Business

Shell: More opportunities await Nigerian firms in offshore developments

Shell: More opportunities await Nigerian firms in offshore developments

Nigerian companies have a lot to benefit from the opportunities in its offshore and shallow water oil and gas projects, Shell Nigeria Exploration and Production Company Ltd (SNEPCo)

Managing Director of SNEPCo, Ronald Adams, stated this at the 5th Nigerian Oil and Gas Opportunity Fair (NOGOF) in Yenagoa, Bayelsa State.

He said projects such as Bonga Southwest Aparo, Bonga North and Bonga Main Life extension could grow Nigerian businesses and improve their expertise if they applied themselves seriously to executing higher value contracts.

“SNEPCo pioneered Nigeria’s deepwater frontier with the Bonga development as the first deepwater oilfield exploration and production venture in the country,” he said.

Part of his remarks delivered by Head, Supply Chain, Charles Oranyeli, read, “Our operations have greatly benefitted Nigerian businesses, and we expect them to get ready to take up more opportunities.”

“SNEPCo sees Nigerian content development as a business driver and not a regulatory requirement and will continue to support our companies to play even bigger roles in their support for oil and gas operations,” he added.

Adams said Nigerian companies could upscale their skills and continue to offer services in logistics, drilling, fabrication and construction of subsea manifolds, mooring and loading systems, pressure vessels and provision of gas processing equipment in deep-water, as well as procurement and civil works in shallow water.

Since starting production at Bonga in 2005, SNEPCo has been supporting Nigerian contractors and service providers to grow their capacity through the development of systems and a competent workforce with the aim to deliver projects safely, on time and within budget not only in Nigeria but also in the West Arican subregion.

The efforts have enabled Nigerian companies to play prominent roles in the safe and efficient operations of the Bonga Floating, Production, Storage and Offloading (FPSO) vessel which produced the one-billionth barrel of oil from the field on February 3, 2023.

Adams said, “SNEPCo sees Nigerian content development as a business driver and not a regulatory requirement and will continue to support our companies to play even bigger roles in their support for oil and gas operations.”

The three-day NOGOF hosted by the Nigerian Content Development and Monitoring Board (NCDMB) came with the theme: “Driving Investment and Production Growth: Shaping a Sustainable Future for Nigeria’s Oil and Gas Industry Through Indigenous Capacity Development.”

SNEPCo is among the sponsors of the event, and is hosting an exhibition, highlighting its contributions to the development of the Nigerian economy and communities.

Business

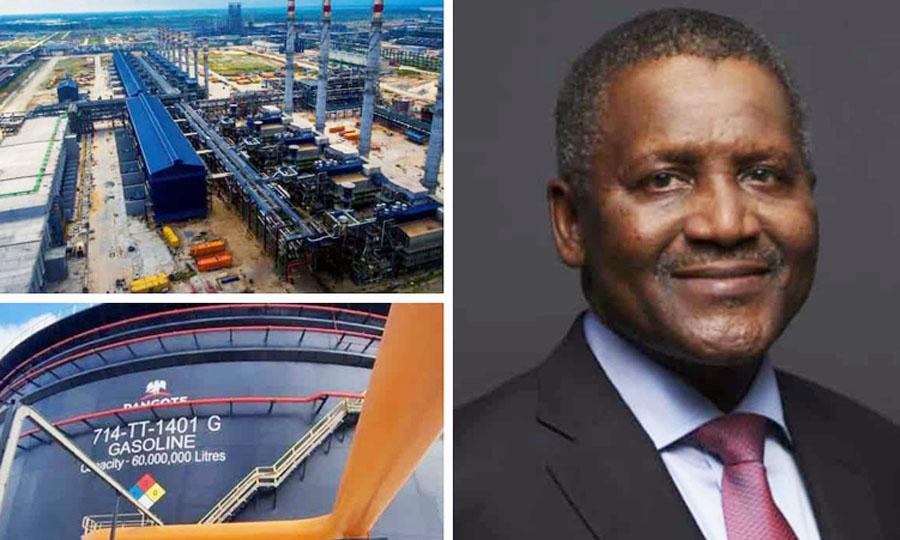

Dangote Raises Alarm Over Widespread Sabotage Crippling Nigeria’s Oil Sector

Dangote Raises Alarm Over Widespread Sabotage Crippling Nigeria’s Oil Sector

Aliko Dangote, President and CEO of the Dangote Group, has sounded the alarm over what he described as deliberate and widespread sabotage crippling Nigeria’s downstream oil sector, including the Port Harcourt Refinery and the $20 billion Dangote Refinery.

Speaking during a media briefing on Sunday, December 14, 2025, at the Dangote Refinery in Lagos, Dangote revealed that the Port Harcourt Refinery experienced over 100 sabotage incidents during its rehabilitation, citing information shared by former NNPC Limited Group CEO Mele Kyari.

He alleged that critical pipeline infrastructure and petroleum depots across the country have been deliberately destroyed by unpatriotic individuals and organised interests, insisting the damage could not be attributed to natural causes.

“Even this $20 billion Dangote Refinery has not been spared. The oil and gas sector is controlled by powerful cartels whose reach surpasses that of criminal drug networks,” Dangote stated, citing instances of vandalism and theft of critical equipment, including a 400-tonne industrial boiler, described as the largest ever built.

READ ALSO:

- Four Suspected Bandits Killed, 13 Abducted in Kogi Shootout

- Man United, Bournemouth Share Eight-Goal Premier League Thriller in Old Trafford Classic

- Aisha Buhari Reveals How Rumours, Missed Meals Triggered Buhari’s 2017 Health Crisis

Dangote further questioned the collapse of Nigeria’s once-functional pipeline network, saying the extensive destruction points to deliberate sabotage rather than neglect. “All the pipelines that were built, right from the military base to date, none of them are functioning… they have destroyed the pipes. If it is not sabotage, is it an earthquake? No, it is sabotage,” he said.

