Business

Ogun cargo airport phase one ready next year – Gov Abiodun

The first phase of agro-cargo airport located at Illisan-Remo in the Ikenne Local Government Area of Ogun State will be ready by May 2022, the state governor, Prince Dapo Abiodun, has said.

The governor stated this while on an inspection of the project work, adding that the airport conceived in 2007 had all necessary approvals, including the Environmental Impact Assessment from Aaviation regulatory body, the Nigerian Civil Aviation Authority.

He said, “This project had been conceived since 2007 and all necessary approvals were gotten in 2008. All the Environment Impart Assessment, all other regulatory assessment (requirements) have been met 100 per cent.

“All we have to do was to brush them up to ensure they meet current realities. This was not the decision that was taken for any other reason except that which is objective.”

Governor Abiodun also explained that his administration decided to pursue the project based on the economic development agenda of the government to have a cargo airport that would fully complement the agro-value chain investments and activities in the state.

“When the Senate Committee on Aviation came to visit us, we shared with them the business case for this airport.

“We reminded them that the two airport proposals were not initiated by this administration. I told them that the committee we set up to look into the two airports concluded unequivocally that this location remained the best and most viable location for the airport.

“The entire cargo value chain is on this corridor. We have oil palm, cashew plantations and green house in Sagamu and multinational companies around here. This is the centre where items for export are evaluated and approved for export. So with a cargo airport here, it is very convenient to move them.”

He disclosed that the state decided to bid for the African Development Bank’s Special Processing Zone, where in the bid document, the location was chosen for the AZ Processing Zone.

He said the area was renamed “an airport city”, because, apart from the airport and processing zone, the area has factories that would turn raw materials into finished goods for export.

The governor said it was important for an airport to have access to good road network, adding that the airport was bound by Sagamu-Benin and Lagos-Ibadan expressways, as well as gas pipelines paralleled to the expressways. Governor Abiodun said the airport was sited on 500 hectares of land, adding that work was ongoing on the 2.4-kilometre access road to enable movement of equipment to the site, as well as on the 3.4-kilometre runway.

Business

Ban on Sachet Alcohol Will Trigger Job Losses, Smuggling — NECA Warns

Ban on Sachet Alcohol Will Trigger Job Losses, Smuggling — NECA Warns

The Nigeria Employers’ Consultative Association (NECA) has cautioned that a blanket ban on sachet alcoholic beverages would amount to economic suicide, warning that such a policy could worsen unemployment, encourage smuggling, and overstretch already burdened security and regulatory agencies.

Speaking with journalists on the ongoing debate over alcohol regulation in Nigeria, NECA’s Director-General, Mr. Smatt-Adewale Oyerinde, said prohibiting the production or sale of sachet alcohol would fail to address the root causes of alcohol abuse, particularly among young people, while inflicting serious economic and security consequences.

Oyerinde questioned the effectiveness of prohibition in a country with porous borders and limited enforcement capacity.

“If children under 18 are consuming alcohol, whose fault is it? Is it the parents, the schools, or the producers? Alcohol is not evil; abuse is the problem. Banning one product while others remain legal will not solve it,” he said.

He disclosed that more than ₦800 billion has been invested in the alcohol and allied industries, which employ thousands of Nigerians directly and indirectly. According to him, a sudden ban would lead to massive job losses, business closures, and loan defaults, further aggravating Nigeria’s unemployment crisis.

READ ALSO:

- One Feared Dead, Five Trapped as Rice Mill Collapses in Kebbi Capital

- Peter Obi Defects to ADC, Unveils Opposition Coalition Ahead of 2027 Elections

- UNN Students Reject 100% Fee Hike, Insist on Maximum 25% Increase

“We seem unconcerned about rising unemployment and the message such policies send to investors. If someone invests a billion dollars today, what assurance do they have that a policy will not abruptly shut down their business in a few years?” Oyerinde asked.

The NECA Director-General warned that scarcity created by a ban would only drive up prices and fuel illegal trade.

