Business

Despite volatility of Nigerian currency, Dangote remains Africa’s richest man

Despite volatility of Nigerian currency, Dangote remains Africa’s richest man

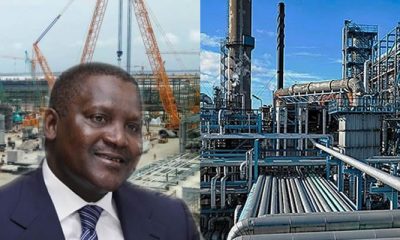

President of Dangote Group, Aliko Dangote, remains the richest man in Africa, despite the volatility of Nigerian currency against the dollar, according to Bloomberg Billionaires Index (BBI).

Bloomberg, in its daily top billionaire lists released on Tuesday, revealed that Dangote with a wealth of $15.6 billion topped other Africans in the Index.

READ ALSO:

- Adeleke surrounded himself with incompetent people – Bashiru

- Tinubu visits Awujale, says I invoked spirit of freedom in Ogun

- Contaminated Sprite drinks in circulation, NAFDAC warns

Other Africans listed in the latest top 500 world billionaires for the year 2023 include Johann Rupert and family of South Africa, now worth $13.3 billion, while Nicky Oppenheimer of South Africa, Nassef Sawiris of Egypt, Natie Kirsh of South Africa, and Naguib Sawiris are also worth $9.0 billion, $7.47 billion, $7.37billion and $5.93 billion respectively. These are the only five other Africans that made the list.

Ellon Musk and Bernard Arnault are the top two richest in the world with $219 billion and $194 billion, respectively, in their kitties, while Jeff Bezos and Bill Gates followed respectively with $151 billion and $130 billion. Larry Ellison was the fifth richest with $130 billion on the world’s billionaires’ chart.

Despite volatility of Nigerian currency, Dangote remains Africa’s richest man

(vanguard)

Auto

10th Transport Day event to focus on safety issues

10th Transport Day event to focus on safety issues

Transport industry experts and other stakeholders from both public and private sectors will x-ray safety issues across all modes of transportation at the 10th edition of the Nigeria Transport Lecture holding in Lagos on May 23, 2024.

The event fixed for Radisson Blu Hotel, Ikeja GRA, Lagos, according to a statement by Transport Day Media, will hold under the theme ‘Transportation Safety in Nigeria: The Way Forward’.

Those expected at the lecture are key industry players such as the Federal Road Safety Corps (FRSC), the Nigerian Maritime Administration and Safety Agency (NIMASA), Nigerian Shippers’ Council, and the Nigeria Safety Investigation Bureau (NSIB).

The Editor-in-Chief of Transport Day Media, Mr. Frank Kintum, said the topic had become relevant in contemporary times because many lives and property were being lost to lack of adherence to safety measures in all modes of transportation.

He said, “Irrespective of the level of infrastructural development in the transportation sector, if safety is not promoted, we are going to continue to record loss of lives and valuable property.

“Hence, the lecture is meant to address pertinent issues concerning the industry as it concerns our local Nigerian setting.

“Aside from the lecture, we are also going to use the opportunity to recognise some players, both public and private sectors, who have significantly contributed to the growth of the sector and the economy in general.”

Auto

BKG holds all-inclusive Lagos Motor Fair, auto parts expose June 4-6

BKG holds all-inclusive Lagos Motor Fair, auto parts expose June 4-6

BKG Exhibitions Limited, organizers of annual Lagos International Motor Fair & Africa Autoparts Expo, has announced this year’s edition will be all-inclusive and billed to hold from June 4 to June 6.

It said in a statement that the event incorporating the Africa Motorcycle and Tricycle Expo aimed at reinforcing focus on attaining a thriving automotive industry in West Africa using Nigeria as the hub.

According to the BKG Managing Director, Mr Ifeanyi Agwu, apart from exhibition of automobiles (18th edition) and auto spare parts (11th), there will be Business-to-Business interface between auto dealers and Original Equipment Manufacturers (OEMs), seminars and workshops with closing of deals.

Even as he urged the Federal Government to focus on auto parts manufacturing, the BKG boss said over 100 original components manufacturers from China, India, South Korea, South Africa, Singapore, Turkey and Nigeria, including major automobile distributing/manufacturing companies in Nigeria would be showcasing at the event.

“Our intention in bringing them is to enable Nigerians and neighbouring West Africans engaged in automobile, spare parts, accessories, and allied businesses to work out rewarding and lasting business relationships with the main companies engaged in manufacturing these products and services.

“Nigeria is endowed with natural as well as man-made resources to become one of the most vibrant automotive industry giant in the world” and as such we in partnership with other well minded players will always deploy all we can to see that the country attains this height sooner than expected.

