Business

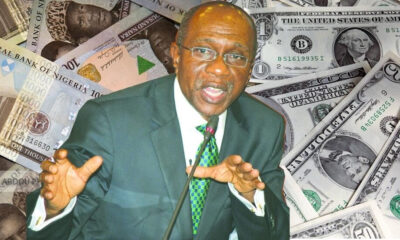

Omicron: Be prepared for ‘hurtful’ policies, Emefiele tells banks

•Urges financial institutions to enhance lending to boost growth

•CBN disburses N370bn targeted credit facility to households, MSMEs

•Sanwo-Olu commends bankers’ committee’s COVID-19 response

Following the renewed threat of the COVID-19 occasioned by the new Omicron variants, the Central Bank of Nigeria (CBN) Governor, Mr. Godwin Emefiele has said banks should be prepared for policies that could upset their quest to make more profit for their shareholders.

Speaking in Lagos yesterday, he also appealed to members of the Bankers’ Committee to be prepared to lend their support to the country whenever the need arises as they did in the past under the umbrella of CACOVID.

This is just as he revealed that the CBN through its Target Credit Facility (TCF) had disbursed a total of N370 billion to households as well as micro, small and medium sized enterprises (MSMEs) in line with efforts to stimulate economic activities.

Emefiele said these at the 12th Annual Bankers’ Committee retreat with the theme: ‘Building Resilience for Economic Growth.’

The CBN had as part of efforts to cushion the devastating effects of the COVID-19 on households and firms introduced the TCF in March 2020, which has since attracted 800,000 beneficiaries till date with an outstanding of N30 billion still available for disbursement.

READ ALSO:

- Why I buried my father without drinks, food, party — Akintola

- Enugu ‘King of Satan’ with 59 wives, 300 children dies at 74

- Housewife, 4 others kidnapped while returning from market in Kogi

“Yes, the economy is growing, inflation is moderating, we are beginning to see signs even in the midst of the third or the fourth pandemic, but I must say that whereas we see the green light at the end of the tunnel, I must say that the road ahead for us to get to the green light remains very rough.

“We will continue to crave your support to work with us because we will continue to come up with policies that in your own boardrooms you will find hurtful to your own quest to make more profit for your shareholders,” he said.

Emefiele who thanked members of the Bankers’ Committee said: “When COVID-19 broke, we called on the banks under the umbrella of CACOVID and the banking industry stood strong with the private sector and we did the little we could to help our country and to help our people to overcome the challenges of COVID-19.

“The banking industry constitutes a very important segment of the monetary policy and of government, even from textbooks that we have read in economics, banks constitute what we can call catalysts to growth in any economy.

“We called on you, we did several things appealing to you, it got to a point where I was beginning to appeal to say, look, how can we have a situation where the banking industry is growing, the banks are declaring profit but the economy is not growing well, or that our people are living in destitution and that it is not possible for us as bankers to live a comfortable life and yet in the midst of destitution and problems in our country.

“We did call on you and you rose to the occasion and you supported. I thank you, sincerely. I cannot say that central bank did this alone, everything that we have done since February 2020, realising your importance as a catalyst to growth in the economy has been with your support, I thank you.

“I must say, yes, the economy is growing, yes, inflation is moderating, yes, we are beginning to see signs even in the midst of the third or the fourth pandemic, but I’m most say that whereas we see the green light ahead of us at the end of the tunnel, but I must say that the road ahead for us to get to the green light at the end of the tunnel remains very, very rough.

READ ALSO:

- Shehu Sani slams NASS for approving Buhari’s loans without hassle

- You’re lying, selling out Yoruba race to make Tinubu president, Pa Adebanjo slams Akande

- Monguno lists religious groups ‘backing terrorism’ in Nigeria

“We will continue to count that you rely and work with us to say that it’s not just about you making profit for your shareholders but it is also about you contributing to the growth of our economy even where there are some discomforts, you will play your part, stand strong and support the government and support the Central Bank of Nigeria to deliver a stronger and resilient economy.”

