Business

Pandora Papers: I’ve never had business dealings with Kola Aluko, says Oyetola

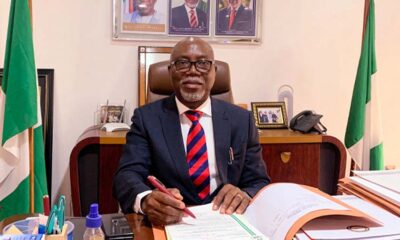

Gboyega Oyetola, governor of Osun, says he was never involved in the purchase of a mansion in London from a company belonging to Kola Aluko, a Nigerian businessman who is being tried for money laundering.

Leaked files, which were reportedly retrieved from 14 offshore service firms around the world and revealed in a Pandora Papers project led by the International Consortium of Investigative Journalists (ICIJ), and which Premium Times is a part of, had shown that in July 2013, the property with title number 340992, was bought for £11.95 million by Zavlil Holdings Ltd, a shell company incorporated in the British Virgin Islands, a tax haven.

Zavlil Holdings Limited is reportedly owned by Aluko, an ally of Diezani Alison-Madueke, former minister of petroleum resources, who has been the subject of various investigations in Nigeria and abroad for allegedly taking part in shady oil contracts.

According to Premium Times, documents obtained from the UK property register revealed that in 2017, Mr Aluko “sold the house for £9 million to Aranda Overseas Corporation, an offshore company incorporated in the British Virgins Island by two of Mr Tinubu’s most trusted surrogates – Adegboyega Oyetola, formerly chair of Paragon Group of Companies and incumbent governor of Osun State, and Elusanmi Eludoyin, Mr Oyetola’s successor at Paragon”.

The newspaper also reported that the governor, who became a shareholder and director of Aranda, did not resign his position even while he served as chief of staff to his predecessor, Rauf Aregbesola.

But reacting in a statement by his chief press secretary, Ismail Omipidan,Oyetola said he resigned from his position at the company when he became a government official and never bought the said mansion.

“We have seen reports in some online media platforms concerning the Pandora Papers’ allegations. This is, therefore, to set the record straight,” the statement reads.

“Mr Adegboyega Oyetola, governor of Osun State, resigned his directorship of Aranda Overseas Corporation in 2011, when he took up the political appointment. He also surrendered his shareholding of the same company.

“Since 2011 to date, he has had no association, dealings and business transactions with the said company, as he is neither a director nor a shareholder of the said company. He, therefore, could not have acquired the said property in 2017, either directly or through the said company as being alleged.

“As a matter of fact, Oyetola has no relationship or link with the alleged owner of the property, Mr Kolawole Aluko, let alone go into a business dealing or transaction with him.

“He also complied fully with the law of the land by exiting Global Investments Offshore Ltd. as a Director in 2011, upon his appointment as the Chief of Staff to the immediate past governor of Osun State, Rauf Aregbesola.”

Business

Naira slumps on NNPC, marketers importation of fuel

Naira slumps on NNPC, marketers importation of fuel

The naira has weakened further on the parallel market, dropping to N1,740/$ from N1,720/$.

Similarly, the NAFEM official exchange rate showed a slight depreciation on Friday, closing at N1,652/$ compared to the earlier rate of N1,650/$.

The Nigerian National Petroleum Company Limited (NNPC) and other oil marketers imported 1.5 million metric tonnes of petrol and 414,018.764 metric tonnes of diesel between October 1 and November 11, 2024.

The country’s inflation rate also spiked, with the Consumer Price Index (CPI) rising to 33.88% in October, up from 32.70% in September, according to the National Bureau of Statistics (NBS).

The oil importation statistics indicated 13,500 metric tonnes of jet fuel alongside petrol and diesel imports during the 42-day period.

The total value of these products was put at $1.9 billion or approximately N3 trillion.

The breakdown revealed that two billion litres of petrol, 500 million litres of diesel, and 17 million litres of jet fuel were imported.

But at an event in Lagos, NNPC’s Group Chief Executive Officer, Mele Kyari, highlighted the company’s commitment to reducing dependence on imported refined products.

The NNPC spokesperson Olufemi Soneye clarified that while the company prioritizes sourcing from local refineries, importation would continue based on economic factors.

READ ALSO:

- NAF air strikes kill scores of bandits in Kaduna, free kidnap victims

- Appeal court affirms Baruwa as NURTW president, renders MC Oluomo election invalid

- 13 Nigerian girls rescued from traffickers in Ghana

“Today, NNPC does not import any products; we are taking only from domestic refineries,” Kyari stated. Soneye, however, added, “The GCEO’s statement should not be construed to imply that NNPC is obligated to be the sole off-taker of any refinery or that we will no longer import fuel. While NNPC prioritises sourcing products from domestic refineries, this is contingent upon economic viability.”

The Dangote Refinery, which has advocated for sourcing locally refined products, faces challenges with pricing dynamics, making the transition complex.

Aliko Dangote, the refinery’s President, recently disclosed that it holds over 500 million litres of fuel in reserves.

The NNPC’s importation data showed Lagos, Warri, Port Harcourt, and Calabar as key discharge points for refined products.

