metro

No need for separate TIN to operate bank accounts – FIRS

No need for separate TIN to operate bank accounts – FIRS

The Federal Inland Revenue Service (FIRS) has refuted claims that Nigerians must obtain a separate Tax Identification Number before they can own or operate a bank account, insisting that the new framework integrates seamlessly with existing national registries such as the National Identification Number and Corporate Affairs Commission records.

This clarification comes amid widespread claims following media reports suggesting that from January 2026, every Nigerian would be required to present a TIN to open or maintain a bank account, a development that generated fears of fresh bureaucratic hurdles for citizens.

Reacting to the controversy, Arabinrin Aderonke Atoyebi, the Technical Assistant on Broadcast Media to the Executive Chairman of FIRS, Zacch Adedeji, elucidated in a post on her official X handle on Saturday that the reports were false.

“In recent debates about Nigeria’s tax reforms, a widespread misconception has taken root: that citizens without a Tax Identification Number (TIN) cannot own or operate a bank account.

“This view, while the reality is that Nigeria’s tax system has evolved to integrate seamlessly with existing national registries, ensuring that every eligible individual or entity is automatically identifiable for tax purposes.

“This article clarifies how the new framework works, drawing from the Federal Inland Revenue Service’s (FIRS) implementation of the National Taxpayer Directory under the Nigeria Tax Administration Act (2025),” parts of her explanation read.

She also explained that the TIN is a 13-digit identifier designed to uniquely capture details of taxable persons and entities across Nigeria.

She continued, “What is a Tax ID? The Tax Identification Number (TIN) is a 13-digit unique identifier for all taxable persons and entities in Nigeria. It encodes details such as issuance year, registry source (NIN for individuals, RC for corporates), state of registration, and a cryptographic fragment for security, ending with a check digit.

READ ALSO:

- JUST IN: ADC denies INEC confirmation of state chairmen list

- I married Soludo as a virgin – Soludo’s wife replies APC’s Ekwunife

- Ex-lawmakers endorse Tinubu for 2027, say South must finish term

“The TIN is not a standalone requirement imposed on citizens. Instead, it’s a statutory tool that ensures every taxpayer, whether an individual, a registered business, or an association, can be uniquely verified within the national tax system.”

Speaking on the integration with national identity systems, Atoyebi stressed that citizens are already tax-compliant once they provide their NIN.

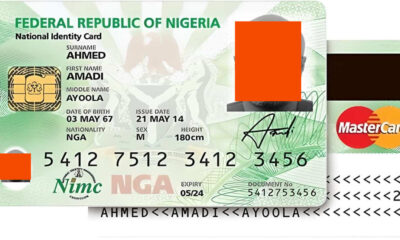

“Tax ID and the National Identity Management Commission (NIMC): For individuals, the TIN is automatically linked to their National Identification Number (NIN) issued by the National Identity Management Commission (NIMC).

“When an individual provides their NIN, such as during bank account opening or Know Your Customer (KYC) processes, the system cross-checks the NIN in the national database. As part of this verification, the TIN is automatically retrieved and attached to the person’s records.

“This means citizens do not need to manually apply for or present a tax ID before opening a bank account. The system handles the integration in real time,” her explanation added.

She also disclosed that businesses are also covered through their CAC registration numbers.

“Tax ID and the Corporate Affairs Commission (CAC): For businesses, the TIN is tied directly to the RC Number issued by the Corporate Affairs Commission (CAC).

“Likewise, for cooperatives, partnerships, professional bodies, and other legal entities, the TIN is connected to their respective recognized registries. This linkage ensures that corporate entities can be transparently identified for both tax & compliance purposes. Just as with individuals, banks and regulators do not require extra documentation beyond the foundational registry numbers to confirm tax status,” she continued.

She emphasized the framework’s overall benefits, arguing that it fosters inclusion, financial access, and fraud prevention.

She added, “Exploring the Benefits of Tax ID:Seamless Banking Access: Individuals and businesses can open and operate bank accounts using their NIN or RC number, with the TIN automatically integrated behind the scenes. Fraud Reduction: The system eliminates duplicate or false identities by ensuring every taxpayer is tied to a verifiable registry.

“Regulatory Compliance: Banks and financial institutions can rely on a single, consent-driven source of truth for onboarding, reporting, and KYC compliance. Inclusivity: Beyond companies, the framework extends coverage to associations, professional bodies, and trustees. Global Compatibility: Nigeria’s tax system can securely interact with international systems for trade finance and compliance.”

According to her, the widespread notion that Nigerians would be barred from banking services without a separate TIN is misplaced.

“The misconception that Nigerians cannot own or operate a bank account without a tax ID overlooks the integrated design of the new TIN system. By linking TINs to existing foundational identifiers such as the NIN and RC Number, the system ensures automatic compliance without creating unnecessary barriers for citizens.

