News

Otedola threatens to sue Zenith Bank over alleged account debt

Otedola threatens to sue Zenith Bank over alleged account debt

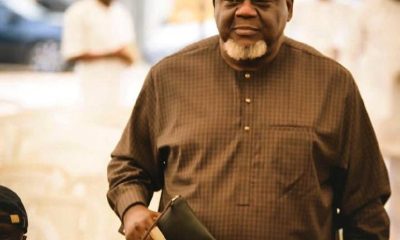

Femi Otedola, the chair of FBN Holdings and majority owner of Geregu Power, and some of his companies are up in arms against Zenith Bank over a controversial debt involving his former company, Zenon Petroleum & Gas and some other firms in which he has interests.

Mr Otedola is accusing Zenith Bank of perpetrating banking fraud against him and some of his companies. He claims the lender controversially disposed of his shares in the bank, manipulated the company’s bank accounts, and forged documents to cover up the alleged crimes.

The businessman has also triggered litigation and police action against Zenith Bank, with the Force Criminal Investigation Department now probing the matter.

The battle between Mr Otedola and Zenith Bank began after the businessman accused his bankers of dishonest accounting in the computation of his liabilities before selling his multibillion naira debt to the Asset Management Corporation of Nigeria (AMCON), an agency of the Nigerian Government, buys bad loans in banks’ books, aiming to pursue recovery afterwards.

Reliable sources with knowledge of the matter told PREMIUM TIMES that the billionaire tycoon turned to the court and the police for a resolution after the dispute became knottier, and efforts to resolve it and other related issues without legal intervention failed.

PREMIUM TIMES learnt that the technical teams of Zenith Bank and Zenon Oil met on 20 May 2024 to resolve the logjam, but the meeting was inconclusive.

READ ALSO:

- Relief as troops rescue kidnapped soldier, others in Benue

- Despite leading South Africa’s election ANC set to lose majority

- Biden allows Ukraine to hit some targets in Russia with US weapons

That was the third reconciliation meeting the two parties held this month, none of which has resolved the conflict.

“It is clear that Zenith Bank Plc is not sincere in resolving this issue out of court and as such a time-wasting exercise,” one of our sources said. “At this juncture, we have resolved to pursue our claims via the judiciary, law enforcement, the CBN and the court of public opinion as we know that our claims are very genuine.”

Zenon claimed its letters of credit that deteriorated into the problematic loan acquired by AMCON were opened before the corporation bought the debt in December 2011. Zenon ceased to operate the account the moment the takeover happened.

Zenon claimed Zenith Bank admitted at meetings that it controversially opened letters of credit after AMCON procured the debt, a practice an official of the oil and gas firm described as unprofessional.

A document seen by PREMIUM TIMES listed the overdue amount on Zenon’s account at the time of AMCON’s intervention as N39 billion. However, Zenon claims Zenith Bank offered the debt to AMCON for N49 billion instead. After intense negotiations, AMCON paid the bank N44.1 billion for the bad debt.

Sunday Enebeli-Uzor, who heads the bank’s corporate communications unit, did not immediately respond to PREMIUM TIMES’ request for comment. Neither did Ayoola Kusimo, the team lead for media relations.

But a top bank official had earlier told one of our reporters that since the matter is already in court and before the police, there was no need discussing it in the media.

When contacted, Mr Otedola confirmed his face-off with Zenith Bank over some unclear transactions on his companies’ accounts but declined to provide details. “We are still trying to resolve it,” he said. “If that fails, I can give you details.”

Another document containing the details of a meeting held by both sides on 20 May said Zenith Bank agreed to refund with compounded accrued interest rate the N205 million it wrongly deducted from Zenon’s account using a backdraft.

READ ALSO:

- BREAKING: Many feared dead in another two-storey building collapse in Lagos

- Calm in Kano as District Heads pledge loyalty to Sanusi amidst legal tussle

- State varsities’ students to benefit from FG’s loan scheme

Seaforce Shipping Company Limited, owned by Mr Otedola, disclosed that Zenith Bank presented some bank statements claiming that Seaforce owed the lender N5.9 billion as of February 2024. The company added that Zenith Bank later abandoned the claim after it showed the bank proof that Seaforce’s account was in credit as of 2018.

According to a company document obtained by PREMIUM TIMES, Seaforce reviewed a bank statement of the company Zenith Bank shared with it and established that no facility existed.

“This is clearly a fraud as it is evident that they prepared fake bank statements,” Seaforce said.