Naira slumps on NNPC, marketers importation of fuel

Business

CBN to penalise banks selling new naira notes to hawkers

CBN to penalise banks selling new naira notes to hawkers

The Central Bank of Nigeria says it will heavily penalise banks with empty ATMs and those selling ‘mint’ cash to naira hawkers.

Solaja Olayemi, CBN’s acting director for the currency operations department, said this in a memo to DMBs on Friday.

Mr Olayemi said that the CBN would engage in “mystery shopping” exercise and periodic “spot checks” on cash distribution and disbursement activities of DMBs to ascertain the source of such Naira notes.

He said that the initiatives were introduced to monitor and prevent practices that facilitate the flow of mint banknotes to hawkers of naira cash, thereby discouraging abuse of the naira.

He said that the initiatives would also ensure that DMBs support efficient and responsible cash disbursement to the public.

READ ALSO:

- How much is Mike Tyson, Jake Paul getting paid for the fight?

- NAF air strikes kill scores of bandits in Kaduna, free kidnap victims

- Appeal court affirms Baruwa as NURTW president, renders MC Oluomo election invalid

“For the avoidance of doubt, it should be noted that DMBs, to whom cash seized from hawkers of cash is traced, will be penalised 10 per cent of the total value of cash withdrawn on the day the seized cash was withdrawn from the CBN.

“Every subsequent offence will be charged an incremental penalty of five per cent.

“DMBs found engaging in cash hoarding, diversion, or any actions that hinder efficient cash distribution, including violations of the Clean Note Policy, will incur appropriate sanctions,” he said.

He urged DMBs to implement internal controls for responsible disbursement and accountability regarding mint banknote payouts at their outlets, as the yuletide season approached, with an anticipated increase in cash demand.

“To enhance public access to cash, we encourage banks to prioritise cash distribution through Automated Teller Machines (ATMs).

“During this season, the CBN, in collaboration with relevant law enforcement agencies, will intensify spot checks and mystery shopping activities to monitor and enforce responsible cash distribution and prevent naira abuse,” he said.

CBN to penalise banks selling new naira notes to hawkers

(NAN)

Business

RT Briscoe appoints Femi Eguaikhide as Deputy Managing Director

RT Briscoe appoints Femi Eguaikhide as Deputy Managing Director

The Board of RT Briscoe Plc has appointed Dr Olorunfemi Abidemi Eguaikhide, the Executive Director responsible for business operations to a new position of Deputy Managing Director.

The appointment, according to the management of the organisation, will take effect from January 1st, 2025.

Born on March 28, 1968, Eguakhide holds a Postgraduate Diploma in Business Administration and an MBA in Marketing Management from the Enugu State University of Science and Technology.

He is an Alumnus of the prestigious Lagos Business School of the Pan Atlantic University having attended the Advanced Management Programme (AMP) in 2016.

He is a full member of the Chartered Institute of Personnel Management of Nigeria (MCIPM); associate member of the Nigerian Institute for Training and Development (AITD); Fellow of the Institute of Credit Administration (FICA), Certified Digital Marketing Professional (CDMP) and Fellow of the Institute of Corporate Administration of Nigeria.

The core experience of the new Deputy Managing Director is in the areas of operations management, sales and marketing management, human resources and business leadership.

Dr. Eguaikhide previously worked with Genesis Group variously as deputy general manager in charge of Human Resources and IT; general manager HR & IT; general manager, operations and chief operations officer at the Bridge Healthcare Company in 2010.

He joined RT Briscoe as group head, human capital development in 2012 and was appointed to manage the Briscoe-Ford Business unit in 2014 as the general manager.

He was subsequently appointed as head of the Briscoe-Motors Business unit in 2017 and later as the group chief operating officer in September 2018.

He obtained his doctorate degree in December 2021 and was appointed a director of RT Briscoe with effect from September 1, 2019.

Reacting to his latest promotion, Mike Ochonma, Chairman of Nigeria Auto Journalists Association (NAJA), described the appointment as a square peg in a square hole.

He said it was as a well deserved elevation, coming at a time when businesses are going through very difficult times, adding that he has no doubt that Eguaikhide would bring his wealth of experience to bear on the role in the company.

-

Sports2 days ago

Sports2 days agoBREAKING: Super Eagles qualify for AFCON 2025

-

Aviation2 days ago

Aviation2 days agoDisaster averted as bird strike hits Abuja-Lagos Air Peace flight

-

metro1 day ago

metro1 day agoCourt orders varsity to pay lecturer N40m compensation for wrongful dismissal

-

Opinion1 day ago

Opinion1 day agoApomu king turns warmonger for PDP

-

Education3 days ago

Education3 days ago12-year-old Nigerian girl Eniola Shokunbi invents air filter to reduce spread of diseases in US schools

-

Politics1 day ago

Politics1 day agoOndo poll: Three gov candidates withdraw for Aiyedatiwa

-

News2 days ago

News2 days agoEdo Gov Okpebholo freezes govt accounts, reverses ministry’s name

-

metro2 days ago

metro2 days agoWe are understaffed, ICPC boss laments