“In practice, this means a Nigerian walking into a bank with their NIN is already tax-compliant. The bank simply retrieves their TIN as part of its onboarding process. Far from being a hurdle, the TIN framework is a gateway to financial inclusion, regulatory transparency, and global interoperability in Nigeria’s evolving digital economy,” Atoyebi concluded.

No need for separate TIN to operate bank accounts – FIRS

metro

Gunmen Abduct Five from Edo Health Centre, Demand ₦100 Million Ransom

Gunmen Abduct Five from Edo Health Centre, Demand ₦100 Million Ransom

A kidnapping incident in Akoko‑Edo Local Government Area, Edo State, has left residents alarmed after five people were abducted from the Makeke Health Centre. The kidnappers have reportedly contacted families, demanding a ₦100 million ransom for the release of two of the victims.

The abductions occurred on February 8, 2026, targeting individuals seeking and providing medical services. The confirmed victims include Mrs. Gladys Okomayin, a nurse at the health centre; Miss Tope Oriloye, a female secondary school student; and Mr. Samuel Ilesanmi, who had brought his son for treatment. The names of the two other victims have not yet been released.

Eyewitnesses reported that the nurse was later abandoned in the bush as she could not keep pace with the kidnappers during their retreat. Following the incident, local hunters and vigilantes mobilised to comb the forests for the abducted individuals, but efforts to locate them were unsuccessful.

READ ALSO:

- Manchester City Defeat Fulham 3‑0 to Narrow Gap on Arsenal

- Senate Budget Defence Disrupted as Natasha Accuses Committee Leadership of Disrespect

- Russia Escalates Digital Control with Attempted WhatsApp Block

The kidnappers have demanded ₦100 million for the release of Miss Oriloye and Mr. Ilesanmi, heightening fears over a rising spate of kidnappings in Edo State and surrounding regions.

Mr. Omowumi Bode Ekundayo, National Coordinator of the Movement for the Advancement of Akoko Edo People, warned that the security situation is deteriorating, stressing that the area has become a gateway for criminal activities from neighboring states. He called on security agencies and state authorities to take urgent action to prevent further tragedies.

The Edo State Police Command, through Public Relations Officer Eno Ikoedem, confirmed the kidnappings and stated that investigations and rescue operations are ongoing. Authorities are working to ensure the safe return of the victims and apprehend those responsible.

This incident adds to Edo State’s growing security challenges, as communities continue to grapple with abductions and ransom demands across rural and semi-urban areas. Residents and local leaders have urged stronger police presence and rapid intervention strategies to tackle the kidnapping menace.

Gunmen Abduct Five from Edo Health Centre, Demand ₦100 Million Ransom

metro

Ex-Acting AGF Nwabuoku Admits Diverting N868.4 Million to Private Firms

Ex-Acting AGF Nwabuoku Admits Diverting N868.4 Million to Private Firms

Chukwunyere Anamekwe Nwabuoku, the former acting Accountant-General of the Federation, has admitted in the Federal High Court in Abuja to authorising the transfer of N868.4 million in public funds from the Ministry of Defence to four private companies. The confession, made during cross-examination on Tuesday, marks a dramatic turn in the ongoing money laundering trial against the former senior public finance official.

The court, presided over by Justice James Omotosho, heard that the funds were transferred to Temeeo Synergy Concept Limited, Turge Global Investment Limited, Laptev Bridge Limited, and Arafura Transnational Afro Limited. Nwabuoku described the transactions in a written statement to the Independent Corrupt Practices and Other Related Offences Commission (ICPC) as for “classified security purposes.” However, this contradicted his earlier testimony in court, where he denied any links to the companies.

READ ALSO:

- Kwankwasiyya Urges US Congress to Drop Kwankwaso’s Name from Bill

- Liverpool Edge Sunderland 1-0 to Halt Impressive Home Streak

- Jakande’s servant-leadership mindset remains relevant — Olurode

During cross-examination by prosecution counsel Ekele Iheanacho, SAN, Nwabuoku was confronted with his ICPC statement dated February 2, 2025, in which he admitted authorising the payments while serving as the Director of Finance at the Defence Ministry. The prosecution argued that there was no evidence that the funds were used for lawful security purposes, insisting that the transactions lacked proper documentation or justification.

Nwabuoku also addressed questions regarding his personal residence, claiming he purchased the property with legitimate earnings. However, he acknowledged a N64 million cheque issued by Mdavi Limited to City Gate Homes for the acquisition of the house, raising further questions about the source of funds.

He faces nine counts of money laundering linked to the N868,465,000, with the EFCC prosecuting the case. Earlier, the court dismissed his no-case submission, ruling that sufficient evidence existed for him to open his defence. The trial has highlighted alleged gaps in public finance management and accountability, particularly in senior government offices.

The case has been adjourned to February 27, 2026, for the adoption of written addresses by counsel, as the court continues to weigh evidence in one of Nigeria’s most high-profile anti-corruption trials.

The proceedings have attracted significant attention, reflecting growing public demand for transparency and the recovery of misappropriated public funds. Nwabuoku’s admission is expected to play a key role in the prosecution’s case and could influence how accountability measures are enforced in the management of federal resources.

