Business

18 Days after Launch, CBN’s eNaira Registers 488,000 Subscribers in 160 Countries

Barely 18 days after its launch, 488,000 consumer wallets have been on-boarded to Nigeria’s Central Bank Digital Currency (CBDC) platform known as the eNaira from over 160 countries through Google Playstore and Apple Store as of Friday.

Data obtained from the Central Bank of Nigeria (CBN) at the weekend, also showed that about 78,000 merchant wallets have also been on-boarded to the digital currency infrastructure.

Also, transactions on the eNaira stood at about 17,000 valued at over N62 million.

This is an indication of growing enthusiasm for the central bank’s digital currency, which has been described as a game-changer.

The digital platform had recorded about 200,000 wallets downloads in less than one day that the portal came alive.

“So far, we have on-boarded over 488,000 consumer wallets and about 78,000 merchant wallets, with these downloads occurring in over 160 countries (per Google Playstore and Apple Store data).

“We have also recorded almost 17,000 transactions amounting to over N62million with the average transaction being about $9.3 each. These numbers suggest the adoption rate has been excellent.

READ ALSO:

- NDLEA Arrests 12 Apapa Dock Workers over Link to Seized N9.5bn Cocaine

- It’s nobody’s business what I do with my boobs –BBNaija star, Angel

- Bandits Kill Nine People, Rustle Livestock in Zamfara

- ‘I salute their courage’, Buhari mourns soldiers killed by ISWAP

- W/Cup qualifiers: Super Eagles beat Liberia 2-0

- Nigerian Army needs no warning against overthrowing Buhari government – Defence headquarters

“It is a direct liability of the bank, a legal tender and will form part of the currency-in-circulation and will be at par with the physical naira,” CBN said.

The eNaira was officially unveiled on October 25, 2021, by President Muhammadu Buhari who said the electronic money would boost the country’s Gross Domestic Product (GDP) by $29 billion in the next 10 years.

Nigeria is the first country in Africa and one of the first in the world to introduce digital currency.

Buhari had said: “Indeed, some estimates indicate that the adoption of CBDC and its underlying technology, called blockchain, can increase Nigeria’s GDP by $29 billion over the next 10 years.

“CBDCs can also help increase remittances, foster cross border trade, improve financial inclusion, make monetary policy more effective, and enable the government to send direct payments to citizens eligible for specific welfare programmes.”

The president further assured Nigerians of the safety and scalability of the CBDC, adding that the journey to create a digital currency for Nigeria began in 2017.

On his part, CBN Governor, Mr. Godwin Emefiele, had said with growing interest in CBDC around the world, the CBN had commenced extensive study, consultations, identification of use cases, and the testing of the CBDC concept in a Sandbox environment as far back as 2017.

He said the objective of the research was to establish a compelling case for the adoption of a digital currency in the country to enable a more prosperous and inclusive economy for all Nigerians.

He added that following the completion of the preliminary work, the researchers and experts at the CBN were able to establish that a digital currency will drive a more cashless, inclusive, and digital economy as well as complement the gains of previous policy measures and our fast-growing payments platforms.

He said CBN decided to implement its own CBDC and to name the digital currency, the eNaira, and believes the innovation will make a significant positive difference to Nigeria and Nigerians.

Specifically, Emefiele said the eNaira will support a resilient payment system ecosystem, encouraging rapid financial inclusion, reducing the cost of processing cash, enabling direct and transparent welfare intervention to citizens, and increasing revenue and tax collection.

He had also said eNaira would also facilitate diaspora remittances, reduce the cost of financial transactions, and improve the efficiency of payments.

He added: “Therefore, the eNaira is Nigeria’s CBDC and it is the digital equivalent of the physical Naira. As the tagline simply encapsulates, the eNaira is the same Naira with far more possibilities. The eNaira – like the physical Naira – is a legal tender in Nigeria and a liability of the CBN. The eNaira and Naira will have the same value and will always be exchanged at 1 naira to 1 eNaira.”

Emefiele said in a bid to further de-risk the process, the CBN had given careful consideration to the entire payments and financial architecture and has designed the eNaira to complement and strengthen these ecosystems, adding that the bank had also implemented security safeguards and policies to maintain the integrity of the financial system.

The CBN boss added that there would be strict adherence to the anti-money laundering and combating the financing of terrorism (AML/CFT) standards to preserve the integrity and stability of Nigeria’s payment system.

According to him, 33 banks had been fully integrated and are live on the platform while N500 million had been successfully minted by the central bank including N200 million which had been issued to financial institutions.

Emefiele said the country had made history with the eNaira launch, pointing out that this would be the first in Africa and one of the earliest around the world.

