue Holdings (1) Pte Limited, and Blue Holdings (2) Pte Limited, respectively.

Each of the FHIC has an investment account with Waverton Investment Management, formerly JO Hambro Investment Management, and James Hambro and Partners, both London-based firms. Assets kept with the two firms are now frozen, according to U.S. court documents. America has been at the forefront of helping Nigeria recover the Abacha loot, saying that hundreds of millions of dollars stolen were laundered through banks under its jurisdiction.

The beneficiaries of each of the family trusts and the corresponding investments domiciled in London were Bagudu, his wife, seven children, and his brother, Ibrahim.

In September 2010, according to minutes of some meetings we reviewed, a sum of 99 million euros was moved from Ridley through the Blue PTC in Singapore to the investment accounts in London and distributed as follows:

Blue Holdings (1) (17,007,016 euros): Waverton – seven million euros; James Hambro – 10,007,016 euros.

Blue Holdings (2) (81,841,163 euros): Waverton – 23 million euros; James Hambro – 58,841,163 euros.

Source of funds: Bagudu and the Abacha plunder machine

The systematic plunder of Nigeria by the Abacha family as well as the worldwide hunt for the stolen funds, worth billions of dollars, is reckoned to be one of the worst cases of kleptocracy and offshore shenanigans in the world.

Between 1998, when Mr Abacha suddenly died, and 2020, 3.6 billion U.S. dollars have been recovered from the Abacha family and their most prolific bagman, Bagudu, now a governor in Nigeria’s impoverished Kebbi State.

The 163 million U.S. dollars recovery from Jersey in 2003 directly involved Mr Bagudu, who then negotiated a deal with the U.S. and Jersey to return the funds to Nigeria in exchange for Jersey’s withdrawal of an extradition request and his free return to Nigeria. He spent six months in American federal prison in Houston while awaiting extradition to Jersey. The deal to return the $163 million was to avoid that extradition.

Also, the latest recovery – 308 million U.S. dollars from Jersey in 2020 – was laundered by Mr Bagudu.

Mr Bagudu was involved with all the offshore front companies and bank accounts – from the British Virgin Islands to Ireland, Switzerland, England, Guernsey, and Jersey – used to steal and launder billions of dollars belonging to Nigeria under the Abacha regime as a director, signatory on accounts or prime beneficiary, according to U.S. court documents and incorporation filings from the Pandora Papers leaks.

In stealing the funds, Mr Abacha set up what Africa Confidential described as a “Plunder Machine,” involving his family, officials, and associates such as Mr Bagudu, complemented by established western and local banks and offshore enablers.

In pushing for the forfeiture of stolen funds laundered through the U.S., American investigators said the criminal network used fraudulent schemes to make dirty money, according to court documents.

One was “security vote fraud,” whereby Mr Abacha and his National Security Adviser Ismaila Gwarzo and others were said to have stolen more than two billion U.S. dollars by “fraudulently and falsely representing that the funds were to be used for national security purposes.” Between 1994 and 1998, they were said to have made over 60 false claims of “security emergencies” to withdraw huge funds from the Central Bank of Nigeria, then headed by Paul Ogumah.

“Rather than use the funds for national security purposes, the stolen money was transported out of Nigeria and deposited into accounts controlled by General Abacha’s associates, including Mohammed Abacha and Mr Bagudu,” the court in Washington, D.C. was told.

Other schemes were bribery and a dramatic conspiracy by Mr Abacha’s son, Mohammed, and Mr Bagudu to lend money stolen from Nigeria back to Nigeria “with zero risks and at an enormous profit” by using proceeds of the security vote fraud to purchase hundreds of millions of dollars of U.S. dollar-denominated Nigerian bonds, called Nigerian Par Bonds, NPBs.

As part of the Brady Bond programme of the 1980s, the NPBs were U.S. dollar-denominated securities whose interest payments were guaranteed by the U.S. Treasury. The Brady Bond programme was created to help developing countries – like Nigeria – holding substantial debt to restructure their debt into bonds. Nigeria first offered the NPBs in 1992.

