Business

Crypto assets may displace local currencies in developing countries — IMF

The International Monetary Fund has said some emerging markets and developing economies face immediate and serious risks of currency substitution by crypto assets.

The IMF disclosed this in a report titled, ‘Global Crypto Regulation Should be Comprehensive, Consistent, and Coordinated’ released on Thursday.

In the report, the IMF said its mandate is to safeguard the stability of the international monetary and financial system.

The Washington DC-based fund said, “Some emerging markets and developing economies face more immediate and acute risks of currency substitution through crypto assets, the so-called cryptoisation.

“Capital flow management measures will need to be fine-tuned in the face of cryptoisation. This is because applying established regulatory tools to manage capital flows may be more challenging when value is transmitted through new instruments, new channels and new service providers that are not regulated entities.”

READ ALSO:

- State of the Nation: I don’t sympathise with you, you applied to be President — Akande tells Buhari

- Former Super Falcons’ goalkeeper, Ayegba, turns bus driver in UK

- BREAKING: Suspected bandits kill 16 worshippers in Niger

According to the IMF, crypto assets will soon pose systemic financial stability in some countries as policy makers struggle to the monitor risks.

It added that crypto assets were drastically changing the financial system it was trying to protect.

The IMF said, “Crypto assets and associated products and services have grown rapidly in recent years. Furthermore, inter linkages with the regulated financial system are rising.

“Policymakers struggle to monitor risks from this evolving sector, in which many activities are unregulated. In fact, we think these financial stability risks could soon become systemic in some countries.”

“While the nearly $2.5tn market capitalisation indicates significant economic value of the underlying technological innovations such as the blockchain, it might also reflect froth in an environment of stretched valuations.”

According to the international fund body, identifying, monitoring, and management of crypto-related risks continues to defy regulators and firms.

It added that in developing economies for instance, cryptoisation was threatening to replace domestic currency, and circumvent exchange restrictions and capital account management measures.

The IMF said, “Such risks underscore why we now need comprehensive international standards that more fully address risks to the financial system from crypto assets, their associated ecosystem, and their related transactions, while allowing for an enabling environment for useful crypto asset products and applications.”

The IMF added that crypto’s cross-sector and cross-border remit limits the effectiveness of national approaches. The body said, “Countries are taking very different strategies, and existing laws and regulations may not allow for national approaches that comprehensively cover all elements of these assets.

READ ALSO:

- Buhari in Lagos, commissions 118 ships, boats, helicopter

- Tension in Imo as gunmen abduct traditional ruler

- Breaking: Two students stopped from taking exams over Hijab in Lagos school

“Importantly, many crypto service providers operate across borders, making the task for supervision and enforcement more difficult. Uncoordinated regulatory measures may facilitate potentially destabilising capital flows.”

According to the IMF, there is a need for a global regulatory framework that provides a level playing ground along the activity and risk spectrum.

It said crypto-asset service providers that deliver critical functions should be licensed or authorised.

The IMF said, “These would include storage, transfer, settlement, and custody of reserves and assets, among others, similar to existing rules for financial service providers.

“Licensing and authorisation criteria should be clearly articulated, the responsible authorities clearly designated, and coordination mechanisms among them well defined. Requirements should be tailored to the main use cases of crypto assets and stablecoins.”

The IMF added there was an urgent need for cross-border collaboration and cooperation to address technological, legal, regulatory, and supervisory challenges.

“Crypto assets are potentially changing the international monetary and financial system in profound ways,” it added.

Punch

Auto

Chanrai Storms Nigeria’s Gas Market, Unveils High-Capacity CNG, LNG Solutions to Power Energy Shift

Chanrai Storms Nigeria’s Gas Market, Unveils High-Capacity CNG, LNG Solutions to Power Energy Shift

By Rasheed Bisiriyu

Nigeria’s drive towards cleaner and more affordable transport fuel gathered fresh momentum on Friday as Chanrai Nigeria Limited formally entered the country’s gas distribution space, unveiling high-capacity CNG and LNG compression technologies in Lagos.

The company, a member of the globally diversified Kewalram Chanrai Group, announced a strategic partnership with India’s Tulip Compression to roll out advanced compressor packages and integrated “single window” CNG solutions aimed at accelerating the Federal Government’s Presidential CNG Initiative.

