Business

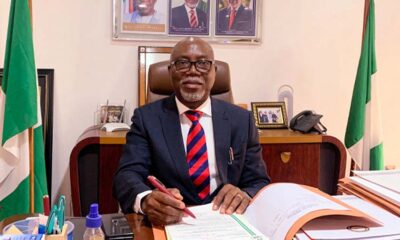

We increased interest rates 26.75% to stem inflation – Cardoso

We increased interest rates 26.75% to stem inflation – Cardoso

In response to mounting public frustration over Nigeria’s economic challenges the Central Bank of Nigeria’s (CBN) Governor, Yemi Cardoso, to insufficient diversification, has attributed the horror to insufficient diversification efforts, excess liquidity, and global economic pressure.

He stated this yesterday at a media briefing to mark the conclusion of the Monetary Policy Committee (MPC)’s 296th meeting in Abuja.

According to him, the MPC increased interest rates by 50 basis points from 26.25 per cent to 26.75 per cent in an effort to manage inflation.

The apex bank adjusted the asymmetric corridor from +100/-300 to +500/-100 basis points, Cash Reserve Ratio (CRR) of deposit money banks at 45 per cent and merchant banks at 14 per cent while retaining Liquidity Ratio at 30 per cent.

Justifying the decisions, Cardoso explained that the MPC acknowledged the detrimental impact of rising prices on households and businesses across Nigeria and reiterated its commitment to maintaining price stability,

He expressed optimism that recent monetary policy measures, coupled with fiscal interventions aimed at addressing food inflation, would help stabilise prices in the near term.

Cardoso highlighted the persistent challenge of food inflation, which is worsened by insecurity in key agricultural areas and high transportation costs, and emphasised the urgent need to enhance food supply within Nigeria.

READ ALSO:

- Nigerians have right to protest, Amnesty International tells FG

- Police arrest fleeing killer of Brigadier General in Abuja, recover pistol

- Republican lawmaker hits Kamala Harris with articles of impeachment

He said: “It was observed that while monetary policy has been moderating aggregate demand, rising food and energy costs continue to exert upward pressure on price development. The prevailing insecurity in food producing areas and high cost of transportation of farm produce are also contributing to this trend. Members were therefore not oblivious to the urgent benefit of addressing these challenges as it will offer a sustainable solution to the persistent pressure on food prices.

“Also noted in its consideration is the increasing activities of middlemen who often finance smallholder farmers, aggregate, hoard and move farm produce across the border to neighboring countries. The committee suggested the need to put in check such activities in order to address the food supply deficit in the Nigerian market to moderate food prices.

The MPC therefore resolved to sustain collaboration with the fiscal authority to ensure that inflationary pressure is subdued.

Reacting, Nigeria’s first professor of the capital markets Prof Uche Uwaleke said: “Having done 750 basis points between February and May this year, I had predicted they would do a minimum of 50bps or a max of 100bps in July.

“I am glad to note that they chose the floor which is a sign that a complete halt is most likely in their next scheduled meeting in September.

But the adjustment to the asymmetric corridor around the MPR is a major source of concern for me.

“The MPC communique did not provide any explanation for increasing the SLR from +100 to +500 and the SDR from -300 to -100.

“By implication, with an MPR of 26.75 per cent, banks will now get loans from the CBN at 31.75 per cent while they will be remunerated for their excess deposits at 25.75 per cent. This will further squeeze liquidity from the banking system and jerk up cost of credit with adverse consequences on output and the equities market.

“The MPC communique should have made it clear why it was better to mask the tightening in the asymmetric corridor than reveal it in the MPR.

“May I observe that unlike previous MPC communiques, recent ones are silent regarding how the members voted. This information is useful at this stage even before their personal statements are published.

“I submit that as far as taming the current elevated inflation in Nigeria is concerned in view of its major non-monetary drivers, the fiscal side holds the ace”, he said.

