Business

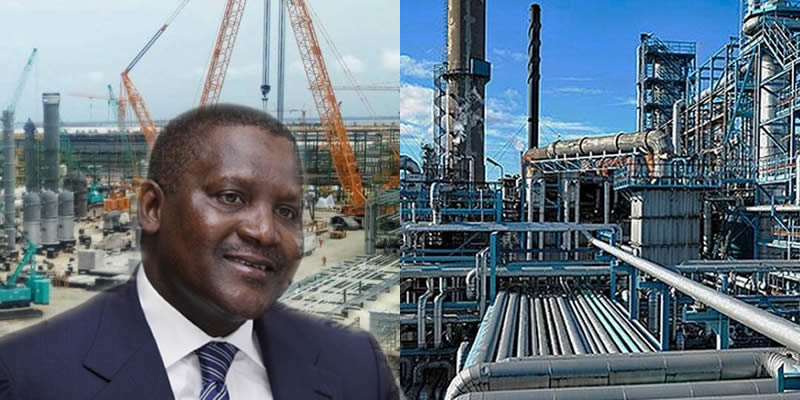

Dangote to NUPRC: Enforce PIA direct crude sale to local refineries

Dangote to NUPRC: Enforce PIA direct crude sale to local refineries

Dangote Petroleum Refinery has said refineries in Nigeria should be allowed to buy crude directly from the companies that produce it in the country rather than from international middlemen.

This, the company said, is in line with the provision of the Petroleum Industry Act (PIA) of 2021.

It therefore urged the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) to enforce the domestic crude supply obligation as specified in the PIA.

Spokesperson for the Dangote Group, Anthony Chiejina, said this last night.

He said, “All we are asking for is for refineries in Nigeria to buy crude directly from the companies that produce it in Nigeria, rather than from international middlemen. This is specified in the PIA.

“Unfortunately, the NUPRC has effectively admitted in their statement that they will be unable to enforce the domestic crude supply obligation as specified in the PIA, citing ‘sanctity of contracts’ as an excuse.”

Chiejina was reacting to NUPRC’s statement that it had facilitated the allocation of 29 million barrels of crude oil to the Dangote Petroleum Refinery and Petrochemicals.

He said, “We would like to thank them for this allocation. But at the same time, we wish to let them know that we are yet to receive these cargoes.

“Aside from the term supply we bilaterally negotiated with NNPCL, so far NUPRC has only facilitated the purchase of one crude cargo from a domestic producer.

“The rest of the cargoes we have processed were purchased from international traders.”

Dangote refinery had insisted that it was not yet getting enough crude required for the effective optimisation of its refinery from the Nigerian National Petroleum Corporation Limited (NNPCL).

The refinery management, in a release signed said that “we therefore still insist that we are unable to secure our full crude requirement from domestic production and urge the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), to fully enforce the domestic crude supply obligation as mandated by the PIA.”

Chiejina clarified that Dangote company had never accused NNPC of not supplying crude.

“Our concern has always been NUPRC’s reluctance to enforce the domestic crude supply obligation and ensure that we receive our full crude requirement from NNPC and the IOCs,” he said.

He added, “For September, our requirement is 15 cargoes, of which NNPC allocated six. Despite appealing to NUPRC, we’ve been unable to secure the remaining cargoes.

“When we approached IOCs producing in Nigeria, they redirected us to their international trading arms or responded that their cargoes were committed.

“Consequently, we often purchase the same Nigerian crude from international traders at an additional $3-$4 premium per barrel which translates to $3-$4 million per cargo.”

Business

Naira Appreciates to ₦1,382/$ in Parallel Market as Official Rate Softens

Naira Appreciates to ₦1,382/$ in Parallel Market as Official Rate Softens

The Nigerian naira showed mixed performance yesterday, appreciating to ₦1,382 per US dollar in the parallel market from ₦1,391 recorded on Wednesday. This rise reflects renewed confidence among traders in the informal foreign exchange market, even as the currency slightly depreciated in the official Nigerian Foreign Exchange Market (NFEM).

