Business

As FG plans borrowing N720bn, Nigeria’s debt to exceed N50tn this year

The Debt Management Office has released the schedule of local borrowings this year and says Nigeria’s public debt will soon exceed N50 trillion, representing a 29.8 per cent increase over the N39.56 trillion recorded at the end of 2021.

Specifically, the DMO said about N720 billion would be borrowed by the Federal Government in the second quarter.

This is contained its FGN Bonds Issuance Calendar for the Second Quarter, 2022.

According to the DMO, the national public debt rose by 20 per cent, year-on-year, YoY, to N39.56 trillion in 2021 from N32.92 trillion in 2020.

The 20 per cent rise in the total public debt was driven by a 25 per cent increase in external debt and 17.3 per cent increase in domestic debt.

While total external debt rose to N15.86 trillion in 2021 from 12.71 trillion in 2020, domestic debt rose to N23.7 trillion in 2021 from N20.21 trillion in 2020.

The debt profile of states and the Federal Capital Territory rose by 8.0 per cent to N6.43 trillion in 2021 from N5.95 trillion in 2021.

Latest data on the fiscal activities of the FG in 2022 shows that the nation’s public debt might increase by N11.8 trillion to bring the year end figure to a little above N51 trillion.

According a report by Vanguard, the FG traditionally exceeds the annual budget deficit. And it recalls that in 2021, the FG exceeded the budget deficit by about 48 per cent to about N7.69 trillion from N5.2 trillion in the approved budget for the year.

It noted if this trend should persist in 2022, the FG could end up with a deficit of N9.24 trillion as against the N6.25 trillion budgeted deficit for the year.

Already, President Muhammadu Buhari has extended fuel subsidy till June 2023, resulting in a supplementary budget request of N2.56 trillion to fund the subsidy from July to December 2022.

With further rises in crude oil prices, subsidy obligation is projected to rise beyond the supplementary budget provisions, a development analysts at Afrinvest Securities Limited, a Lagos-based investment house, said would push the public debt level to dangerous territories and further worsen the nation’s debt sustainability indices.

They therefore called for a N2 trillion cut in the FG’s expenditure in 2022 to halt further deterioration in the nation’s debt sustainability indices.

Business

Reversing electricity tariff hike will cost us N3.2 trillion – FG

Reversing electricity tariff hike will cost us N3.2 trillion – FG

The Federal Government has said the reversal of the current increment in electricity tarrif will put more financial pressure on it.

The government said it would need about N3.2 trillion to subsidise and shoulder the cost of electricity this year should the recent hike be canceled.

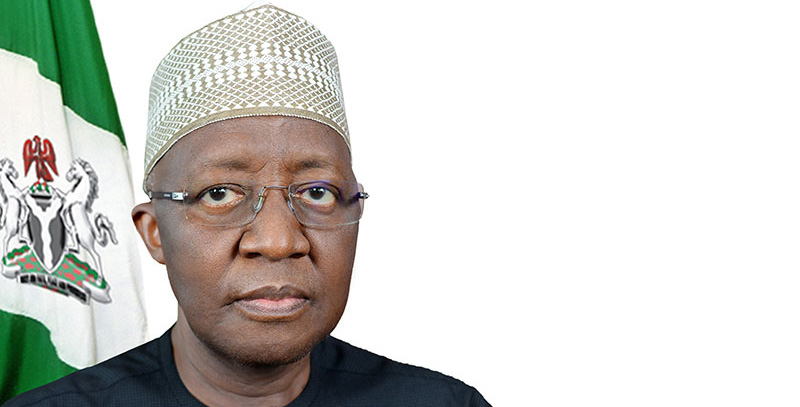

Sanusi Garba, the chairman, Nigeria Electricity Regulatory Commission (NERC), made this known at a stakeholders’ meeting organised by the House of Representatives committee on power in Abuja on Thursday.

He said that the current investments in the power sector were not enough to guarantee a stable electricity supply nationwide.

He added that if nothing was done to tackle foreign exchange instability and non-payment for gas, the sector would collapse.

Garba disclosed that prior to the tariff review, Electricity Distribution Companies (DisCos) were only obligated to pay 10 per cent of their energy invoices, adding that lack of cash backing for subsidy had created liquidity challenges for the sector.

He added that the inability of the government to pay subsidy led to continuous decline in gas supply and power generation.

READ ALSO:

- Bandits gun down 23 villagers in Kaduna community

- Netizens knock Tinubu aide, Onanuga, over comment on Yahaya Bello arrest

- Boy, 19, nabbed for raping 9-year-old girl in Kwara

He said that the continued decline in the generation and system collapse were largely linked to liquidity challenges.

He said from January 2020 to 2023, the tariff was increased from 55 per cent to 94 per cent of cost recovery.

He added that “the unification of FX and current inflationary pressures were pushing cost reflective tariff to N184/kWh”

“If sitting back and doing nothing is the way to go, it will mean that the National Assembly and the Executive would have to provide about N3.2 trillion to pay for subsidy in 2024,” he said.

