metro

Worry over cash scarcity in banks as farmers mop up naira

Worry over cash scarcity in banks as farmers mop up naira

There is rising complaints by bank customers and Point of Sale (POS) operators in some states across the country over alleged cash squeeze just as citizens try to meet their increasing demands for notes especially as yuletide shopping begins.

The states where these concerns are being raised include Bauchi, Borno, Kaduna, Kano, Kebbi, Taraba, as well as some satellite towns of the Federal Capital Territory (FCT).

The scarcity, which has lasted over a week in the reported states, is coming amidst data from the Central Bank of Nigeria (CBN), revealing that the total currency in circulation has reached N4.14 trillion, with N3.87 trillion of this amount currently outside the banking system.

The recent CBN data indicates that 93.34 per cent of the nation’s currency is in the hands of individuals and businesses, while only 6.66 per cent remains within the banking sector.

The gap between currency outside banks and the total currency in circulation suggests that Nigerians, especially those living in the northern part of the country, still heavily rely on cash for daily transactions, despite the rise of digital banking services.

Also, the CBN data revealed that currency in circulation in Nigeria has added N1.48 trillion or 55.8 per cent Year-on-Year (YoY) to N4.14 trillion as of August 2024, from N2.66 trillion in August 2023.

Cash squeeze pronounced in the North

Daily Trust findings revealed that the northern states are mostly affected by the current scarcity largely due to the onset of harvest and the fewer numbers of financial institutions in the rural areas of the North.

READ ALSO:

- We didn’t arrest Hamdiyya Sidi for criticising Sokoto governor – Police

- Four varsity lecturers dismissed for sexual misconduct

- Super Eagles seal AFCON 2025 spot, draw 1-1 against Benin

Findings by our reporters in Borno State indicate that some businessmen buying up grains on a large scale were said to be mopping up cash.

A POS operator, Hamza Abdullahi, said operators no longer get the required cash in banks, therefore, depend on traders and petrol stations.

Hamza attributed the scarcity to the harvest and yuletide period that is fast approaching.

He said: “Traders are busy buying the new harvests and to do this, they need cash because farmers in our rural areas do not use electronic payment channels. Some do not even have bank accounts”.

He said many people are also buying goats and other animals that are transported to the South ahead of Christmas, adding that these are largely cash transactions contributing to the scarcity.

He said for N50,000, POS operators now charge N1, 000 as against N500 previously.

Kano

Abubakar Sadiq Danzaria, said POS operators are milking customers, raising charges because of the scarcity.

Another POS operator in Rijiyar Zaki Motor park, Adamu Salisu, who said he visited Guaranty Trust Bank (GTB) in Murtala Mohammed road said, “Banks give only N50,000 a day and that is not enough to cater to the needs of our customers. Therefore, we source the cash from traders or filling stations.”

On his part, the chairman of Singer Market Development Association (SIMDA), Alhaji Junaidu Muhammad Zakaria, agreed with the POS operators that cash scarcity exists.

Speaking, a businessman, Muntari Aliyu said: “if you go to the rural markets, you can withdraw N3 million from the POS operator. They have the cash.

READ ALSO:

- 2027 PDP ticket: I defeated you in 2019, 2023, Atiku mocks Wike

- NNPC achieves 1.8mbpd crude oil production

- BREAKING: FEC proposes N47.9 trillion budget for 2025 fiscal year

“People there don’t do business with our modern means of transactions; they don’t trust it that’s why they are not taking the money to the bank. It’s not in circulation the way it should”, he said.

Abdullahi Haruna, a grain merchant said it was tough for him to get N10 million that he needed to visit the grains market in Sumaila, on Wednesday.

“I had to use traders at the ‘Yankura and other markets in the Kano metropolis. This took me more than one week,” he said.

Zainab Almu, an entrepreneur, said the cash scarcity is as a result of the harvest season, and not necessarily a policy matter.

“Farmers who are bringing the grains from the villages are still sceptical about bank transfer. They want to collect their money in cash and go back home.

