Business

Sale of crude to Dangote refinery in naira begins Oct 1 – Edun

Sale of crude to Dangote refinery in naira begins Oct 1 – Edun

The sale of crude oil to the Dangote refinery in naira will commence on October 1, the Federal Government has said.

Ministry of Finance said in a statement on Monday that the decision was made at a meeting with the technical implementation committee led by Mr. Wale Edun, minister of finance and coordinating minister of the economy.

The government on August 15 inaugurated a technical sub-committee to ensure the smooth implementation of President Bola Tinubu’s directive to sell crude to local refineries in naira.

Edun on Monday stressed the need for transparency and directed the technical sub-committee to finalise the details of the arrangement.

He also asked the committee to prepare a report for President Tinubu, confirming that his directives are on track for implementation from September.

At the meeting on Monday, the committee reviewed progress on key initiatives — including “the upcoming commencement of Naira payments for crude oil sales to the Dangote Refinery starting October 1, 2024”.

“Key roles were outlined for stakeholders, including the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), Central Bank of Nigeria (CBN), Nigerian Upstream Petroleum Regulatory Commission (NUPRC), and the African Export-Import Bank (Afreximbank) to ensure smooth implementation,” the ministry said.

“Updates on the Port Harcourt and Dangote Refineries were also provided, with significant production increases expected from November 2024.”

At the meeting, Zacch Adedeji, executive chairman of the Federal Inland Revenue Service (FIRS) and chairman of the technical sub-committee, said the petrol delivery from Dangote is expected next month under existing agreements.

Business

Exchange rate ends 2024 at N1,535/$1, marking a 40.9% depreciation

Exchange rate ends 2024 at N1,535/$1, marking a 40.9% depreciation

The exchange rate between the naira and the dollar ended the year at N1,535/$1 representing a 40.9% depreciation for 2024.

The official exchange rate between the naira and dollar closed in 2023 at N907.11/$1 thus depreciating by 40.9% for the year which compares to a 49.1% devaluation at the end of 2023.

READ ALSO:

- Lagos govt clears traders from rail tracks at Bolade, Oshodi

- Four countries that won’t celebrate New Year

- Social media abuzz over Fayose claim of N50m donation to VeryDarkMan’s NGO

Nigeria introduced several foreign exchange policies in 2024 as the central bank expanded on market-friendly forex policies to attract foreign investors.

Meanwhile, on the parallel market where the exchange rate is sold unofficially, the naira exchanged for N1,660 to the dollar when compared to N1,215/$ according to Nairametrics tracking records. This represents a 26.8% depreciation.

Exchange rate ends 2024 at N1,535/$1, marking a 40.9% depreciation

Business

Warri refinery: Marketers hopeful of further petrol price drop

Warri refinery: Marketers hopeful of further petrol price drop

There was excitement on Monday as the Warri Refining and Petrochemical Company (WRPC) commenced partial production.

This is coming after nearly a decade of dormancy as the 125,000 barrels per day refinery was confirmed to be working at 60 per cent capacity, according to the Nigerian National Petroleum Company Limited (NNPCL).

The refinery, inactive since 2015 due to prolonged repairs, reportedly began refining activities last Saturday at its Area 1 plant, where crude oil was successfully pumped into the system.

This was coming about a month after the commencement of operations at the 60,000-barrel-per-day-old Port Harcourt Refinery.

The NNPCL Group Chief Executive Officer, Mele Kyari, announced the resumption of operation at the Warri Refinery during a tour of the facility on Monday.

Kyari was seen in a video posted by Channels TV addressing a tour team, which included the Chief Executive Officer of the Nigerian Midstream and Downstream Petroleum Regulatory Authority, Farouk Ahmed.

READ ALSO:

- Catholic priest sentenced to 11 years for criticising his president

- Warri refinery now operational, doing 125,000bpd – NNPCL boss

- Kwankwaso says no power-sharing agreement with Atiku, Obi

Earlier, Kyari explained that the inspection aimed to show Nigerians the level of work completed so far.

He said though the repairs on the facility were not 100 per cent complete, operations had commenced.

He said, “We are taking you through our plant. This plant is running. Although it is not 100 per cent complete, we are still in the process. Many people think these things are not real. They think real things are not possible in this country. We want you to see that this is real.”

With the addition of Warri Refinery, Nigeria’s refining capacity has further increased with marketers anticipating a further reduction in price of premium motor spirit (PMS).

The 650,000-barrel Dangote Refinery has commenced production in addition to the Port Harcourt Refinery with a total capacity of 210,000 barrels per day (bpd) comprising 60,000 bpd for the old plant and 150,000 bpd for the new plant.

It’s good for business, prices may reduce – Marketers

Major Energy Marketers’ Association of Nigeria (MEMAN) and the Independent Marketers Association of Nigeria (IPMAN) welcomed the revival of the Warri refinery, saying it would deepen competition, diversify supply and ultimately resort to price reduction.