“This informs our resolve to use our events despite the challenges which keep increasing to support the rapid growth of the industry.

Agwu, who is also the chairman of the event’s organizing committee, also said, “We have been using the events over the years to drive more investment into automobile spare parts and accessories manufacturing in Nigeria as well as boosting aftermarket activities in the sector with the objective of showcasing the capacities and potential of this important sector of the economy.”

The event, he stressed, aimed at spurring the rapid springing up of companies that manufacture these components parts and use it to enhance the policy leading to the establishment of a virile automotive sector in the country.

He advised the Federal Government to focus more on spare parts manufacturing in place of assembling. According to him, spare parts is the place where the real technology transfer takes place.

Specifically, Agwu noted that this involves precision and proper planning more than the coupling that takes place in assembling.

This, he added , would give rise to establishing of more Original Equipment Manufacturers and increase employment”.

He said that there should be a review of the ongoing auto policy to make it achieve the desired ends.

Agwu stated, “Organizing the event has been very challenging we are only trying to find a way to push it as a key event in the sector we cannot but use the event to draw the necessary attention to the sector.

“Government should bail out the automobile companies operating in the country.

“It is a sector that affects virtually everything. It occupies prime position in the economy.

“If it is not done now it will in the very near future affect a whole lot in the life of the people and the economy.

“The challenges of hosting this event is becoming daunting but our drive in continuing is that the sector must not be allowed to die.

“In conjunction with our foreign partners, we have reached out to many of such companies, and happily, the response has been tremendous and we are expecting close a lot of them.

The statement said from June 4-7, 2024 at the Federal Palace Hotel, Victoria Island, Lagos, the venue of the event, each of those days that the fair will last is loaded with activities and events that will make this edition remarkably rewarding to the exhibitors, visitors, and other stakeholders.

Business

Naira drops further to N1,421.06 per dollar

Naira drops further to N1,421.06 per dollar

The declining fortunes of the Naira persisted yesterday with further depreciation in the parallel and official markets due to the re-emergence of speculation and hoarding, even as some Bureaux De Change, BDCs withdrew from the Central Bank of Nigeria, CBN’s, dollar sales program.

Vanguard also learnt that despite the sustained nationwide raids and arrest of street currency hawkers, the Naira further depreciated yesterday to N1,435 per dollar in the parallel market, from N1,415 per dollar on Tuesday, and also depreciated to N1,421.06 per dollar in the Nigerian Foreign Exchange Market, NAFEM.

Data from FMDQ showed that the indicative exchange rate for NAFEM fell to N1,421.06 per dollar from N1,416.57 per dollar on Tuesday, indicating N4.49 depreciation for the naira.

Consequently, the margin between the parallel market and NAFEM rates widened to N13.94 per dollar from N1.57 per dollar on Tuesday.

Dollar sales to BDCs

In a bid to intervene in the retail segment of the forex market, the CBN in February resumed dollar sales to BDCs. Since then the apex bank has held three editions of the dollar. At the last edition, the CBN offered to sell $10,000 per BDCs at directing them to sell at the maximum margin of 1.5 per cent.

READ ALSO:

- EFCC to arraign Sirika, daughter over fresh N2.7 billion contract scam

- Breaking: Fubara bars all LGA heads from appearing before Rivers Assembly

- Russia urges Israel to comply with international humanitarian law in Rafah

BDC operators however complained dollar disbursement from CBN is too slow that and takes three to four weeks between when they make payment and when the dollars are disbursed to them.

Vanguard reliably gathered that as a result of this delay and the uncertainty in the forex market, some BDCs, have asked the CBN to refund their Naira payment.

Top BDC operators who confirmed this development to Vanguard under the condition of anonymity said that some of the BDCs that asked for refunds have gotten their money.

Speaking to Vanguard on condition of anonymity, the Chief Executive of a BDC said, “I think the CBN is overwhelmed. You pay money and it takes one month for you to collect $10,000. It is over a month now since they intervened and they have not intervened again.

-

metro1 day ago

metro1 day agoCleric allegedly sets wife’s house ablaze following prayer disagreement in Ekiti

-

metro2 days ago

metro2 days ago33 states face flooding risk, NEMA warns

-

metro2 days ago

metro2 days agoEkiti university expels students over viral bullying video

-

metro2 days ago

metro2 days agoDSS nabs wanted Oyo motorpark boss

-

Business2 days ago

Business2 days agoFuel: Independent marketers introduce new pump price

-

Health2 days ago

Health2 days agoForeigners now visit Nigeria for plastic surgery, others – Minister

-

Sports2 days ago

Sports2 days agoDortmund whip PSG 2-0 aggregate to reach Champions League final

-

Sports2 days ago

Sports2 days agoDiego Maradona’s golden ball trophy for auction in Paris