Data from the Central Bank of Nigeria (CBN) showed that the indicative official exchange rate moved to ₦1,361 per dollar, up from ₦1,359.5 per dollar on Wednesday — a ₦1.5 depreciation for the naira. Consequently, the margin between the parallel and official rates narrowed to ₦21 per dollar, down from ₦31.5 per dollar previously, indicating a reduction in the spread between formal and informal FX markets.

Experts say the parallel market gains were supported by improved dollar liquidity, steady remittance inflows, and robust external reserves, which recently reached levels not seen in over a decade. Analysts note that a narrowing spread between the black market and official rates typically signals growing market confidence and stability, even as structural challenges in Nigeria’s FX landscape persist.

READ ALSO:

- Presidency, APC Reject Opposition Claims on Electoral Act 2026

- Shariah Council Tells US No Foreign Power Can Force Nigerian Muslims to Abandon Shariah

- FCCPC Finds Evidence of Airfare Manipulation by Domestic Airlines

“While the naira is stronger in the parallel market, pressure remains on the official segment due to high demand for foreign currency by importers and businesses,” said a currency analyst. “The recent movements show optimism but highlight the ongoing volatility across exchange segments.”

The parallel market rate, often called the black market rate, responds quickly to dollar demand and supply at street level, while the official NFEM rate reflects CBN interventions and regulated forex flows. Observers say continued policy measures, remittance growth, and export receipts will be critical in maintaining naira stability ahead of the 2027 election period.

Despite the mixed trends, the recent appreciation in the parallel market is being viewed as positive for consumer confidence, though analysts caution that structural issues, including trade imbalances and uneven forex distribution, could still pressure the naira in coming weeks.

Naira Appreciates to ₦1,382/$ in Parallel Market as Official Rate Softens

Aviation

FCCPC Finds Evidence of Airfare Manipulation by Domestic Airlines

FCCPC Finds Evidence of Airfare Manipulation by Domestic Airlines

The Federal Competition and Consumer Protection Commission (FCCPC) says it has uncovered credible evidence of airfare manipulation by domestic airlines in Nigeria, revealing that some carriers may have artificially inflated ticket prices during the December 2025 festive travel season beyond what market forces would justify. In an interim report released on Thursday, the FCCPC said its extensive forensic review of airfare data collected directly from airlines across key domestic routes shows striking irregularities in pricing patterns that appear inconsistent with normal seasonal demand, fuel costs, foreign exchange movements, or other operational variables.

The review by the Commission’s Surveillance and Investigations Department, led by Director of Corporate Affairs Ondaje Ijagwu, compared peak-season fares in December 2025 against ticket prices in the post-holiday period of January 2026. In many cases — notably on high-traffic corridors such as Abuja–Port Harcourt, Lagos–Calabar, and Lagos–Enugu — the difference in fares reached as high as ₦405,000 for a single ticket, even though essential cost drivers remained relatively stable. “These fare differences appear to reflect airlines’ arbitrary pricing decisions, yield management strategies, and capacity allocation practices rather than any variation in regulated fees or significant changes in operating conditions,” Ijagwu said, suggesting that multiple domestic carriers might have engaged in tacit coordination rather than true competition.

The report also showed that during the peak period, reduced seat availability paired with clustered price ranges across multiple operators raised further competition concerns, lending weight to potential violations of Nigeria’s Federal Competition and Consumer Protection Act (FCCPA) 2018. The interim findings flagged possible breaches of provisions governing restraint of competition, abuse of dominant positions, price-fixing, conspiracy, unfair contract terms, and consumers’ right to fair dealings — signalling that airlines may have breached multiple competition and consumer protection rules.