Executive Secretary of MEMAN, Clem Isong in a chat with our correspondent stated that the Warri Refinery is the shortest route to the North, describing its revival as good news.

“The market becomes more competitive and we are diversifying supply,” he said.

On whether it would lead to price reduction, he stated, “There are many factors that affect price, competition is always good and you can always get your product at the best price.”

National Public Relations Officer of IPMAN, Alhaji Olanrewaju Okanlawon in a chat with our correspondent said, “If there is excess supply, it will keep bringing down the price. We now run a free market and it is about demand and supply. It will continue bringing down the price. It will decongest Lagos.”

Energy expert, Dr. Ayodele Oni said the resumption of Warri Refinery would boost the local refining capacity in addition to enabling the country to sell to other neighbouring countries.

“We can refine more and even have some to sell. We now stop being hewers of wood and drawers of water. We add value to what we produce and can make/ do more with our base resources. This is very pleasant news,” he said.

Warri refinery: Marketers hopeful of further petrol price drop

Business

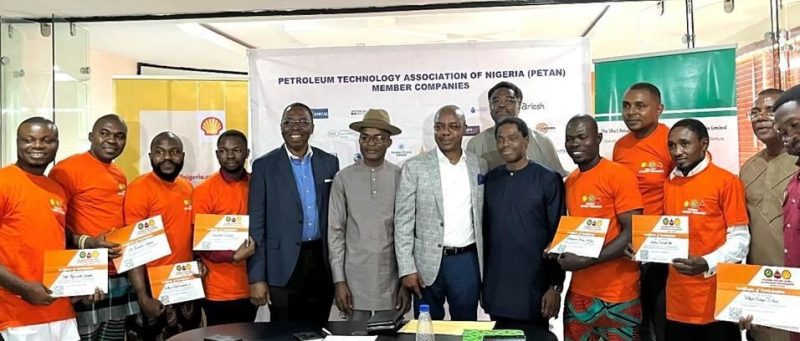

Shell, partners employ 133 young graduates after internship engagement

Shell, partners employ 133 young graduates after internship engagement

Shell Petroleum Development Company of Nigeria Ltd (SPDC) and its partners have offered jobs to 133 young graduates after their engagement in internship programme.

They are part of 170 young graduates that benefitted from the NCDMB/PETAN/SPDC JV Graduate Internship programme attached to indigenous technical oilfield service companies in the upstream and downstream sectors for hands-on experience.

A statement obtained on Monday said the 133 employed by the companies indicated the success of the programme as a talent pipeline for the oil and gas industry in Nigeria.

It disclosed that the latest batch of 49 intakes graduated at a ceremony in Port Harcourt early this month after completing their internship which began in 2022.

Speaking at the ceremony, Chairman of the Petroleum Technology Association of Nigeria (PETAN), Wole Ogunsanya, commended the Shell Petroleum Development Company of Nigeria Ltd (SPDC) Joint Venture for the support for the programme, helping to build local manpower for a critical sector of the economy.

SPDC and PETAN had jointly set up the programme in 2014 whereby young graduates are attached to the over 100 member companies of the organisation with SPDC paying them monthly stipends.

From 2022 when the Nigerian Content Development and Monitoring Board (NCDMB) joined the collaboration, the programme has run for two years with 100 intakes.

The NCDMB/PETAN/SPDC JV Graduate Internship programme has been lauded as a key human capital development initiative which is central to the promotion of Nigerian content in the oil and gas industry.

SPDC’s General Manager Nigerian Content, ‘Lanre Olawuyi, said, “The internship is more than a learning opportunity. It provides fresh graduates with technical expertise, equipping them with the practical skills needed to excel in their careers.

“It aligns with SPDC’s broader educational initiatives, contributing significantly to the actualisation of the UNESCO ‘Education for All’ agenda and the Sustainable Development Goals in Nigeria, particularly in the Niger Delta.

“We owe the success of the programme to the untiring support of our JV partners, the Nigerian National Petroleum Company Limited (NNPCL,) TotalEnergies and Nigerian Agip Oil Company Limited for which we’re grateful.”

-

Politics3 days ago

Politics3 days agoGbajabiamila speaks on his rumoured Lagos governorship ambition

-

metro2 days ago

metro2 days agoFarotimi to pursue disbarment over arrest, defamation allegations

-

Business2 days ago

Business2 days agoReal reason Dangote, NNPC drop petrol price — IPMAN

-

Health2 days ago

Health2 days agoABU Teaching Hospital will begin kidney transplant in 2025 – CMD

-

Sports23 hours ago

Sports23 hours agoAnthony Joshua prostrates before Governor Abiodun during Ogun visit

-

International3 days ago

International3 days agoBREAKING: Plane skids off runway in South Korea, killing at least 120

-

metro3 days ago

metro3 days agoEl-Rufai accuses Tinubu govt of Yoruba agenda, Reno Omokri reacts

-

metro2 days ago

metro2 days agoNigerian govt urged to intervene in Mozambique post-election violence