Also, Emefiele, while addressing participants at the retreat called on banks to enhance credit to critical sectors of the economy, stressing the need for the country’s Gross Domestic Product (GDP) to rise above five per cent annually, higher than its present average growth rate of 2.7 per cent.

Emefiele said: “Given our mandate to promote a sound monetary and financial system, and working with the fiscal authorities, the CBN took unprecedented measures to contain the effects of the pandemic on our economy and spurred increased productivity in key sectors.

“First, the CBN collaborated with the fiscal authorities to formulate strong policy support measures through the Economic Sustainability Plan (ESP) to restore stability and catalyse growth.

“In support of the recovery efforts, the bank deployed more than N3.5 trillion, which is about 4.1 per cent of Nigeria’s GDP, to support critical sectors including agriculture, manufacturing, healthcare, electricity, and construction. Other CBN policy measures that we took to help the economy recover included a reduction of the monetary policy rate from 13.5 percent to 11.5 percent to spur lending.

“The reduction of the interest rate on all CBN intervention loans from nine per cent to five per cent, extension of the moratorium on principal repayments for CBN intervention facility to March 2022, regulatory forbearance for banks to restructure loans to sectors severely affected by the pandemic and creation of a N400 billion TCF for households and small and medium enterprises. Of this, nearly N370 billion has been released to over 800,000 beneficiaries.”

Speaking further, the Emefiele also pointed out that a N1 trillion facility for local manufacturing and production in critical sectors of the economy was also established. On this, so far, 53 manufacturing, 21 agriculture-related, and 13 service projects had been funded from this facility.

In addition, he reiterated that a N200 billion healthcare intervention fund for pharmaceutical companies and healthcare practitioners was also established in the wake of the pandemic, to expand and strengthen the capacity of the country’s healthcare institutions and mobilise.

READ ALSO:

- 2023: I am still consulting, says Tinubu

- Photos: Toyota Nigeria shines as Starlet, Hilux, Hiace, Ade.Ojo win NAJA awards

- Bandits attack travellers on Kaduna-Zaria highway, kill one, abduct many

Furthermore, he disclosed that the CBN mobilised key stakeholders in the Nigerian economy, under the Private Sector Coalition Against Covid-19 (CACOVID) team that raised N39.65 billion to tackle the scourge.

“Continued implementation of efforts to boost credit to productive sectors is required to sustain the recovery, quicken growth, and improve the livelihood of Nigerians.

“With population growth at about 2.7 percent annually, it is important that we continue to deploy measures that will enable our economy to attain faster and balanced growth rates of over 5 percent on an annual basis.

“In furtherance of these efforts and given current global realities, I enjoin and challenge this Bankers’ Committee Retreat to focus on fashioning out strategies to fortify the fabric of the Nigerian economy, boost growth and engender resilience especially to exogenous shocks.

“To spur growth, we will need to assess policy measures that can address subsisting imbalances and constraints to finance. This retreat should provide actionable steps to ensure that the Bankers’ Committee continue to make meaningful contributions to Nigeria’s growth and development,” he added.

Also, the CBN Governor outlined some of the policies the apex bank has undertaken in recent time to support the federal government in its job-creation as well as economic diversifican drive.

The he listed to include the 00 for 100 Initiative, under which targeted credit of up to N5 billion would be provided to 100 firms every 100 days.

READ ALSO:

- NUC rates University of Ibadan best varsity in Nigeria

- UK makes a U-turn, to lift travel ban on Nigeria, others

- Inspector shot dead as gunmen attack Abia State Police Command Headquarters

Selected firms would be those investing in Greenfield projects, significantly able to create employment opportunities, and use local raw materials. The initiative will also support firms producing goods for the export market.

“On the growth of the digital economy, the CBN is focused on building a robust payment system in Nigeria which is cheap, fast, efficient, and safe. With the growing pace of digitalisation globally, we will continue to leverage digital channels in fulfilling this objective.

