News

Zenith Bank manager tells court how Emefiele moved funds from CBN to wife’s account

Zenith Bank manager tells court how Emefiele moved funds from CBN to wife’s account

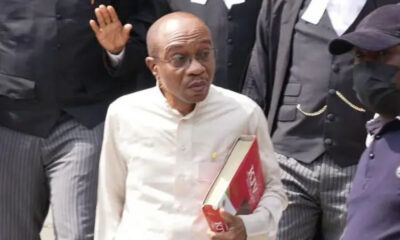

An Assistant Manager with Zenith Bank Plc, Mrs Ifeoma Ogbonnaya, has narrated how Mr Godwin Emefiele, the former Governor of the Central Bank of Nigeria (CBN), moved funds to his wife, Mrs Margaret Emefiele.

Ogbonnaya told an Ikeja Special Offences Court on Tuesday how Emefiele used the bank to move multimillion naira to his wife.

Emefiele is standing trial over abuse of office and alleged $4.5 billion and N2.8 billion fraud while in office.

Ogbonnaya, the fifth prosecution witness, was led in evidence by the Economic and Financial Crimes Commission (EFCC) Counsel, Mr Rotimi Oyedepo (SAN).

She told the court how Emefiele used Zenith Bank to transfer millions of naira in tranches to his wife through various companies.

Ogbonnaya said the companies that received the cash flow were Amswing Resources and Solution, Limelight Dimensional Service Ltd., Omec Support Service Ltd. and Mango Farm.

“Limelight manages the facilities of CBN, located at Alakija and all transactions pertaining to power and fixing things that are not working was always done by the vendors,” she said.

The witness who also doubles as a Business Relationship Manager, joined the bank in 2006.

Ogbonnaya said she never had direct dealings with the ex-CBN governor but received instructions from his wife to transfer cash from CBN into their private companies through Zenith Bank account.

She said apart from Mrs Emefiele she also received instructions from two other people, one Mr John Ogah and one Mr Opeyemi Oludimu, who worked for the Emefiele but now late.

The witness, however, said that she managed the various companies accounts through which the multimillion naira was sent to.

READ ALSO:

- Some Katsina varsity workers working for bandits – VC

- Bandits release three abducted children of Kaduna judge (+Photos)

- Fuel scarcity persists as situation worsens in Lagos, Abuja

“Mrs Margaret Emefiele, the ex-CBN governor’s wife, is the direct beneficiary of the accounts. The companies sent transfer instructions to my email and Margaret is the beneficial owner of the accounts.

“All transactions made in the accounts were confirmed by Mrs Emefiele before they were processed. She sends transfer instructions directly to my official email address with Zenith Bank or sends two other persons to act on her behalf but I still receive approval from her,” she said.

The witness also told the court that from March 9 to 11, 2015, the accounts received cash flow from the apex bank to the tune of N18. 9 million and N1.8 million respectively

“On Feb. 22, 2021, there was a cash flow of N43 million from CBN, on July 21, 2022, there was a cash flow of N37.3 million, on Oct. 21, 2022, there was a credit flow of N44.6 million, on May 10, 2023, there was a cash flow of N93.1 million from CBN, among others,” she said.

The witness further said that she usually communicate with Emefiele’s wife through email, phone calls and Whatsapp on transactions that were to be carried out on the accounts before processing them.

She said the bundles of documents which entailed the various transactions were printed from her office desktop computer.

“The documents were sent to my email and when investigation started, I was requested to print all the documents to the law enforcement which I did.

“I printed from the office desk top and took them to compliance officer. I also have certificate confirming that these documents were printed from Zenith Bank,” Ogbonnaya said.

The prosecution sought to tender the bundles of documents which entailed the various transactions that took place between the witness and Emefiele’s wife.

Emefiele’s Counsel, Mr Olalekan Ojo (SAN), and the second defence counsel, Mr Kazeem Gbadamosi (SAN), did not object the admissibility of the documents.

READ ALSO:

- TUC insists on N250,000 minimum wage

- Ex-INEC chairman Jega gets Tinubu top appointment

- Dangote refinery: NUPENG, PENGASSAN want IOCs investigated

The court, thereafter, admitted into evidence the certificate of identification, bundle of printed documents, following no objections from the defence.

The witness, thereafter, spoke into the documents and briefly explained the inflow and outflow of fund, purportedly sent from the CBN through Zenith Bank to Emefiele’s wife.

The prosecution also sought the indulgence of the court for the witness to write down the number in which she used to have conversations with Mrs Emefiele on an A4 paper which was admitted into evidence.

The witness, however, said that she could not remember some digits of the number by heart but she could recall it through her mobile phone.

The two defence counsel, however, objected to the witness, recalling the number through her phone.

The News Agency of Nigeria (NAN) reports that Justice Rahman Oshodi had earlier in the proceeding granted the application filed by the second defence counsel to recall the first prosecution witness, Monday Osazuwa.

EFCC had on April 8 arraigned Emefiele on 23 counts bordering on abuse of office, accepting gratifications, corrupt demand, receiving property fraudulently obtained and conferring corrupt advantage.