Thisday

Business

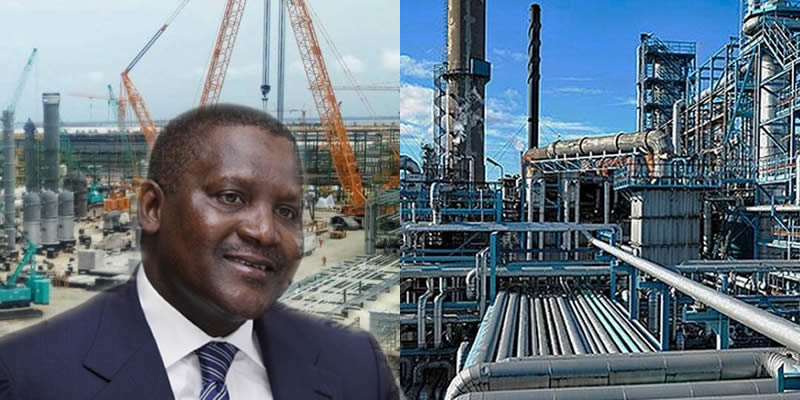

Dangote refinery further drops diesel price to N940/litre

Dangote refinery further drops diesel price to N940/litre

Dangote Petroleum Refinery has announced a further reduction in the price of both diesel to N940 per litre.

This is coming a few days after the refinery reduced diesel price to N1,000 per litre.

It also gave a new price for aviation fuel, pegging it at N980 per litre.

It disclosed this in a statement on Tuesday, saying the diesel price change of N940 is applicable to customers buying five million litres or more from the refinery, while those purchasing one million litres or more will pay N970.

It said this marked the third major reduction in diesel price “in less than three weeks when the product sold at N1,700 to N1,200 and also a further reduction to N1,000 and now N940 for diesel and N980 for aviation fuel per litre”.

Speaking on the new development, Anthony Chiejina, head of communication, Dangote Group, said the new price was in tandem with the company’s commitment to alleviating the effect of economic hardship in Nigeria.

“I can confirm to you that Dangote Petroleum Refinery has entered a strategic partnership with MRS Oil and Gas stations, to ensure that consumers get to buy fuel at affordable price, in all their stations, be it Lagos or Maiduguri,” he said.

“You can buy as low as one litre of diesel at N1,050 and aviation fuel at N980 at all major airports where MRS operates.”

He said the partnership would be extended to other major oil marketers.

“The essence of this is to ensure that retail buyers do not buy at exorbitant prices,” he said.

“The Dangote Group is committed to ensuring that Nigerians have a better welfare and as such, we are happy to announce this new prices and hope that it would go a long way to cushion the effect of economic challenges in the country.”

Director-General of the Manufacturers Association of Nigeria (MAN), Ajayi Kadiri, said the decision “to first crash the price from about N1,750/litre to N1,200/litre, N1,000/litre and now N940 is an eloquent demonstration of the capacity of local industries to positively impact the fortunes of the national economy.

“The trickle-down effect of this singular intervention promises to change the dynamics in the energy cost equation of the country, in the midst of inadequate and rising cost of electricity.”

Aviation

Dana Air grounds plane after runway incident, 83 passengers on board

Dana Air grounds plane after runway incident, 83 passengers on board

Dana Air says it has grounded its airplane that skidded off the Lagos airport runway on Tuesday.

The affected aircraft, a McDonald Douglas (MD-83) with registration 5N-BKI, had 83 passengers on board, it added.

Spokesman for the airline, Mr Kingsley Ezenwa, however, said all the 83 passengers and crew onboard the flight disembarked safely without injuries.

He said in a statement that the airline decided to ground the plane to allow for proper investigation into what caused the accident.

The statement read in part, “Dana Air regrets to inform the public of a runway incursion involving one of our aircraft, registration number 5N BKI, which was flying from Abuja to Lagos today, 23/04/24.

“We are relieved to confirm that all 83 passengers and crew onboard the flight disembarked safely without injuries or scare as the crew handled the situation with utmost professionalism.

“We have also updated the Accident Investigation Bureau, AIB, and Nigerian Civil Aviation Authority (NCAA) on the incident, and the aircraft involved has been grounded by our maintenance team for further investigation.

“We wish to thank the airport authorities, our crew for their very swift response in ensuring the safe disembarkation of all passengers following the incident, and our sincere apologies and appreciation to the passengers on the affected flight for their patience and understanding.”

Aviation

Just in: Panic as Dana Air plane skids off Lagos airport runway

Just in: Panic as Dana Air plane skids off Lagos airport runway

Tragedy was averted on Tuesday as a Dana Air plane skidded off the Lagos airport runway.

Although it was not immediately clear why the pilot lost control, causing the plane skid off the runway, Newstrends learnt that the incident led to the diversion of other flights to the international wing of the Murtala Muhammed Airport, Lagos.

In a post by X user, BelemaMhart — who boarded another airline — it was stated that there were no casualties.

-

Education3 days ago

Education3 days agoWhy we charge N42m fees for primary school pupils — Charterhouse Lagos

-

Business6 days ago

Business6 days agoGovt paying N600bn for fuel subsidy monthly — Rainoil CEO

-

News5 days ago

News5 days agoUpdated: More trouble for Yahaya Bello as Immigration places him on watch list

-

Auto3 days ago

Auto3 days agoWe expect massive roll-outs of Nigeria-made cars by December 2024 – Minister

-

News7 days ago

News7 days agoKano anti-corruption agency slams fresh charges against Ganduje

-

News7 days ago

News7 days agoIMF predicts 3.3% growth for Nigeria’s economy in 2024

-

metro6 days ago

metro6 days agoEdo court sentences three to death by hanging for kidnapping, murder

-

International5 days ago

International5 days agoUpdated: Tragedy hits Kenya, Defence chief, nine others die in military helicopter crash