“There is the need for more sensitisation in this part of the country. Again, some of them have been duped in the past, especially during the cash crunch ahead of the 2023 elections.

“Many of them lost their fortunes because they received fake credit alerts from some dubious Nigerians. A lot of sensitisation must be done to convince such people to trust the system again,” he said.

She said she has accounts in Access, Zenith and GT banks. “All the banks are facing some challenges of notes. When you go to withdraw, there is limit to what they will give you,” she said.

Worry over cash scarcity in banks as farmers mop up naira

Daily Trust

metro

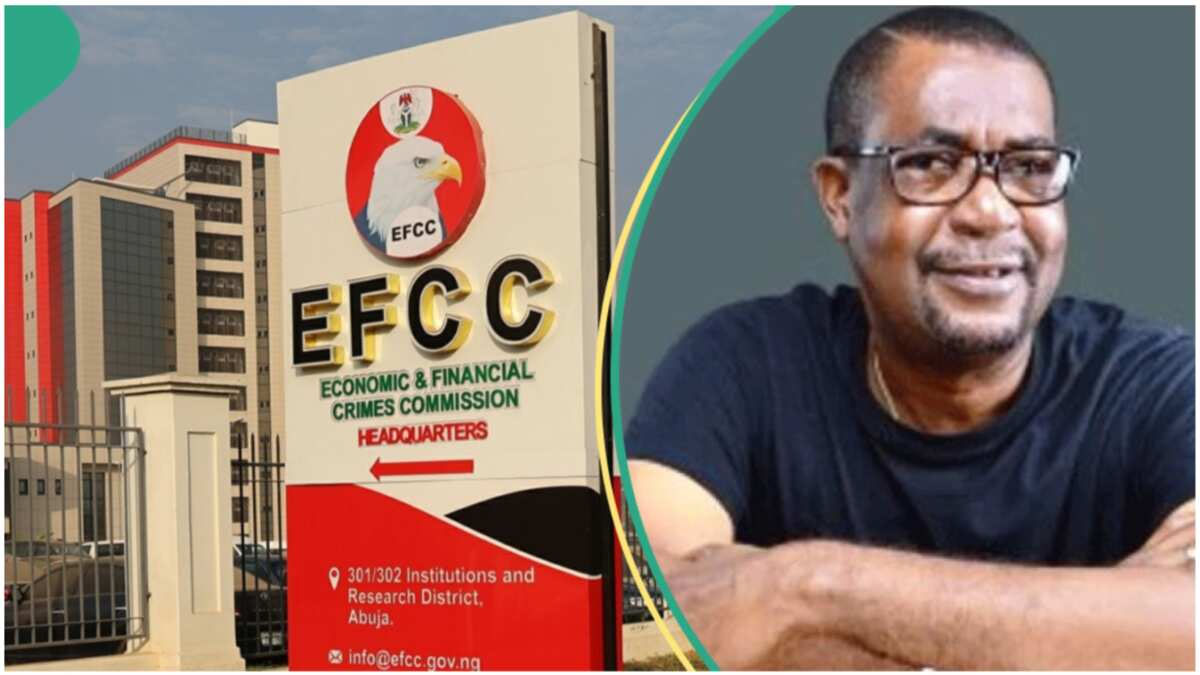

$6bn fraud: Judge scolds Agunloye’s counsel over delay tactics

$6bn fraud: Judge scolds Agunloye’s counsel over delay tactics

Justice Jude Onwuegbuzie of the Federal High Court, Apo, Abuja On Thursday, chastised Adeola Adedipe, SAN, counsel to former Minister of Power, Olu Agunloye, for using delay tactics to slow the pace of the former minister’s prosecution.

Agunloye is being prosecuted by the Economic and Financial Crimes Commission, EFCC, on seven counts of official corruption and fraudulent award of the Mambilla Power Project contract worth $6 billion.

During Thursday’s hearings, the court observed that the defence counsel has been in the habit of making excuses based on Agunloye’s health and age, as well as filing various motions, ensuring that little progress has been achieved in the trial.