In another scheme, the conspirators were also said to have defrauded Nigeria of more than 282 million U.S. dollars by causing the government to repurchase Nigeria’s own debt from one of their companies for more than double what Nigeria would have paid to repurchase the debt in the open market.

According to American investigators, the initial funding of Bagudu’s Ridley’s account at Credit Agricole Indosuez, London, to the tune of 90 million U.S. dollars in 1998 was from the Par bonds and the debt-buy-back fraud.

The Ridley assets were later transferred to the Blue structure facilitated by Asiaciti and are the outstanding defendant assets being targeted for forfeiture by the United States, court documents showed.

The U.S. filed its forfeiture litigation in 2014. It said, then, the assets held by the Blue holdings, traceable to the old Ridley structure, and domiciled in London investment portfolios held with Waverton and James Hambro, were last valued at a total of 96 million euros.

Bagudu’s brother, Ibrahim, continues to claim the assets, seeking to prevent their forfeiture to Nigeria, court documents showed.

In a reply to written questions by The Guardian of UK in conjunction with PREMIUM TIMES and ABC of Australia, Nicola Boulton of PCB Byrne, Mr Bagudu’s lawyers said “all monies held by the Blue Trusts are lawfully held,” citing a 2003 settlement between Mr Bagudu and the Nigerian government under then-President Olusegun Obasanjo.

Mr Bagudu is yet to respond to further inquiries PREMIUM TIMES sent to him three weeks ago as part of the reporting for this story.

Keeping the Bagudu Dirty Money Flowing – The Enablers

Barely a week after Mr Bagudu’s delegation’s initial visit to Singapore in February 2010, Asiaciti determined that he “has a somewhat controversial background,” making references to his association with the Abacha family and his involvement in “extensive litigation between 2000 and 2006, both criminal investigations and civil claims,” Asiaciti’s internal memo showed.

Despite this determination, as well as the awareness that Mr Bagudu’s had since 2003 admitted to financial irregularities as he agreed to return about 163 million US dollars to Nigeria to avoid extradition to Jersey from the U.S., Asiaciti accepted Mr Bagudu as a client in 2010.

The Monetary Authority of Singapore, MAS, slammed Asiaciti with a fine of one million and a hundred thousand dollars in 2020 for the company’s anti-money laundering and anti-terrorism financing failures between 2007 and 2018, covering the period the company helped Mr Bagudu set up the Blue structure to shelter assets said to have been made from the plunder of Nigeria.

“We maintain a strong compliance programme and each of our offices have passed third-party audits for Anti-Money Laundering & Counter-Financing of Terrorism practices in recent years,” Asiaciti said in a written reply to ICIJ over the Pandora Papers. “However, no compliance programme is infallible – and when an issue is identified, we take necessary steps with regard to the client engagement and make the appropriate notifications to regulatory agencies.”

In defending its role, when questioned by authorities following the unsealing of the indictment against Bagudu by the U.S. in 2014, Asiaciti said, “Farrer & Co, a prestigious London law firm, who acts for the Royal Family had accepted the explanations provided and was prepared to act for him, having strict UK CDD requirements.” This was contained in a defence Asiaciti wrote to the regulator.

Indeed, as documents showed, between Byrne and Farrer and Co., Asiaciti was advised that Mr Bagudu would not be a problematic client and that the funds he sought to shelter were not derived from criminal sources. That turned out to be false.

In an April 2010 memo to press for the acceptance of Mr Bagudu as a client, Bernard O’Sullivan of Byrne said there were no outstanding claims to Mr Bagudu’s assets and that, in 2003, Nigeria, then led by President Olusegun Obasanjo, reached a “global settlement” with Mr Bagudu.

The settlement Mr O’Sullivan referred to was that which was executed when Mr Bagudu agreed to return about 163 million U.S. dollars to Nigeria in 2003. Mr O’Sullivan attached a copy of an August 8, 2003, confidential statement by Mr Obasanjo to withdraw all claims from criminal and civil proceedings against Mr Bagudu.

This defence was restated in Byrne’s reply following Pandora Papers reporting. “Mr Bagudu reached a compromise with the FRN (Nigeria) in 2003 by which all claims against him and his family were ended and the FRN received cash and certain rights,” Byrne’s Mr Boulton said.

