Business

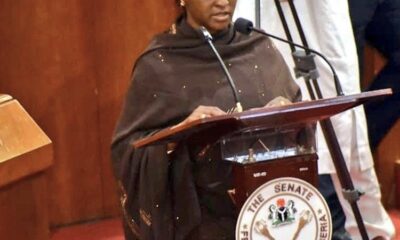

FG considering fresh borrowing from IMF – Finance minister

The Federal Government is considering tapping into the newly created fund by the International Monetary Fund (IMF) to cater for its urgent financial needs, Minister of Finance, Budget and National Planning, Zainab Ahmed, has said.

She gave the indication on the sidelines at the ongoing IMF- World Bank meetings on Wednesday in Washington.

Many people including National Assembly members have expressed concern that the country might be approaching a debt trap its total debt standing at N42.84 trillion ($103,31bn) as of June this year.

The minister also said the FG had been engaging financial institutions to look into the country’s portfolio debt to restructure and further stretch the debt service period to give more fiscal relief.

“It is a fact that Nigeria’s debt has increased over the last three to four years, and this increase in debt was occasioned by the different kinds of exogenous shocks that the country faced, which are not unique to Nigeria,” she said.

“The last drawing we had from the IMF is the second round of special drawing rights (SDRs) that was provided for all the member countries. The IMF recently offered a food security package that countries can draw, and it is equivalent to about 50 per cent of their SDRs.

“We have not taken a decision to draw on that. We have to examine the requirements, terms and conditions, to see if it will be safe for us to draw because we don’t want to be drawn into an IMF programme.

“If they work for us, we will now decide to take it because the funds can certainly be useful in terms of adding to our reserves and coping with the challenges the country is facing.”

She said there were signs that the recent flooding in the country would cause more stress to the food system, affecting harvest and prices.

“The floods that have been happening are going to cause more stress on our food system. We realise that the floods are currently destroying crops and therefore the harvest that is expected will be much less, and it will mean that more of our people will struggle to afford food,” she added.

Ahmed also said the Federal Government plans to use up to 65 per cent of government revenues next year to service debt.

She said the government would scale back on some tax incentives and expand the tax net to ramp up domestic revenue.

The minister said, “Unfortunately, the cost of debt service is rising because of the rising interest rate globally, resulting in higher debt service costs. Our projection from the debt sustainability analysis is that Nigeria is able to cope with its debt service.

“We have been engaging financial institutions to look at the opportunity to restructure our debt to further stretch the debt service period to give us more fiscal relief. Those are some of the things we want to achieve in this meeting.

“Also, what we are doing is to ramp up domestic revenue mobilisation. There are so many different aspects that we are looking at, including cutting down on tax expenditure taxes, furniture, waivers, incentives that are being provided to encourage businesses.”

IMF Director of Research Department, Pierre-Olivier Gourinchas, advised low-income countries to progress toward debt restructuring to avert sovereign debt crises.

Gourinchas said many low-income countries were close to or already in debt distress and should urgently consider improving their liquidity buffers, including by requesting access to precautionary instruments from the Fund.

He said, “Countries should also aim to minimise the impact of future financial turmoil through a combination of preemptive macroprudential and capital flow measures, where appropriate, in line with IMF’s Integrated Policy Framework.

“There are clouds on the horizon, but progress on climate policies, debt resolution, and other targeted global issues will demonstrate that strengthened cooperation can achieve progress for all and help to overcome geoeconomic fragmentation.”

Railway

Lagos Govt to redesign Oshodi motor park for rail integration

Lagos Govt to redesign Oshodi motor park for rail integration

The Lagos State Government has announced plans to redesign the Oshodi Transport Interchange (OTI) to integrate the facility with the Red Line and Blue Line rail systems, advancing its Rail Mass Transit project.

This initiative aims to deliver seamless connectivity between the two key rail networks and enhance commuters’ experience in Lagos.

The disclosure was conveyed via a statement shared on the official X (formerly Twitter) account of the Lagos State Ministry of Transportation on Saturday, highlighting the need to optimize the design and operations of the OTI to boost efficiency and align with global standards.

READ ALSO:

- Nurse punished in UK for addressing convicted transgender paedophile as ‘Mr’

- Ex-LG chair challenges El-Rufai’s claims on council funds

- Some ladies in movie industry ready to sleep their way to fame — Jide Kosoko

To kickstart the process, the Honourable Commissioner for Transportation, Seun Osiyemi, held a meeting with stakeholders to assess the current state of the interchange and outline strategies for its improvement.