Addressing the defence counsel, Justice Onwuegbuzie stated that “My principle of justice is that of no delay. The other time you brought the issue of amicus curiae and wasted the time of the court. You should also know that in my court I don’t read processes.

READ ALSO:

- Emefiele printed new naira notes different from what Buhari approved – Ex-CBN official

- Train attack: ECOWAS court dismisses SERAP suit against FG

- Court orders varsity to pay lecturer N40m compensation for wrongful dismissal

“If you need time to serve processes, it must reach me on time, and your colleague must also be duly aware in time. There must be mutual respect. Do not come and serve processes in court; I don’t take that in my court,” he said.

Prosecuting Counsel Abba Mohammed, SAN, informed the court at the start of proceedings that the business of the day was the adoption of the prosecution’s application for the amendment of the charge, which was filed on October 30, 2024, to which the defence responded with a counter-affidavit and a request for an adjournment to allow the prosecution to study the affidavit.

Justice Onwuegbuzie adjourned the case until November 28, 2024, to rule on the adoption of the application.

$6bn fraud: Judge scolds Agunloye’s counsel over delay tactics

metro

Emefiele printed new naira notes different from what Buhari approved – Ex-CBN official

Emefiele printed new naira notes different from what Buhari approved – Ex-CBN official

The trial of former Central Bank of Nigeria (CBN) Governor, Godwin Emefiele, continued at the Federal Capital Territory (FCT) High Court in Maitama on Thursday, November 14, 2024.

A former CBN Deputy Governor, Kingsley Obiora, who served in the policy department, testified that the newly printed naira notes issued during Emefiele’s tenure deviated from the approval granted by then-President Muhammadu Buhari.

In his testimony before Justice Maryann Anenih via Zoom, Obiora disclosed, “the approval by then President Muhammadu Buhari was different from what was eventually produced,” according to a statement from the Economic and Financial Crimes Commission (EFCC).

Obiora, responding to evidence presented by prosecution counsel Rotimi Oyedepo SAN, explained that he noticed discrepancies when comparing the naira notes in circulation with the President’s original directive.

During his seven-year tenure at the CBN, Obiora served on the Committee of Governors (COG), which he described as a body comprising “the governor, four deputy governors, and the director of corporate services.” He clarified, “The governor is the Chairman of the Committee, and during my tenure as Deputy Governor, Emefiele was our Chairman.” Obiora said the Committee met every Wednesday to address significant policy matters.

READ ALSO:

- Train attack: ECOWAS court dismisses SERAP suit against FG

- Court orders varsity to pay lecturer N40m compensation for wrongful dismissal

- Worry over cash scarcity in banks as farmers mop up naira

Obiora recalled the initial introduction of the redesign plan during an event marking the one-year anniversary of the e-naira in Lagos on October 25, 2022. “The governor called all four deputy governors into a huddle and informed us of the plan to redesign the currency,” he said, expressing immediate concerns, as he felt “the event itself may not be the appropriate place to announce such a major policy.” He advised that the policy undergo further scrutiny before any public announcement.

Despite his reservations, Obiora noted that Emefiele proceeded with the plan, formally presenting it to the COG on October 26, 2022. “The governor mentioned that we had already had the president’s approval for the policy,” he stated, adding, “The deputy governor in charge of currency operations presented a memo, and it was discussed, deliberated upon.” Following this, a press conference was held to announce the redesign.

Obiora explained that the CBN Board was formally briefed on the naira redesign months later, in mid-December 2022. He said, “The policy was discussed at the board level mid-December. The board did not sit as day-to-day management but instead gave policy directions.” Obiora clarified that “the board’s involvement in the policy was limited to endorsing the COG’s prior decision, not initiating it.”

During cross-examination, defense counsel Olalekan Ojo, SAN, questioned Obiora about the timing of the board’s formal involvement. Ojo suggested that the December meeting “conforms with the naira notes currently in circulation,” to which Obiora responded, “Yes, sir.” He noted there had been no indication or directive from former President Buhari challenging the redesign.

Reflecting on past experiences with currency design, Obiora mentioned that while he was with the bank during the introduction of a redesigned N100 note in 2014, he was not directly involved in its development.

