News

Tinubu didn’t create current economic problems, Presidency replies New York Times

Tinubu didn’t create current economic problems, Presidency replies New York Times

The presidency has declared that the present economic crisis being experienced by Nigerians was caused by the previous administration and not the present government.

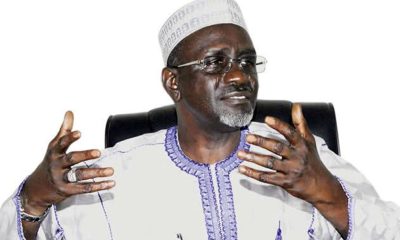

Bayo Onanuga, Special Adviser to President Bola Ahmed Tinubu on Information and Strategy, reacted Sunday in a statement to a piece on the Nigerian economy titled ‘Nigeria Confronts Its Worst Economic Crisis in a Generation’ published by the New York Times.

He said the article was not only predetermined but a “reductionist, derogatory, and denigrating way foreign media establishments reported African countries for several decades.”

In trying to put the report in perspective, the presidency said, “President Tinubu did not create the economic problems Nigeria faces today. He inherited them. As a respected economist in our country once put it, Tinubu inherited a dead economy,” adding that, “The economy was bleeding and needed quick surgery to avoid being plunged into the abyss, as happened in Zimbabwe and Venezuela.”

Onanuga noted that the above scenario was the background to the policy direction taken by the government in May/June 2023, “the abrogation of the fuel subsidy regime and the unification of the multiple exchange rates.”

The presidential aide said: “For decades, Nigeria had maintained a fuel subsidy regime that gulped $84.39 billion between 2005 and 2022 from the public treasury in a country with huge infrastructural deficits and in high need of better social services for its citizens.

“The state oil firm, NNPC, the sole importer, had amassed trillions of naira in debts for absorbing the unsustainable subsidy payments in its books. By the time President Tinubu took over the leadership of the country, there was no provision made for fuel subsidy payments in the national budget beyond June 2023. The budget itself had a striking feature: it planned to spend 97 percent of revenue servicing debt, with little left for recurrent or capital expenditure.”

READ ALSO:

- Finidi: Ex- Eagles Anichebe wants FG to sack NFF

- Two arrested for rape, armed robbery in Anambra

- Ohanaeze blames S:East politicians for Kanu’s detention

The presidency disclosed that the previous administration had resorted to massive borrowing to cover such costs. “Like oil, the exchange rate was also being subsidised by the government, with an estimated $1.5 billion spent monthly by the CBN to ‘defend’ the currency against the unquenchable demand for the dollar by the country’s import-dependent economy.

“By keeping the rate low, arbitrage grew as a gulf existed between the official rate and the rate being used by over 5000 BDCs that were previously licensed by the Central Bank. What was more, the country was failing to fulfil its remittance obligations to airlines and other foreign businesses, such that FDIs and investment in the oil sector dried up and, notably, Emirate Airlines cut off the Nigerian route,” it said.

It added that President Tinubu had to deal with the “cancer of public finance on the first day by rolling back the subsidy regime and the generosity that spread to neighbouring countries. Then, his administration floated the naira.

“After some months of the storm, with the naira sliding as low as N1,900 to the US dollar, some stability is being restored, though there remain some challenges. The exchange rate is now below N1500 to the dollar, and there are prospects that the naira could regain its muscle and appreciate to between N1000 and N1200 before the end of the year.

“The economy recorded a trade surplus of N6.52 trillion in Q1, as against a deficit of N1.4 trillion in Q4 of 2023. Portfolio investors have streamed in as long-term investors. When Diageo wanted to sell its stake in Guinness Nigeria, it had the Singaporean conglomerate, Tolaram, ready for the uptake. With the World Bank extending a $2.25 billion loan and other loans by the AfDB and Afreximbank coming in, Nigeria has become bankable again. This is all because the reforms being implemented have restored some confidence.”

The presidency also stated that inflationary rate is slowing down, as shown in the figures released by the National Bureau of Statistics for April, adding that, “Food inflation remains the biggest challenge, and the government is working very hard to rein it in with increased agricultural production.

“The Tinubu administration and the 36 states are working assiduously to produce food in abundance to reduce the cost. Some state governments, such as Lagos and Akwa Ibom, have set up retail shops to sell raw food items to residents at a lower price than the market price.

“The Tinubu government, in November last year, in consonance with its food emergency declaration, invested heavily in dry-season farming, giving farmers incentives to produce wheat, maize, and rice. The CBN has donated N100 billion worth of fertiliser to farmers, and numerous incentives are being implemented. In the western part of Nigeria, the six governors have announced plans to invest massively in agriculture.”

Tinubu didn’t create current economic problems, Presidency replies New York Times

News

Why governors’ forum is silent on Rivers emergency, by DG

Why governors’ forum is silent on Rivers emergency, by DG

The Nigeria Governors’ Forum (NGF) yesterday attributed its neutral position on the recent declaration of a state of emergency in Rivers State to the need to steer clear of taking positions that may alienate members with varying political interests.