He disclosed that the Dangote Refinery alone has lost about $82 million to theft and sabotage, prompting the company to deploy over 2,000 security personnel, more than the number of operational staff, to safeguard the facility. Dangote noted that thieves have grown increasingly brazen, attempting to remove materials using long cords and other methods.

The industrialist’s revelations underscore the significant challenges facing Nigeria’s refining, pipeline, and petroleum depot infrastructure, highlighting the urgent need for stronger security measures and government intervention to protect the nation’s oil assets.

Dangote Raises Alarm Over Widespread Sabotage Crippling Nigeria’s Oil Sector

Business

Naira Holds Mixed Stability as Official FX Rate Closes at ₦1,452/$, Black Market Trades Higher

Naira Holds Mixed Stability as Official FX Rate Closes at ₦1,452/$, Black Market Trades Higher

The Nigerian foreign exchange market opened the week on a mixed note on Tuesday, December 16, 2025, with the Naira showing relative stability at the official FX window while trading weaker at the parallel (black market).

Data from the Nigerian Foreign Exchange Market (NFEM) showed that the Naira closed early trading at ₦1,452.27 per US Dollar, reflecting the Central Bank of Nigeria’s (CBN) continued efforts to stabilise the official exchange rate. During the opening session, trades were recorded within a narrow band of ₦1,451.19 to ₦1,452.57, signalling controlled volatility compared to previous weeks.

READ ALSO:

- Lagos Moves to End Illegal Evictions, Landlord Harassment with Tough New Tenancy Bill

- Ogun Lawmaker Rasheed Kashamu Defects from PDP to APC

- Ex-Osun Assembly Speaker Najeem Salaam Wins ADC Guber Primary

In contrast, the parallel market exchange rate remained higher. Checks with Bureau De Change (BDC) operators and street traders indicated that the US Dollar exchanged between ₦1,465 and ₦1,475 for cash transactions. The premium over the official rate underscores persistent demand-supply gaps in the unofficial market, largely driven by unmet foreign exchange needs of small businesses and individuals.

Currency analysts attributed the relative calm at the official window to improved FX liquidity injections by the CBN and a seasonal slowdown in corporate foreign exchange demand as the year draws to a close. However, they noted that the continued gap between official and black market rates highlights structural weaknesses, speculative activities, and lingering pressure on the Naira.

Market participants remain cautious, closely watching potential CBN policy decisions, particularly measures aimed at exchange rate unification, boosting investor confidence, and easing inflationary pressures in Africa’s largest economy.

Naira Holds Mixed Stability as Official FX Rate Closes at ₦1,452/$, Black Market Trades Higher

Business

Dangote Refinery: Nigerians to Enjoy Affordable Petrol as Importers Face Losses

Dangote Refinery: Nigerians to Enjoy Affordable Petrol as Importers Face Losses

The president of Dangote Refinery has assured Nigerians that locally refined fuel will provide more affordable petrol prices, even as fuel importers continue to incur losses.

Speaking during a briefing at the 650,000-barrel-per-day Dangote Refinery in Lagos on Sunday, he emphasized that consumers now have the option to buy high-quality locally refined petrol or pay higher prices for blended PMS from importers.

“Nigerians have a choice to buy better quality fuel at a more affordable price or to buy blended PMS at a higher rate. Importers can continue to lose, so long as Nigerians benefit,” he said.

READ ALSO:

- Nigeria Education Policy Update: FG Bans SS3 Transfers, Admissions Over Exam Malpractice

- Man Arrested for Allegedly Killing Wife in Ahiazu Mbaise Domestic Dispute

- (UPDATED) Sydney Bondi Shooting: Anti-Semitic Attack Leaves 16 Dead, 40 Injured

He added, “Anyone who chooses to continue importing despite the availability of locally refined products should be prepared to face the consequences.”

The refinery executive also noted that the retail fuel price nationwide should not exceed N740 per liter.

This statement follows a recent reduction of the refinery’s gantry fuel price by 15.99 percent to N699 per liter, although pump prices in Abuja remained at N905 to N937 per liter as of Sunday night.

Keywords for SEO: Dangote Refinery, affordable petrol Nigeria, fuel importers losses, locally refined fuel, PMS price, Nigerian petrol price, Dangote petrol price reduction, Nigerian fuel market.

Dangote Refinery: Nigerians to Enjoy Affordable Petrol as Importers Face Losses

-

metro3 days ago

metro3 days agoNigerian Troops Repel ISWAP Attack on Borno FOB, Kill Terrorists

-

Health3 days ago

Health3 days agoBauchi Gov Approves 100% Salary Increase for Doctors, Health Workers

-

metro2 days ago

metro2 days agoEnd Biafra Agitation, Tinubu Has Integrated Ndigbo Into National Development — Umahi

-

metro3 days ago

metro3 days agoAdelabu–Ayodele controversy: Cleric knocks minister, gives reasons (Updated)

-

Business2 days ago

Business2 days agoNigeria FX Market: Dollar Demand Surges, Naira Slides Slightly in Festive Season

-

International2 days ago

International2 days ago(UPDATED) Sydney Bondi Shooting: Anti-Semitic Attack Leaves 16 Dead, 40 Injured

-

Politics2 days ago

Politics2 days agoAshimolowo Casts Doubt on Obi’s Northern Support as Opposition Coalition Wobbles

-

Politics2 days ago

Politics2 days agoPeter Obi Poised to Dump Labour Party as Leadership Crisis Worsens