Business

Dangote, Rabiu renew bitter business rivalry, feud, fight dirty

Dangote, Rabiu renew bitter business rivalry, feud, fight dirty

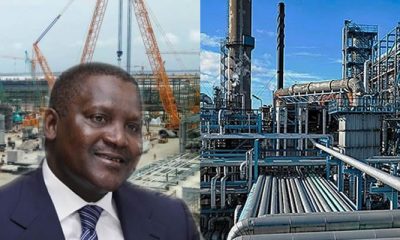

Aliko Dangote and Abdul Samad Rabiu, two Nigerian billionaires, are at each other’s throat again.

They are currently locked up a bitter war over who controls the cement sugar industries in the country.

The latest dangerous trend is an allegation of illegal business deals and economic sabotage.

Dangote is Africa’s richest man and owns Dangote Industries Limited. Rabiu is the founder of BUA Group.

The two moneybags are no strangers to bitter business rivalry and feud. Their business disputes span three decades.

Dangote Cement is considered the largest cement producer in Nigeria, with a market share of over 60 per cent.

BUA Cement is the second-largest producer, with a market share of about 20 per cent.

The latest media war between the duo was ignited on Thursday when Dangote, in an advertorial in the national dailies accused Rabiu of sponsoring false reports against him and his businesses.

The Dangote Industries Limited (DIL) refuted allegations of being engaged in illegal foreign exchange deals, warning those peddling the allegation of economic sabotage against the company to desist.

It boldly mentioned the name of Rabiu in the advertorial.

The company described the report as a rehash of a similar report peddled out of malice in 2016.

But BUA Group, in its response, accused Dangote and his company of trying to ruin its cement and sugar business over the years.

The DIL made reference to an allegation in some online media, suggesting that the company was being probed over alleged illegal foreign exchange laundering running to $3.4bn allegedly perpetrated by the Central Bank of Nigeria under the leadership of Godwin Emefiele over the years.

Dangote said as an organisation, it was not in its custom to respond to any spurious allegation, but that “since it is a rehash of a similar report peddled out of malice by a competitor masquerading as a concerned Nigerian in 2016, we are constrained to provide context to this issue.

“The reporting of this spurious foreign exchange allegation by some media houses was turned down by some credible traditional and online media news until it was featured as a paid advertorial in two Nigerian newspapers BusinessDay and Leadership (Published on March 14, 2016) titled “Acts of Economic Sabotage by Dangote Cement” published in the name of David Osa Ighalo, from Benin, Edo State.

“It is saddening to note that this publication of Monday, March 16, 2016, in BusinessDay and Leadership newspapers wherein the author alleged that ‘monies went from the company in question to other sister Dangote Companies Outside Nigeria.”

The company said it was estimated that $3bn had been taken out of Nigeria through these means.

It stated, “This encourages round-tripping and, in effect, money laundering since there is no proper documentation has recently been given a fresh false slant by one Ahmed Fahad, purporting it to be a new petition directed to the attention of President Bola Ahmed Tinubu and Mr. Jim Obazee, the Special Investigator probing the CBN.”

BUA fired back in a statement, accusing Dangote of cheap attempts at blackmailing the company.

BUA alleged that in August 1991, “a young BUA was doing its commodities trading business just as Nigeria faced a scarcity of sugar. As sugar was scarce, BUA was lucky to be one of the few with any stock for sale, and we stood prepared to supply the nation’s needs as best as our stock could.”

It also stated, “It was during this period Aliko Dangote approached us to purchase sugar. If only we knew he was setting the first of many traps in our business history.

“He gave us a Societe Generale Bank of Nigeria cheque, which bounced upon presentation to the bank. Unbeknown to us, this was a ruse that would lead to a court-sanctioned freeze of our assets orchestrated by Dangote.

“For three agonising months, our accounts were garnished, warehouses shuttered, and our spirit tested. Yet, from the ashes of deceit, BUA survived.”

BUA also alleged that a few years later, it decided that since it was making good progress in its various businesses, it should open a sugar refinery.

The company said they approached Usman Dantata, Dangote’s uncle, and leased his NPA waterfront land (4.5 hectares) at the Tincan Island port, ‘Polo House.