Chief Operating Officer of Chanrai Nigeria Limited, Anil Sahgal, described the Tulip CNG Compressor Packages as a “game-changer” for Nigeria’s evolving energy landscape.

“With our commitment to safety, efficiency and OEM-grade partnership, we’re empowering the nation to achieve its CNG ambitions while driving economic growth and environmental sustainability,” Sahgal said.

The move marks Chanrai’s expansion beyond its traditional business interests — which span automobiles, agro-products, healthcare and fast-moving consumer goods — into the fast-growing gas infrastructure segment, as fleet operators and industrial users increasingly seek alternatives to petrol and diesel.

Under the partnership, Chanrai Nigeria and Tulip Compression will deliver Compression Station on Single Window (CssW) solutions — integrating compressors, dispensers, storage and stainless-steel tubing under one brand — to simplify deployment and reduce installation timelines.

The compressor packages come in a wide capacity range, from 250 to 4,500 standard cubic metres per hour, making them suitable for small refuelling stations as well as large gas hubs.

A 1,400 SCMH gas engine-driven booster compressor is designed to refuel heavy-duty CNG trucks in about 20 minutes by drawing gas from tube trailers.

The systems are available in both electric motor-driven and gas engine-driven configurations, eliminating the need for large gas generators while ensuring energy efficiency and lower life-cycle costs.

According to the company, the equipment features dual-chamber leak-proof safety systems, advanced sealing technology to eliminate gas loss and global certifications including ATEX, CE, BIS and SGS standards.

The unveiling underscores the growing private sector response to government reforms encouraging gas adoption as a cost-effective and environmentally friendly alternative fuel.

With the compressor packages now available for immediate orders, Chanrai Nigeria said it would provide 24/7 after-sales support, operations and maintenance services, as well as remote asset monitoring solutions.

The development signals intensifying investment in CNG infrastructure as Nigeria seeks to deepen local gas utilisation, reduce fuel import dependence and cushion consumers from volatile petrol prices.

Entertainment

NRC, Entertainers Finalise Plans for 2026 Valentine Train Ride

NRC, Entertainers Finalise Plans for 2026 Valentine Train Ride

A team of leading Nigerian artistes and entertainment executives has paid a courtesy visit to the Managing Director of the Nigerian Railway Corporation (NRC), Kayode Opeifa, ahead of the 2026 Valentine Love Train experience.

The delegation included celebrated musician Sunny Neji, Managing Director of Ojez Entertainment Limited, Joseph Odobeatu, and veteran vocalist Yinka Davies.

The high-profile visit formed part of final preparations for the Valentine-themed train ride scheduled for Saturday, February 14, 2026, at the Mobolaji Johnson Train Station.

Dr. Opeifa received the artistes and commended the creative industry for choosing the national rail system as the venue for the annual Valentine event. He noted that the partnership reflects growing public confidence in the corporation’s safety standards, operational improvements, and renewed focus on customer experience.

READ ALSO:

- 2027 General Elections: INEC Announces February 20 for Presidential Poll

- EFCC Nabs Three in Borno Over Viral ₦500 Naira Mutilation Video

- Omokri Accuses El-Rufai of Rights Abuses During Kaduna Governorship

“The 2026 edition aims to deliver an unforgettable experience while deepening public engagement with the rail service,” Opeifa said, reaffirming the NRC’s commitment to providing secure and efficient transport for passengers during special events.

Organisers disclosed that this year’s edition will feature an expanded entertainment lineup, including performances and appearances by Charles Inojie, Yinka Davies, Sunny Neji, and Segun Arinze. Guests are expected to enjoy live music, comedy, a couple’s game show, fashion showcases, and special performances throughout the Lagos–Ibadan–Lagos train ride, culminating in a Valentine banquet ball.

The Valentine Love Train has in recent years become a fixture on the NRC’s festive calendar, attracting couples, families, and leisure seekers with its blend of travel, romance, and entertainment. The initiative also aligns with ongoing efforts by the corporation to promote rail transportation as a viable and enjoyable alternative for intercity travel.

With final logistics being fine-tuned, organisers say the 2026 edition promises to combine safety, comfort, and premium entertainment for participants.

NRC, Entertainers Finalise Plans for 2026 Valentine Train Ride

Auto

Lagos Motor Fair, Autoparts Expo to begin March 17, targeting Investment, Industry Growth

Lagos Motor Fair, Autoparts Expo to begin March 17, targeting Investment, Industry Growth

The 20th edition of the Lagos International Motor Fair and the 13th Africa Autoparts Expo is set to spotlight investment, technology transfer and industry collaboration as organisers intensify efforts to position Nigeria as a major automotive hub in West Africa.

