News

Reps Raise Alarm Over Plot To Sink Nigeria Through Fuel Subsidy

… says Nigeria subsidising for neighbouring countries

NNPC extends DSDP to avert fuel scarcity during Christmas.

THE House of Representatives on Monday raised the alarm over alleged plans to sink the country through the controversies trailing the fuel subsidy regime.

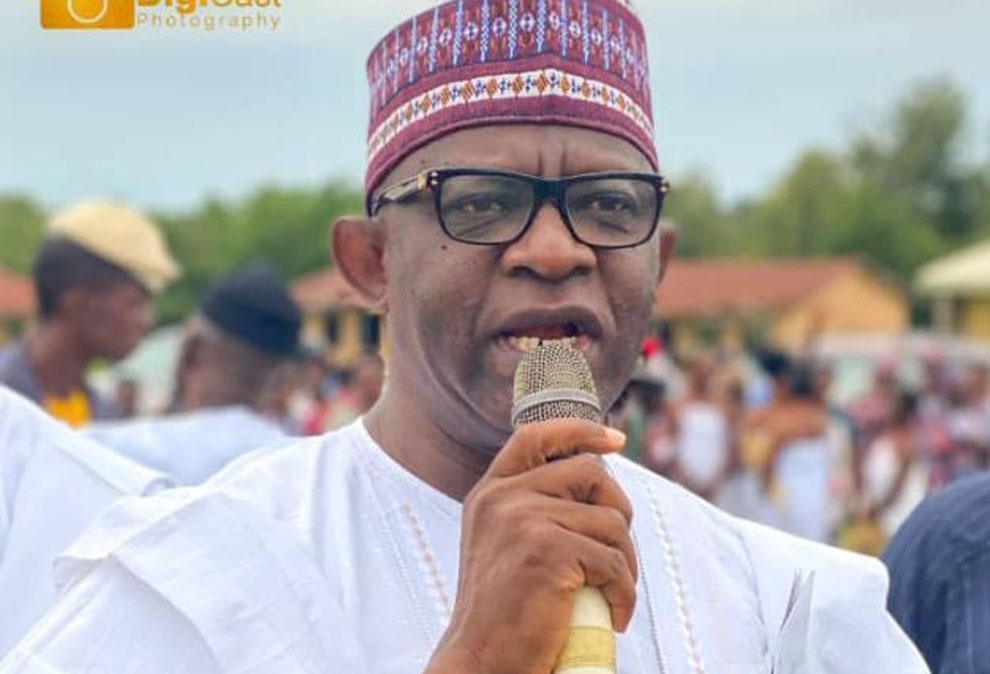

Chairman, House ad hoc committee investigating the subsidy regime between 2013 and 2021, Honourable Ibrahim Mustapha, disclosed this while responding to the submission of the Group Managing Director of Nigerian National Petroleum Corporation (NNPC) Limited, Mr Mele Kyari, who averred that Nigeria is subsiding West African countries.

While responding to a question on the huge allocation of petrol to states near border towns, the NNPC helmsman lamented that previous efforts made by the Petroleum Product Pricing Regulatory Agency (PPPRA) to install Acquila facility with a view to forestalling illegal transportation of PMS across illegal border failed.

He, however, said: “If you have N5 million, you can cross the borders with trucks laden with PMS and that is the bitter truth: we have porous borders; yes, we have the Customs service but I do not know.

“PMS crosses anywhere to Cameroon through the North-East, Nigerian petrol gets to Upper Volta, Mali; our neighbouring countries hardly import petrol; in fact, some of them do not have the LC cover to back up imports.

READ ALSO:

- Russia-Ukraine updates: Ukrainian forces preparing Luhansk offensive

- Violence erupts in Iran after woman dies in ‘morality police’ custody

- ASUU strike: Reprieve as NANS suspends Lagos protest, awaits Gbajabiamila intervention

“Cameroon refinery got burnt sometime last year or so, since that time, they have not imported petrol and then, still using the product. If you go to Niger, you find that petrol is sold in bottles just like Coca-Cola because, to them, it is a cheaper source why waste their foreign exchange? So, we are subsidising for our neighbours, that is the simple truth.”

