Business

NNPC sells petrol to IPMAN at N995/litre

NNPC sells petrol to IPMAN at N995/litre

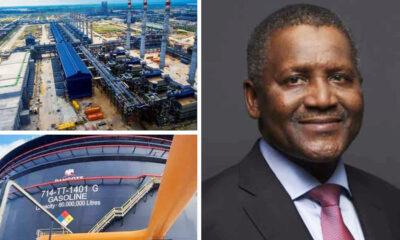

The Nigerian National Petroleum Company Limited (NNPCL) has agreed to supply Premium Motor Spirit (petrol) to members of the Independent Petroleum Marketers Association of Nigeria (IPMAN) for N995 per litre.

This came when the Department of State Services stepped in to resolve the dispute between the two parties.

The National Vice President of IPMAN, Hammed Fashola, informed our correspondent that the DSS intervention resolved many of the issues that merchants had.

Fashola also acknowledged that, as a result of their participation, the Nigerian Midstream and Downstream Petroleum Regulatory Authority agreed to pay the association’s unpaid N10 billion while resolving concerns with direct petrol purchases from the Dangote refinery.

“We really appreciate their intervention. They are doing their job. Anywhere they have seen that there may be a crisis, it is their duty to intervene. And their intervention brokered peace and understanding between the parties, and everybody agreed to work together,” Fashola stated.

Speaking on how much the NNPC will sell PMS to IPMAN, he replied, “For now, tentatively, I think they are offering us N995 per litre.”

With the N995 ex-depot pricing, Fashola promised that IPMAN members would no longer sell at costs much greater than those of large marketers, but said that distance is another reason for overpriced PMS.

“Our members sell at N1,200 or so, and this depends on the location. I think with the N995, there will be a little reduction. Don’t forget that if you transport a product from Lagos to a far distance, you will pay for transportation and other charges.

“We want to work on that because we want to have common ground. When we sit down and look at the price analysis offered to us and factor in all our expenses, we want to have a uniform price as much as possible.

“So, I will not be able to tell you the exact price now, but we are working on it, especially in the Lagos axis and other zones. We will look at the transportation cost and all that. At the end of the day, we will fix the price for ourselves,” he stated.

READ ALSO:

- Just in: Fuel, food prices push up inflation to 32.70%

- PDP Govs nullifies Damagum’s suspension asks rival to vacate office

- FG spends ₦380bn on electricity subsidy in second quarter —NERC

The IPMAN head highlighted that IPMAN is interested in competitive prices, citing price disparities as a detriment to independent marketers.

“The price disparity has been a disadvantage between us and the NNPC Retail and major marketers. So, we are trying to look at how to close that gap so that we come back fully into the business. The lack of direct supply has been our problem, and now that we are solving that problem, I don’t think that disparity will be there again,” he stressed.

Fashola elucidated that the price differential is the reason for the queues in some filling stations in the cities.

“The queues you see are because of that difference in prices; that’s why people are saying there are queues. There are no queues; it is the price disparity that is causing the queues. So, if there is not much difference, we have filling stations everywhere; just drive in, buy fuel, and go. But that so much difference in the price is creating that scenario of queues,” he narrated.

Speaking on the directive that marketers can now buy petrol directly from local refineries, Fashola said the association would meet with Dangote this week.

“For now, we intend to meet with Dangote this week to see how we work out the modalities and all that. The Federal Government has given a directive, and we want to take full advantage of that,” he posited.

The IPMAN vice president emphasised that the association is not ignoring the NNPC either, as it would patronise the best price.

“At the same time too, we are not ignoring NNPC. So, whichever way, we are ready to do business with NNPC. It depends on the price; we go for the best.

IPMAN disclosed on Thursday that the cost of fuel from the Dangote Petroleum Refinery to NNPC was approximately N898/litre, but that NNPC was selling the same product to independent marketers in Lagos for N1,010/litre.

The association, which owns more than 70% of filling stations in the country, protested and threatened to shut down operations, as well as a return from the NNPC for previous petrol supply payments made by its members.

Abubakar Maigandi, the IPMAN national president, said in a live television interview on Thursday that the price was greater than what the NNPC paid for the Dangote refinery product.

He also stated that the national oil company had kept independent marketers’ funds for almost three months.

According to him, the NNPC acquired the fuel from the refinery for N898/litre but is demanding marketers to pay N1,010/litre in Lagos, N1,045 in Calabar, N1,050 in Port Harcourt, and N1,040 in Warri.

