Uncategorized

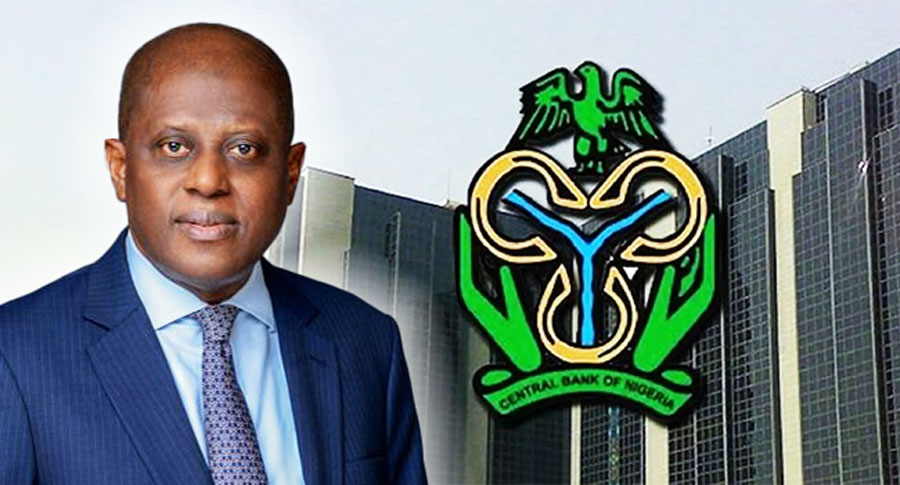

CBN raises interest rate from 18 to 22.75%

CBN raises interest rate from 18 to 22.75%

The Central Bank of Nigeria has increased monetary policy rate otherwise known as interest rate from 18 per cent to 22.75 per cent.

It also raised the Cash Reserve Ratio from 35 per cent to 45 per cent.

The CBN’s Governor, Olayemi Cardoso, announced the rate adjustment at a news conference on Tuesday after the Monetary Policy Committee’s meeting in Abuja.

The monetary policy rate is the baseline interest rate in an economy, every other interest rate used within the economy is built on it.

The rate hike is the first monetary policy decision made by the committee since Cardoso assumed office on September 26, 2023.

Cardoso said the committee raised the MPR by 400 basis points to 22.75 percent, and adjusted the asymmetric corridor at +100 and -700 basis points from +100 basis points and -300 basis points around the MPR.

He said the committee also increased the Cash Reserve Ratio (CRR) from 32.5 per cent to 45 per cent, while retaining the liquidity rate at 30 percent.

He also spoke on inflation, saying the rate of change in prices of goods and services rose to 29.9 per cent in January 2024 — up from 28.92 per cent in the previous month.

Uncategorized

Just in: Edo govt announces N70,000 minimum wage for workers starting May 1

Just in: Edo govt announces N70,000 minimum wage for workers starting May 1

Edo State Government has approved a new minimum wage of N70,000 for civil servants in the state.

The state governor Godwin Obaseki announced this on Monday while commissioning the new Labour House in Edo State.

He said the new minimum wage would come into effect on May 1st this year, which is Wednesday this wee

k.

Business

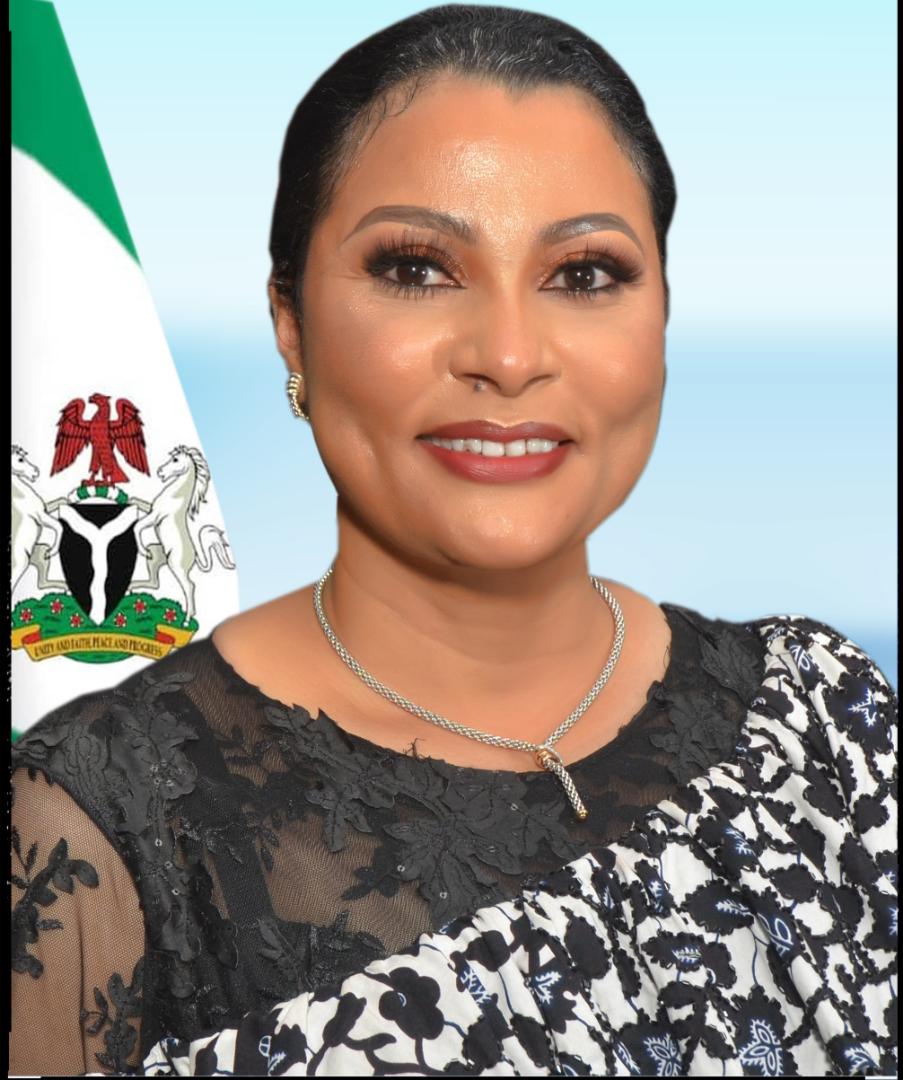

N50,000 presidential grant: 100,000 small businesses benefit in first phase

N50,000 presidential grant: 100,000 small businesses benefit in first phase

A total of 100,000 small businesses across the country have so far received a presidential grant of N50,000 under the first phase of the Trade Grants Scheme.