In a swift response, Honourable Mustapha said: “There is a committee set up by the seventh Assembly that investigated subsidy. And, in the report of that committee, it was established that 31.5 million litres of PMS were being consumed daily as of that time; that was in 2012.

“Now, in comparison with the figure we are having before us here, 66 million plus litres, one will wonder what increase of consumption is it that within 10 years, we have over 100 per cent increment. How can we justify it?

“For a layman like me, if I say 1,500 trucks were discharged from various depots into the country, it will at least take those trucks five to 12 hours to arrive at their final discharge point and then, it will take more hours to discharge.

“So, how come that these trucks will discharge and return same day and also be able to load to maintain the 64 or 66 million consumption daily?

“And the second issue, if you look at this your table, gasoline price across West African countries per naira per litre. Maybe you will help a layman like me that probably we are simply subsidising for the West African region. Even in Niger Republic, it is sold for N536; in Mali, N577; in neighbouring Benin, N389; in Ghana, N589 and in Togo, N470. In Chad, N362 and in Cameron, N423, whereas the landing cost plus incidentals, profit and whatever as you projected here is N462 in Nigeria and we subsidise it to N162 or N165 or thereabout.

“Don’t you think we deliberately choose to sink the country for the benefits of others? What justification can we say we have to justify this to Nigerians? These are some of the key issues we will like to hear from the horse’s mouth.”

Speaking earlier, the NNPC helmsman, who painted a gory picture of how oil theft and pipeline vandalisation plagued the industry, disclosed that the country, which produced 2.3 million barrel per day before COVID-19, currently produces between 1.2 million and 1.6 million barrel per day, against 1.8 million barrels per day approved by OPEC.

READ ALSO:

- Nigeria Customs auctions 408 impounded vehicles at N4.72m

- Obi links govt officials to oil theft, seeks total overhaul of security architecture

- Ford innovates using pedestrian Bluetooth to alert drivers

Noting that the joint venture partners are entitled to about half of the total production, some of the partners, he said, have declared force majeure, with ExxonMobil shut-in, while Shell has also signified plans to follow suit.

Kyari, who was represented by the company’s Chief Financial Officer, Mr Umar Ajia, said: “We have about 1.6 billion litres incoming, land and marine. This is what is the minimum level we have to maintain, especially as we approach winter. Most of the refineries that we procure are actually shutting down their operations because of the clamour for green energy and COP26 compliance.

“Even gas that is transition fuel for us is being given eight years. Of course, we do not agree. When you look at PMS outlook, we want be closing each and every month with a two billion closing stock. That is the only way you can sustain petroleum so that a marketer do not see some slack and take advantage by begin to hoard product that create, artificial scarcity which can lead to queue.

“There is a huge arbitrage for anybody to move product to outside. We are not saying that the bulk of the product is smuggled. The reality is that there is no study to validate the actual consumption. What we are reporting daily is what the authority, which is the regulator, publishes. They are represented at every depot in Nigeria.

“Exchange rate has been moving steadily from N195.5 to now N390.6 to a dollar, on average. The subsidy scheme is two ways, the fx subsidy and price.

“The shipping cost has doubled, therefore the landing cost of PMS has moved from N87 per litre in 2015 to about N327.68 per litre today. When you compare it to what we sell, you have a N209 on every litre. When you multiply the N209 per litre with an average of 66.7 million litre, you are talking about N3.4 trillion subsidy for the year.

READ ALSO:

- Ukraine, using captured Russian tanks, firms up its lines

- King Sunny Ade Agrees to Meet Woman Claiming to Be His Daughter

- Obi links govt officials to oil theft, seeks total overhaul of security architecture

“The reality today is that if one were to take statistics of the number of vehicles in Nigeria, how many Keke NAPEP do we have? How many pumping machines do we have? On a routine visit, I saw nothing less than a million keke. Take an average that each one uses four litres every day, that is four million litres, one city.

“We have not done a study to validate; people are saying that we are evacuating 66 million a day. That is the reality. Some days, what is evacuated can go as much as 100 million a day, while some weekends, we do zero. The marketers are watching.

“States like Oyo and Ogun states even consume more than Lagos State, so you wonder. Is it that they have more vehicles than Lagos? This explains that these are states with porous borders and that will explain why this bulk evacuation is going out of Oyo and Ogun states, probably neighbouring countries.”