“Our major challenge now is that independent marketers have an outstanding debt from the NNPC, and the company collected products through Dangote at a lower rate, which is not up to N900, but they are telling us now to buy this product from them at the price of N1,010/litre in Lagos; N1,045 in Calabar; N1,050 in Port-Harcourt; and N1,040 in Warri,” Maigandi stated.

NNPC sells petrol to IPMAN at N995/litre

Auto

Lanre Shittu Motors to endow Automobile Department of Lagos Technical College

Lanre Shittu Motors to endow Automobile Department of Lagos Technical College

Lanre Shittu Motors has announced a novel idea that will boost automobile studies in a Lagos technical college.

Specifically, it has pledged to adopt the Automobiles Department of the Government Technical College, Aso-Soba in the Festac area of Lagos.

This is intended to raise academic and practical programme standards of the school.

The company said this would involve adequate funding, in-school training and intensive industrial training (IT) with welfare package to encourage more young people to pursue academic career in automotive engineering.

Business Support/Admin Manager of LSM, Mr Babatunde Adenuga, disclosed this in Lagos, in an interview with journalists.

Adenuga represented the LSM Managing Director, Mr Taiwo Shittu, at the just concluded Engineering Week of the college sponsored by the auto company, where he unveiled the plan to the staff and students at the event’s grand finale.

Aside from the needed financial support to make the auto department functional and standard, he said LSM would provide the tools, overall wears/workshop uniform, among others, as part of the welfare package for the students.

He said it would be a win-win situation for the school and the company.

Adenuga said, “The school will benefit immensely from the LSM package for the department as we take the financial trouble of running the department away from them.

“Students from the department can come for their internship at LSM workshops, and getting jobs after school won’t be difficult.

“For us, it will be a seamless arrangement in getting suitable personnel familiar with our training and business orientation.”

He also said the LSM had been absorbing students from the school and others for their industrial training (IT), providing them with useful hands-on training and monthly stipend to keep them going.

The LSM MD, Taiwo Shittu, commenting on the support, said, “We’ll be part of the progress of the school. We want to own a department in the technical college, the automobile department of studies that will enable us to fund the place; take care of the welfare of students, providing the tools, overall uniform and other facilities.”

“At LSM, we see training the youths as part of our Corporate Social Responsibility. Every year, we take in youths into our facility and train them; even while in training, we give them stipends.”

The highpoint of the LSM-sponsored Government Technical College event was the presentation of prizes to outstanding students in the various competitions held for the Engineering Week.

Three of the students whose projects stood out such as locally produced water pumping machine and water heater went home with impressive cash awards.

Principal of the college, Mr Folarin Sunkanmi, expressed appreciation to LSM for the interest in the school, starting with giving the students the opportunity for industrial training and offering them monthly stipend.

The principal commended the LSM efforts of sponsoring the engineering week’s activities, whose theme was given as ‘Engineering for Sustainable Development (Innovators of tomorrow)’

He urged other companies to emulate the LSM example in order to boost the employability chances of products of the technical colleges and engineering departments of higher institutions in the country.

Business

Elon Musk sells X to AI startup for $33 billion

Elon Musk sells X to AI startup for $33 billion

Billionaire entrepreneur Elon Musk has announced the merger of his artificial intelligence startup, xAI, with his social media platform, X, in an all-stock transaction valued at $45 billion.

This move brings xAI’s valuation to $80 billion, while X is valued at $33 billion.

Both xAI and X are privately held entities under Musk’s control.

The two companies share notable investors, including Andreessen Horowitz, Sequoia Capital, Fidelity Management, Vy Capital, and Saudi Arabia’s Kingdom Holding Co.

Musk, in a post on X, stated that the merger would combine their data, computing power, distribution, and talent to create more advanced AI-driven experiences while staying committed to their core mission of truth and knowledge advancement.

“@xAI has acquired @X in an all-stock transaction. The combination values xAI at $80 billion and X at $33 billion ($45B less $12B debt).

Since its founding two years ago, xAI has rapidly become one of the leading AI labs in the world, building models and data centers at unprecedented speed and scale.

READ ALSO:

- Barbaric mass burning of innocents in Edo, by Farooq Kperogi

- Investigation of wanted businesswoman Achimugu not linked with Atiku, Sanwo-Olu – EFCC

- No Sallah durbar festival in Kano this year – Police warn

X is the digital town square where more than 600M active users go to find the real-time source of ground truth and, in the last two years, has been transformed into one of the most efficient companies in the world, positioning it to deliver scalable future growth.

xAI and X’s futures are intertwined. Today, we officially take the step to combine the data, models, compute, distribution and talent. This combination will unlock immense potential by blending xAI’s advanced AI capability and expertise with X’s massive reach. The combined company will deliver smarter, more meaningful experiences to billions of people while staying true to our core mission of seeking truth and advancing knowledge. This will allow us to build a platform that doesn’t just reflect the world but actively accelerates human progress.