“When you ban a product you cannot effectively police, you simply create a thriving market for smugglers,” he noted, adding that unregulated foreign alcohol products had already flooded the market during the recent festive season.

He also argued that banning alcohol consumption in public places would merely shift consumption elsewhere.

“If people cannot drink on the streets, they will drink at home. If not at home, then in their cars. So what exactly have we solved?” he queried.

Oyerinde stressed that agencies such as the Nigeria Police, Customs, and other regulatory bodies would be overwhelmed by the additional burden of enforcing a ban, insisting that policy decisions must consider the broader economic impact.

Rather than imposing a blanket ban, NECA called for targeted and coordinated solutions, including stronger institutions, improved regulation, and innovative enforcement strategies such as random checks and sobriety testing, as practiced in other countries.

“A blanket ban is a lazy approach. What Nigeria needs is thoughtful and dynamic policymaking that tackles abuse, protects young people, and preserves jobs without damaging the wider economy,” he said.

He added that NECA was willing to collaborate with government agencies, including NAFDAC, to develop practical and sustainable solutions to alcohol abuse in Nigeria.

Ban on Sachet Alcohol Will Trigger Job Losses, Smuggling — NECA Warns

Aviation

VAT on Aircraft, Spare Parts Threatens Survival of Nigerian Airlines, says Allen Onyema

VAT on Aircraft, Spare Parts Threatens Survival of Nigerian Airlines, says Allen Onyema

The Air Peace CEO, Allen Onyema, has warned that Nigeria’s new tax laws threaten the survival of local airlines, arguing that the legislation reinstates taxes removed under the 2020 reforms. The taxes include customs duties on imported aircraft, aircraft parts, engines, and Value Added Tax (VAT) on tickets, which Onyema says will impose unsustainable financial burdens on airlines.

Speaking in an interview with Arise News on Sunday, Onyema stressed the high cost implications for airline operators.

“There is VAT on the importation of aircraft. For an aircraft worth $80 million, you are supposed to pay 7.5 percent. With bank loan interest rates at 30–35 percent, plus VAT on spare parts, it is unsustainable,” Onyema said. “If we implement that tax reform, Nigerian airlines will go down in three months.”

The Air Peace CEO also announced that the airline industry will no longer tolerate unruly passengers starting January 1, 2026. Onyema cited instances of disruptive behaviour by passengers on flights, including smuggling alcohol into the cabin, forcing upgrades to business class without payment, and threatening fellow travellers.

READ ALSO:

- Train Derailment in Southern Mexico Kills 13, Injures Nearly 100 in Oaxaca

- Tragedy in Lekki as Lexus SUV Crashes Into Children, One Feared Dead, Four Injured

- Presidency Intervenes in Akume, Alia Political Dispute in Benue

He referenced a recent incident on a flight diverted to Manchester, UK, due to bad weather, where passengers staged a viral video accusing Air Peace of misconduct, despite British authorities confirming that over 200 flights were diverted that day.

Onyema emphasised that airlines will now enforce stricter measures, including blacklisting unruly passengers, asserting that the behaviour is currently being “supported by the system unnecessarily.”

The statement comes amid growing concerns over rising domestic airfares. On December 10, the Senate summoned the Aviation Minister, Festus Keyamo, and industry stakeholders over soaring ticket prices. Subsequently, on December 11, the House of Representatives called on the federal government to reduce aviation taxes by 50 percent to ease costs for travellers.

Onyema’s comments highlight both the financial pressures on Nigerian airlines due to aviation taxes and the sector’s new stance on passenger discipline to safeguard safety and service standards.

VAT on Aircraft, Spare Parts Threatens Survival of Nigerian Airlines, says Allen Onyema

Auto

Changan CS55, Kia Seltos take top SUV honours at 2025 NAJA Auto Awards

Changan CS55, Kia Seltos take top SUV honours at 2025 NAJA Auto Awards

Changan CS55 and Kia Seltos have clinched top honours at the 2025 Nigeria Auto Journalists Association (NAJA) International Auto Awards, winning Midsize SUV of the Year and Compact SUV of the Year, respectively.