He also informed the lawmakers that the company resolved to extend the Direct Sales Direct Purchase (DSDP) contract, which was billed to end in August 2022, in order to avert fuel scarcity in December and during the 2023 general election.

“It is a very dangerous period to begin to re-tender for that because we are facing the winter. These are the difficult ‘embers months’ that we normally avoid fuel scarcity,” he said.

Before resorting to a closed-door session, Mustapha had directed some subsidiaries, including Duke Oil and NNPC Retail Limited, to appear on Thursday with relevant documents.

Tribune

News

Why governors’ forum is silent on Rivers emergency, by DG

Why governors’ forum is silent on Rivers emergency, by DG

The Nigeria Governors’ Forum (NGF) yesterday attributed its neutral position on the recent declaration of a state of emergency in Rivers State to the need to steer clear of taking positions that may alienate members with varying political interests.

Taking positions on contentious partisan issues, the NGF said, would not augur well for it, especially in view of its past experience in fundamental division.

Notwithstanding, the declaration of the state of emergency by President Bola Tinubu yesterday generated more kudos and knocks from across the country.

Special Adviser to the President on Senate Matters, Senator Basheer Lado, said the action of the president was meant to ensure protection of lives and restoration of law and order in the state, while the President’s Special Adviser on Media and Public Communications, Sunday Dare, said his principal was required to “avert needless harm and destruction .”

National Publicity Secretary of the ruling All Progressives Congress (APC), Felix Morka, said Tinubu, by his action, cleared what had manifested as a constitutional crisis in Rivers state.

But former President Goodluck Jonathan saw it from a different perspective.

READ ALSO:

- Senate didn’t get 2\3 majority for Tinubu emergency rule in Rivers –Tambuwal

- FG destroys another 200 containers of expired drugs

- Rivers court bars woman from answering ex-husband’s name

He described “abuse of office and power by the three arms of government in the country“ as a dent on Nigeria’s image.

The NGF, in a statement by its Director General Abdulateef Shittu, said it is essentially “an umbrella body for sub-national governments to promote unified policy positions and collaborate with relevant stakeholders in pursuit of sustainable socio-economic growth and the well-being of the people.”

It added: “As a technical and policy hub comprising governors elected on different platforms, the body elects to steer clear of taking positions that may alienate members with varying political interests.

“In whatever language it is written, taking positions on contentious partisan issues would mean a poor sense of history — just a few years after the forum survived a fundamental division following political differences among its members.

“Regardless, the Forum is reputed for its bold positions on governance and general policy matters of profound consequences, such as wages, taxes, education and universal healthcare, among others.”

It asked for “the understanding of the public and the media, confident that appropriate platforms and crisis management mechanisms would take care of any such issues.”

Why governors’ forum is silent on Rivers emergency, by DG

News

Rivers: Tinubu acted to save state, economy, says Karimi

Rivers: Tinubu acted to save state, economy, says Karimi

Chairman of the Senate Services Sunday Karimi has hailed President Bola Tinubu for the decision to declare a state of emergency in Rivers State.

He told reporters on Friday in Abuja that the President acted in the best interest of the State and Nigeria, having taken his decision in compliance with the Constitution.

“No President or government worth a name, will fold its arms and watch a political situation deteriorate to what we saw unfolding in Rivers State.

“We saw that bombing of pipelines had begun, and the security situation was getting worse with the tension everywhere”, Karimi stated.

Karimi, who represents Kogi-West on the ticket of the All Progressives Congress (APC), recalled the “fatherly role” Tinubu had played in the crisis since 2023 in a bid to get the Minister of the Federal Capital Territory (FCT), Nyesom Wike, and suspended Governor Siminalayi Fubara to reach an understanding, to no avail.

He explained: “We were all here in 2023 when Mr President called that truce meeting at the Aso Rock Villa. There was the eight-point agenda for settlement reached between the factions.

“When Nigerians expected that progress should be made to achieve peace, things started deteriorating considerably to a point where the governor demolished the House of Assembly building and administered the state with only three legislators.”

READ ALSO:

- Oluwo accuses Ooni of plotting to dethrone him

- Natasha: Court blocks recall attempt, stops INEC

- US ends legal status for 500,000 immigrants

Karimi observed that with the recent judgment of the Supreme Court, which gave the upper hand to the 27 lawmakers loyal to the camp of the FCT Minister, matters merely got worse in the State as the lawmakers were set to impeach the Governor.