This March, Zenon, Seaforce, Luzon Oil & Gas, Garment Care Limited, and Mr Otedola obtained an injunction against Zenith Bank, Quantum Zenith Securities and Investment, Veritas Registrar, and Central Securities Clearing System.

The interim injunctions forbade the defendants, their agents, and their servants from trading with the plaintiffs’ shares or paying dividends on them until the hearing of the motion on notice for interlocutory injunction already filed before the court, the Federal High Court Lagos.

According to the insider, Zenith Bank sold the 415 million shares Zenon held in the bank for N4.9 billion in December 2010. The shares were repurchased by Zenith Bank in January 2011 for N5.4 billion, resulting in a net loss of N142.9 million.

The source said similar transactions were carried out on Mr Otedola’s account, with a net loss of N61.5 million recorded in that case, resulting in a cumulative loss of N205.4 million.

The insider said the amount was debited to Zenon’s main account on 27 January 2011. He claimed Zenith Bank admitted to trading on the account and agreed to reverse the debit and pay the accumulated interest to date. PREMIUM TIMES has not been able to verify the claim independently.

Police steps in, summons Zenith Bank

The police have stepped into the matter based on a petition by Mr Otedola and his companies. On 16 May, Isyaku Mohammed, the commissioner of police in charge of administration at the Force Criminal Investigation Department, summoned the managing director of Zenith Bank over what he described as an alleged unauthorised debit to Zenon’s account.

“This office is investigating an alleged case of fraudulent misrepresentation, wrongful debit and unauthorised transactions referred from the assistant inspector general of police, FCID Annex, Alagbon Close, Ikoyi, Lagos, involving your financial institution,” the letter, a copy of which was obtained by PREMIUM TIMES, read.

“A precis of the petition at disposal reveals that sometime in 2011, an unauthorised withdrawal was carried out on the account of Zenon Petroleum Gas Limited with number 10110385211 to the tune of Two Hundred and Five Million, Three Hundred and Forty-six Thousand, Five Hundred and Seventy-Three Naira (N205,346,573.00) without justification.”

The letter also stated that several letters of credit were unlawfully opened by Zenith Bank after the takeover of Zenon by AMCON in 2011, leading to some unsolicited loan disbursement that further plunged the company into indebtedness.

The summon requested Zenith Bank’s managing director to report to the Force Criminal Investigations Department Annex, Alagbon Close, Ikoyi, Lagos, on Monday, 20 May 2024, for questioning.

It is unclear whether the bank chief has honoured the invitation, but those familiar with the matter said some bank legal department officials have met with the police in recent weeks.

Otedola threatens to sue Zenith Bank over alleged account debt

Premium Times

News

Nigeria Customs Service begins 2025 recruitment [How to apply]

Nigeria Customs Service begins 2025 recruitment [How to apply]

The Nigeria Customs Service (NCS) has announced the commencement of its recruitment exercise, assuring Nigerians that the process is entirely free and fair.

The agency has cautioned the public to be vigilant against scammers who may attempt to exploit unsuspecting applicants during the recruitment period.

Applications are invited for positions in the Superintendent, Inspector, and Customs Assistant cadres as part of the Service’s plan to recruit 3,927 officers in 2025.

This initiative is aimed at enhancing trade facilitation and supporting Nigeria’s economic recovery efforts.

“Our recruitment is entirely free and fair. At no stage do we charge fees. Anyone requesting payment is a scammer,” the agency emphasized, urging applicants to be wary of fraudulent schemes.

READ ALSO:

- Dangote, Tinubu, Lookman, Badenoch named among 100 most influential Africans in 2024

- Heavy security in Ilesa as ex-Osun deputy gov emerges new Owa-Obokun

- Hacker has stolen N180m from my NGO account – VeryDarkMan cries out

The NCS outlined eligibility criteria, stating that applicants must be Nigerian citizens by birth, possess a valid National Identification Number (NIN), and have no criminal record or ongoing investigations.

Academic qualifications for the three cadres are as follows:

Superintendent Cadre: A university degree or Higher National Diploma (HND) along with an NYSC discharge or exemption certificate.

Inspectorate Cadre: A National Diploma (ND) or Nigeria Certificate in Education (NCE) from an accredited institution.

Customs Assistant Cadre: At least an O’Level certificate (WAEC or NECO).

In addition to these qualifications, the NCS stressed that all applicants must be physically and mentally fit, providing evidence of medical fitness from a recognized government hospital.

