News

We can’t afford N110bn ASUU demand for varsities – FG

- Again ASUU-FG meeting ends in deadlock

Contrary to the impression given by the government that an end to the prolonged strike by university lecturers was at sight, a meeting held to resolve all lingering issues on Wednesday ended in a deadlock.

Specifically, the meeting attended by representatives of the Federal Government and those of the Academic Staff Union of Universities, was over the poor funding of Universities and the controversy surrounding the Integrated Payroll and Personnel Information System payment platform.

Minister of Labour and Employment, Dr Chris Ngige, told journalists after the meeting that the government could not meet the N110bn demand of ASUU for university revitalisation because of the damaging effects of COVID-19 on the economy.

According to him, the Federal Government has offered the union N20bn for revitalisation and N30bn for Earned Academic Allowances, making a total of N50bn as a show of its commitment towards ending the strike.

He said, “There are three issues. revitalization fund where government offered ASUU N20bn as a sign of good faith based on the Memorandum of Understanding (MOU) they entered into in 2013 as a result of the renegotiation they had with government in 2009. This present government is still committed to it. That is why we are giving them offers of some fund.”

He also said, “This government is not against revitalization but this government says that because of dire economic situation and COVID-19, we cannot really pay the N110bn which they are demanding for revitalization.

“We offered N20bn as revitalization fund. On Earned Academic Allowances (EAA), the government offered N30bn to all the unions in the universities, making it N50bn all together.

“ASUU is saying that the N30bn should be for lecturers alone, irrespective of the fact that there are three other unions. So there is a little problem there. We don’t have any money to offer apart from this N30bn.

“Again, another cardinal issue is the University Transperancy and Accountability Solution (UTAS) versus IPPIS. Today ASUU submitted their document on UTAS for onward submission to National Information Technology Development Agency (NITDA). As you know last week, the Minister of Communication and Digital Economy had approved that NITDA gets their system (UTAS) and subject it to integrity test. This test should be conducted without fear or favour and as early as possible. So today they have submitted the document for onward transmission to NITDA.”

Ngige explained that the transition period and how to disburse the Earned Academic Allowances and other entitlements remained unresolved as ASUU wanted an exemption from the IPPIS whereas the government team led by the Accountant General of the Federation insisted on the IPPIS, being the only government approved payment platform.

He said, “So that is where we are for now. So we are all going back to our principals and they will receive via me the irreducible minimum of what federal government has to offer.”

The two teams agreed to reconvene on Friday November 6.

News

Currency in circulation now N4.8tn – CBN report

Currency in circulation now N4.8tn – CBN report

Currency in circulation has reached an all-time high of N4.8 trillion as of November 2024, recording over seven per cent increase from the previous month.

Also, currency outside banks grew significantly in the same month hitting an all-time high of N4.6 trillion from the N4.2 trillion in the month of October.

These figures were contained in the money and credit supply data from the Central Bank of Nigeria (CBN).

The currency in circulation is the amount of cash–in the form of paper notes or coins–within a country that is physically used to conduct transactions between consumers and businesses.

It represents the money that has been issued by the country’s monetary authority, minus cash that has been removed from the system.

Similarly, currency outside a bank refers to cash held by individuals, businesses and other entities that is not stored in banks.

The currency outside the bank represents about 96 per cent of the currency in circulation.

Nigerians have in recent times been facing acute cash shortage with banks limiting daily withdrawal at Automated Teller Machines (ATMs) to N20,000 irrespective of the number of accounts held by an account owner.

READ ALSO:

- Cross River man kills mother, dumps body inside well

- El-Rufai mocks Reno Omokri with throwback protest photos against Tinubu

- Warri refinery: Marketers hopeful of further petrol price drop

According to the latest data, the currency in circulation grew by seven per cent to reach 4,878,125.22 from 4,549,217.51 in October.

Currency in circulation has grown steadily in the outgoing year 2024 with over one trillion naira added to cash in circulation after starting the year with N3.65 trillion in January.

In February, the currency in circulation slightly increased to N3.69 trillion representing an increase of N43 billion or 1.18 per cent from the January figure.

March also saw an appreciable increase to N3.87 trillion while it further increased to N3.92 trillion in the following month of April.

The growth trajectory continued in May with the currency in circulation increasing slightly to N3.97 trillion, an increase of N42 billion or 1.07 per cent while it reached an all-time high of 4.04 trillion, an increase of 2.11 per cent from May.

The July figure also rose marginally with the currency in circulation settling for N4.05 trillion before growing to N4.14 trillion in August and N4.43 trillion in September and N4.5 trillion in October.

In the same vein, currency outside banks grew from N4.2 trillion in October to N4.6 trillion in November, showing increasing preference for other means of storing outside bank deposits.

Economist, Dr. Paul Alaje attributed the development to the expanding money supply, adding, “Money supply is expanding but this may not necessarily be in cash. As it is expanding, it will necessarily induce inflation. But you can’t blame the people. People must look for money. How much was bottled water last year, how much is it today? All of this will induce inflation. If you now ask, what is the cause of inflation? Is it money supply itself or a devaluation policy? It is a devaluation policy. Money supply is an offshoot. So the Central Bank is raising interest rates to actually reduce money supply but the more they try the more money supply expands.”

