Business

Masked impact: How low storytelling limits Nigeria’s insurance industry growth

Masked impact: How low storytelling limits Nigeria’s insurance industry growth

In this piece, TUNDE AJAJA examines the prospects of Nigeria’s insurance industry and how increased publicity of success stories from insured persons and entities can increase awareness, reduce trust deficit, deepen penetration and strengthen the sector for optimal performance

For hours, the traffic was snarled up on his side of the ever-busy Lagos-Abeokuta Expressway. It was a Sunday afternoon, and Mr John Ayodele and his wife were heading home after church service when they ran into the traffic jam.

The blazing sunlight and the accompanying heat outside were unrelenting, but John and his wife found solace in the cool refuge of their car as they exchanged banter intermittently. With soft music in the background, the air conditioning hummed softly, creating a refreshing chill that contrasted with the sweltering world outside their windows.

As the traffic jam eased and the road ahead began to clear, what should have been a relief for them swiftly became a tragic moment. The truck in front of their vehicle suddenly began to roll back.

“The truck in front of our vehicle started coasting backward, apparently due to a mechanical failure. I kept honking my horn, but it seemed the vehicle had lost control. It only stopped after hitting my vehicle. I could not even reverse because the vehicle behind me was quite close; they call it ‘bumper to bumper’ in Lagos,” he explained.

He said he rushed out of the car to see that his bonnet and one of the headlamps had been damaged.

As if that was not enough, he said the truck driver escaped, aided by the traffic. “I was lost,” he recalled.

“The truck driver moved and quickly changed lanes. On one hand, I couldn’t chase him because of the traffic. On the other hand, I couldn’t run after him leaving my car behind. It ruined that day for me.”

The accidented vehicle

Fortunately for John, the vehicle had comprehensive insurance cover, which he said he grudgingly did a few months earlier.

“The following morning, I contacted my insurer. They asked me some questions and requested a written report. Then, they asked for an estimate since it was a “minor” damage, and in a matter of days, they sent me the N160,000 quoted for the repair and replacement of the damaged headlamp.”

READ ALSO:

- Why Mohbad held secret wedding – Mum

- Appeal Court affirms order proscribing IPOB as terrorist group

- Police recovered 1,519 stolen vehicles in 2024 – FPRP

He told our correspondent that it was almost impossible for him to raise such an amount within the period. “It felt like a dream, because that was the first time I was making a claim, despite paying a premium every year.”

John admitted that every time he had to renew his compulsory motor vehicle insurance yearly, he always paid his premium grudgingly “because I never had reasons to make a claim. But having seen it work without stress, I have become an advocate of insurance and I’m making plans to insure my house against fire and theft.”

Insurance, a proven safety net

Like John, several individuals, governments and legal entities in Nigeria have, over the years, benefitted from the relief insurance provides.

For instance, in the aftermath of the violent #EndSARS protest in 2020, during which thousands of shops were looted, houses burnt and several government properties vandalised, torched or razed, the Lagos State government revealed that it lost properties running into billions of naira, but that adequate insurance arrangements aided the state’s recovery from the losses.

Lagos buses burnt during #EndSARS

Speaking at the state’s Civil Service Insurance Week in August 2021, Governor Babajide Sanwo-Olu stated, “If not for a solid and proper insurance arrangement, Lagos will still be grappling with the challenges of replacement, reinstatement, and repairs of damaged properties.”

The Nigerian Insurers Association, which is the umbrella body for all insurance companies in the country, later revealed that insurance companies settled about 718 claims, which ran into over N11bn.

Similarly, businesses, especially the large ones, approached by our correspondent admitted that insurance was inevitable, considering the nature of their business and huge capital invested.

Speaking on conditions of anonymity so as not to undermine shareholders/clients’ confidence, they noted that they had had reasons to file for claims at different times for incidents such as fire, loss of goods in transit and theft.

READ ALSO:

- Court grants Sowore N10m bail for calling Egbetokun illegal IGP

- NNPP woos Aregbesola after APC expulsion

- 18 bodies recovered from Washington River after US plane crash

Indeed, a seasoned economist and former Director-General of the Lagos Chamber of Commerce and Industry, Dr Muda Yusuf, affirmed that many big companies have different insurance covers and that they usually get claims when they suffer losses.