The three-day event, which will also incorporate the Africa Motorcycle and Tricycle Expo, is scheduled to hold from March 17 to 19, 2026, at the Federal Palace Hotel in Lagos.

Organisers said the upcoming edition would focus strongly on accelerating the development of the country’s automotive sector by creating platforms that connect global manufacturers with local industry players.

“Nigeria has all it takes to become a global automotive industry giant,” the organisers stated, noting that the fair remains a strategic contribution toward driving growth despite prevailing industry challenges.

Chairman of the Organising Committee, Ifeanyichukwu Agwu, said the exhibitions had over the years evolved into a key platform for attracting investment into automobile spare parts and accessories manufacturing while strengthening aftermarket activities across the region.

“We have consistently used these events to attract investment into auto components manufacturing and to showcase the enormous capacity and potential of this critical sector of the economy,” he said.

READ ALSO:

- First Daughter of Murtala Muhammed Reflects on Life Without Father, Preserving His Legacy

- Anambra Police Arrest Motel Owner, Two Others Over Firearms, Drug Trafficking

- 2 Nigerians Killed While Fighting for Russian Army in Ukraine War

Agwu, who also serves as Managing Director of BKG Exhibitions Limited, disclosed that the 2026 edition would place emphasis on business-to-business engagement between original equipment manufacturers (OEMs) and auto parts dealers from Nigeria and neighbouring countries.

According to him, the goal is to foster partnerships capable of leading to the establishment of component manufacturing plants locally.

He added that the exhibition is expected to support government policies aimed at building a sustainable automotive industry by stimulating the emergence of companies involved in component production.

Calling for policy adjustments, Agwu urged the Federal Government to prioritise spare parts and components manufacturing over vehicle assembly, arguing that deeper technology transfer and innovation occur within the components segment.

“Spare parts manufacturing is where real technology transfer occurs. It involves precision engineering, planning and innovation—far beyond the coupling processes involved in assembly,” he said, while also advocating a review of the existing automotive policy to better support local production.

Despite the challenges associated with hosting large-scale industry events, Agwu reaffirmed the organisers’ commitment to sustaining the platform, warning that neglecting the automotive sector could have far-reaching consequences for the economy and employment.

The organisers said more than 100 original components manufacturers from countries including China, India, South Korea, South Africa, Singapore and Turkey, alongside major automobile distribution and manufacturing companies operating in Nigeria, are expected to participate.

In addition to product exhibitions, the event will feature seminars and technical workshops focusing on policy, investment opportunities, technology transfer and industry best practices, with each day structured to deliver value to exhibitors, investors, policymakers and other stakeholders.

Lagos Motor Fair, Autoparts Expo to begin March 17, targeting Investment, Industry Growth

-

Education1 day ago

Education1 day agoCheck Your Name: UNILORIN Releases Updated NELFUND Refund List for 2024/2025 Students

-

News16 hours ago

News16 hours agoOsogbo Sons and Daughters Mark 5th Anniversary with Awards, Political Undertones

-

metro2 days ago

metro2 days agoWoman Arrested Over Murder of Nigerian E-Hailing Driver in South Africa

-

metro2 days ago

metro2 days agoBoko Haram Terrorists Release Video of 176 Abducted Kwara Residents

-

News1 day ago

News1 day agoAfenifere Calls for Immediate Take-Off of State Police as Terror Threats Rise in Yorubaland

-

metro3 days ago

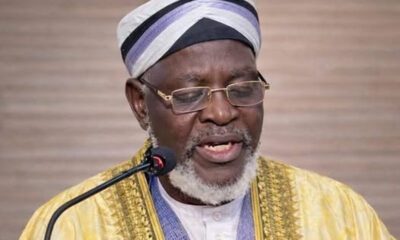

metro3 days agoCourt Orders DIA to Produce Cleric Accused of Coup Plot by February 18

-

metro1 day ago

metro1 day agoUS Military Boosts Support for Nigeria’s Fight Against Insurgency With Ammunition, Troop

-

metro1 day ago

metro1 day agoArgungu Festival 2026 Highlights Peace, Stability, Economic Growth — Tinubu