“Reflective of the confidence in our payment system, between 2015 and 2020, about $700 million has been invested in firms run by Nigerian founders,” he added.

“The eNaira which is the first central bank digital currency in Africa and one of the first in the world, the eNaira will foster greater financial inclusion using digital channels, support cross-border payments for businesses and firms, and provide a reliable channel for remittance inflows into the country.

“The eNaira will ensure that Nigerians in remote areas can conduct financial activities using their digital devices at little or no cost,” Emefiele said.

In his address at the retreat, Lagos State Governor, Mr. Babajide Sanwo-Olu commended the CBN and the Bankers’ Committee over their policy response and monetary support to spur growth in the economy as well as in fighting the pandemic.

Sanwo Olu said: “I’m expecting that the retreat is not only strategic by providing a platform for all of you to review the various monetary policies and all the intervention program and to provide an opportunity for you to know what the New Year would have for all of us.

“It’s also very appropriate that at this time I commend and thank the leadership of the CBN and Bankers’ Committee in the way and manner that you’ve all stood up and addressed this challenging situation.”

Thisday

Business

Dangote urges wealthy Nigerians to invest in industries, not luxury cars, private jets

Dangote urges wealthy Nigerians to invest in industries, not luxury cars, private jets

Africa’s richest man, Aliko Dangote, has called on wealthy Nigerians to redirect funds currently spent on luxury cars and private jets into industrial investments that can generate jobs and foster sustainable economic growth.

In a widely shared interview, the Dangote Group chairman warned that the country’s elite have increasingly prioritized lavish spending over productive ventures. “If you have money to buy a Rolls-Royce, you should take that money and put up an industry in your locality or anywhere there is need,” Dangote said.

He expressed concern over the number of private jets parked at local airports, arguing that the resources tied up in such assets could instead create employment opportunities.

READ ALSO:

- Mohamed Salah Slams Liverpool Boss Arne Slot, Hints at Anfield Exit Ahead of AFCON Departure

- Indonesia Flood Disaster: Death Toll Exceeds 900 as Search for Hundreds Continues

- Russia Intensifies Airstrikes on Ukraine as Zelensky, Trump Envoys Advance Peace Talks

Dangote highlighted Nigeria’s growing population, with an estimated 7.8 million births annually, stressing that both government and private sector actors must invest in infrastructure, power, and productive businesses.

Acknowledging the country’s high taxes, he maintained that businesses must still meet their obligations. “For a company like ours, the tax we pay is too much, but we don’t mind… What we are asking for is an enabling environment, but we too must do our civic duties,” he said.

He also urged Nigerians to prioritize domestic investment over foreign capital, noting that attracting investment depends on good policy and rule of law. “We should stop calling for foreign investors because there’s no foreign investor anywhere. What attracts investment is good policy and rule of law,” Dangote added.

Dangote urges wealthy Nigerians to invest in industries, not luxury cars, private jets

Business

Imo Economic Summit: Aliko Dangote Vows to Become State’s Largest Investor

Imo Economic Summit: Aliko Dangote Vows to Become State’s Largest Investor

OWERRI — Africa’s richest man, Aliko Dangote, has assured Imo State Governor Hope Uzodimma that the Dangote Group is prepared to become one of the biggest investors in Imo State, reaffirming the conglomerate’s commitment to expanding its footprint in Nigeria.

Speaking on Thursday during the opening session of the Imo Economic Summit 2025, Dangote called on the state government to specify key sectors requiring investment, promising immediate action once directives are given.

Dangote, who described Governor Uzodimma as a long-time friend, commended him for fostering an enabling environment for business and economic growth in the state.

READ ALSO:

- NSCDC rejects VIP protection requests from senators as demand surges after police withdrawal

- Edo Assembly Moves to Arrest Obaseki, Others Over MOWAA, Radisson Hotel Probe

- Three Top Contenders to Replace William Troost-Ekong as Super Eagles Captain

“We will be one of your biggest investors in Imo. So please tell me the area to invest and we will invest,” he said.