Yusuf, who is the Chief Executive Officer of the Centre for the Promotion of Private Enterprise (CPPE), stated, “If you look at the amount of claims insurance companies pay, it’s usually big, running into several billions of naira. That couldn’t have been for just third party motor vehicle insurance.

“Some big companies are getting claims, maybe for fire or other insurable risks. Even if the money they get is not sufficient, it gives them the initial capital to rebuild.

“I know quite a number of companies file for and received claims, and it helps to prevent disruptions to their businesses.”

Data source: NAICOM

From motor vehicle insurance to fire, general accident, marine, oil and gas and life insurance, there abound testimonies of insured persons and entities who found succour and great relief in the swift intervention of their insurers when they suffered losses, easing unexpected burden.

In September 2022, popular Nigerian skit maker, Emmanuel Ejekwu, popularly known as Sabinus, was involved in a major auto accident that severely damaged his Mercedes Benz GLE sport utility vehicle. The vehicle at the time cost a whopping N125m, and it could be more, depending on the specifications and special features. But a month after, he announced on his Instagram page that his insurance company had replaced the vehicle with a new one.

He shared the picture with a message: “It’s brand new. We just got a car replacement, you know the accident that happened. You see why e good to buy motor put insurance (You see why it’s good to insure your vehicle).”

Picture of Sabinus

Data speaks

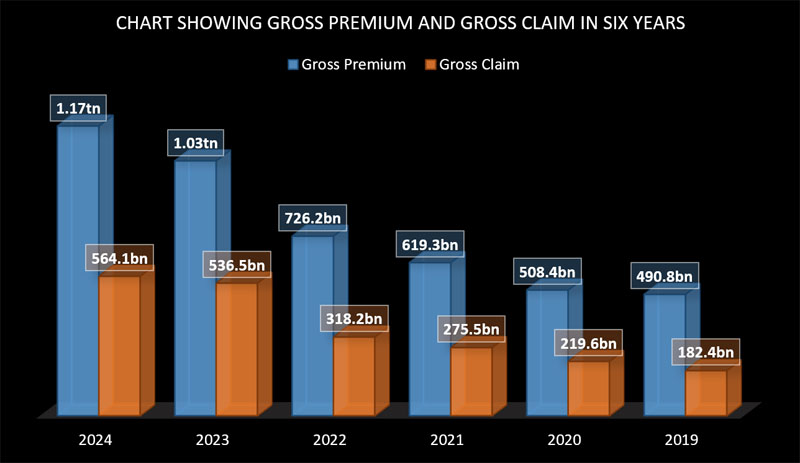

Meanwhile, in 2024, the National Insurance Commission revealed that the gross premium received by insurers stood at N1.173tn, while the gross claims incurred within the period was a whopping N564.1bn, representing about 48.1 per cent.

Data source: NAICOM and NIA

This does not only show the steady increase in gross premium paid and consistent growth of the sector, the proportion paid as claims in successive years underscores the increasing awareness by the insured, the responsiveness of insurers to claims filed by the insured, as well as a reflection of the potential of insurance to keep individuals and key sectors afloat.

Identifying perennial industry challenges

Clearly, these indicate a positive trajectory for the insurance sector. However, there are concerns that despite Nigeria being the largest economy and most populous nation in Africa, its insurance penetration at about 0.5 per cent is particularly low, compared to smaller countries on the continent, and it leaves a huge room for improvement.

Speaking to the issues holding back the development of the sector, KPMG in its Sector Report identified them as low income levels, low awareness and understanding of insurance across various population segments, distrust between operators and the populace, and absence of incentives to attract multinational companies into the African market.

It identified other factors as lack of reliable information for easy assessment of people’s risk, poor legal and judicial systems, inadequate human capital and expertise, and some communities’ preference for informal forms of insurance.