Minister of Industry, Trade and Investment, Doris Uzoka-Anite, disclosed this, adding that one million nano businesses would benefit from the scheme.

A report by Saturday Punch quoted the minister as saying this through her aide, Terfa Gyado, in an interview with the newspaper.

Newstrends notes that the grant aimed at driving sustainable economic growth at the grassroots level will be disbursed with 70 per cent going to women and youths, 10 per cent individuals with disabilities, and five per cent senior citizens, and the remaining 15 per cent allocated to other groups.

Bank of Industry (BOI) was appointed as the executing agency for the funds.

The minister said the disbursement which began a few weeks ago would be distributed to 1,291 nano businesses in each of the 774 local governments in the country.

The Federal Government in December announced the Presidential Conditional Grant Scheme to empower small businesses as part of the Presidential Palliatives Programme.

It said a total of N200 billion would be disbursed through the BoI to support manufacturers and businesses across the country.

Aniete, giving an update on the scheme, said all verified applicants would receive their grants in subsequent phases.

The minister said, “The Presidential Conditional Grant Scheme kicked off a few weeks back and disbursement has been made to the first batch.

“Each grant applicant gets N50,000 while the applicants are judged by the criteria of owning a nano business and being verified using their Bank Verification Number and their National Identification Number.

“So those who were successfully verified on the nature of their business and all other criteria have been able to get some of the initial disbursement.”

The minister said the grant was paid directly to beneficiaries’ accounts after proper verifications with a target to reach one million small businesses in the 774 LGs and the six council areas in the Federal Capital Territory.

“The target is for one million nano businesses across the 774 local governments across the federation and that works out to a total of 1,291 nano businesses per local government and that is how the spread is going to be.

“So far, the disbursement has hit about 100,000 small businesses and they have got the initial disbursement and the target remains one million. “Disbursement is still ongoing and we are still waiting for data from across all the states and it is an ongoing process.”

News

FG to launch new national ID card for payment, others

FG to launch new national ID card for payment, others

The Federal Government says it has concluded arrangements to launch a new National Identity Card with payment and other social service features.

It said the New National Identity card would be delivered in collaboration with the Central Bank of Nigeria (CBN) and the Nigeria Inter-bank Settlement System (NIBSS).

The project would be powered by AfriGO, a national domestic card scheme, Head of Corporate Communications of NIMC, Dr Kayode Adegoke, announced in a statement in Abuja.

The statement read, ”The National ID card, layered with verifiable National Identity features, is backed by the National Identity Management Commission (NIMC) Act No. 23 of 2007, which mandates NIMC to enrol and issue a General Multipurpose card (GMPC) to Nigerians and legal residents.

“This card will address the demand for physical identification enabling cardholders to prove their identity, access government and private social services, facilitate financial inclusion for disenfranchised Nigerians, empower citizens, as well as encourage increased participation in nation-building.

“Only registered citizens and legal residents with the National Identification Number (NIN) will be eligible to request the card.

“The card, which will be produced according to ICAO standards, is positioned as the country’s default national identity card.

“In addition to this functionality, cardholders will also be able to use the cards as debit or prepaid cards by linking same to bank accounts of their choice.

“The card shall enable eligible persons especially those financially excluded from social and financial services have access to multiple government interventions programmes.”

Its key features are as follows:

Machine-readable Zone (MRZ) in conformation with ICAO for e-passport information

Identity card Issue Date and document number in line with ICAO standard.

Additional features are travel, health insurance information, microloans, agriculture, food stamps, transport, and energy subsidies, etc

Nigeria’s quick response code (NQR) containing the national identification number

Biometric authentication, such as fingerprint and pictures, as the primary medium for identity verification through the data on the card chip

Offline capability that allows transactions in areas with limited network coverage or zero infrastructure connectivity

“Functionality as a debit and prepaid card catering to both banked and unbanked individuals

Request for cards by registered citizens and legal residents will be made available online, at any commercial bank, various agencies or agents participating in multiple programs and/or any NIMC offices nationwide

-

Auto2 days ago

Auto2 days agoBKG holds all-inclusive Lagos Motor Fair, auto parts expo June 4-6

-

Sports1 day ago

Sports1 day agoEPL: Man City go top after thrashing Fulham

-

metro1 day ago

metro1 day agoWhy I claimed Ooni is my father – Man recants, apologises (+ VIDEO)

-

News2 days ago

News2 days agoRivers crisis may truncate Nigeria’s democracy, remember ‘Operation Wetie’ – Bode George warns

-

metro3 days ago

metro3 days agoSeveral students abducted as bandits attack Kogi varsity

-

News1 day ago

News1 day agoBritish High Commission shuns Prince Harry, Meghan ceremonies in Nigeria

-

News14 hours ago

News14 hours agoAisha Yesufu under fire for celebrating naira fall

-

News13 hours ago

News13 hours agoMinister inspects Nigeria-assembled CNG buses, says transport costs to drop