News

Stolen $2bn: Report exposes Abacha looting machinery, strategies

- FG drags UK to court over £150m loot

Fresh facts have emerged on the modus operandi used by a former Head of State, late Gen. Sani Abacha, to steal humongous amount from Nigeria’s treasury and stashed the funds running into two billions of dollars away in secret foreign accounts.

This is coming as the Nigerian government has sued Britain’s National Crime Agency (NCA) over €180 million (£150 million) reportedly stashed abroad by the late dictator, asking that the funds be returned to the country (Nigeria).

In a new report by the Telegraph of the UK, Abachi was said to have executed the looting after seizing power in a 1993 coup, using his position as Nigeria’s head of state to place himself above the law and skim vast sums of money from the oil-rich nation.

For instance, the report stated that he would tell advisers to make spurious requests to him for money to deal with national “emergencies”, according to the US court documents.

Signed letters would then be sent to the CBN, which would provide cash, travellers’ cheques or arrange a wire transfer.

The report added, “Money was stuffed into boxes or bags and transported to Abacha’s house, before associates arranged for it to be sent abroad.

“At least $2 billion is thought to have been stolen this way, using more than 60 letters to the central bank.

“Abacha also arranged for the government to sell bonds to a company controlled by his allies before buying them back at vastly inflated prices, generating an illicit windfall of $282 million.”

Separately, the report stated that Abacha and his associates extorted French engineering firm, Dumez Group, of $97 million and used his spoils to live a luxurious lifestyle.

“Inside his many sprawling homes, he kept piles of glittering jewellery, including gold necklaces and rings, and at one stage as much as $100 million in cash,” the report noted.

However, the money Abacha and his associates plundered became the subject of an international search after the dictator’s sudden death in 1998 at the age of 54.

The report stated that weeks after his death, Abacha’s widow was caught trying to flee the country with 38 suitcases packed with money and his family later forfeited nearly $1 billion.

“Yet the only clues hinting at where other stashes of money could be found were a few details of secret offshore bank accounts discovered by authorities,” it said.

“Since then, the Nigerians have sought foreign help to recover as much as possible, with more than $1 billion eventually returned from Switzerland alone,” it added.

Efforts to recover the stolen funds have reportedly been hampered by the sheer complexity of Abacha’s dealings as well as marathon legal battles that have dragged on for years, some involving former associates.

The latest is that the Nigerian government has sued Britain’s National Crime Agency (NCA) over control of €180 million (£150 million) stashed abroad by former Head of State, late Gen. Sani Abacha.

According to the UK Telegraph, the case is expected to spark fresh questions about dirty money flowing through the City of London.

Nigeria is asking the NCA to release funds (about N84.5 billion) that it froze at the request of the US authorities.

In just one example of the web of transactions crisscrossing the globe, some US prosecutors outlined in court filings how money was laundered by Abacha and his associates through bank accounts in Lagos, London, New York, Paris, Zurich, and Geneva.

The assets were stashed in banks, including Deutsche Bank, HSBC, and Banque SBA, according to the lawsuit, although there was no suggestion that the banks were involved in any wrongdoing.

The Telegraph stated, “This legal action eventually resulted in a 2020 deal to repatriate about $321 million, which had been laundered through the US banking system and then held in accounts in Jersey under the name of Doraville Properties Corporation, a British Virgin Islands company, and Abacha’s son, Mohammed.”

The new development comes as Britain fights claims that it has been very tolerant of dirty money flowing through the City of London.

US officials said last month that they were concerned that deep links between the UK and several Russian oligarchs meant that sanctions issued against Moscow if it invades Ukraine could be rendered ineffective.

Last Sunday, Briish Labour MP David Lammy accused ministers of doing too little to deal with corruption in Britain.

Lammy said, “We have to fix the dirty money problem we have, this huge problem of money laundering in London, of corruption and fraud.

“There’s so much that (ministers) are not doing. Joe Biden knows it and he’s concerned.”

But simultaneously, another court tussle in the UK is happening in parallel. At stake is more than €90 million, some of which came from Abacha’s security votes fraud, according to a High Court judgement issued in 2014.