READ ALSO:

- Suspected herdsmen kill five farm workers in Ondo community

- Yul Edochie dumps Salvation ministry, joins traditional religion

- El-Rufai on vengeance mission, says Tinubu aide

The report also quoted the MD/CEO of AIICO Insurance, Mr Babatunde Fajemirokun, as listing the challenges facing the sector to include the lack of customer awareness, “as people hardly see advertisements” as well as lack of trust in insurance companies.

Meanwhile, findings indicated that some of the issues facing the sector were self-inflicted. For example, in the past, many insured persons and organisations lamented the reluctance or delay by some insurers to settle claims, which eroded the confidence of potential and existing insured persons and entities.

The National Association of Chambers of Commerce, Industry, Mines and Agriculture (NACCIMA) had in the past called on NAICOM and the Federal Government to sanction insurance companies found wanting in fulfilling their obligations to their clients before the practice would discourage many from embracing insurance.

The then Director-General of the association, John Isemede, said, “Most people no longer trust insurance companies due to the dubious attitude of some of them. Some insurance companies cheat people by either under-valuing or over-valuing goods, while some delay the payment of claims in the event of a loss.”

In its 2024-2027 Strategic Agenda unveiled in July 2024, NAICOM admitted that the insurance industry had been challenged with delays in claims processing and settlements, as well as a raft of unethical practices which had eroded public trust.

But in response and as part of efforts to build people’s confidence in the sector, NAICOM has repeatedly warned insurers against delayed settlement of claims.

Among other disciplinary measures, the regulator has serially imposed fines on insurers, and in October 2024, it dissolved the board and management of an insurance company over years of insolvency and its failure to meet its obligations to policyholders.

In November, 2024, NAICOM also gave a December 31 deadline for all insurance companies to settle all outstanding genuine claims.

Indeed, NAICOM noted in the strategy, “Over the past three years, NAICOM has made progress, mandating insurers to disclose outstanding claims and successfully launching a NAICOM’s claim portal to ensure prompt claims settlement and rebuild public trust.”

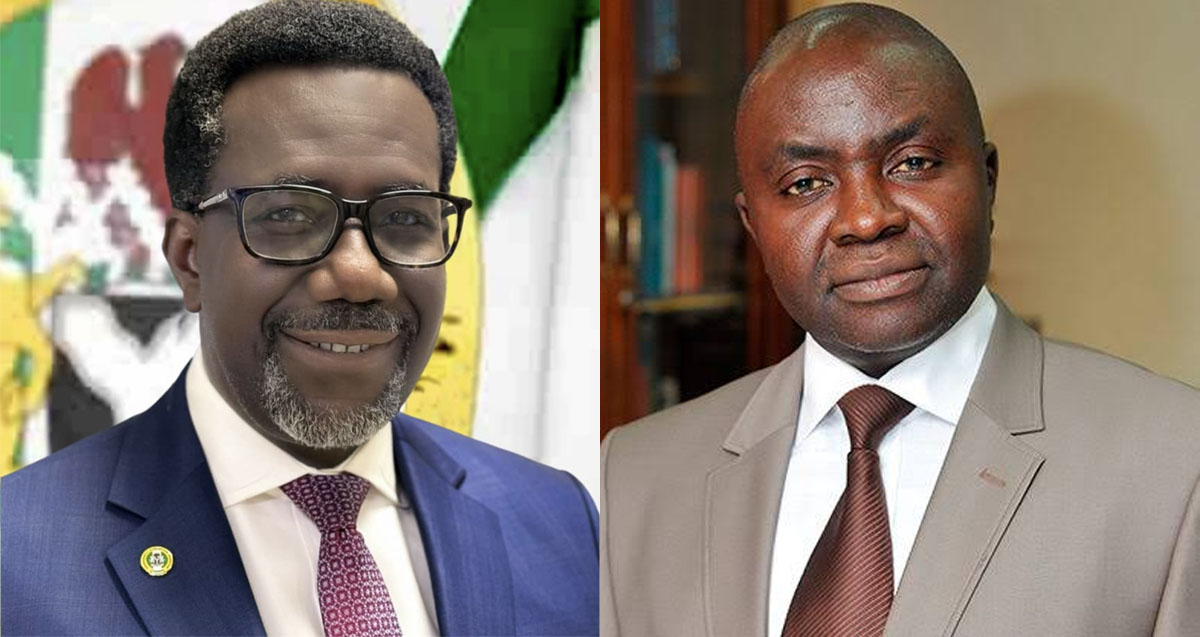

NAICOM CEO, Olusegun Ayo Omosehin

It also promised an “efficient insurance claim process, strong regulatory environment and effective supervision of insurance operators, improved industry policies and standards, growth in innovative products and adoption of sustainable insurance products, as well as improved insurance literacy to aid higher insurance coverage and penetration rates.”