Taking positions on contentious partisan issues, the NGF said, would not augur well for it, especially in view of its past experience in fundamental division.

Notwithstanding, the declaration of the state of emergency by President Bola Tinubu yesterday generated more kudos and knocks from across the country.

Special Adviser to the President on Senate Matters, Senator Basheer Lado, said the action of the president was meant to ensure protection of lives and restoration of law and order in the state, while the President’s Special Adviser on Media and Public Communications, Sunday Dare, said his principal was required to “avert needless harm and destruction .”

National Publicity Secretary of the ruling All Progressives Congress (APC), Felix Morka, said Tinubu, by his action, cleared what had manifested as a constitutional crisis in Rivers state.

But former President Goodluck Jonathan saw it from a different perspective.

READ ALSO:

- Senate didn’t get 2\3 majority for Tinubu emergency rule in Rivers –Tambuwal

- FG destroys another 200 containers of expired drugs

- Rivers court bars woman from answering ex-husband’s name

He described “abuse of office and power by the three arms of government in the country“ as a dent on Nigeria’s image.

The NGF, in a statement by its Director General Abdulateef Shittu, said it is essentially “an umbrella body for sub-national governments to promote unified policy positions and collaborate with relevant stakeholders in pursuit of sustainable socio-economic growth and the well-being of the people.”

It added: “As a technical and policy hub comprising governors elected on different platforms, the body elects to steer clear of taking positions that may alienate members with varying political interests.

“In whatever language it is written, taking positions on contentious partisan issues would mean a poor sense of history — just a few years after the forum survived a fundamental division following political differences among its members.

“Regardless, the Forum is reputed for its bold positions on governance and general policy matters of profound consequences, such as wages, taxes, education and universal healthcare, among others.”

It asked for “the understanding of the public and the media, confident that appropriate platforms and crisis management mechanisms would take care of any such issues.”

Why governors’ forum is silent on Rivers emergency, by DG

News

Rivers: Tinubu acted to save state, economy, says Karimi

Rivers: Tinubu acted to save state, economy, says Karimi

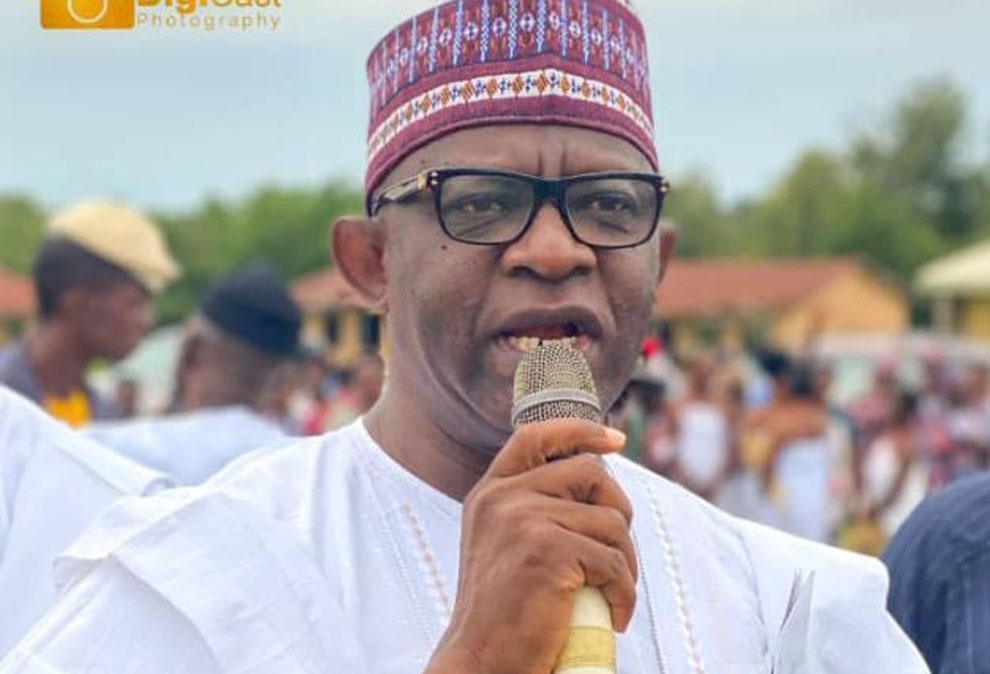

Chairman of the Senate Services Sunday Karimi has hailed President Bola Tinubu for the decision to declare a state of emergency in Rivers State.

He told reporters on Friday in Abuja that the President acted in the best interest of the State and Nigeria, having taken his decision in compliance with the Constitution.

“No President or government worth a name, will fold its arms and watch a political situation deteriorate to what we saw unfolding in Rivers State.

“We saw that bombing of pipelines had begun, and the security situation was getting worse with the tension everywhere”, Karimi stated.