Obasanjo, who entered the settlement agreement with Mr Bagudu, could not be reached to comment for this story as he was said to be travelling in Ethiopia. But sources close to him said it was a “pragmatic step” by the administration that was then desperate to recover stolen funds and that believed Mr Bagudu could help disclose where the funds were stashed. In return, Mr Obasanjo then signed the settlement ending all claims, globally, against Mr Bagudu.

Boulton said Bagudu helped Nigeria recover at least one billion dollars following Abacha’s death.

As documents suggest, between the time the Blue structure was created in 2010 and when its assets were frozen in 2014, 4.6 million dollars or $6.8 million euros was disbursed for Mr Bagudu’s children’s education and the “generous” lifestyle his family “was accustomed to”.

The transferred sum included one hundred thousand dollars annuity to his brother Ibrahim and another three million U.S. dollars moved into Ibrahim’s bank account for “investment in real estate and property development in Abuja.”

In one case in 2013, Farrer and Co helped Bagudu ensure funds were distributed to his family and resisted Asiaciti’s “level of scrutiny”, an attempt at enhanced due diligence.

In an email, Diana Davidson of Farrer and Co. wrote that Bagudu’s brother Ibrahim was “not entirely happy at the level of scrutiny being sought at the sole discretion of Asiaciti”.

In response, an Asiaciti’s client services official said they were “in no way inferring that the distribution requests are suspicious in any way,” and reminded Ms Davidson that Mr Bagudu was a politically exposed person, PEP, thus the transfers he sought required enhanced due diligence.

A breakdown of disbursements showed that 100 thousand U.S. dollars were advised to be paid out for Bagudu’s “son’s school fees” days after Farrer and Co’s Ms Davidson helped him pressure Asiaciti.

But beyond the role played by British firms in the Bagudu shenanigans, the British public service institution was also involved, documents suggested.

In a witness statement in 2015, Asiaciti said Farrer and Co and Byrne & Partners received consent from the UK’s Serious Organised Crime Agency, SOCA, now the National Crimes Agency (NCA), to facilitate the restructuring of Mr Bagudu’s offshore holdings in 2010.

“A protective disclosure was made to SOCA in the UK and their consent was obtained to the resettlement of the Ridley Trust into the Blue Family Trusts before funds were transferred from Ridley Group Limited to Blue Holdings 1 Pte. Ltd and Blue Holdings 2 Pte. Ltd,” Asiaciti’s Karen Hanlong submitted.

Years later, the NCA started working with the U.S. to hunt the assets held by Bagudu from the Abacha plunder of Nigeria.

PREMIUM TIMES said Bagudu did not respond to inquiries sent to him over the report.

Bagudu’s lawyers respond

Responding to questions from investigators, Nicola Boulton of PCB Byrne, Mr Bagudu’s lawyers, said “all monies held by the Blue Trusts are lawfully held,” citing a 2003 settlement between Mr Bagudu and the Nigerian government under then-President Olusegun Obasanjo.

PREMIUM TIMES

Business

CBN Policies, Foreign Inflows Drive Naira to Two-Year Peak

CBN Policies, Foreign Inflows Drive Naira to Two-Year Peak

Nigeria’s naira has extended its recent rally, trading at one of its strongest levels against the U.S. dollar in nearly two years, supported by sustained foreign portfolio inflows, tighter liquidity management, and targeted policy interventions by the monetary authorities.

A macroeconomic update by CardinalStone shows that the local currency has appreciated 6.9 per cent year-to-date at the official foreign exchange market, closing at ₦1,347.78/$—its strongest performance since early 2024. The appreciation reflects improved FX liquidity and growing confidence in the official trading window.

Despite the gains, a gap persists between the official and parallel markets. However, the premium narrowed from about 5.7 per cent to roughly 3.2 per cent following renewed foreign exchange interventions by the Central Bank of Nigeria. According to CardinalStone, the compression of the spread indicates stronger liquidity conditions in the official market, reducing incentives for speculative trading and arbitrage.