It said, “We took the land, signed an agreement with the consent of NPA, and paid all applicable dues.

“Dangote waited until our contractors and equipment had been mobilised to the site, then he went to former President Obasanjo. President Obasanjo had the land revoked entirely and gave the lease to Dangote.

“As a result, even his uncle lost the land. BUA was only given 24 hours to vacate the land.”

BUA said it took them over a year to get another land, saying that its survival as a business, especially its Lagos sugar refinery was a legacy handed to it by a loving father who, seeing his son’s distress.

BUA stated, “With unwavering faith, our Chairman’s late father – may his soul rest in eternal peace – handed him the land on which our Lagos Sugar Refinery stands today.

“This land was the location of one of his thriving businesses with a warehouse, which he shut down handed to us without asking for compensation. He just saw the pain of our chairman, Abdul Samad Rabiu, called him one day and handed him the papers to the land. His gesture was a beacon of hope in one of our darkest hours.

“And so, BUA survived again another Dangote trap. Today, we are now the largest Sugar refining concern in West Africa.

“Our businesses continued to surge forward amid several other attempts, too many to mention now.

“In 2007, under President Yar’Adua’s visionary mandate to broaden Nigeria’s cement industry and break the monopoly in the sector, BUA was among the six companies selected and granted licences.

“Our approach was unconventional but effective: we introduced a floating terminal – ‘BUA CEMENT I’, which is a cement factory built into a large ship, as a stopgap while we were working on securing our land-based cement plant. “What followed, however, was another act intended to drive us out of business. Our application to dock the floating terminal in Lagos met with resistance.

“We then decided to berth the ship at the terminal we owned in Port Harcourt. Despite this, we faced considerable pushback and it took the decisive intervention of late President Yar Adua, who directed that the Minister of Transport and the Chairman of NPA honour our right to contribute to the nation’s growth,” the company explained.

“But the hurdles didn’t end there. The drama intensified when Orwell Brown, a Deputy Comptroller General who was also an older brother to a Dangote staff, launched a sudden strike, attempting to deport our vessel’s entire expatriate crew.

“It was a Friday that is forever seared into our memory-the shock of our expatriates rounded up, their confusion as they were shepherded onto a Dangote-funded one-way local flight from Port Harcourt to Lagos en-route Asia via Emirates.

“Upon hearing of what had happened, we reached out to Tanimu Yakubu, the then Chief Economic Adviser, who acted with the urgency that the situation demanded.

“His call to the CG of Immigration was a lifeline, and our expatriate team was brought back from the Emirates aircraft and not deported.

“The aftermath was swift action by the President, who ensured that such a misuse of power would not go unchecked. DCG Brown, caught in a tangle of undue influence, admitted what he did to the Minister, and he was later dismissed.”

Business

Panic in financial sector, others over depreciating naira at N1,500/$

Panic in financial sector, others over depreciating naira at N1,500/$

The depreciating value of Nigeria’s currency, the naira, is causing panic among businesspeople and others in the finance sector.

Naira went over N1,500 mark to one US dollar on Sunday on the parallel market.

Ibrahim Dollar as one of the BDC operators in Lagos is called told Newstrends Sunday morning that there appeared to be a mop-up of the dollars.

He said, “As of today, we sell one dollar at N1,500 and buy at N1,460.

“In the last one month, we get more people buying the dollars than those exchanging dollars for naira.”

The N500/$ rate is about N34 loss compared to 1,466 that the naira exchanged for a US dollar on Friday.

The naira lost N40 between Thursday and Friday when it closed at N1,426 to a dollar, according to the National Autonomous Foreign Exchange Market (NAFEM), the official exchange market.

Surprisingly, the naira had about a month ago firmed up against the dollar, exchanging below N1,000.

The continued fall in naira has fuelled the fears that prices of goods including food items may further rise and worsen the current high cost of living.

Nigeria’s inflation rate jumped to 33.20% in March 2024 from 31.70% in February when naira recorded some gain

This was after a number of reforms and interventions by the Central Bank of Nigeria (CBN) including supply of dollars to the Bureau De Change (BDC) operators.

But with increasing demand for the US dollars, the earlier gain has been retarded.

