Business

A novice’s guide to understanding eNaira

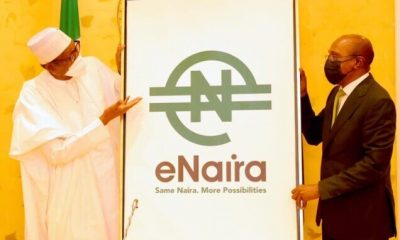

Finally, it’s live! The long-awaited and much-anticipated eNaira has officially been launched. While I have written a number of articles on the eNaira, one thing I have noticed is that a lot of people are still finding it hard to grasp the idea behind the Central Bank Digital Currency.

It is perfectly understandable that there are still citizens who are yet unclear about the nature of the eNaira and, more importantly, how to use the digital currency. In most cases, some need to be convinced as to why they should join the race to download the eNaira app and what this will mean for their business. There are valid concerns, if I may say so.

Hence, in this piece, I attempt to demystify the eNaira, explain what it is and what it is not while giving a brief analysis of how to make or accept transactions using the eNaira.

Dissecting the eNaira

The eNaira is a digital version of the paper naira issued by the Central Bank of Nigeria. Playing a purely complementary role to the naira, the digital currency will have equal value as physical cash that we use in our day-to-day activities.

Contrary to what many think, the eNaira is not a cryptocurrency like Bitcoin, Ethereum, Dogecoin or any other kind of crypto. It is not decentralised and cannot be privately controlled the way cryptocurrencies are.

However, like these currencies, the eNaira is built on a blockchain open ledger technology; this is to ensure that a holder of the CBDC cannot have a duplicate or fake eNaira because each eNaira note will be unique.

READ ALSO:

- APC very corrupt, lacks leadership capacity, says Atiku

- Bayelsa: One killed as security operatives foil kidnap attempt on expatriates

- FIFA win Siasia’s lawsuit over match-fixing ban

- PDP elects 25-year-old man as youth leader, Oyinlola loses

Another concern that comes to mind is the stability of the eNaira. Before venturing into the unknown, especially in financial matters, security and stability are matters of key interest for any party in a given business transaction. When it comes to the eNaira, people want to know if it is a stable coin.

Keep in mind that a stablecoin is a cryptocurrency backed by reserves that are currencies or other assets, such as gold, that can be readily transferable and are used to balance transactions and payments anywhere in the world – case in point, the US dollar.

Stablecoins refer to cryptocurrencies that seek to attach their market value to some external reference. An example of a stablecoin is the USDT, which is tied to a currency, the US dollar, and maintains a stable exchange value.

The eNaira technically is linked to the FIAT naira; and as we know from personal experience, the naira is not exactly stable. So, for the eNaira to be stable, it then has to be linked to a universally stable currency like the US dollar or euro.

The eNaira is designed for all whether you are an individual, consumers, merchants, government ministries, departments and agencies, licensed financial institutions, and even the central bank itself.

Using the eNaira for transactions

Imagine you want to send N100 to your aged mother in one remote village where there are no bank branches. A common process is to buy a recharge card of the same value, text to her mobile phone, after which she goes to any phone card retailer and exchanges her N100 credit for N95 in cash.

Rather than go through all that, you only need to debit your bank account for N100, convert it to eNaira, and transfer it to your mother. Having received the money, she can spend it directly from her phone or exchange it for cash. To enjoy this service, you need to have an eNaira wallet into which you store and use your digital currency.

In the case of a person-to-person transaction, holders of the eNaira wallet can easily transfer eNaira to another holder. In a simple process, it is possible to credit your eNaira wallet from your account within the same bank or a different bank account. While you cannot cash out from eNaira to physical cash, you can do so from your eNaira wallet to your cash within the same bank or another account in a different bank.

The same straightforward process applies also when making person-to-merchant payments, government-to-citizen, or citizen-to-government payments. With the e-Naira, you can make or receive salary payments, and payments for goods and services can be concluded.

Taking full advantage of eNaira

The eNaira has a cutesy tagline, ‘Same Naira, More Possibilities’. No doubt this is to inspire trust while encouraging the mass adoption of digital currency. Anyway, it has a low-cost advantage in comparison to FIAT.

For one, traders will pay no fees for withdrawals and deposits to and from their bank account; that in itself is a massive incentive. In line with Nigeria’s financial inclusion agenda, the e-Naira will also onboard millions of the unbanked – Nigerians who have mobile phones but without bank accounts. Though formerly unable to enjoy financial services in their entirety, these ones will be brought into the formal financial economy.