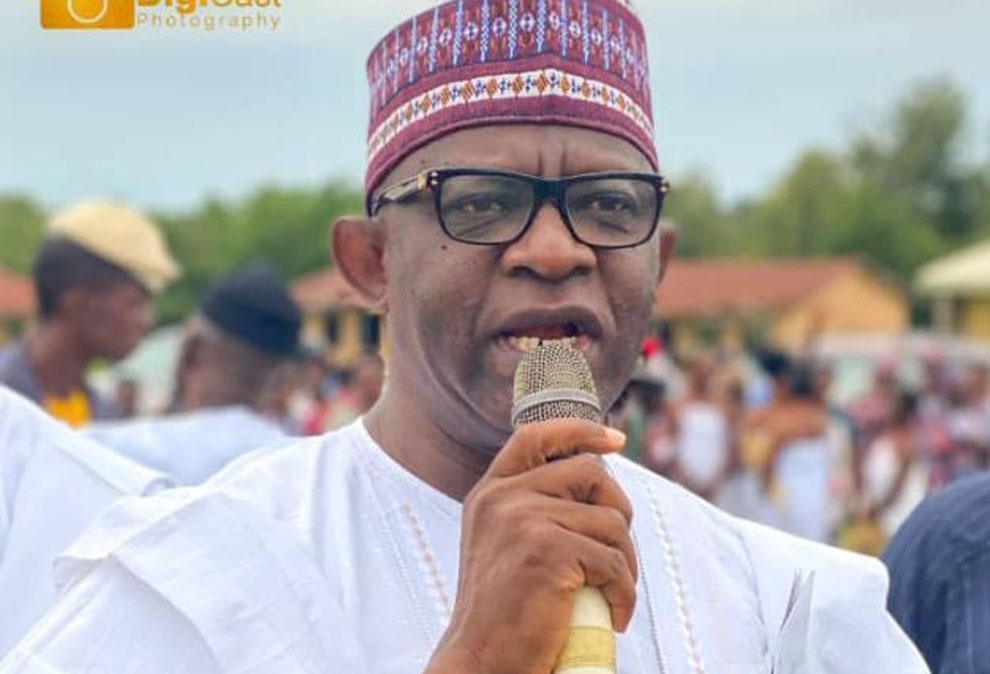

The money is said to be controlled by a Singapore-based trust set up for the benefit of the family of Abubakar Bagudu, the serving governor of Kebbi State, who is accused of playing an “instrumental role” in many of Abacha’s corrupt schemes by the US prosecutors.

Bagudu has always denied any wrongdoing. His office did not respond to a request for comment, the report said.

His brother, Ibrahim, is a director of two companies known as Blue Holdings owned by the Singapore trust.

According to the Pandora Papers, a leaked cache of documents obtained by the International Consortium of Investigative Journalists last year, the Bagudu brothers enlisted Farrer & Co, an elite London law firm that has advised the Queen, to help them set up these businesses.

They moved €98 million from a British Virgin Islands trust to a new structure spanning Singapore and the Cook Islands.

Farrer & Co said it carried out “extensive due diligence” on Bagudu and that it obtained approval from the Serious Organised Crime Agency (SOCA), the precursor to the NCA, to move the funds.

The amount reportedly controlled by the Singapore trust may now have grown to as much as €180 million and kept in accounts at Waverton Investment Management and James Hambro & Partners, both in London.

The NCA has been working with American authorities in a bid to confiscate the funds and return them to “the people of Nigeria,” the report stated.

However, the Nigerian government wants them to be returned directly to the country and the parties, including lawyers for Bagudu, have been holding negotiations about a possible settlement, court filings in the US show.

Bagudu struck a deal with the Nigerian government in 2003, in which he agreed to return a sum of money but made no admission of wrongdoing, and the agreement was reaffirmed by President Muhammadu Buhari in 2018.

This is interpreted to mean almost 70 per cent of the UK money could be handed to Bagudu if returned.

Court filings showed the Nigerian government subsequently sought to unlock the funds and repatriate them in legal action against the NCA – a move that was opposed by the UK and the US.