The Executive Secretary/Chief Executive Officer at the Nigerian Council of Registered Insurance Brokers (NCRIB), Mr Tope Adaramola, said in an interview with our correspondent that things had improved unlike what obtained in the past.

He said, “I want to affirm that the insurance industry of today pays claims, unlike what we used to have that made many people to lock up their minds, somewhat, against the industry.”

Not all gloom

In spite of these perennial challenges, it is not entirely bleak for the sector. In fact, in successive years, gross premiums, claims paid, and the number of policies have maintained a steady increase, evident in the figures published by NIA and NAICOM.

It is however believed that if insurance companies adequately publicise their success stories, it would significantly increase awareness, boost credibility, deepen penetration and reduce, substantially, the distrust that exists in the sector.

The NCRIB boss said, “As a chartered insurer and reputation management professional in the industry, I have always been an advocate of publicising the success stories, because storytelling comes with a level of credibility, and it also speaks to the integrity of the figures that you release. When people share their stories, vis-à-vis how their insurance companies stepped in when they suffered losses, potential and existing clients would be able to relate with such, and by so doing, you would have more public inclination towards what you sell.

Tope Adaramola

“There is a saying in our sector that whatever you would lose that would make you lose your sleep, it is better you insure it. If losing my laptop or phone would make me lose my sleep, composure and hope, I should insure it. But that example applies to the retail side; it will not sell with a multibillionaire because laptops or phones are nothing to them.

“That means we must be able to segment our storytelling. We know what the rich would love to hear and what would appeal to the lower income class. We should then begin to work around the right narratives that would interest these people we are targeting. That would enhance insurance acceptance.

“We have been trying to do some storytelling when it comes to large, corporate or commercial entities rather than the retail end, but we need to do more. Telling the stories of how we intervened and the speed with which their claims were paid would convince more people to embrace insurance.”

He argued that those in the lower income class need insurance more because they often lack recovery capability, forcing them to rely on government or begging to raise funds to start again, adding that if both fail, some remain trapped in the situation indefinitely.

Also speaking on the need for publicising the success stories to deepen the penetration, Yusuf, the ex-LCCI DG, said the insurance companies must be deliberate about pushing out such stories.

“It has a lot to do with insurance companies telling their own stories more or getting people who have benefitted to tell the stories for them. There has to be a very deliberate effort on the part of the insurance companies to change the perception of the citizens about insurance.

Dr. Muda Yusuf

“Even though there were complaints about difficulty in getting claims, many have benefitted as evidenced by the data released by the operators and regulators. I think insurers should get people, their clients, to tell more of that story, so people’s perception can change. They are not doing that enough,” he stated.

He explained further that formal sector operators value insurance much more than individuals, the informal sector and SMEs.

This, he said, was “because those in the formal sector are not as many as these other sets. That is why people get the impression that not much is happening. But a lot is happening, despite the low penetration, just that insurers should let their clients tell their success stories.”

READ ALSO:

- Hisbah arrests couple for marrying at Kano restaurant

- Man who burnt Quran shot dead in Sweden

- US streets deserted for fears of arrest amid Trump immigration crackdown

The KPMG report quoted the AIICO insurance boss as saying that the most rapid growth in the insurance sector would come from the retail market – individuals and families, which underscores the need to encourage beneficiaries to share their stories.

While experts advocate increased publicity of success stories, findings showed that there are several platforms insurers could leverage to get their messages to every nook and cranny of the country. Given that there is an average of 35 million Nigerians on social media, Instagram, Facebook, X, LinkedIn, TikTok and Snapchat could be used to reach many people. There are also many Nigerians on popular video sharing platform, YouTube.