Karimi, who represents Kogi-West on the ticket of the All Progressives Congress (APC), recalled the “fatherly role” Tinubu had played in the crisis since 2023 in a bid to get the Minister of the Federal Capital Territory (FCT), Nyesom Wike, and suspended Governor Siminalayi Fubara to reach an understanding, to no avail.

He explained: “We were all here in 2023 when Mr President called that truce meeting at the Aso Rock Villa. There was the eight-point agenda for settlement reached between the factions.

“When Nigerians expected that progress should be made to achieve peace, things started deteriorating considerably to a point where the governor demolished the House of Assembly building and administered the state with only three legislators.”

READ ALSO:

- Oluwo accuses Ooni of plotting to dethrone him

- Natasha: Court blocks recall attempt, stops INEC

- US ends legal status for 500,000 immigrants

Karimi observed that with the recent judgment of the Supreme Court, which gave the upper hand to the 27 lawmakers loyal to the camp of the FCT Minister, matters merely got worse in the State as the lawmakers were set to impeach the Governor.

“What did you expect would be the implications? There would have been more destruction, killings and economic losses for the country.

“With the bombings that had already started, it was a matter of time before the whole state would be engulfed in flames. No responsible President would sit, arms folded, and allow that to happen “ he added.

The senator further argued that it took “painstaking efforts” by the administration to raise daily crude oil production to around 1,800 barrels, noting that Nigeria’s economy was already “witnessing a rebound under the renewed hope projects of the government.”

“Allowing the situation in Rivers to get worse before he would act, wouldn’t have helped the state or Nigeria as a country in any way.

“Mr. President intervened at the right time, and his actions are covered by law,” he said.

Karimi also spoke on the emergency declaration in Borno, Yobe, Adamawa and a couple of other states by former President Goodluck Jonathan without removing the Governors from office or suspending the state assemblies.

According to him, the case with those States was not generated by political crises but rather security concerns.

“So, I will advise those comparing the two scenarios to remember that one was purely about security threats resulting from the insurgency caused by Boko Haram, while that of Rivers is clearly political.

“It was the proper thing to do to suspend the political actors in the two factions to allow for tensions to diffuse. Nigerians should appreciate the President for the action he has taken so far,” he stated.

Sen. Karimi also noted that there was no cause for alarm as the National Assembly had indicated that the emergency rule could be reviewed as soon as there were signs that things could quickly normalise in Rivers State.

Rivers: Tinubu acted to save state, economy, says Karimi

News

Just in: Tinubu swears in Rivers Sole Administrator Ibas

Just in: Tinubu swears in Rivers Sole Administrator Ibok-ete Ibas

President Bola Tinubu has sworn in Vice Vice Admiral Ibok-ete Ibas (Retd.) as the Sole Administrator of Rivers State.

The administrator was sworn in on Wednesday after a short meeting with the President.

Tinubu announced the appointment of the retired naval chief at a nationwide broadcast on Tuesday, when he declared a state of emergency in Rivers State and suspended Governor Siminalayi Fubara, Deputy Governor, Ngozi Odu, and the state House of Assembly members.

The President said his decision was based on Section 305 of the 1999 Constitution, saying he could not continue to watch the political situation in Rivers escalate without taking concrete action.

The suspension of Fubara and other elected representatives has been rejected and condemned by many eminent Nigerians, legal luminaries, groups such as Atiku Abubakar, Peter Obi, Femi Falana, the Labour Party (LP), the Peoples Democratic Party (PDP) and the Nigerian Bar Association.

However, the emergency rule has been praised by the pro-Nyesom Wike Assembly led by Martins Amaewhule, accusing Fubara of contravening the Supreme Court ruling on the political situation in the state.

Ibas was the Chief of Naval Staff from 2015 to 2021.

He is from Cross River State where he had his early education.

The new sole administrator went to the Nigerian Defence Academy in 1979 from where he proceeded to have a successful career in the Navy, rising through the ranks to the very top.

He is a member of the Nigerian Institute of International Affairs (NIIA) and the Nigerian Institute of Management.

President Muhammadu Buhari who appointed him as Chief of Naval Staff conferred him with the National Honour of Commander of the Federal Republic (CFR) in 2022.

-

metro2 days ago

metro2 days agoAttack on Mufty of Ilorin: Onikijipa Family Charges Stakeholders to Call Sheikh Habibullahi Al-Ilory to Order

-

metro3 days ago

metro3 days agoCourt refers Ojukwu property case to alternative dispute resolution

-

Health2 days ago

Health2 days agoNigerian doctor pioneers W’Africa first robotic prostate cancer surgery

-

metro3 days ago

metro3 days agoCBN rejects Osun nomination of ex-Aregbesola’s commissioner as bank director

-

metro3 days ago

metro3 days agoRivers: Presidency reveals security intelligence leading to emergency rule

-

metro2 days ago

metro2 days agoFubara: Supreme Court reacts to photo of Justice Agim with Wike

-

metro2 days ago

metro2 days agoUNIOSUN mourns as 5 students die in auto crash

-

metro3 days ago

metro3 days agoShehu Sani faults senators taking voice vote objection to media