The country hired Kingsley Napley, the London law firm famed for representing a host of celebrities, including Rebekah Vardy, to represent it.

The report quoted Spotlight on Corruption, a non-profit campaign group, as saying that the case raises questions about whether, “law enforcement is being paid and resourced enough to get its act together”.

News

Why governors’ forum is silent on Rivers emergency, by DG

Why governors’ forum is silent on Rivers emergency, by DG

The Nigeria Governors’ Forum (NGF) yesterday attributed its neutral position on the recent declaration of a state of emergency in Rivers State to the need to steer clear of taking positions that may alienate members with varying political interests.

Taking positions on contentious partisan issues, the NGF said, would not augur well for it, especially in view of its past experience in fundamental division.

Notwithstanding, the declaration of the state of emergency by President Bola Tinubu yesterday generated more kudos and knocks from across the country.

Special Adviser to the President on Senate Matters, Senator Basheer Lado, said the action of the president was meant to ensure protection of lives and restoration of law and order in the state, while the President’s Special Adviser on Media and Public Communications, Sunday Dare, said his principal was required to “avert needless harm and destruction .”

National Publicity Secretary of the ruling All Progressives Congress (APC), Felix Morka, said Tinubu, by his action, cleared what had manifested as a constitutional crisis in Rivers state.

But former President Goodluck Jonathan saw it from a different perspective.

READ ALSO:

- Senate didn’t get 2\3 majority for Tinubu emergency rule in Rivers –Tambuwal

- FG destroys another 200 containers of expired drugs

- Rivers court bars woman from answering ex-husband’s name

He described “abuse of office and power by the three arms of government in the country“ as a dent on Nigeria’s image.

The NGF, in a statement by its Director General Abdulateef Shittu, said it is essentially “an umbrella body for sub-national governments to promote unified policy positions and collaborate with relevant stakeholders in pursuit of sustainable socio-economic growth and the well-being of the people.”

It added: “As a technical and policy hub comprising governors elected on different platforms, the body elects to steer clear of taking positions that may alienate members with varying political interests.

“In whatever language it is written, taking positions on contentious partisan issues would mean a poor sense of history — just a few years after the forum survived a fundamental division following political differences among its members.

“Regardless, the Forum is reputed for its bold positions on governance and general policy matters of profound consequences, such as wages, taxes, education and universal healthcare, among others.”

It asked for “the understanding of the public and the media, confident that appropriate platforms and crisis management mechanisms would take care of any such issues.”

Why governors’ forum is silent on Rivers emergency, by DG

News

Rivers: Tinubu acted to save state, economy, says Karimi

Rivers: Tinubu acted to save state, economy, says Karimi

Chairman of the Senate Services Sunday Karimi has hailed President Bola Tinubu for the decision to declare a state of emergency in Rivers State.

He told reporters on Friday in Abuja that the President acted in the best interest of the State and Nigeria, having taken his decision in compliance with the Constitution.

“No President or government worth a name, will fold its arms and watch a political situation deteriorate to what we saw unfolding in Rivers State.

“We saw that bombing of pipelines had begun, and the security situation was getting worse with the tension everywhere”, Karimi stated.

Karimi, who represents Kogi-West on the ticket of the All Progressives Congress (APC), recalled the “fatherly role” Tinubu had played in the crisis since 2023 in a bid to get the Minister of the Federal Capital Territory (FCT), Nyesom Wike, and suspended Governor Siminalayi Fubara to reach an understanding, to no avail.

He explained: “We were all here in 2023 when Mr President called that truce meeting at the Aso Rock Villa. There was the eight-point agenda for settlement reached between the factions.

“When Nigerians expected that progress should be made to achieve peace, things started deteriorating considerably to a point where the governor demolished the House of Assembly building and administered the state with only three legislators.”

READ ALSO:

- Oluwo accuses Ooni of plotting to dethrone him

- Natasha: Court blocks recall attempt, stops INEC

- US ends legal status for 500,000 immigrants

Karimi observed that with the recent judgment of the Supreme Court, which gave the upper hand to the 27 lawmakers loyal to the camp of the FCT Minister, matters merely got worse in the State as the lawmakers were set to impeach the Governor.