Other potent platforms are traditional media such as television stations, radio, and newspapers. And given the dwindling attention span of people, it is equally believed that the stories could be captured in short videos, documentaries, interviews and feature articles that spotlight the success stories.

By using all these platforms, people across age groups and social status would have been reached.

“Digital marketing has come to stay, so sponsored posts can also be used on those platforms and the message would get to as many people as possible. They should be subtitled so that no one is excluded and there could be translations to local languages on radio. They can use such stories to even market their various products, and it will be more believable,” a PR professional told our correspondent.

Insurance remains the way

Speaking to the benefits of insurance, regardless of the distrust and recurring perception by many that their premium is lost if there is no claim, Adaramola lamented that many people expect insurance to work the way banks operate, in which case they want to access their premium the same way they could withdraw their money from the bank with or without interest.

“They forget that it’s a pool of risks, and everybody in the pool pays a token called premium in anticipation of a loss that could be 40 times the loss,” he added.

He said instead of asking what would happen to their premium if they don’t suffer a loss, they should rather ask what would happen if they suffer a loss.

He stated, “For instance, you do your third party motor vehicle insurance, and the first month of paying the premium, you incur a loss and an insurance company has to pay N3m, which is the limit of the third party liability, except life is involved.

“So, how do you reconcile someone paying N15,000 premium and collecting N3m? That person would smile home and thank God. We must therefore realise that the money that person collected was the money of other people who didn’t suffer a loss at that time. That is the basic explanation that is difficult for many Nigerians to understand.”

The NCRIB boss called for a review of the way insurance is marketed to people, saying, “The number one explanation that those who market insurance should give is that we sell peace of mind. If you are driving an insured car, you can rest assured that if an accident happens or anything happens to the car, it will easily be taken care of. With that, your worry is limited.

“Likewise, if you start a business and you insure it, you know that if anything untoward happens to the business you are not going back to ground zero; you have peace of mind. But those who sell insurance hardly talk about the peace of mind. They present insurance from a disaster point of view. The presentation of our products has to be tweaked.”

He called on insurance companies to be innovative and do more in the area of corporate social responsibility, not only at an individual level but at a corporate level.

He concluded, “According to former President Olusegun Obasanjo, insurance is like a nation’s army that you think you don’t need in time of peace until war breaks out. Stories are powerful, and I believe we can do more, by showing everybody how we have been there for our clients when the untoward happened. That would show them that insurance actually pays.”

With the volume of accidents, fire incidents and other insurable risks not insured, Nigeria might be losing a lot, Yusuf noted.

He said, “If they are insured, there will be no need to appeal to the government to come to their aid. But since there is no culture of insurance, once there is a loss, everybody carries their cross. So, we are losing a lot.

“Even from the point of view of investment, insurance helps to minimise your risk. When people want to support you with funds, it will be easier for them if you have insurance. This is because they know if anything goes wrong, their investment is not lost. The essence of insurance is to help you manage risk, but when you are exposed, you lose when there is a loss.”

As Nigeria seeks to deepen its penetration and grow the insurance sector, it is believed that adequate publicity of the gains made over the years could help to eliminate the distrust that has for years undermined the growth of the sector, while other solutions such as improved regulation and innovative products from insurance companies will complement the gains.

Masked impact: How low storytelling limits Nigeria’s insurance industry growth

Auto

Lanre Shittu Motors to endow Automobile Department of Lagos Technical College

Lanre Shittu Motors to endow Automobile Department of Lagos Technical College

Lanre Shittu Motors has announced a novel idea that will boost automobile studies in a Lagos technical college.

Specifically, it has pledged to adopt the Automobiles Department of the Government Technical College, Aso-Soba in the Festac area of Lagos.

This is intended to raise academic and practical programme standards of the school.

The company said this would involve adequate funding, in-school training and intensive industrial training (IT) with welfare package to encourage more young people to pursue academic career in automotive engineering.

Business Support/Admin Manager of LSM, Mr Babatunde Adenuga, disclosed this in Lagos, in an interview with journalists.