Also, his co-defendant Henry Omoile-Isioma, was arraigned on three counts bordering on acceptance of gift by agents.

The defendants, however, pleaded not guilty.

The judge, however, adjourned the case until July 10 for continuation of trial.

Zenith Bank manager tells court how Emefiele moved funds from CBN to wife’s account

(NAN)

News

INEC May Adjust 2027 Election Dates Over Ramadan Concerns

INEC May Adjust 2027 Election Dates Over Ramadan Concerns

The Independent National Electoral Commission (INEC) has acknowledged growing concerns over the timing of the 2027 general elections, which currently coincide with the holy month of Ramadan, and said it may seek legislative intervention if necessary to ensure full electoral participation.

In a statement released on Friday, INEC National Commissioner and Chairman of the Information and Voter Education Committee, Mohammed Kudu Haruna, said the commission is sensitive to public concerns and is consulting with stakeholders on possible adjustments to the election timetable.

The commission explained that the current schedule, developed in strict compliance with the Constitution of the Federal Republic of Nigeria, 1999 (as amended), the Electoral Act, 2022, and INEC’s own Guidelines and Regulations for the Conduct of Elections, 2022, sets Saturday, February 20, 2027, for the presidential and National Assembly elections, and Saturday, March 6, 2027, for the governorship and State Houses of Assembly elections. Party primaries are slated for May 22 to June 20, 2026.

READ ALSO:

- Man Allegedly Kills Brother in Rivers Over Witchcraft Accusation

- Regina Daniels Gifts Mother Two Luxury SUVs in Emotional Surprise

- El-Rufai Alleges Ribadu Ordered Arrest, Says Intercepted Calls Exposed Plot

However, INEC noted that these dates overlap with Ramadan, a period of fasting, prayer, and religious observances for Muslims, which could affect voter turnout and participation, particularly in predominantly Muslim areas. The commission emphasized that any adjustment to the timetable will remain consistent with constitutional and statutory requirements.

“The commission wishes to assure the public that it remains sensitive to all legitimate concerns that may impact electoral participation and the overall conduct of elections. In view of these representations, INEC is currently undertaking consultations and may, where necessary, seek appropriate legislative intervention,” the statement read.

Several political figures have already expressed concerns. Former Vice President Atiku Abubakar called on INEC to reconsider the February 20 date, citing potential disruption of voting during Ramadan. Former presidential aide Bashir Ahmad also urged the commission to review the schedule to avoid disenfranchisement of Muslim voters.

The commission reaffirmed its commitment to conducting transparent, credible, and inclusive elections. It promised to keep the public informed of any adjustments to the election timetable arising from consultations with political parties, civil society, and religious stakeholders.

The debate over the 2027 election schedule highlights the challenges of balancing constitutional timelines with religious and cultural sensitivities, underscoring the importance of ensuring accessible and fair elections for all Nigerians.

INEC May Adjust 2027 Election Dates Over Ramadan Concerns

News

2027 General Elections: INEC Announces February 20 for Presidential Poll

2027 General Elections: INEC Announces February 20 for Presidential Poll

The Independent National Electoral Commission (INEC) has officially fixed February 20, 2027 for Nigeria’s presidential and National Assembly elections, while governorship and State Houses of Assembly elections will be held on March 6, 2027.

INEC Chairman, Joash Ojo Amupitan, announced the dates on Friday during a media parley at the Commission’s national headquarters in Abuja, describing the move as the formal commencement of the 2027 general elections process.

According to the INEC chairman, the release of the Notice of Election and the comprehensive timetable complies with provisions of the 1999 Constitution of Nigeria and the Electoral Act 2022, which require the Commission to publish election notices ahead of the polls.

“It is with a deep sense of constitutional responsibility and commitment to democratic consolidation that the Commission today formally releases the Notice of Election and the Timetable and Schedule of Activities for the 2027 General Elections,” he stated, adding that any earlier unofficial announcements of election dates were misleading and did not originate from INEC.

READ ALSO:

- EFCC Nabs Three in Borno Over Viral ₦500 Naira Mutilation Video

- Omokri Accuses El-Rufai of Rights Abuses During Kaduna Governorship

- Lagos Motor Fair, Autoparts Expo to begin March 17, targeting Investment, Industry Growth

Amupitan disclosed that the tenure of the President, Vice President, governors, and deputy governors — except in off-cycle states — will expire on May 28, 2027, while the National and State Assemblies will be dissolved on June 8, 2027. He noted that the timeline provides sufficient room for political parties to conduct primaries, submit nomination forms, and organise campaigns in line with electoral regulations. Campaigns, he added, must end 24 hours before election day, as stipulated by law.

The INEC boss warned political parties to strictly comply with the approved schedule, stressing that the Commission would enforce the law where necessary. “Political parties are strongly advised to strictly adhere to the timelines. The Commission will not hesitate to enforce compliance with the law,” he said.

He also reaffirmed INEC’s commitment to deploying technology to enhance transparency in the 2027 general elections, updating the national voters’ register, strengthening collaboration with security agencies, and expanding voter education nationwide.