The awards were announced at a recent well-attended ceremony held at the Oriental Hotel, Victoria Island, Lagos, which brought together key stakeholders across Nigeria’s automotive value chain to celebrate excellence, resilience and innovation in the industry.

Changan CS55’s latest recognition comes after its impressive performance at last year’s 17th edition of the awards, where it was crowned Nigeria’s New Car of the Year.

At the 2025 ceremony, the compact crossover SUV edged out strong contenders such as the Kia Sonet and Chery Tiggo to secure the coveted Midsize SUV title.

Changan vehicles are marketed and assembled in Nigeria by Mikano Motors, reinforcing the growing impact of local assembly in the country’s automotive sector.

In the Compact SUV category, the Kia Seltos emerged winner, beating notable competitors such as the Toyota Prado, Changan CS55 and Chery Tiggo.

READ ALSO:

- Ojuelegba Bridge Gridlock as Container Truck Overturns in Surulere, Lagos

- Troops Foil Kidnapping on Otukpo–Enugu Expressway, Rescue Passengers in Benue

- Davido Joins Accord Party, Aligns With Uncle, Osun Governor Ademola Adeleke

Industry analysts have described the Seltos as a compelling blend of practicality and style, praising its bold design, versatility and appeal to modern drivers.

Other corporate winners at the event are the Mikano Group, which was named Auto Company of the Year; Iron Products Industries (IPI) Limited, honoured as Truck Assembler/Body Builder of the Year; Lanre Shittu Motors (JAC), awarded Truck Plant of the Year; and Innoson Vehicle Manufacturing (IVM), which won Passenger Car Assembly Plant of the Year.

These recognitions highlighted the depth and growing strength of indigenous participation in Nigeria’s automotive industry.

Speaking at the ceremony, the Director-General of the National Automotive Design and Development Council (NADDC), Otunba Joseph Osanipin, commended NAJA for sustaining a credible platform promoting excellence and accountability within the sector.

In his welcome address, NAJA Chairman Mr Theodore Opara described the awards as a benchmark for performance in Nigeria’s evolving automotive ecosystem, noting that the industry continues to adapt amid policy reforms, technological advancements and changing consumer expectations.

The 2025 NAJA International Auto Awards once again underscored the critical role of leading brands in strengthening Nigeria’s transportation and industrial backbone, while celebrating outstanding achievements across the nation’s automotive landscape.

Changan CS55, Kia Seltos take top SUV honours at 2025 NAJA Auto Awards

-

metro2 days ago

metro2 days agoNiger Delta Crackdown: Army Seizes ₦150m Stolen Oil, Arrests 19 Suspects

-

Sports3 days ago

Sports3 days agoCristiano Ronaldo Wins Best Middle East Player at 2025 Globe Soccer Awards in Dubai

-

Sports2 days ago

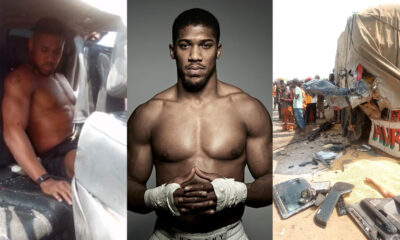

Sports2 days agoAnthony Joshua injured as two die in fatal Lagos-Ibadan Expressway crash (plus photos)

-

metro1 day ago

metro1 day agoMrs. Regina Akume Urges SGF George Akume to Return to Christianity Amid New Marriage

-

metro2 days ago

metro2 days agoTwo Close Aides of Anthony Joshua Identified as Victims of Fatal Crash

-

metro2 days ago

metro2 days agoOgun Man Arrested After ₦4,000 Debt Dispute Claims Stepbrother’s Life

-

metro1 day ago

metro1 day agoMalami, Son, Wife Remanded Over ₦Billions Money Laundering Charges

-

metro2 days ago

metro2 days agoTinubu Condoles Anthony Joshua After Ogun Crash That Killed Two Associates