A report by Bloomberg last week rated the naira as the worst performing current in the world in the last one month.

This was after the CBN had disclosed that the naira came as the best performing currency.

The Economic and Financial Crimes Commission (EFCC) last week announced that henceforth transactions at the foreign embassies in Nigeria would be conducted in naira and no longer in dollars, just to shore up the value of the nation’s currency.

Business

Tinubu bows to pressure, asks CBN to suspend cybersecurity levy

Tinubu bows to pressure, asks CBN to suspend cybersecurity levy

President Bola Tinubu has directed the Central Bank of Nigeria (CBN) to suspend cybersecurity levy implementation and review the policy.

A major report by Sunday Punch quoted some sources at the Presidency as saying the President’s action followed the public outcry that greeted last week’s announcement of the levy by the CBN.

This came three days after the House of Representatives had urged the CBN to withdraw its circular directing all banks to start charging the 0.5 per cent cybersecurity levy on all electronic transactions in the country from May 20, 2024.

The CBN issued the circular on May 6, 2024, mandating all banks, mobile money operators and payment service providers to implement the new levy, in accordance with Cybercrime (Prohibition, Prevention, etc) (Amendment) Act 2024 provisions.

In suspending the levy, Tinubu was said to be sensitive to the feelings of Nigerians and did not want anything that could add to the burden of the people.

“He has asked the CBN to hold off on that policy and ordered a review. I would have said he ordered the CBN, but that is not appropriate because the CBN is autonomous.

“But he has asked the CBN to hold off on it and review things again,” a senior presidency official reportedly said.

Another presidency official said, “If you look at it, the law predates the Tinubu administration. It was enacted in 2015 and signed by Goodluck Jonathan. It is only being implemented now.

“You know he (Tinubu) was not around when that directive was being circulated. And he does not want to present his government as being insensitive.

“As it is now, the CBN has held off the instruction to banks to start charging people. So, the President is sensitive. His goal is not to just tax Nigerians like that. That is not his intention. So, he has ordered a review of that law.”

Aviation

Dana Air lays off workers amid govt audit

Dana Air lays off workers amid govt audit

Dana Air has sacked some of its workers amid an operational audit being conducted and by the Nigerian regulatory authorities.

Dana disclosed this through its head of corporate communications, Kingsley Ezenwa, in a statement on Saturday, May 11.

The audit coming after some incidents is to ensure the airline complies with necessary standards and regulations.

Ezenwa stated, “In light of the ongoing audit, Dana Air has made the decision to temporarily disengage some staff members pending the conclusion of the audit.

“This decision has been made to ensure efficient management of resources and to facilitate a thorough review of operational procedures.”

He said the management appreciated the sacked workers’ resilience and dedication and recognised the difficulties they had faced.

Ezenwa also said that the airline pledged to provide updates and support for its staff members throughout the audit process.

He said the airline had commenced talks with lessors and was engaging stakeholders on the progress made so far.

“Dana Air therefore urges for calm and understanding from our very dedicated staff for their altruism,” he added.

The Nigeria Civil Aviation Authority (NCAA) recently suspended the Air Operator Certificate (AOC) of Dana Air after one of its aircraft skidded off the runway at the Murtala Muhammed Airport, Lagos State.

-

Auto3 days ago

Auto3 days agoBKG holds all-inclusive Lagos Motor Fair, auto parts expo June 4-6

-

Sports2 days ago

Sports2 days agoEPL: Man City go top after thrashing Fulham

-

metro2 days ago

metro2 days agoWhy I claimed Ooni is my father – Man recants, apologises (+ VIDEO)

-

News2 days ago

News2 days agoRivers crisis may truncate Nigeria’s democracy, remember ‘Operation Wetie’ – Bode George warns

-

metro3 days ago

metro3 days agoSeveral students abducted as bandits attack Kogi varsity

-

News2 days ago

News2 days agoBritish High Commission shuns Prince Harry, Meghan ceremonies in Nigeria

-

News23 hours ago

News23 hours agoMinister inspects Nigeria-assembled CNG buses, says transport costs to drop

-

News1 day ago

News1 day agoAisha Yesufu under fire for celebrating naira fall