“What did you expect would be the implications? There would have been more destruction, killings and economic losses for the country.

“With the bombings that had already started, it was a matter of time before the whole state would be engulfed in flames. No responsible President would sit, arms folded, and allow that to happen “ he added.

The senator further argued that it took “painstaking efforts” by the administration to raise daily crude oil production to around 1,800 barrels, noting that Nigeria’s economy was already “witnessing a rebound under the renewed hope projects of the government.”

“Allowing the situation in Rivers to get worse before he would act, wouldn’t have helped the state or Nigeria as a country in any way.

“Mr. President intervened at the right time, and his actions are covered by law,” he said.

Karimi also spoke on the emergency declaration in Borno, Yobe, Adamawa and a couple of other states by former President Goodluck Jonathan without removing the Governors from office or suspending the state assemblies.

According to him, the case with those States was not generated by political crises but rather security concerns.

“So, I will advise those comparing the two scenarios to remember that one was purely about security threats resulting from the insurgency caused by Boko Haram, while that of Rivers is clearly political.

“It was the proper thing to do to suspend the political actors in the two factions to allow for tensions to diffuse. Nigerians should appreciate the President for the action he has taken so far,” he stated.

Sen. Karimi also noted that there was no cause for alarm as the National Assembly had indicated that the emergency rule could be reviewed as soon as there were signs that things could quickly normalise in Rivers State.

Rivers: Tinubu acted to save state, economy, says Karimi

News

Just in: Tinubu swears in Rivers Sole Administrator Ibas

Just in: Tinubu swears in Rivers Sole Administrator Ibok-ete Ibas

President Bola Tinubu has sworn in Vice Vice Admiral Ibok-ete Ibas (Retd.) as the Sole Administrator of Rivers State.

The administrator was sworn in on Wednesday after a short meeting with the President.

Tinubu announced the appointment of the retired naval chief at a nationwide broadcast on Tuesday, when he declared a state of emergency in Rivers State and suspended Governor Siminalayi Fubara, Deputy Governor, Ngozi Odu, and the state House of Assembly members.

The President said his decision was based on Section 305 of the 1999 Constitution, saying he could not continue to watch the political situation in Rivers escalate without taking concrete action.

The suspension of Fubara and other elected representatives has been rejected and condemned by many eminent Nigerians, legal luminaries, groups such as Atiku Abubakar, Peter Obi, Femi Falana, the Labour Party (LP), the Peoples Democratic Party (PDP) and the Nigerian Bar Association.

However, the emergency rule has been praised by the pro-Nyesom Wike Assembly led by Martins Amaewhule, accusing Fubara of contravening the Supreme Court ruling on the political situation in the state.

Ibas was the Chief of Naval Staff from 2015 to 2021.

He is from Cross River State where he had his early education.

The new sole administrator went to the Nigerian Defence Academy in 1979 from where he proceeded to have a successful career in the Navy, rising through the ranks to the very top.

He is a member of the Nigerian Institute of International Affairs (NIIA) and the Nigerian Institute of Management.

President Muhammadu Buhari who appointed him as Chief of Naval Staff conferred him with the National Honour of Commander of the Federal Republic (CFR) in 2022.

-

metro2 days ago

metro2 days agoRivers administrator Ibas fires Fubara’s political appointees

-

metro2 days ago

metro2 days agoJUST-IN: Ex-Oyo gov Ajimobi’s first child Bisola dies At 42

-

International3 days ago

International3 days agoCanada removes bonus ranking points for job offers in Express Entry system

-

metro2 days ago

metro2 days agoHow ritualists, native doctor drugged, murdered underage sisters in PH – Police

-

metro2 days ago

metro2 days agoFG declares public holidays for Eid-el-Fitr

-

Sports3 days ago

Sports3 days agoNigeria’s Super Eagles falter in W’Cup qualifiers against Zimbabwe, S’Africa lead, Egypt, Morocco qualify

-

metro3 days ago

metro3 days agoAkpabio has habit of abusing women, says Atiku

-

Africa2 days ago

Africa2 days agoNiger coup leader sworn in as president for five years