Ex-Acting AGF Nwabuoku Admits Diverting N868.4 Million to Private Firms

metro

Deji Adeyanju Mocks El-Rufai Over Alleged Arrest Plot

Deji Adeyanju Mocks El-Rufai Over Alleged Arrest Plot

Human rights lawyer Deji Adeyanju has mocked former Kaduna State governor Nasir Ahmad El-Rufai following the latter’s claim that the Federal Government is planning to arrest and detain him upon his return to Nigeria.

El-Rufai had raised the alarm in a two-page document titled “Confidential Briefing Memo”, dated February 10, 2026, in which he expressed concerns about what he described as an anticipated politically motivated detention. The memo, reportedly sighted by BusinessDay, outlined alleged sustained pressure from security and anti-corruption agencies after his fallout with the ruling All Progressives Congress (APC) and his withdrawal from participating in President Bola Tinubu’s administration.

In the memo, the former governor said that since formally declining to serve in the Tinubu administration in August 2023 and subsequently resigning from the APC, he and his associates have faced repeated investigations.

“Since formally withdrawing my earlier acceptance to serve in the Tinubu administration in August 2023 and subsequently resigning from the ruling All Progressives Congress (APC), my close allies and I have been subjected to repeated investigations by security and anti-corruption agencies,” he stated.

El-Rufai, who is reportedly outside the country, further alleged that several former officials who served in his administration, as well as business associates linked to him, have been unlawfully detained without charge for extended periods.

READ ALSO:

- Omokri Defends Electronic Transmission, Questions Feasibility of Real-Time Results in Nigeria

- 2027 Polls: Christian Group Cautions Shari’a Council Over INEC Boycott Threat

- Starvation Cult Preacher Faces Expanded Murder, Terrorism Charges in Kenya

“Officials who served in my administration and business persons alleged to be associated with me have been unlawfully detained without charge for extended periods, including my Chief of Staff (50 days), a Senior Adviser (28 days), a commissioner (24 days), and a CEO (over 70 days and still detained). They are then arraigned on phantom charges, with judges influenced to deny bail or impose stringent conditions,” he claimed.

The former governor also recalled what he described as a similar attempt to prosecute him during the administrations of late President Umaru Musa Yar’Adua and former President Goodluck Jonathan. According to him, efforts by the Economic and Financial Crimes Commission (EFCC) between 2010 and 2013 failed after he was discharged and acquitted of an alleged abuse of office charge relating to land approvals while serving as Minister of the Federal Capital Territory.

“Despite years of intense, multi-agency investigation, no credible evidence has been presented against me, and no charges have been filed,” El-Rufai added.

On the alleged new plan to arrest him, he said he had received credible information indicating the certainty of detention upon his imminent return to Nigeria. He described the move as inconsistent with constitutional safeguards and Nigeria’s international obligations, while also alleging selective prosecution of opposition figures and sponsored media attacks aimed at damaging his reputation.

However, reacting via social media, Deji Adeyanju dismissed El-Rufai’s claims and accused him of hypocrisy, referencing his record while serving as Kaduna State governor.

“El-Rufai said they are planning to arrest him soon. El-Rufai arrested everyone who criticized him in Kaduna,” Adeyanju wrote.

He cited the case of Abubakar Idris, popularly known as Dadiyata, a government critic who was abducted in 2019 and has not been found since.

“His critic Dadiyata who was abducted in front of his wife and daughter disappeared till today without trace. The oppressors of yesterday are now comrades,” Adeyanju added.

As of the time of filing this report, there has been no official response from the Federal Government, the Presidency, or relevant security agencies regarding El-Rufai’s allegations of an impending arrest.

The development marks another chapter in the ongoing political tensions involving the former governor, who has recently been vocal about his disagreements with the current administration and internal dynamics within the APC.

Deji Adeyanju Mocks El-Rufai Over Alleged Arrest Plot

-

News3 days ago

News3 days agoBREAKING: Tinubu Holds Reconciliation Meeting With Wike, Fubara, Rivers Leaders at Aso Rock

-

metro2 days ago

metro2 days agoLeadership Crisis at NAHCON as Chairman Abdullahi Saleh Usman Resigns

-

News2 days ago

News2 days agoOyo Muslims Reaffirm Loyalty to Sultan on Islamic Matters — Grand Chief Imam

-

News2 days ago

News2 days agoUS Judge Orders FBI, DEA to Release Tinubu’s Criminal Records, Faults Delays

-

News3 days ago

News3 days agoOWN Calls for Immediate Resignation of INEC Chairman

-

International2 days ago

International2 days agoUS to Deport 18 More Nigerians on ‘Worst-of-the-Worst’ Criminal List (Full Names)

-

metro2 days ago

metro2 days agoFormer NAHCON Chief Explains Why He Stepped Down, Denies Conflicts

-

Business2 days ago

Business2 days agoNaira Posts Strong Comeback, Breaking Two‑Year High Against Dollar