After delivering his testimony, Justice Anenih discharged Obiora and adjourned the case to December 4, 2024, and January 21, 2025, for further proceedings.

Emefiele printed new naira notes different from what Buhari approved – Ex-CBN official

metro

Train attack: ECOWAS court dismisses SERAP suit against FG

Train attack: ECOWAS court dismisses SERAP suit against FG

The Community Court of the Economic Community of West African States (ECOWAS Court) has rejected a suit filed by a group of Nigerian activists, the Socio-Economic Rights and Accountability Project (SERAP) over an attack by bandits on an Abuja-Kaduna train on March 28, 2022.

The court held that it lacks jurisdiction over the case because relevant ingredients that could qualify it to be entertained as a public interest litigation were missing.

SERAP filed the case after bandits attacked the Abuja-Kaduna passenger train in 2022.

In the attack, armed assailants bombed the train carrying over 970 passengers on the Abuja-Kaduna rail line near Rigasa in Kaduna.

The attack led to numerous fatalities, injuries, and abductions.

SERAP, by its case, sought to hold the government of Nigeria accountable for alleged human rights violations in relation to the terrorist attack.

The organisation claimed, among others, that the attack was the result of the state’s inability to provide tight security for the passengers.

READ ALSO:

- Court orders varsity to pay lecturer N40m compensation for wrongful dismissal

- Worry over cash scarcity in banks as farmers mop up naira

- FG announces plans to borrow N13.8tn for 2025 budget

SERAP argued that Nigeria’s alleged lack of measures to avert the attack violated the rights of passengers to life, security, and dignity.

It prayed for a N50 million compensation for each of the passengers and their families.

In a judgment delivered on Wednesday, the regional court declared the suit inadmissible due to lack of victim status required for public interest litigation.

A statement by the court said the judgment was delivered by Justice Dupe Atoki.

It added: “The court recognised its jurisdiction to hear the case as it involved potential human rights violations within a member-state, in accordance with Article 9(4) of the ECOWAS Supplementary Protocol.

“However, the court found the claim inadmissible on grounds that it failed to meet the victim status requirement essential for litigation under Article 10(d) of the same Protocol.

“In its findings, the court said that SERAP claimed to be acting in public interest, citing previous incidents of terrorism in the region, including attacks on educational institutions and transportation services.

“However, the court determined that the case did not meet the criteria for a public interest action, or actio popularis, which requires that the alleged violations affect a large, indeterminate segment of the public or the general public itself.

“The Court highlighted that: The victims of the March 28 attack were identifiable individuals rather than an indeterminate public group, making the claim unsuitable as a public interest litigation.

“The reliefs sought, including specific monetary compensation, were directed at the identifiable victims of the attack rather than the public at large.

“Members of the three-member panel of the court were Honourable Justice Ricardo Cláudio Monteiro Gonçalves(presiding judge), Honorable Justice Sengu Mohamed Koroma (panel member), and Honorable Justice Dupe Atoki (judge rapporteur).”

Train attack: ECOWAS court dismisses SERAP suit against FG

-

Sports18 hours ago

Sports18 hours agoBREAKING: Super Eagles qualify for AFCON 2025

-

Aviation20 hours ago

Aviation20 hours agoDisaster averted as bird strike hits Abuja-Lagos Air Peace flight

-

Railway3 days ago

Railway3 days agoNigerian railway adds extra train to Friday, Saturday trips on Lagos-Ibadan route

-

International3 days ago

International3 days agoUK announces 45,000 seasonal worker visas for 2025

-

Education2 days ago

Education2 days ago12-year-old Nigerian girl Eniola Shokunbi invents air filter to reduce spread of diseases in US schools

-

metro5 hours ago

metro5 hours agoCourt orders varsity to pay lecturer N40m compensation for wrongful dismissal

-

Business3 days ago

Business3 days agoTop 5 crypto apps that work with Nigerian Bank accounts

-

Politics2 days ago

Politics2 days agoWhy I can’t form coalition with Peter Obi – Sowore