Artisans including plumbers, tailors, carpenters and fashion designers can accept payments on their phones, store them in their wallets, and make transactions with any vendor or customer.

Also, the eNaira will be upgraded, and when this is done, it will allow for cross-border transactions. This means that eNaira can be used by any two-party actors who can credit a Nigerian banking institution with corresponding currency. To illustrate, a trader banking with UBA in Kenya can settle his import bills from the Democratic Republic of Congo using e-Naira.

Interestingly, because many citizens lack trust in financial institutions, eNaira will make it possible for customers to monitor their wallets, balances, and transaction history in real time.

On the one hand, by integrating into the CBN’s forex process, the digital currency will make it easier for remittances to flow into Nigeria. On the other, Nigerians in the diaspora can send funds to friends or relatives through international money transfer organisations who will buy eNaira from their corresponding Nigerian banks.

The problem of accessibility

Having gained more understanding about eNaira, compared to when you started reading this piece, perhaps you wish to experiment with this idea. The question on your mind might be how to get the eNaira. To access the eNaira, you need to download the ‘speed wallet’, which allows you to conduct transactions with speed and ease.

Before you make that decision, however, reports have it that the eNaira speed wallet pulled a disappearing act from the Google Play Store barely 48 hours after its launch. Conversely, the eNaira merchant wallet is still up and running with over 10,000 downloads.

While some users have complained about poor user experience, others are pretty distrustful of the terms, conditions, and disclaimer notice given by the CBN.

I believe these are fixable issues, and since we live in a digital world that is increasingly becoming cashless, the eNaira project, to all intent and purposes, is a boon to the Nigerian economy.

In my next piece on the ICT Clinic column, I will explore the possibility of the eNaira becoming a world-class digital currency and the importance of local collaboration in driving Nigeria’s vibrant financial sector forward.

CFA is co-founder of techbuild.africa & blockbuild.africa, platforms deepening Africa’s tech ecosystem & godohub.org, a social enterprise supporting innovation in Africa.

Punch

Railway

Lagos Rail Mass Transit part of FG free train ride – NRC

Lagos Rail Mass Transit part of FG free train ride – NRC

The Nigerian Railway Corporation (NRC) has disclosed that the Lagos Rail Mass Transit (LRMT) trains are included in the Federal Government’s free train ride initiative for the Christmas and New Year celebrations.

The LRMT, which currently includes the Phase 1 Blue Line Rail and the Phase 1 of the Red Line Rail, operates under the Lagos Metropolitan Area Transport Authority (LAMATA).

This announcement was made by Ben Iloanusi, the Acting Managing Director of the NRC, during an interview on NTA News TV on Friday, following the launch of the initiative earlier that day.

While Iloanusi stated that Phase 1 of both the Blue Line and Red Line Rail projects are part of the program, LAMATA has yet to confirm this inclusion.

READ ALSO:

- Nigeria denies alleged plot to destabilise Niger Republic

- Navy arrests 19 Nigerians attempting to reach Europe by hiding on ship

- Troops arrest four Ambazonian rebels in Taraba

Iloanusi outlined the other routes benefiting from the scheme, which include the Lagos-Ibadan Train Service, Kaduna-Abuja Train Service, Warri-Itakpe Train Service, Port Harcourt-Aba Train Service, and the Bola Ahmed Tinubu Mass Transit in Lagos. Notably, little was previously known about the Bola Ahmed Tinubu Mass Transit service until this disclosure.

“Let me mention the routes where this free train service is happening. We have the Lagos-Ibadan Train Service, we have the Kaduna-Abuja Train Service, we have the Warri-Itakpe Train Service, we have the Lagos Rail Mass Transit trains, we have the Port Harcourt-Aba Train Service, and we have what we call the Bola Ahmed Tinubu Mass Transit, which is also in Lagos,” he stated.

Iloanusi provided operational updates, stating that passengers nationwide can access free tickets online or, for those unable to do so, at train stations where they will be profiled and validated.

He noted that passengers using NRC-managed services (excluding the Lagos Rail Mass Transit) should reserve tickets via the official website, www.nrc.gov.ng, with a valid ID required. He also advised travelers to plan, arrive on time, and bring valid identification.

Lagos Rail Mass Transit part of FG free train ride – NRC

Business

NNPC denies claim of Port Harcourt refinery shutdown

NNPC denies claim of Port Harcourt refinery shutdown

The Nigerian National Petroleum Company Limited (NNPCL) has denied claims in media reports that the newly refurbished Port Harcourt refinery has shut down.

The national oil company denied the claim in a press release issued by its Chief Corporate Communications Officer, Olufemi Soneye, on Saturday.