He stated that the floatation policy of the CBN has created inflation, adding, “It is like chasing one’s tail and I don’t know if you are going to catch it.”

Currency in circulation now N4.8tn – CBN report

News

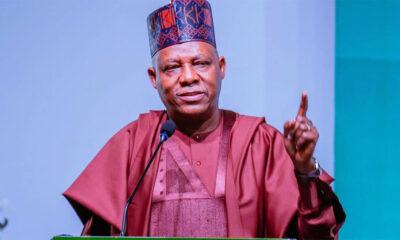

Tinubu not telling Nigerians the truth, says Sule Lamido

Tinubu not telling Nigerians the truth, says Sule Lamido

President Bola Tinubu has been accused of not being forthright about the true state of Nigeria under his administration.

Former Jigawa State Governor and senior Peoples Democratic Party (PDP) member, Sule Lamido, made the accusation while speaking on the BBC Hausa programme Gane Mini Hanya.

Lamido criticized both Tinubu and former President Muhammadu Buhari for what he described as a lack of transparency in governance.

“Buhari’s and Tinubu’s governments are not being transparent with Nigerians unlike during the time when PDP was in power where everything was transparent and open to all Nigerians,” Lamido said.

READ ALSO:

- Odili: Fubara prevented Wike from turning Rivers to private estate

- Putin apologises over Azerbaijan plane crash reportedly shot down

- 256 terrorists, two logistics suppliers arrested in one week – DHQ

He accused the two administrations of relying on propaganda rather than providing citizens with accurate information.

Lamido also expressed concerns over President Tinubu’s recent loan requests, questioning the logic behind them. “If Nigerians are being told the truth then there is nothing wrong with that, but how would you budget N30tn, generate N50tn and then request loan when you have a surplus of N20tn,” he said, referencing last year’s budget.

He described the situation as “reckless” and “selfish,” adding, “This recklessness and clear-cut selfishness is not done anywhere in the world, but yet you find (some) Nigerians supporting it. Visit social media and see how APC is being criticised, being referred to as calamity, yet you find some protecting it.”

Tinubu not telling Nigerians the truth, says Sule Lamido

News

Nigeria Customs Service begins 2025 recruitment [How to apply]

Nigeria Customs Service begins 2025 recruitment [How to apply]

The Nigeria Customs Service (NCS) has announced the commencement of its recruitment exercise, assuring Nigerians that the process is entirely free and fair.

The agency has cautioned the public to be vigilant against scammers who may attempt to exploit unsuspecting applicants during the recruitment period.

Applications are invited for positions in the Superintendent, Inspector, and Customs Assistant cadres as part of the Service’s plan to recruit 3,927 officers in 2025.

This initiative is aimed at enhancing trade facilitation and supporting Nigeria’s economic recovery efforts.

“Our recruitment is entirely free and fair. At no stage do we charge fees. Anyone requesting payment is a scammer,” the agency emphasized, urging applicants to be wary of fraudulent schemes.

READ ALSO:

- Dangote, Tinubu, Lookman, Badenoch named among 100 most influential Africans in 2024

- Heavy security in Ilesa as ex-Osun deputy gov emerges new Owa-Obokun

- Hacker has stolen N180m from my NGO account – VeryDarkMan cries out

The NCS outlined eligibility criteria, stating that applicants must be Nigerian citizens by birth, possess a valid National Identification Number (NIN), and have no criminal record or ongoing investigations.

Academic qualifications for the three cadres are as follows:

Superintendent Cadre: A university degree or Higher National Diploma (HND) along with an NYSC discharge or exemption certificate.

Inspectorate Cadre: A National Diploma (ND) or Nigeria Certificate in Education (NCE) from an accredited institution.

Customs Assistant Cadre: At least an O’Level certificate (WAEC or NECO).

In addition to these qualifications, the NCS stressed that all applicants must be physically and mentally fit, providing evidence of medical fitness from a recognized government hospital.

Nigeria Customs Service begins 2025 recruitment [How to apply]

-

Politics3 days ago

Politics3 days agoGbajabiamila speaks on his rumoured Lagos governorship ambition

-

metro3 days ago

metro3 days agoFarotimi to pursue disbarment over arrest, defamation allegations

-

Business2 days ago

Business2 days agoReal reason Dangote, NNPC drop petrol price — IPMAN

-

Health2 days ago

Health2 days agoABU Teaching Hospital will begin kidney transplant in 2025 – CMD

-

Sports1 day ago

Sports1 day agoAnthony Joshua prostrates before Governor Abiodun during Ogun visit

-

metro3 days ago

metro3 days agoEl-Rufai accuses Tinubu govt of Yoruba agenda, Reno Omokri reacts

-

metro3 days ago

metro3 days agoNigerian govt urged to intervene in Mozambique post-election violence

-

Politics3 days ago

Politics3 days ago2027: Why PDP shouldn’t field northern presidential candidate – Ex-Atiku campaigner

You must be logged in to post a comment Login