“The Ministry of Transportation sought to address the ongoing developments and challenges affecting the Oshodi Transport Interchange (OTI) in preparedness for the integration of the Rail Mass transit system; Red Line rail project connecting the Blue Line.

“The Ministry recognized that a review of the OTI’s design and operations is essential for its optimization which led to the Honourable Commissioner for Transportation, Oluwaseun Osiyemi meeting with relevant Stakeholders to discuss the current state of the OTI and identify viable solutions that would enhance its operational efficiency in alignment with global standards and Standard Operating Procedures,” the statement read in part.

Lagos Govt to redesign Oshodi motor park for rail integration

Auto

Nigeria’s firm, Weststar Associates, shines in Dubai, wins Daimler Truck EliteClass award

Nigeria’s firm, Weststar Associates, shines in Dubai, wins Daimler Truck EliteClass award

Weststar Associates Limited, Authorised General Distributor of Daimler Truck in Nigeria, has brought honour home all the way from United Arab Emirates specifically at the EliteClass 2024 Season Awards.

Daimler Truck Middle East Africa the Weststar team with the Silver Award in the Elite CSP (Customer Service and Parts) Performance category.

This is contained in a statement issued in Lagos, which added that the EliteClass 2024 Awards ceremony brought together 40 Daimler Truck Business Partners for a night of recognition and celebration.

Held at the One & Only Royal Mirage in Dubai, the prestigious black-tie event honoured top-performing general distributors that have demonstrated exceptional performance, dedication, and commitment to excellence in 2024.

The EliteClass 2024 Awards C

ceremony was the culmination of a year-long EliteClass programme for the Middle East and Africa measuring 24 categories across the entire business spectrum for Mercedes-Benz Trucks, Daimler Buses, and Fuso Trucks & Bus.

The awards highlighted the dedication and resilience of partners who have achieved outstanding performance and a remarkable commitment to excellence and contributed significantly to Daimler Truck’s success in the MEA regions.

President & CEO of Daimler Truck Middle East Africa, Mr. Michael Dietz, emphasized the importance of collaboration and performance-driven success during his opening address. “EliteClass 2024 is more than just an awards ceremony—it is a testament to the hard work, commitment, and shared vision of our partners.

“Their achievements continue to drive our brand forward, setting new benchmarks in customer experience and operational excellence across the region,” he said.

Weststar’s General Manager, Sales, Mr. Christopher Irumudomon, was present at the EliteClass 2024 Season Awards ceremony to accept the Silver Award in the Elite CSP (Customer Service and Parts) Performance category.

While presenting this award, the Daimler Trucks MEA leadership made the following statement: “Congratulations on your achievement in the EliteClass Central Africa 2024 Season. We are pleased to recognize your individual category achievement.”

The EliteClass 2024 Awards reaffirms Daimler Truck’s commitment to excellence, continuous growth, and the recognition of partners who drive success in an evolving industry landscape.

According to the statement, Weststar Associates Limited continues to fly the flag of the “brand with the star” high in Nigeria.

It said the company had remained the go-to home for all Mercedes-Benz needs in this region.

“With a dealership network that expands to the major regions of the country, along with highly trained and experienced sales and after-sales staff. Nigerians can rest assured that they will always have ‘the best or nothing’ at their disposal,” it stated.

Railway

NRC to revive Lagos 2pm MTTS train as Opeifa tours districts

NRC to revive Lagos 2pm MTTS train as Opeifa tours districts

The Nigerian Railwaiy Corporation (NRC) will soon revive its Lagos 2pm mass transit train service (MTTS) in line with the demands of passengers.

Managing Director of the NRC, Dr Kayode Opeifa, disclosed in Lagos, assuring Nigerians of the readiness of the corporation to serve them better.

He spoke at the Iddo Train Station, while addressing train passengers commuting daily from Ijoko and other border communities in Ogun State to Iddo and Idumota axis of the Lagos Island.

A statement by the Deputy Director of Public Relations at the NRC, Mahmood Yakubu, quoted the MD as saying, “NRC management being aware of the centrality of the MTT Kajola to Iddo rail line to the continued prosperity of the Iddo, Idumota and some other big markets in Lagos will not only continue to sustain the line, but work to add addition service after careful commercial market viability and sustainability studies.”

Opeifa was at Iddo Station to assess the available space in preparation for upcoming developmental and revitalization initiatives.