Soneye said the claim was false and urged Nigerians to disregard it. He stressed that the Port-Harcourt Refinery is fully operational.

READ ALSO:

- Like Ibadan, stampede claim 10 lives for Abuja Catholic church, 17 in Anambra

- Marketers react after NNPCL slashes petrol price to N899 per litre

- Electricity: We installed 184,507 meters, issued 50 licences in Q3, says FG

The statement read, “The attention of the Nigerian National Petroleum Company Limited (NNPC Ltd.) has been drawn to reports in a section of the media alleging that the Old Port Harcourt Refinery which was re-streamed two months ago has been shut down.

“We wish to clarify that such reports are totally false as the refinery is fully operational as verified a few days ago by former Group Managing Directors of NNPC.”

He noted that preparation for the day’s loading operation is currently ongoing, and added that claims of the shutdown are “figments of the imagination of those who want to create artificial scarcity and rip-off Nigerians.”

NNPC denies claim of Port Harcourt refinery shutdown

Business

CBN permits BDCs to buy up to $25,000 FX weekly from NFEM

CBN permits BDCs to buy up to $25,000 FX weekly from NFEM

The Central Bank of Nigeria (CBN) has granted Bureau de Change (BDC) operators temporary permission to purchase up to $25,000 weekly in foreign exchange (FX) from the Nigerian Foreign Exchange Market (NFEM).

The Central Bank of Nigeria (CBN) has granted Bureau de Change (BDC) operators temporary permission to purchase up to $25,000 weekly in foreign exchange (FX) from the Nigerian Foreign Exchange Market (NFEM).

This move, detailed in a circular dated December 19, 2024, is designed to meet seasonal retail demand for FX during the holiday period.

The circular was signed by T.G. Allu, on behalf of the Acting Director of the Trade and Exchange Department.

The arrangement will be in effect from December 19, 2024, to January 30, 2025.

Under the directive, BDCs may purchase FX from a single Authorized Dealer of their choice, provided they fully fund their accounts before accessing the market.

Transactions to occur at the prevailing NFEM rate

The transactions will occur at the prevailing NFEM rate, and BDCs are required to adhere to a maximum 1% spread when pricing FX for retail end-users.

READ ALSO:

- Badenoch’s negative portrayal of Nigeria Police unfair-PCRC

- Bitcoin price crashes to $95,000 as market continues to react to Federal rate cuts

- Bauchi high court dismisses blasphemy, cybercrime charges against Rhoda Jatau

All transactions conducted under this scheme must be reported to the CBN’s Trade and Exchange Department.

The circular read in part:

“In order to meet expected seasonal demand for foreign exchange, the CBN is allowing a temporary access for all existing BDCs to the NFEM for the purchase of FX from Authorised Dealers, subject to a weekly cap of USD 25,000.00 (Twenty-five thousand dollars only).

This window will be open between December 19, 2024 to January 30, 2025.

“BDC operators can purchase FX under this arrangement from only one Authorized Dealer of their choice and will be required to fully fund their account before accessing the market at the prevailing NFEM rate. All transactions with BDCs should be reported to the Trade and Exchange department, and a maximum spread of 1% is allowed on the pricing offered by BDCs to retail end-users.”

The CBN assured the general public that PTA (Personal Travel Allowance) and BTA (Business Travel Allowance) remain available through banks for legitimate travel and business needs.”

These transactions are to be conducted at “market-determined exchange rates” within the NFEM framework.

This initiative reflects the CBN’s strategy to stabilize the FX market and manage seasonal surges in demand.

CBN permits BDCs to buy up to $25,000 FX weekly from NFEM

-

Railway15 hours ago

Railway15 hours agoLagos Rail Mass Transit part of FG free train ride – NRC

-

metro2 days ago

metro2 days agoCourt stops customs from seizing imported rice in open market

-

metro3 days ago

metro3 days agoFG transfers electricity market regulatory oversight in Lagos to LASERC

-

metro2 days ago

metro2 days agoIbadan stampede: Tinubu orders probe as death toll hits 40

-

metro2 days ago

metro2 days agoAfe Babalola: Court grants Dele Farotimi bail, barred from media interviews

-

metro16 hours ago

metro16 hours agoNIMC warns against extortion, reaffirms free NIN enrollment

-

metro1 day ago

metro1 day agoIbadan stampede: Ooni reacts after arrest of ex-wife

-

News2 days ago

News2 days agoAdebayo Ogunlesi, 2 other Nigerians make Forbes 50 wealthiest Black Americans list 2024