“What did you expect would be the implications? There would have been more destruction, killings and economic losses for the country.

“With the bombings that had already started, it was a matter of time before the whole state would be engulfed in flames. No responsible President would sit, arms folded, and allow that to happen “ he added.

The senator further argued that it took “painstaking efforts” by the administration to raise daily crude oil production to around 1,800 barrels, noting that Nigeria’s economy was already “witnessing a rebound under the renewed hope projects of the government.”

“Allowing the situation in Rivers to get worse before he would act, wouldn’t have helped the state or Nigeria as a country in any way.

“Mr. President intervened at the right time, and his actions are covered by law,” he said.

Karimi also spoke on the emergency declaration in Borno, Yobe, Adamawa and a couple of other states by former President Goodluck Jonathan without removing the Governors from office or suspending the state assemblies.

According to him, the case with those States was not generated by political crises but rather security concerns.

“So, I will advise those comparing the two scenarios to remember that one was purely about security threats resulting from the insurgency caused by Boko Haram, while that of Rivers is clearly political.

“It was the proper thing to do to suspend the political actors in the two factions to allow for tensions to diffuse. Nigerians should appreciate the President for the action he has taken so far,” he stated.

Sen. Karimi also noted that there was no cause for alarm as the National Assembly had indicated that the emergency rule could be reviewed as soon as there were signs that things could quickly normalise in Rivers State.

Rivers: Tinubu acted to save state, economy, says Karimi

News

Just in: Tinubu swears in Rivers Sole Administrator Ibas

Just in: Tinubu swears in Rivers Sole Administrator Ibok-ete Ibas

President Bola Tinubu has sworn in Vice Vice Admiral Ibok-ete Ibas (Retd.) as the Sole Administrator of Rivers State.

The administrator was sworn in on Wednesday after a short meeting with the President.

Tinubu announced the appointment of the retired naval chief at a nationwide broadcast on Tuesday, when he declared a state of emergency in Rivers State and suspended Governor Siminalayi Fubara, Deputy Governor, Ngozi Odu, and the state House of Assembly members.

The President said his decision was based on Section 305 of the 1999 Constitution, saying he could not continue to watch the political situation in Rivers escalate without taking concrete action.

The suspension of Fubara and other elected representatives has been rejected and condemned by many eminent Nigerians, legal luminaries, groups such as Atiku Abubakar, Peter Obi, Femi Falana, the Labour Party (LP), the Peoples Democratic Party (PDP) and the Nigerian Bar Association.

However, the emergency rule has been praised by the pro-Nyesom Wike Assembly led by Martins Amaewhule, accusing Fubara of contravening the Supreme Court ruling on the political situation in the state.

Ibas was the Chief of Naval Staff from 2015 to 2021.

He is from Cross River State where he had his early education.

The new sole administrator went to the Nigerian Defence Academy in 1979 from where he proceeded to have a successful career in the Navy, rising through the ranks to the very top.

He is a member of the Nigerian Institute of International Affairs (NIIA) and the Nigerian Institute of Management.

President Muhammadu Buhari who appointed him as Chief of Naval Staff conferred him with the National Honour of Commander of the Federal Republic (CFR) in 2022.

-

metro1 day ago

metro1 day agoCourt refers Ojukwu property case to alternative dispute resolution

-

Entertainment2 days ago

Entertainment2 days agoSome ladies in movie industry ready to sleep their way to fame — Jide Kosoko

-

metro2 days ago

metro2 days agoPresidency blasts Jonathan, Soyinka over comments on emergency rule in Rivers

-

metro2 days ago

metro2 days agoAdeleke University didn’t suspend Muslims for praying – MSSN

-

Politics2 days ago

Politics2 days agoAtiku, Obi, El-Rufai’s coalition can’t unseat Tinubu – Shekarau

-

metro2 days ago

metro2 days agoDisregard court order against Rivers Administrator, says Fubara’s aide

-

Politics2 days ago

Politics2 days agoPDP gives condition to back Atiku, Obi, El-Rufai in 2027

-

Entertainment2 days ago

Entertainment2 days agoActress Jayesimi blames mother for childlessness at 60