I would like to recognize the hardcore dedication of everyone at xAI and X that has brought us to this point. This is just the beginning,” he stated.

xAI’s growing footprint in AI

Founded less than two years ago, xAI aims to “understand the true nature of the universe.” The company has been developing large language models and AI tools, positioning itself as a direct competitor to OpenAI, a company Musk co-founded in 2015 before exiting due to strategic differences.

In June 2024, xAI announced plans to build a supercomputer in Memphis, Tennessee, to train its AI chatbot, Grok. By September, Musk revealed that part of the Memphis-based supercomputer, called Colossus, was already online.

xAI’s rapid expansion has drawn scrutiny from environmental and public health advocates, who cite a lack of community input in its Memphis project. The Colossus supercomputer is powered by natural gas-burning turbines, and xAI plans to expand operations with a nearby graywater facility.

Elon Musk sells X to AI startup for $33 billion

Business

MTN, Airtel to share network infrastructure in Nigeria

MTN, Airtel to share network infrastructure in Nigeria

Airtel Africa has partnered with MTN Group to expand digital inclusion by sharing network infrastructure in Uganda and Nigeria.

In a statement in Lagos on Wednesday, Airtel said the sharing agreements aim to improve network cost efficiencies, expand coverage, and provide enhanced mobile services to millions of customers.

A sharing agreement is a formal arrangement between two or more parties to share resources, assets, or services.

According to the telecommunications company, the partnership will benefit customers in remote and rural areas who do not yet fully enjoy the benefits of a modern connected life.

Airtel assured that both parties will ensure the agreement complied with local regulatory and statutory requirements.

Sunil Taldar, chief executive officer (CEO) of Airtel Africa, said telecommunications companies are driving digital financial inclusion by building common infrastructure within the regulatory framework.

Taldar noted that the collaborative approach not only advances digital transformation and financial inclusion but also reduces the duplication of expensive infrastructure.

READ ALSO:

- Kogi group seeking Senator Natasha’s recall not registered – CAC

- Obasanjo’s position on Rivers emergency rule hypocritical, says Presidency

- Bill to stop politicians above 60 from contesting presidential, gov poll scales 2nd reading in Reps

As a result, Taldar said operational efficiencies are boosted, ultimately benefiting customers.

He further said telecoms continue to compete fiercely in the market, differentiating themselves through their brand, services, and offerings.

“The initiative is part of a growing global trend toward network sharing. By collaborating, telecoms operators can explore innovative and pro-competitive solutions to improve service quality while managing costs more effectively,” Taldar said.

“The sharing of infrastructure has the potential to enable the delivery of world-class, reliable mobile services to more and more customers across Africa.”

Taldar added that following the conclusion of agreements in Uganda and Nigeria, MTN and Airtel Africa are also exploring various opportunities in other markets, including Congo-Brazzaville, Rwanda, and Zambia.

Ralph Mupita, MTN Group CEO, said there is a need to invest in coverage and capacity to ensure high-quality connectivity to meet customers’ increasing demands.

“As MTN, we are driven by the vision of delivering digital solutions that drive Africa’s progress,” Mupita said.

“We continue to see strong structural demand for digital and financial services across our markets.

“To meet this demand, we continue to invest in coverage and capacity to ensure high-quality connectivity for our customers.”

Mupita added that there are opportunities within regulatory frameworks for sharing resources to drive higher efficiencies and improve returns.

MTN, Airtel to share network infrastructure in Nigeria

-

Uncategorized13 hours ago

Uncategorized13 hours agoBreaking: Moon sighted in Saudi, UAE, others, Eid-Fitr holds Sunday

-

metro3 days ago

metro3 days agoRivers administrator Ibas fires Fubara’s political appointees

-

metro3 days ago

metro3 days agoJUST-IN: Ex-Oyo gov Ajimobi’s first child Bisola dies At 42

-

metro3 days ago

metro3 days agoFG declares public holidays for Eid-el-Fitr

-

metro2 days ago

metro2 days agoEFCC re-arraigns son of ex-PDP chairman for alleged N2.2bn oil subsidy fraud

-

Africa3 days ago

Africa3 days agoNiger coup leader sworn in as president for five years

-

metro3 days ago

metro3 days agoNatasha: Murray-Bruce slams Atiku, defends Akpabio

-

International3 days ago

International3 days agoAI will replace doctors, teachers, others in 10 years – Bill Gates