Adenuga represented the LSM Managing Director, Mr Taiwo Shittu, at the just concluded Engineering Week of the college sponsored by the auto company, where he unveiled the plan to the staff and students at the event’s grand finale.

Aside from the needed financial support to make the auto department functional and standard, he said LSM would provide the tools, overall wears/workshop uniform, among others, as part of the welfare package for the students.

He said it would be a win-win situation for the school and the company.

Adenuga said, “The school will benefit immensely from the LSM package for the department as we take the financial trouble of running the department away from them.

“Students from the department can come for their internship at LSM workshops, and getting jobs after school won’t be difficult.

“For us, it will be a seamless arrangement in getting suitable personnel familiar with our training and business orientation.”

He also said the LSM had been absorbing students from the school and others for their industrial training (IT), providing them with useful hands-on training and monthly stipend to keep them going.

The LSM MD, Taiwo Shittu, commenting on the support, said, “We’ll be part of the progress of the school. We want to own a department in the technical college, the automobile department of studies that will enable us to fund the place; take care of the welfare of students, providing the tools, overall uniform and other facilities.”

“At LSM, we see training the youths as part of our Corporate Social Responsibility. Every year, we take in youths into our facility and train them; even while in training, we give them stipends.”

The highpoint of the LSM-sponsored Government Technical College event was the presentation of prizes to outstanding students in the various competitions held for the Engineering Week.

Three of the students whose projects stood out such as locally produced water pumping machine and water heater went home with impressive cash awards.

Principal of the college, Mr Folarin Sunkanmi, expressed appreciation to LSM for the interest in the school, starting with giving the students the opportunity for industrial training and offering them monthly stipend.

The principal commended the LSM efforts of sponsoring the engineering week’s activities, whose theme was given as ‘Engineering for Sustainable Development (Innovators of tomorrow)’

He urged other companies to emulate the LSM example in order to boost the employability chances of products of the technical colleges and engineering departments of higher institutions in the country.

Business

Elon Musk sells X to AI startup for $33 billion

Elon Musk sells X to AI startup for $33 billion

Billionaire entrepreneur Elon Musk has announced the merger of his artificial intelligence startup, xAI, with his social media platform, X, in an all-stock transaction valued at $45 billion.

This move brings xAI’s valuation to $80 billion, while X is valued at $33 billion.

Both xAI and X are privately held entities under Musk’s control.

The two companies share notable investors, including Andreessen Horowitz, Sequoia Capital, Fidelity Management, Vy Capital, and Saudi Arabia’s Kingdom Holding Co.

Musk, in a post on X, stated that the merger would combine their data, computing power, distribution, and talent to create more advanced AI-driven experiences while staying committed to their core mission of truth and knowledge advancement.

“@xAI has acquired @X in an all-stock transaction. The combination values xAI at $80 billion and X at $33 billion ($45B less $12B debt).

Since its founding two years ago, xAI has rapidly become one of the leading AI labs in the world, building models and data centers at unprecedented speed and scale.

READ ALSO:

- Barbaric mass burning of innocents in Edo, by Farooq Kperogi

- Investigation of wanted businesswoman Achimugu not linked with Atiku, Sanwo-Olu – EFCC

- No Sallah durbar festival in Kano this year – Police warn

X is the digital town square where more than 600M active users go to find the real-time source of ground truth and, in the last two years, has been transformed into one of the most efficient companies in the world, positioning it to deliver scalable future growth.

xAI and X’s futures are intertwined. Today, we officially take the step to combine the data, models, compute, distribution and talent. This combination will unlock immense potential by blending xAI’s advanced AI capability and expertise with X’s massive reach. The combined company will deliver smarter, more meaningful experiences to billions of people while staying true to our core mission of seeking truth and advancing knowledge. This will allow us to build a platform that doesn’t just reflect the world but actively accelerates human progress.

I would like to recognize the hardcore dedication of everyone at xAI and X that has brought us to this point. This is just the beginning,” he stated.

xAI’s growing footprint in AI

Founded less than two years ago, xAI aims to “understand the true nature of the universe.” The company has been developing large language models and AI tools, positioning itself as a direct competitor to OpenAI, a company Musk co-founded in 2015 before exiting due to strategic differences.