As part of efforts to further stabilise the FX market, the CBN recently authorised licensed Bureau de Change (BDC) operators to access foreign exchange from approved dealers at prevailing market rates, subject to a weekly cap of $150,000 per BDC and strict Know-Your-Customer (KYC) requirements. Under the framework, operators must sell unused FX balances within 24 hours, limit cash transactions to 25 per cent of total trades, and settle transactions through licensed financial institutions.

READ ALSO:

- Edo Governor Okpebholo Names Mercy Johnson-Okojie Special Adviser

- Many Feared Dead as Suspected Lakurawa Militants Attack Kebbi Communities

- AMAC Polls Shock: Another PDP Candidate Withdraws from FCT Race, Backs APC

With 82 licensed BDCs currently operating, CardinalStone estimates that potential FX supply to the segment could rise to about $50 million monthly. Although this remains significantly below pre-pandemic levels, the renewed supply has helped ease retail FX demand pressures and compress the premium in the parallel market.

While foreign inflows have strengthened the naira, analysts caution that continued appreciation could prompt profit-taking by offshore investors. CardinalStone estimates outstanding foreign portfolio investment (FPI) exposure at between $12 billion and $14 billion, noting that Nigeria’s carry trade remains one of the most attractive across emerging and frontier markets.

The firm added that assuming many investors entered the market at around ₦1,500/$, a move toward ₦1,200–₦1,250/$ could deliver over 22 per cent FX gains on currency alone. Such gains could heighten the risk of portfolio rebalancing or exits, particularly as political and election-related uncertainties begin to build.

Ahead of the latest meeting of the Monetary Policy Committee, analysts describe the macroeconomic signals facing policymakers as mixed. Inflation has started to moderate, while short-term interest rates have converged near 22 per cent, about 500 basis points below the 27 per cent Monetary Policy Rate (MPR).

However, the CBN has signalled low tolerance for excess liquidity, intensifying Open Market Operations (OMO) issuances and keeping the Standing Deposit Facility (SDF) attractive to absorb surplus funds and prevent renewed inflationary pressure. Analysts also point to concerns around election-related liquidity, which is expected to intensify in the second half of the year, with over 75 per cent of projected 2026 liquidity expected in the first half.

Looking ahead, CardinalStone expects the CBN to hold the policy rate while adjusting the asymmetric corridor to align SDF rates with OMO yields and preserve the attractiveness of naira assets for foreign investors. Forward market indicators suggest a softer currency path later in the year, with the naira projected to trade within a ₦1,350–₦1,450/$ range in 2026, despite the recent rally.

CBN Policies, Foreign Inflows Drive Naira to Two-Year Peak

Railway

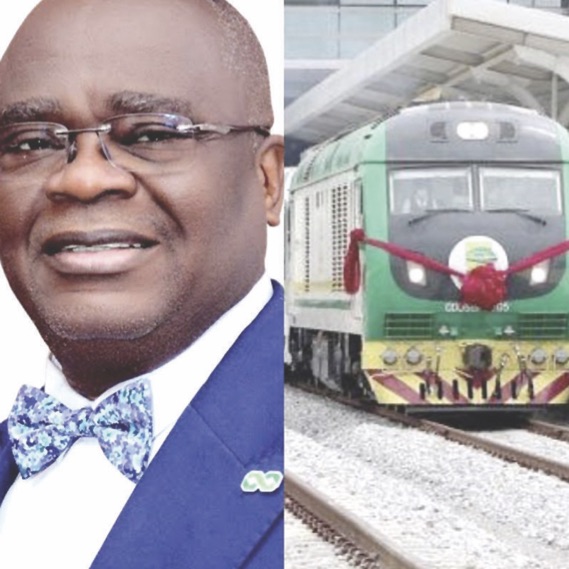

Railway track vandalism: Urgent need for laws prohibiting scrap/metal picking to protect critical assets

Railway track vandalism: Urgent need for laws prohibiting scrap/metal picking to protect critical assets

By Onyedikachi Stanley Onovo

The wanton destruction and theft of Nigeria’s railway infrastructure and other critical public assets represent one of the gravest threats to national development and security.

Across the nation—from the Warri-Itakpe line to Abuja-Kaduna, the Eastern and Western Districts, Lagos-Ibadan, and throughout the Northern network—vandals systematically dismantle tracks, steal armoured cables, and pillage essential equipment. This crisis demands an immediate and robust legislative response.