We increased interest rates 26.75% to stem inflation – Cardoso

Business

We’re not involved in N40m HxAfrica mortgage scheme – FMBN

We’re not involved in N40m HxAfrica mortgage scheme – FMBN

By Dada Jackson

The Federal Mortgage Bank of Nigeria (FMBN) has distance itself from claims linking it to a N40 million mortgage pre-financing scheme promoted by Housing Exchange Africa (HXAfrica).

In an official disclaimer issued by Virginia Jang, FMBN’s Group Head of Corporate Communications, it clarified that the bank has no formal partnership or approval arrangement with HXAfrica concerning the alleged scheme.

“The management of the Federal Mortgage Bank of Nigeria wishes to disclaim reports in the media by HXAfrica (Housing Exchange Africa) on a purported N40 million mortgage pre-financing scheme, which referred to FMBN as a partner,” Jang stated

She further explained that while HXAfrica had applied for engagement with the bank, no approvals had been granted, and no formal agreements had been finalized.

Jang emphasized that FMBN remains committed to advancing housing initiatives, including the forthcoming Diaspora Mortgage Scheme, which is being developed in collaboration with the National Diaspora Commission (NIDCOM)

“While the FMBN and NIDCOM remain committed to the roll-out of the Diaspora Mortgage Scheme after obtaining the necessary regulatory approvals, we will endeavour to provide official information and updates on our respective websites and social media handles to prevent the public from being misled,” she added.

The statement also revealed that NIDCOM had issued a similar disclaimer regarding the HXAfrica scheme, urging the public to be cautious of unverified claims.

FMBN assured citizens that details of the official Diaspora Mortgage Scheme would be communicated through authorized channels once regulatory approvals are secured.

The bank reiterated its commitment to delivering credible housing solutions while encouraging the public to rely only on updates from its verified platforms.

Auto

Soludo: Kojo assembly plant will make Anambra auto manufacturing hub

Soludo: Kojo assembly plant will make Anambra auto manufacturing hub

Anambra State Governor, Professor Charles Chukwuma Soludo, has expressed optimism that the new Kojo automotive assembly plant at Umunya along the Enugu-Onitsha Expressway will not only boost the economy of the state but also reposition it as an automotive manufacturing hub.

The assembly plant nearing completion is expected to roll out its first set of vehicles under the Soludo administration soon.

The governor spoke at the just concluded Anambra State Investment Summit (ANINVEST 2.0) with Kojo Motors as one of the official partners and sponsors.

This year’s ANINVEST held under the theme “Changing Gears: Accelerating Anambra’s Economic Transformation”

was organised by the state government as a pivotal event in advancing the collective vision for rapid development of the state’s economy.

Speaking on the sidelines of the summit, Managing Director of OMAA, Chinedu Oguegbu, reiterated the plan of the company to invite Governor Soludo to commission the plant and drive the first locally assembled vehicle out of the Kojo Assembly Plant by the first quarter of 2025.

He said, “His Excellency is very passionate about the Kojo Motors auto assembly plant. He is very eager to see its completion and commencement of assembly of vehicles come to reality.

“I can assure him and the state government that we are doing everything possible to ensure we meet with the governor’s wishes and aspirations.”

The event brought together stakeholders from the various sectors of the local and global economy including industry leaders, development partners, financial institutions and other relevant participants, all united in a commitment to accelerating the economic transformation of Anambra State.

Anambra, according to the state governor, is fast becoming a renewed investors’ destination for different types of money bags rushing to the state to capitalise on the pledged ease of doing business to set up businesses.

“This time around, one of such massive investments is being undertaken by John Ikenna Oguegbu, an indigene of the state and chairman, founder and CEO, Kojo Motors Limited,” Chinedu Oguegbu said.

Last year September, Governor Soludo performed the groundbreaking ceremony of the Kojo Motors auto assembly plant for the local assembly of the OMAA range of gas-powered mini passenger and commercial buses as well as Chinese range of Yutong passenger and commercial buses.