In June 2024, xAI announced plans to build a supercomputer in Memphis, Tennessee, to train its AI chatbot, Grok. By September, Musk revealed that part of the Memphis-based supercomputer, called Colossus, was already online.

xAI’s rapid expansion has drawn scrutiny from environmental and public health advocates, who cite a lack of community input in its Memphis project. The Colossus supercomputer is powered by natural gas-burning turbines, and xAI plans to expand operations with a nearby graywater facility.

Elon Musk sells X to AI startup for $33 billion

Business

MTN, Airtel to share network infrastructure in Nigeria

MTN, Airtel to share network infrastructure in Nigeria

Airtel Africa has partnered with MTN Group to expand digital inclusion by sharing network infrastructure in Uganda and Nigeria.

In a statement in Lagos on Wednesday, Airtel said the sharing agreements aim to improve network cost efficiencies, expand coverage, and provide enhanced mobile services to millions of customers.

A sharing agreement is a formal arrangement between two or more parties to share resources, assets, or services.

According to the telecommunications company, the partnership will benefit customers in remote and rural areas who do not yet fully enjoy the benefits of a modern connected life.

Airtel assured that both parties will ensure the agreement complied with local regulatory and statutory requirements.

Sunil Taldar, chief executive officer (CEO) of Airtel Africa, said telecommunications companies are driving digital financial inclusion by building common infrastructure within the regulatory framework.

Taldar noted that the collaborative approach not only advances digital transformation and financial inclusion but also reduces the duplication of expensive infrastructure.

READ ALSO:

- Kogi group seeking Senator Natasha’s recall not registered – CAC

- Obasanjo’s position on Rivers emergency rule hypocritical, says Presidency

- Bill to stop politicians above 60 from contesting presidential, gov poll scales 2nd reading in Reps

As a result, Taldar said operational efficiencies are boosted, ultimately benefiting customers.

He further said telecoms continue to compete fiercely in the market, differentiating themselves through their brand, services, and offerings.

“The initiative is part of a growing global trend toward network sharing. By collaborating, telecoms operators can explore innovative and pro-competitive solutions to improve service quality while managing costs more effectively,” Taldar said.

“The sharing of infrastructure has the potential to enable the delivery of world-class, reliable mobile services to more and more customers across Africa.”

Taldar added that following the conclusion of agreements in Uganda and Nigeria, MTN and Airtel Africa are also exploring various opportunities in other markets, including Congo-Brazzaville, Rwanda, and Zambia.

Ralph Mupita, MTN Group CEO, said there is a need to invest in coverage and capacity to ensure high-quality connectivity to meet customers’ increasing demands.

“As MTN, we are driven by the vision of delivering digital solutions that drive Africa’s progress,” Mupita said.

“We continue to see strong structural demand for digital and financial services across our markets.

“To meet this demand, we continue to invest in coverage and capacity to ensure high-quality connectivity for our customers.”

Mupita added that there are opportunities within regulatory frameworks for sharing resources to drive higher efficiencies and improve returns.

MTN, Airtel to share network infrastructure in Nigeria

-

metro2 days ago

metro2 days agoRivers administrator Ibas fires Fubara’s political appointees

-

metro2 days ago

metro2 days agoJUST-IN: Ex-Oyo gov Ajimobi’s first child Bisola dies At 42

-

metro3 days ago

metro3 days agoHow ritualists, native doctor drugged, murdered underage sisters in PH – Police

-

metro2 days ago

metro2 days agoFG declares public holidays for Eid-el-Fitr

-

metro1 day ago

metro1 day agoEFCC re-arraigns son of ex-PDP chairman for alleged N2.2bn oil subsidy fraud

-

Africa2 days ago

Africa2 days agoNiger coup leader sworn in as president for five years

-

metro2 days ago

metro2 days agoNatasha: Murray-Bruce slams Atiku, defends Akpabio

-

International2 days ago

International2 days agoAI will replace doctors, teachers, others in 10 years – Bill Gates