Calling for peaceful conduct, Amupitan urged political parties to organise credible primaries, shun violence and inflammatory rhetoric, and uphold internal democracy. He also appealed to candidates, supporters, civil society groups, the media, and citizens to play constructive roles throughout the electoral cycle.

“As we commence this national exercise, I assure Nigerians that the Commission is fully prepared and determined to deliver elections that reflect the sovereign will of the people,” he added.

With the formal release of the INEC 2027 election timetable, stakeholders are now expected to begin full-scale preparations for Nigeria’s next general elections.

2027 General Elections: INEC Announces February 20 for Presidential Poll

News

INEC Seeks N1.04 Trillion for 2027 Elections, Operational Needs – Amupitan

INEC Seeks N1.04 Trillion for 2027 Elections, Operational Needs – Amupitan

The Independent National Electoral Commission (INEC) has requested a total of ₦1.04 trillion from the Federal Government of Nigeria to fund off-cycle elections this year, the 2027 general election, and its operational activities in 2026, subject to approval by the National Assembly of Nigeria.

The request was made by INEC Chairman Prof. Joash Amupitan while defending the commission’s spending proposal before the Joint Committee on Electoral Matters of the National Assembly. Amupitan urged lawmakers to grant timely approval and release of funds, warning that delays could hamper preparations for upcoming elections.

According to the INEC chairman, the commission is seeking ₦873.778 billion for the 2027 general election and ₦171 billion for its 2026 operational activities. The 2026 allocation covers Federal Capital Territory (FCT) area council elections, by-elections scheduled for next week, and the Ekiti and Osun governorship elections slated for June and September.

READ ALSO:

- Alake: Killers of Mining Marshal Will Face Full Wrath of the Law

- Lagos Police Launch Manhunt for Suspect in Brutal Ajah Murder

- Lookman Shines as Atlético Madrid Hammer Barcelona 4-0

Breakdown of the 2027 Election Budget

The N873.778 billion earmarked for the 2027 general election includes:

- ₦379.748 billion for operational costs

- ₦92.317 billion for administrative expenses

- ₦209.206 billion for technology

- ₦154.905 billion for election capital costs

- ₦42.608 billion for miscellaneous expenses

For the N171 billion proposed for 2026 operations, Amupitan said:

- ₦109 billion would cover personnel costs

- ₦18.7 billion for overheads

- ₦42.63 billion for election conduct

- ₦1.4 billion for capital expenditure

He noted that the budget was prepared in line with Section 3(3) of the Electoral Act 2022, which mandates submission of election budgets at least one year before a general election.

Calls for Timely Fund Release and Dedicated Network

Amupitan criticized the envelope system of budgeting, describing it as unsuitable for INEC’s operational needs that often require urgent interventions. He appealed for a bulk release of funds, highlighting the need for a dedicated communication network to enhance accountability and transparency during elections.

“If we have our own network, Nigerians can hold us responsible for any hitch,” he said.

Lawmakers Back INEC’s Proposal

Senator Adams Oshiomhole argued that no government agency should impose the envelope budgeting system on INEC, emphasizing that full release of funds is critical for smooth election preparations. Similarly, House member Billy Osawaru called for the budget to be placed on first-line charge, allowing the commission access to all funds immediately.

Following deliberations, the joint committee approved a one-time release of INEC’s annual budget and pledged to consider increasing allowances for National Youth Service Corps (NYSC) members deployed for election duties. The proposed increase would cost ₦32 billion, equating to ₦125,000 per corps member.

Senator Simon Lalong, chairman of the Senate Committee on Electoral Matters, assured INEC of lawmakers’ support, pledging close collaboration to ensure a successful 2027 election. House Committee chairman Bayo Balogun also promised legislative backing but cautioned INEC against overpromising, citing prior misrepresentations about real-time uploads to the INEC Result Viewing (IReV) portal, which was never provided for in the Electoral Act but only in INEC regulations.

The approval of the commission’s budget and operational requests is expected to enhance election preparedness, technological deployment, and transparency ahead of the 2027 general elections, while addressing logistical and operational challenges that have hampered past polls.

INEC Seeks N1.04 Trillion for 2027 Elections, Operational Needs – Amupitan

-

metro2 days ago

metro2 days agoIKEDC Sets Feb 20 Deadline for Customers to Submit Valid IDs or Face Disconnection

-

Education2 days ago

Education2 days agoSupreme Court Affirms Muslim Students’ Right to Worship at Rivers State University

-

metro2 days ago

metro2 days agoLagos Police Launch Manhunt for Suspect in Brutal Ajah Murder

-

News2 days ago

News2 days agoAso Rock Goes Solar as Tinubu Orders National Grid Disconnection

-

Business2 days ago

Business2 days agoNaira Could Trade Below ₦1,000/$ With Dangote Refinery at Full Capacity — Otedola

-

metro2 days ago

metro2 days agoArmy University Professor Dies in Boko Haram Captivity After Nearly One Year

-

International2 days ago

International2 days agoTrump Halts Minnesota Immigration Crackdown After Fatal Shootings, Protests

-

Politics3 days ago

Politics3 days agoCity Boy Movement Receives Bus Donations from Zenco, Obi Cubana for Tinubu’s Campaign