While congratulating John Ikenna Oguegbu, chairman and chief executive of Kojo Motors Limited for bringing his wealth to his home state to invest. Governor Soludo also commended the Yutong buses manufacturers from China for the smart move of coming to Anambra State to set up the auto assembly plant in collaboration with the local franchisee.

The governor stated that the decision to allow prospective investors to come and invest in the state was not out of philanthropy or charity, but rather a business decision model that would take Anambra State to the world and bring the outside world to the state.

Governor Soludo pledged the state government’s commitment and patronage of the vehicles rolling out of the Yutong Assembly plant.

He declared that the state government under his administration was on course for massive industrial development, employment generation and prosperity for all its citizens.

Business

Naira slumps on NNPC, marketers importation of fuel

Naira slumps on NNPC, marketers importation of fuel

The naira has weakened further on the parallel market, dropping to N1,740/$ from N1,720/$.

Similarly, the NAFEM official exchange rate showed a slight depreciation on Friday, closing at N1,652/$ compared to the earlier rate of N1,650/$.

The Nigerian National Petroleum Company Limited (NNPC) and other oil marketers imported 1.5 million metric tonnes of petrol and 414,018.764 metric tonnes of diesel between October 1 and November 11, 2024.

The country’s inflation rate also spiked, with the Consumer Price Index (CPI) rising to 33.88% in October, up from 32.70% in September, according to the National Bureau of Statistics (NBS).

The oil importation statistics indicated 13,500 metric tonnes of jet fuel alongside petrol and diesel imports during the 42-day period.

The total value of these products was put at $1.9 billion or approximately N3 trillion.

The breakdown revealed that two billion litres of petrol, 500 million litres of diesel, and 17 million litres of jet fuel were imported.

But at an event in Lagos, NNPC’s Group Chief Executive Officer, Mele Kyari, highlighted the company’s commitment to reducing dependence on imported refined products.

The NNPC spokesperson Olufemi Soneye clarified that while the company prioritizes sourcing from local refineries, importation would continue based on economic factors.

READ ALSO:

- NAF air strikes kill scores of bandits in Kaduna, free kidnap victims

- Appeal court affirms Baruwa as NURTW president, renders MC Oluomo election invalid

- 13 Nigerian girls rescued from traffickers in Ghana

“Today, NNPC does not import any products; we are taking only from domestic refineries,” Kyari stated. Soneye, however, added, “The GCEO’s statement should not be construed to imply that NNPC is obligated to be the sole off-taker of any refinery or that we will no longer import fuel. While NNPC prioritises sourcing products from domestic refineries, this is contingent upon economic viability.”

The Dangote Refinery, which has advocated for sourcing locally refined products, faces challenges with pricing dynamics, making the transition complex.

Aliko Dangote, the refinery’s President, recently disclosed that it holds over 500 million litres of fuel in reserves.

The NNPC’s importation data showed Lagos, Warri, Port Harcourt, and Calabar as key discharge points for refined products.

Naira slumps on NNPC, marketers importation of fuel

-

metro1 day ago

metro1 day agoSouth-West NURTW: Why we chose Oluomo over Baruwa

-

metro3 days ago

metro3 days agoCourt orders varsity to pay lecturer N40m compensation for wrongful dismissal

-

Opinion3 days ago

Opinion3 days agoApomu king turns warmonger for PDP

-

Politics3 days ago

Politics3 days agoOndo poll: Three gov candidates withdraw for Aiyedatiwa

-

News2 days ago

News2 days agoLate COAS Lagbaja gets CFR honour, buried amid tributes

-

News12 hours ago

News12 hours ago[UPDATED] [Breaking] APC’s Lucky Aiyedatiwa wins Ondo governorship election

-

metro2 days ago

metro2 days agoNAF air strikes kill scores of bandits in Kaduna, free kidnap victims

-

metro10 hours ago

metro10 hours agoNURTW: Agbede urges Baruwa to congratulate MC Oluomo, in spirit of sportsmanship