The unending menace

The vandalism is perpetrated by a network of individuals, from local miscreants (“iron condemn”) to organised merchants who purchase and export stolen materials. Security reports and countless arrests underscore the scale of the problem:

In December 2023, a private security firm arrested 13 suspects for vandalising Abuja Mass Transit Rail assets. The suspects were said to be casual workers engaged by a Chinese company working on the railways, but said to have used the opportunity to steal the materials.

On June 2024, The Cable reported that the Nigerian Army arrested 47 suspected rail track vandals in Kaduna State.

In October 2025, police arrested a suspect vandalising railway electrical installations also in Kaduna State.

Radio Nigeria in December 2025 announced the arrest of three persons in Kwara State for vandalizing and stealing Railway clips and nuts in Offa.

In May 2021, TVC reported some individuals, including one Ejike Okeke were apprehended in Enugu with stolen sleepers and tracks.

On the 30th of January 2026 the Nigerian Television Authority reported that the NSCDC, Bauchi State Command arrested five suspects and intercepted a truck carrying vandalized railway tracks.

This relentless assault has plagued successive management of the Nigerian Railway Corporation (NRC), defying conventional counter-strategies.

A transformative leadership initiative

A pivotal shift began under the administration of President Bola Ahmed Tinubu with the appointment of Dr. Kayode Opeifa as Managing Director/CEO of the NRC.

Dr. Opeifa introduced a fundamental paradigm shift by redesignating what was carelessly termed “scrap” as “unserviceable critical national assets.”

This reframing has driven a transformative partnership with experts to manage these assets responsibly. The era of controversial public auctions—which often saw valuable national iron assets disappear, depriving Nigeria of materials for repurposing and industrialisation—is now over.

Today, a systematic process ensures these materials are reused or responsibly processed, with revenue reinvested into the Corporation. This home-grown solution is a commendable breakthrough that proves Nigerians can effectively solve national challenges.

The critical legislative gap: Targeting the market

While the NRC’s internal reforms are laudable, they alone cannot stem the tide. The root enabler of this vandalism is the thriving, unregulated market for stolen metal. To kill the vandal’s incentive, we must eradicate the demand.

Therefore, there is an urgent need for the National Assembly to enact legislation that:

1. Prohibits the buying and selling of any railway materials (serviceable or unserviceable) on the open market.

2. Imposes severe penalties on buyers and merchants of vandalised public assets, effectively targeting the economic drivers of this crime.

3. Mandates stringent federal regulation of all scrap metal dealers nationwide.

THE SCRAP DEALER NEXUS

The opaque operations of scrap dealers are a major concern. Their compounds are often shrouded, hiding the provenance of their materials. This unregulated space fuels not only railway vandalism but also community theft—from iron crossing bars in homes to street lamp holders.

Trailers loaded with questionable materials move freely from cities and expressways to unknown destinations. Without regulating this sector, our fight against vandalism remains superficial.

CONCLUSION

The partnership and innovation under Dr. Opeifa’s leadership at the NRC demonstrate what is possible with commitment and vision.

However, to secure our railways, power installations, and other critical assets, we must complement this institutional resolve with strong, deterrence-based law. Legislation that dismantles the market for stolen public property is not an option; it is a national imperative for Nigeria’s security and industrial future.

*Onyedikachi Stanley Onovo, Ph.D

FCAI, ANIPR

onyedikachionovo1@gmail.com excellentdikachi@yahoo.com

Auto

MOMAN, ALCMAN Partner BKG to Drive Nigeria’s Shift from Auto Imports to Industrial Production

MOMAN, ALCMAN Partner BKG to Drive Nigeria’s Shift from Auto Imports to Industrial Production

In what industry stakeholders view as a decisive move toward industrial rebirth, BKG Exhibitions Limited has entered into a strategic partnership with the Motorcycle Manufacturers Association of Nigeria (MOMAN) and the Automotive Local Content Manufacturers Association of Nigeria (ALCMAN) to accelerate local automotive manufacturing and reduce the country’s heavy reliance on imports.