The African industrialist also encouraged Nigerian entrepreneurs to focus on developing their home regions, stressing that sustainable economic growth cannot depend on foreign capital alone.

“What attracts foreign investors is a domestic investor. Africa has about 30 percent of the world’s minerals. We are blessed,” he noted.

Dangote further highlighted progress at the Dangote Refinery, announcing that the facility is on track to achieve a 1.4 million barrels-per-day production capacity, making it the largest single-train refinery in the world.

The assurance marks a significant boost for Imo State’s investment outlook as the government continues efforts to strengthen its economy and attract large-scale private sector participation.

Imo Economic Summit: Aliko Dangote Vows to Become State’s Largest Investor

Auto

Court of Appeal Affirms Ruling Barring VIO from Seizing Vehicles or Fining Motorists

Court of Appeal Affirms Ruling Barring VIO from Seizing Vehicles or Fining Motorists

The Court of Appeal, Abuja, on Thursday, upheld a previous Federal High Court judgment prohibiting the Vehicle Inspection Officers (VIO) and the Directorate of Road Traffic Services (DRTS) from confiscating vehicles or imposing fines on motorists without lawful authority.

A three-member panel of appellate justices, led by Justice Oyejoju Oyewumi, dismissed the appeal filed by the VIO, describing it as lacking merit and affirming the October 16, 2024 ruling of the high court.

The original suit, marked FHC/ABJ/CS/1695/2023, was filed by public interest lawyer Abubakar Marshal, who alleged that he was unlawfully stopped and had his vehicle confiscated by VIO officials at Jabi District, Abuja, on December 12, 2023. He contended that the action was a violation of his fundamental rights.

READ ALSO:

- FG secures release of three Nigerians detained in Saudi Arabia

- Groups Reject Senator’s Call for Removal of NSA Nuhu Ribadu

- US authorities arrest Nigerian CEO Cashmir Chinedu Luke for alleged $7m VA fraud

Justice Nkeonye Maha of the Federal High Court had declared that no law empowers the VIO to stop, seize, impound, or fine motorists, and granted a perpetual injunction restraining the agency and its agents from further violating citizens’ freedom of movement, presumption of innocence, and right to own property.

The court held that only a court of competent jurisdiction can impose fines or sanctions on motorists. It further ruled that the actions of the Respondents violated Section 42 of the 1999 Constitution and relevant articles of the African Charter on Human and Peoples’ Rights.

Although the applicant had sought N500 million in damages and a public apology, the court awarded him N2.5 million. Respondents included the Director of the Directorate of Road Traffic Services, the Abuja Area Commander, the team leader, and the Minister of the Federal Capital Territory.

The appellate court’s decision confirms that the VIO and DRTS cannot legally harass motorists, reinforcing citizens’ constitutional rights on the road.

Court of Appeal Affirms Ruling Barring VIO from Seizing Vehicles or Fining Motorists

-

metro3 days ago

metro3 days agoSenate Launches Emergency Probe into Widespread Lead Poisoning in Ogijo, Lagos/Ogun

-

Auto3 days ago

Auto3 days agoCourt of Appeal Affirms Ruling Barring VIO from Seizing Vehicles or Fining Motorists

-

Sports1 day ago

Sports1 day ago2026 FIFA World Cup Draw: England Draw Croatia as Brazil Face Morocco in Tournament Opener

-

News3 days ago

News3 days agoUS authorities arrest Nigerian CEO Cashmir Chinedu Luke for alleged $7m VA fraud

-

metro3 days ago

metro3 days agoFG secures release of three Nigerians detained in Saudi Arabia

-

News1 day ago

News1 day agoAkpabio sues Natasha for ₦200bn over sexual harassment allegations

-

metro3 days ago

metro3 days agoNed Nwoko vows legal action against rising online harassment, criminal defamation

-

metro2 days ago

metro2 days agoTinubu Govt Eliminates More Terrorists Than Previous Administrations — Fani-Kayode