READ ALSO:

- US Lawmaker Says Christians in Nigeria Bear Brunt of Violence, Calls on Trump to Act

- Eric Chelle Explains $130,000 Salary Proposal, Reaffirms Loyalty to Super Eagles

- Suspected Arsonists Set St. Mary’s Catholic Church Ablaze in Cross River

The Airline Operators of Nigeria (AON) swiftly pushed back against the FCCPC’s report. AON spokesman Prof. Obiora Okonkwo said the Commission lacks the specialised expertise to analyse aviation pricing, warning that the probe could harm Nigeria’s fragile airline sector. “They don’t understand the economics of airlines or how ticket prices are set based on yield, load factors, aircraft utilisation and revenue management systems,” Okonkwo said. “This action is very detrimental to the survival of domestic operators.”

Independent aviation analysts in Nigeria say pricing behaviour in the sector has long lacked transparency. Dr. Uche Okoro, a transport economist, told news editors that while peak-season travel normally pushes fares up, the consistency of spikes across multiple airlines on the same dates and routes — even where there was no significant change in fuel or exchange rates — suggests coordinated pricing behaviour. “Market competition should push airlines to differentiate prices based on service levels and actual costs,” Okoro said. “When several carriers raise prices almost in unison, especially on predictable peak travel dates, it warrants scrutiny.”

The Nigerian Civil Aviation Authority (NCAA) acknowledged the FCCPC’s interim report and pledged to support the broader probe, noting that the aviation sector must balance airline financial sustainability with fair market practices. An NCAA spokesperson said: “We are engaging with the FCCPC and industry stakeholders to promote a transparent pricing environment. While airlines need to remain viable, consumers must also be protected from exploitative fare regimes.” The NCAA emphasised that factors such as fleet size limits, airport slot restrictions, seasonal demand patterns, and infrastructure capacity do affect pricing, but agreed that unusually steep price spikes merit investigation.

According to the FCCPC, the route-by-route analysis showed that on Abuja–Port Harcourt, average peak-period fares were far higher than post-peak levels, with many tickets in December priced well above the typical seasonal range. On Lagos–Calabar and Lagos–Enugu, similar patterns of clustered fare bands across airlines suggested pricing behaviour broadly aligned among competitors rather than differentiated by market forces. Across sampled routes, median fares during the festive period were significantly elevated compared with post-peak benchmarks, despite stable fuel price trends, unchanged airport taxes, and no major exchange rate shocks. The FCCPC noted that while predictable seasonal demand surges can justify higher fares, the magnitude and pattern of the increases observed in December 2025 are not fully explained by ordinary market conditions.

FCCPC Executive Vice Chairman and CEO Tunji Bello stressed that the interim report is not an enforcement action, but a step toward deeper investigation. “The Commission’s role is to ensure that market outcomes reflect competition and consumer protection principles,” he said, adding that full findings and possible enforcement measures will follow after the ongoing review. Bello also signalled that foreign airlines operating international routes involving Nigeria will soon be probed, following complaints that Nigerian passengers are often charged significantly higher fares on similar international distances. “No operator — domestic or foreign — will be shielded if evidence confirms fare-fixing or consumer exploitation,” Bello said. The FCCPC has asked both airlines and consumers to assist in the investigation by providing additional data, while warning airlines that violations of the FCCPA could result in regulatory sanctions, fines, or mandatory corrective orders once the full review is concluded.

FCCPC Finds Evidence of Airfare Manipulation by Domestic Airlines

Auto

Carloha shakes up pickup market with launch of heavy-duty Chery Himla

Carloha shakes up pickup market with launch of heavy-duty Chery Himla

Carloha Nigeria has officially unveiled the Chery Himla pickup in Nigeria, marking the brand’s entry into the country’s highly competitive pickup segment with a bold focus on productivity, durability and business efficiency.

The launch, held at Orange Island, Lekki, Lagos on February 19, 2026, positions the Himla not merely as a utility vehicle but as a high-performance mobile business asset tailored for commerce, agriculture, logistics, security operations and regional trade.

Speaking at the event, Managing Director of Carloha Nigeria, Mr. Sola Adigun, described the unveiling as a significant milestone for the company and Nigerian entrepreneurs.