The alliance, formalised in Lagos, signals a coordinated private-sector effort to reposition Nigeria’s automotive ecosystem from an import-dependent market to a production-driven industrial base capable of delivering value addition, technology transfer, and large-scale employment.

For decades, Nigeria’s automotive sector has been dominated by the importation of fully built vehicles and, more recently, the assembly of semi-knocked-down (SKD) and completely knocked-down (CKD) kits.

While these models generated commercial activity, stakeholders argue they failed to build deep industrial capacity or strengthen indigenous engineering expertise.

The new partnership seeks to change that narrative by transforming trade exhibitions into structured industrial platforms that connect manufacturers with policymakers, institutional buyers, investors, and international technical partners.

A senior executive at BKG Exhibitions said the collaboration represents a deliberate shift in strategy.

“Exhibitions must go beyond passive marketplaces. They must become engines of economic transformation where Nigerian manufacturers secure contracts, attract capital, and demonstrate production competence,” he said, noting that Nigeria already possesses strong demand but lacks a coordinated ecosystem to convert that demand into domestic output.

“Nigeria remains one of Africa’s largest mobility markets, driven by rapid urbanisation, a growing youth population, and expanding last-mile logistics services.

“Motorcycles and tricycles play a critical role in urban transport, agriculture distribution, and the fast-growing delivery economy.

“However, a substantial portion of these vehicles and their components are imported, placing pressure on foreign exchange and limiting domestic industrial growth.”

MOMAN President Rev. Lambert Ekewuba emphasized that strengthening local production would go beyond import substitution.

“When we manufacture locally, we create jobs, retain capital, and build the technical foundation for advanced automotive engineering,” he said.

ALCMAN Chairman, Chief Anselm Ilekuba, stressed the importance of developing a resilient components ecosystem, describing it as the backbone of any successful automotive industry.

“No country becomes an automotive powerhouse without first nurturing strong supplier networks. Nigeria must empower small and medium-scale enterprises producing metal parts, plastics, electrical systems, and other inputs,” he said.

Under the alliance, future exhibitions will feature dedicated pavilions showcasing Nigerian-made components and vehicles, offering manufacturers direct access to government agencies, transport operators, and regional distributors.

Analysts believe such curated exposure could gradually shift procurement patterns toward locally produced alternatives.

Beyond the domestic market, the partnership aims to position Nigeria as a manufacturing hub serving West and Central Africa, leveraging opportunities under the African Continental Free Trade Area (AfCFTA).

Industry leaders say expanding export capacity will depend on strengthening standards, financing mechanisms, and technical capability.

The alliance also plans coordinated advocacy for policies that support localisation, including improved access to financing, reduced duties on industrial machinery, technical training aligned with modern production systems, and procurement frameworks favouring locally manufactured goods.

Economists argue that a revitalised automotive manufacturing base could stimulate growth across steel, petrochemicals, logistics, warehousing, and tooling industries, reinforcing the sector’s role as a catalyst for broader industrialisation.

Coming at a time when Nigeria is intensifying efforts to diversify its economy away from oil dependence, stakeholders say the success of this alliance could mark a turning point — shifting the country from being one of Africa’s largest automotive consumption markets to an emerging centre of production, innovation, and regional trade.

-

Politics1 day ago

Politics1 day agoPeter Obi Launches ‘Village Boys Movement’ to Rival Tinubu’s City Boys Ahead of 2027

-

International2 days ago

International2 days agoCanada Opens New Express Entry Draw for Nigerian Workers, Others

-

News1 day ago

News1 day agoPolice to Arrest TikToker Mirabel After She Recants False Rape Claim

-

News3 days ago

News3 days agoKorope Drivers Shut Down Lekki–Epe Expressway Over Lagos Ban (Video)

-

International1 day ago

International1 day agoEpstein, Ex-Israeli PM Named in Alleged Profiteering From Boko Haram Crisis

-

metro2 days ago

metro2 days agoOsun Awards 55.6km Iwo–Osogbo–Ibadan Road Project to Three Contractors

-

Politics2 days ago

Politics2 days agoUpdated: Rivers Senator Mpigi Barinada dies at 64

-

metro2 days ago

metro2 days agoOndo Monarch Killed as Bandits Strike Akure North