According to him, the transformation of the Iddo Terminal is central to the corporation’s goal to significantly improve the terminal’s infrastructure, optimize its capacity and elevate the passenger experience

He also said the management would urgently embark on the rehabilitation of the coaches to improve the ambience of the interior of the trains and the Iddo stations for better customer experience and patronage.

Opeifa said he would not hesitate to terminate the contract of any contractor not willing or ready to add value to the corporation’s service.

The managing director, who spent some time going round the Iddo Station, also directed the installation of solar panels around the station to better improve the lightening condition, even as he sent the signal that a comprehensive review of all land leases around the station is underway.

Opeifa was nostalgic about the several interesting monuments and railway relics.

He called on corporate organisations and other philanthropists to support the corporation in the area of provision of conveniences for train passengers as part of their corporate social responsibility.

The Railway District Manager (RDM), Engr Augustine Arisa, and District Superintendent, Mrs Chidinma Mba, also informed the MD that the prosperity of the Idumota market is also related to the operations of the MTT line as any day the train does not run, the market feels it.

The NRC MD had earlier commenced his maiden tour of the NRC districts across the country, with a tour to the Running Shed of the corporation at Ebute Metta, which he learnt was a hub to other districts.

He expressed delight at the industry of ironmen (women engineers and technicians) working in the corporation who are competing with their male counterparts in ensuring that all the nation’s rolling assets are in serviceable conditions.

The tour took him to the store, where Opeifa directed that the management must commence the painting of several legacy buildings of the corporation across the country.

He added that the corporation was determined to improve its image as a frontline mobility service provider and the hub for logistics services in the country.

Opeifa who observed that there are no scraps in the railway, reiterated earlier calls on Nigerians to beware of anyone vandalizing the rail materials across the country, adding that security agencies especially the Nigeria Security and Civil Defence Corps (NSCDC) had been directed to prosecute anyone caught vandalizing any rail assets.

He said the corporation would put back to shape as many narrow gauge locomotives still serviceable and would deploy them across the country to serve passenger traffic anywhere the corporation had existing train lines just as the Federal Government would aggressively continue to invest and expand the national standard gauge corridor.

The tour also took the managing director to the Battery Room, as well as the laboratory, an inspection of all the mechanical fluids which was a crucial facility responsible for analyzing the quality and integrity of mechanical fluids used in NRC rail operations.

He assured the laboratory that the management under his watch would continue to support their growth and development as he himself trained and once worked as an analytical chemist.

The tour also took Opeifa to Agege Station where he had a closed door meeting with officials from the Lagos Metropolitan Area Transport Authority (LAMATA), led by the Director Rail Services Engr Olasunkanmi Okusaga, on how to firm up security challenges between the two stations Babatunde Raji Fashola Station and the Lagos State Train Station at Agege Station.

Opeifa who was led round by the Agege Station Manager, Mrs Ese Asowata, went round to check the station’s conveniences, the VIP Lounge, the control room, the ticketing lounge and administrative sections among others.

The managing director took time to address the concerns of some train passengers, one of them, Olatunde Apata, who complained of what could be done for any passenger who missed his train. Apata, who was heading to the Prof. Wole Soyinka Station, in Abeokuta, Ogun State, had missed his train because he went to pray.

Addressing all challenges Opeifa directed that under no circumstances should the ticket not work to relief passengers with disability access the train.

He equally said efforts were being made to see how the issue of those missing their train would be addressed even as he disclosed that the NRC and LAMATA were working at how to ensure passengers could co-switch and access the metro train to continue their journey from the stations.

-

metro2 days ago

metro2 days ago‘We’re not hiring,’ NNPC denies viral recruitment adverts

-

metro1 day ago

metro1 day agoNatasha: Court blocks recall attempt, stops INEC

-

Sports1 day ago

Sports1 day agoOdegbami speaks on Osimhen breaking his 44-year goals record

-

metro3 days ago

metro3 days agoMore trouble brews in Rivers as Ijaw congress considers self-determination option

-

Entertainment1 day ago

Entertainment1 day agoI didn’t snatch Asake’s mother from her husband -Musibau Alani

-

Sports2 days ago

Sports2 days ago2026 WCQ: Super Eagles move up to third place with 2-0 win in Rwanda

-

metro1 day ago

metro1 day agoBoko Haram attacks military base in Adamawa

-

Sports2 days ago

Sports2 days agoOsimhen breaks Odegbami’s Eagles goal record