Business

E-Naira adds no value to Nigeria’s economy – Expert faults FG

Following the launch of the much anticipated digital currency, e-Naira, which is the first of its kind in Africa, as social justice expert has raised concerns.

President Muhammadu Buhari had launched the e-Naira on Monday at the Presidential Villa, Abuja.

The Central Bank Digital Currency (CBDC) and its underlying technology, called blockchain, has the ability to improve Nigeria’s Gross Domestic Product, GDP, by $29 billion over the next 10 years, President Muhammadu Buhari had said.

E-Naira, according to Buhari would enable the government send direct payments to citizens eligible for specific welfare programmes as well as foster cross border trade.

The digital currency has the capacity to ensure economic growth through better economic activities, increase remittances, improve financial inclusion and make monetary policy more effective.

But speaking on the issue, the Lead Director of Centre for Social Justice, CSJ, Eze Onyekpere, faulted the launch of e-Naira.

In a chat with DAILY POST, Onyekpere lamented that the newly launched e-Naira adds “no spectacular value” to the economy.

Describing the latest action of the government as “cosmetic,” the CSJ Lead Director wondered what value the digital currency would add to the economy.

He said: “I think the important thing right now is what adds value to the economy in terms of job creation, stabilizing our currency, economic growth, and reducing the run on the Naira.

“So all these, be it e-money or x-money, is not adding any spectacular value; it’s just a different format of the money available.

“For me, it’s not about having the capacity or not, of course we have it; but it’s a little bit cosmetic; what value is it adding to the economy?

“I’m yet to see any major value, is it going to create jobs for the teeming youths? Is it going to return the value of the Naira? Is it going to reduce inflation? Or it’s just one of those formal things that doesn’t hold the substance of the challenge of the Nigerian economy?”

DAILY POST observed that one of the major threats to the digital currency is fraud, and the Nigerian government launched the e-Naira at a time when the country is witnessing an escalation in advanced fee fraud popularly called Yahoo Yahoo.

Some Nigerian youths have taken to Yahoo Yahoo as a shorter route to economic empowerment, which is a direct result of the government’s inadequacies to provide jobs and ensure improvement in the quality of lives.

Recall that a Nigerian Instagram celebrity, Ramon Abbas aka Hushpuppi and his cronies had used financial platforms like Bitcoin to hide some of the loots they acquired from Yahoo Yahoo.

However, Onyekpere urged the Central Bank of Nigeria, CBN, and security agents to be proactive in protecting the digital currency from fraudsters.

He said: “Everything that has an advantage must have a disadvantage. E-money does not necessarily means fraud, and as some people are planning it; there should be security measures to put in place by CBN, security agencies, and financial intelligent unit, who should work towards curtailing such, that is why we pay them.

“That people can commit fraud should not be a reason why we should not operate e-money. I think we should work towards curtailing any negative tendencies.”

Eze Onyekpere is a lawyer with specialization in development law including electricity reforms, fiscal governance, human rights and constitutional reforms. He has worked on electric power sector reforms, privatization, gender and trade policy and liberalization of education.

Daily Post

Business

CBN sells dollar to BDCs at N1,021/$1

CBN sells dollar to BDCs at N1,021/$1

The Central Bank of Nigeria (CBN) has announced a $10,000 sale to each licensed Bureau De Change (BDC) operator nationwide.

The apex bank has made its second intervention this month.

The CBN detailed the action in a circular issued to the President of the Association of Bureau De Change Operators (ABCON).

BDCs can purchase dollars at a rate of N1,021 per dollar.

READ ALSO:

- Just in: Ex-Imo Gov Ihedioha heads for LP, dumps PDP

- Policeman shot dead corps member at LAUTECH convocation party

- Tinubu approves palliative for traditional, religious institutions

They are, therefore, authorized to sell this forex to eligible end users at a maximum spread of 1.5 percent above the purchase price, translating to a maximum selling price of N1,036.15 per dollar.

On the 8th of April 2024, the CBN sold $10,000 FX to each of the 1,588 participating BDCs at a fixed rate of N1101 per US dollar at a spread capped at 1.5 percent above the purchase price from the CBN (approximately N1,116.15 per dollar). This limited the potential profit BDCs could make on each transaction

The latest circular has instructed all eligible BDCs to commence immediate payment of the Naira equivalent for their allocated $10,000 into designated CBN Naira Deposit Accounts.