“Today’s launch represents a key milestone, with Himla engineered to enhance efficiency and productivity for security outfits, farmers, logistics operators, entrepreneurs and others,” he said.

Built for Bigger Load, Fewer Tripsĺ

At the heart of the Himla’s appeal is its class-leading 1,276-litre cargo bed (1,530 mm × 1,620 mm × 515 mm), designed to accommodate standard industrial pallets and enable what the company describes as “one-trip loading.”

Its optimised chassis and suspension design minimise wheel arch intrusions, creating a flatter and more practical loading surface.

Integrated side and rear steps simplify loading and unloading, helping businesses improve turnaround time in demanding work environments.

READ ALSO:

- Suspected Bandits Use IED to Blow Up Cement Trailer in Zamfara

- How Nigerian Ex-Naval Officer Allegedly Tricked Into Russia’s Army via Fake Job Offer

- MURIC Demands Suspension of Olubi School Principal, VPs Over Alleged Religious Discrimination

Built on a high-strength ladder frame with reinforced rear-spring suspension, the Himla offers a rated payload exceeding 1,000 kg while maintaining stability under heavy loads.

It also boasts a 3-ton towing capacity, positioning it as a strong contender for hauling equipment, refrigerated containers and other heavy-duty applications across logistics, construction and agriculture.

Engineered for Nigerian Terrain

Designed with Nigeria’s diverse road conditions in mind, the Himla features advanced 4×4 capability and 265 mm ground clearance to tackle rough job sites and rural terrain with confidence.

Carloha says the pickup is engineered for durability in high temperatures and humid environments, incorporating wear-resistant and anti-corrosion materials, galvanised steel components and high-strength body panels. Multiple heavy-duty anchoring points ensure cargo stability even on uneven surfaces.

The vehicle is available in ICE variants and comes equipped with premium leather seats, a 15.6-inch central touchscreen, a 9.2-inch digital dashboard display and enhanced rear-seat comfort. Higher-end models feature advanced driver assistance systems.

Real-World Test Drive

Motoring journalists, customers and automobile enthusiasts at the launch event had the opportunity to test-drive the Himla across simulated terrains.

The demonstration highlighted its 4×4 capability, hill approach and descent angles, towing strength, load stability, water-wading ability, in-cabin quietness and overall ride comfort.

General Manager, Marketing at Carloha Nigeria, Mr. Felix Mahan, described the Himla as a cornerstone of Chery’s global pickup strategy.

He said the model combines “class-leading cargo capacity, hardcore load capability, advanced technology and climate-adapted engineering” to serve Nigerian entrepreneurs as a reliable business partner.

Backed by a class-leading six-year warranty, the Himla enters the Nigerian market with a strong value proposition.

With its unveiling, Carloha is betting that Nigeria’s evolving economy will increasingly demand pickups that do more than transport goods — vehicles designed to power productivity, cut operational costs and drive enterprise growth.

Carloha shakes up pickup market with launch of heavy-duty Chery Himla

-

Entertainment2 days ago

Entertainment2 days agoNollywood Actor Okemesi Confirmed Dead After Brief Illness

-

News3 days ago

News3 days agoBREAKING: IGP Kayode Egbetokun Steps Down as Tinubu Names Tunji Disu as New Police Chief

-

metro2 days ago

metro2 days agoFrank Mba, Senior DIGs to Exit Police Service After Disu’s Appointment

-

metro2 days ago

metro2 days agoAfrican Virologists Elected to Lead World Society for Virology

-

News2 days ago

News2 days agoBREAKING: Tinubu Decorates Tunji Disu as Acting Inspector‑General of Police

-

News3 days ago

News3 days agoMother of Three Dies by Suicide After Fiance’s Family Rejects Marriage in Ijebu-Ode

-

metro2 days ago

metro2 days agoAbroad-Based Nigerian Woman Kneels with Children in Emotional Tribute to Husband (VIDEO)

-

News3 days ago

News3 days agoU.S. Congress Submits Report to Trump on Alleged Christian Persecution in Nigeria