Nigeria Customs Service begins 2025 recruitment [How to apply]

News

Tinubu to critics: I won’t reduce my cabinet size

Tinubu to critics: I won’t reduce my cabinet size

President Bola Tinubu on Monday unequivocally responded to critics who described his cabinet as “bloated” by saying he is unprepared to reduce the size of his 48-man cabinet.

“I am not ready to shrink” the size of my cabinet, Tinubu said during a media chat at his Bourdillon residence in the highbrow Ikoyi area of Lagos State.

“I am not prepared to bring down the size of my cabinet,” the former Lagos governor said, arguing that “efficiency” has been at the core of his selection of ministers.

The president also said he has no regret removing the petrol subsidy in May 2023, saying Nigeria cannot continue to be Father Christmas to neighbouring countries.

READ ALSO:

- Kolawole Erinle: Appeal court affirms sentence for ex-convict over $1.4m fraud

- We’ve forced Lakurawa terrorists back to Mali, says FG

- Petrol: MRS enforces N935 per litre nationwide

“I don’t have any regrets whatsoever in removing petrol subsidy. We are spending our future, we were just deceiving ourselves, that reform was necessary,” he told reporters.

Tinubu appointed 48 ministers in August 2023, three months after his inauguration. The Senate immediately screened and confirmed the ministers. One of the ministers, Betta Edu, was suspended in January while another, Simon Lalong, moved to the Senate.

There were calls for the President to reshuffle his cabinet as many Nigerians have not been impressed by the performance of some of the ministers, especially in the face of unprecedented inflation, excruciating economic situation and rising insecurity.

In October 2024, Tinubu re-assigned 10 ministers to new ministerial portfolios and appointed seven new ministers for Senate confirmation. He also sacked five of his ministers but critics insist that the President’s cabinet remains large, especially with the creation of a Livestock Ministry with a minister.

Tinubu to critics: I won’t reduce my cabinet size

News

Tinubu: Food stampede incidents, grave error

Tinubu: Food stampede incidents, grave error

..Don’t publicise gifts distribution if you don’t have enough

President Bola Tinubu has described the recent three stampede incidents during distribution of relief materials to children and others as a grave error.

He told people to be more organised and stay away from giving palliative or publicity of the giving if they had insufficient materials.

He stated this during his first presidential media chat on Monday.

The President said he had been sharing palliatives in his Lagos residence for 25 years without any incident and blamed the recent food stampedes in the country on poor organisation.

A total of 35 children died on December 18 during a stampede that happened at a funfair event in Ibadan, Oyo State.

10 people, including children, also died on December 21 in another stampede at the Holy Trinity Catholic Church in the Maitama district of Abuja during the distribution of palliatives.

Another 22 people were reported dead during a rice distribution event at Amaranta Stadium in Ojika, Ihiala LGA, on the same day.

“It’s unfortunate and very sad, but we will continue to learn from our mistakes. I see this as a grave error on the part of the organisers,” he said.

But the President insisted that the incidents should not dampen the “happiness of the season”.

“It is very sad that people are not well organised. We just have to be more disciplined in our society. Condolences to those who lost members, but it is good to give,” Tinubu said.

“I’ve been giving out foodstuff and commodities, including envelopes in Bourdillon, for the last 25 years, and I’ve never experienced this kind of incident because we are organised and disciplined.

“If you know you won’t have enough to give, don’t attempt to give or publicise it.”

The President compared the situation to food banks in countries such as the United States of America (USA) and Britain, noting their structured approach.

“Every society, even in America, has food banks. They have hungry people. In Britain, they have food banks and warehouses, and they are organised. They take turns m lining up and collect,” he added.

-

Business2 days ago

Business2 days agoBe creative, monarch, others challenge Muslim professionals on economic revival

-

Auto1 day ago

Auto1 day agoLSM MD extols founder’s qualities after latter posthumous industry award

-

Entertainment2 days ago

Entertainment2 days agoMultiChoice announces free access to all DSTV channels for 3 days

-

metro2 days ago

metro2 days agoJigawa State governor loses son 24 hours after mother’s death

-

News1 day ago

News1 day agoNigeria Customs Service begins 2025 recruitment [How to apply]

-

metro1 day ago

metro1 day agoHeavy security in Ilesa as ex-Osun deputy gov emerges new Owa-Obokun

-

metro1 day ago

metro1 day agoLagos Imam to Tinubu: You haven’t disappointed us

-

metro1 day ago

metro1 day agoDangote, Tinubu, Lookman named among 100 most influential Africans in 2024 (Full list)