Mr Garba said that only N185 billion out of the N645 billion subsidy in 2023 was cash-backed, leaving a funding gap of N459.5 billion.

The vice-chairman of NERC, Musiliu Oseni, also justified the recent tariff increase, saying the increment was needed to save the sector from total collapse.

Rep. Victor Nwokolo, the chairman of the committee, said the goal of the meeting was to address the increase in tariff and the issue of band A and others.

Mr Nwokolo said the officials of NERC and DISCOS had provided useful Information to the committee.

“We have not concluded with them because the Transmission Company of Nigeria is not here and the Generation Companies too.

“From what they have said which is true, is that without the change in tarrif, which was due since 2022, the industry lacks the capital to bring the needed change.

“Of course, the population explosion in Nigeria, is beyond what they have estimated in the past and because they need to expand their own network, they also needed more money, ” he said

Reversing electricity tariff hike will cost us N3.2 trillion – FG

Business

Naira loses N81 to dollar in one day

Naira loses N81 to dollar in one day

The naira lost N81.34 against the US dollar at the foreign exchange market on Thursday

FMDQ data showed that the naira fell to N1,154.08 per dollar on Thursday from N1,072.74 on Wednesday.

This represents a 7.04 per cent loss against the dollar compared to N1,072.74 per dollar traded the previous day.

At the parallel market, the naira also depreciated N1,100 per dollar on Thursday from N1, 040 on Wednesday.

This is the second time the naira would be depreciating against the dollar in three days amid fears of depleting foreign exchange reserves.

Nigeria’s foreign reserves dropped to $32.29 billion as of April 15.

Business

Govt paying N600bn for fuel subsidy monthly — Rainoil CEO

Govt paying N600bn for fuel subsidy monthly — Rainoil CEO

The CEO of Rainoil Limited, Gabriel Ogbechie, has claimed that the federal government resumed the payment of the controversial fuel subsidy following the devaluation of the Naira in the foreign exchange market.

Ogbechie made this statement on Tuesday during the Stanbic IBTC Energy and Infrastructure Breakfast Session held in Lagos.

He pointed out that with Nigeria’s daily fuel usage at 40 million liters and the foreign exchange rate at N1,300, the government’s subsidy per liter of fuel falls between N400 and N500, culminating in a monthly total of approximately N600 billion.

He said; “When Mr. President came in May last year, one of the things he said was that Subsidy is gone. And truly, the subsidy was gone, because immediately the price of fuel moved from 200 to 500 per liter. At that point truly, subsidy was gone.

“During that period, Dollar was exchanging for N460, but a few weeks later, the government devalued the exchange rate. And Dollar moved to about N750. At that point, subsidy was beginning to come back.

READ ALSO:

- North Central Support Group rejects Northern Elders, pledges allegiance to Asiwaju

- Gunmen kidnap 2 FRSC officers along Abakaliki-Enugu highway

- Driver killed, 16 passengers abducted on Abuja-Lokoja road

“The moment the two markets officially closed, officially the market went to about N1,300. At that point, that conversation was out of the window. Subsidy was fully back on petrol. If you want to know where petrol should be, just look at where diesel is. Diesel is about N1,300 and petrol is still selling for N600.

Furthermore, he said that NNPC being the only petrol importer in the country implies that there is an ongoing subsidy, as prices had to be fixed.

Earlier yesterday, the former governor of Kaduna State, Nasir El Rufai, said the federal government is spending more on petrol subsidy than before.

In addition, the Special Adviser to the President on Energy, Mrs. Olu Veŕheijen, said that the Federal Government reserves the right to pay fuel subsidy intermittently to cushion hardship in the country.

“The subsidy was removed on May 29. However, the government has the prerogative to maintain price stability to address social unrest. They reserve the right to intervene.

“If the government feels that it cannot continue to allow prices to fluctuate due to high inflation and exchange rates, the government reserves the right to intervene intermittently and that does not negate the fact that subsidy has been removed,” she said.

Govt paying N600bn for fuel subsidy monthly — Rainoil CEO

-

Entertainment7 days ago

Entertainment7 days agoTolani Baj expresses love for Bobrisky

-

metro6 days ago

metro6 days agoTroops neutralise 188 terrorists, rescue 133 hostages in assault operations

-

News6 days ago

News6 days agoFG gives update on where fleeing Binance executive is hiding

-

Business7 days ago

Business7 days agoNaira continues gain, sold N1,150/$ at parallel market

-

Opinion7 days ago

Opinion7 days agoBBC, Betta Edu, and ministry of corruption – Farooq Kperogi

-

metro6 days ago

metro6 days agoViral video: Edo CP orders trial of officer threatening people with gun

-

News6 days ago

News6 days agoNLC, TUC jointly propose N615,000 new minimum wage

-

Sports4 days ago

Sports4 days agoUnited in hot chase for Osimhen amid transfer speculations