CBN sells dollar to BDCs at N1,021/$1

Business

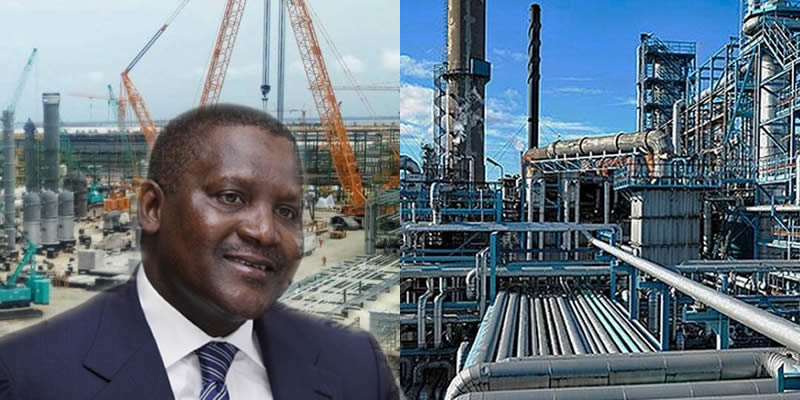

Dangote refinery further drops diesel price to N940/litre

Dangote refinery further drops diesel price to N940/litre

Dangote Petroleum Refinery has announced a further reduction in the price of both diesel to N940 per litre.

This is coming a few days after the refinery reduced diesel price to N1,000 per litre.

It also gave a new price for aviation fuel, pegging it at N980 per litre.

It disclosed this in a statement on Tuesday, saying the diesel price change of N940 is applicable to customers buying five million litres or more from the refinery, while those purchasing one million litres or more will pay N970.

It said this marked the third major reduction in diesel price “in less than three weeks when the product sold at N1,700 to N1,200 and also a further reduction to N1,000 and now N940 for diesel and N980 for aviation fuel per litre”.

Speaking on the new development, Anthony Chiejina, head of communication, Dangote Group, said the new price was in tandem with the company’s commitment to alleviating the effect of economic hardship in Nigeria.

“I can confirm to you that Dangote Petroleum Refinery has entered a strategic partnership with MRS Oil and Gas stations, to ensure that consumers get to buy fuel at affordable price, in all their stations, be it Lagos or Maiduguri,” he said.

“You can buy as low as one litre of diesel at N1,050 and aviation fuel at N980 at all major airports where MRS operates.”

He said the partnership would be extended to other major oil marketers.

“The essence of this is to ensure that retail buyers do not buy at exorbitant prices,” he said.

“The Dangote Group is committed to ensuring that Nigerians have a better welfare and as such, we are happy to announce this new prices and hope that it would go a long way to cushion the effect of economic challenges in the country.”

Director-General of the Manufacturers Association of Nigeria (MAN), Ajayi Kadiri, said the decision “to first crash the price from about N1,750/litre to N1,200/litre, N1,000/litre and now N940 is an eloquent demonstration of the capacity of local industries to positively impact the fortunes of the national economy.

“The trickle-down effect of this singular intervention promises to change the dynamics in the energy cost equation of the country, in the midst of inadequate and rising cost of electricity.”

Aviation

Dana Air grounds plane after runway incident, 83 passengers on board

Dana Air grounds plane after runway incident, 83 passengers on board

Dana Air says it has grounded its airplane that skidded off the Lagos airport runway on Tuesday.

The affected aircraft, a McDonald Douglas (MD-83) with registration 5N-BKI, had 83 passengers on board, it added.

Spokesman for the airline, Mr Kingsley Ezenwa, however, said all the 83 passengers and crew onboard the flight disembarked safely without injuries.

He said in a statement that the airline decided to ground the plane to allow for proper investigation into what caused the accident.

The statement read in part, “Dana Air regrets to inform the public of a runway incursion involving one of our aircraft, registration number 5N BKI, which was flying from Abuja to Lagos today, 23/04/24.

“We are relieved to confirm that all 83 passengers and crew onboard the flight disembarked safely without injuries or scare as the crew handled the situation with utmost professionalism.

“We have also updated the Accident Investigation Bureau, AIB, and Nigerian Civil Aviation Authority (NCAA) on the incident, and the aircraft involved has been grounded by our maintenance team for further investigation.

“We wish to thank the airport authorities, our crew for their very swift response in ensuring the safe disembarkation of all passengers following the incident, and our sincere apologies and appreciation to the passengers on the affected flight for their patience and understanding.”

-

Education4 days ago

Education4 days agoWhy we charge N42m fees for primary school pupils — Charterhouse Lagos

-

Business7 days ago

Business7 days agoGovt paying N600bn for fuel subsidy monthly — Rainoil CEO

-

News5 days ago

News5 days agoUpdated: More trouble for Yahaya Bello as Immigration places him on watch list

-

Auto4 days ago

Auto4 days agoWe expect massive roll-outs of Nigeria-made cars by December 2024 – Minister

-

metro7 days ago

metro7 days agoEdo court sentences three to death by hanging for kidnapping, murder

-

International5 days ago

International5 days agoUpdated: Tragedy hits Kenya, Defence chief, nine others die in military helicopter crash

-

metro4 days ago

metro4 days agoJUST IN : Borrow pit collapses, kills seven Qur’anic school pupils

-

News3 days ago

News3 days agoWe’re not part of Yoruba Nation agitation, says MKO Abiola family