Business

HURIWA applauds NNPCL’s transparency, accountability in 2023 financial report

HURIWA applauds NNPCL’s transparency, accountability in 2023 financial report

The Human Rights Writers Association of Nigeria (HURIWA) has commended the Nigerian National Petroleum Company Limited (NNPCL) for its unprecedented display of transparency and accountability in releasing its 2023 Audited Financial Statement (AFS).

HURIWA stated that the NNPCL’s declaration of a net profit of N3.3 trillion, alongside the announcement of a N2.1 trillion dividend, marks a significant milestone in the company’s history and represents a clear departure from the opacity and inefficiency that once characterized the former Nigerian National Petroleum Corporation (NNPC).

In a statement released on Sunday, HURIWA’s National Coordinator, Comrade Emmanuel Onwubiko lauded the management of NNPCL under the leadership of the Group Managing Director, Mele Kyari, noting that the company’s impressive financial performance and commitment to openness signal a new era in Nigeria’s petroleum industry. According to HURIWA, the reborn NNPCL has demonstrated a commitment to upholding the principles of good corporate governance, a stark contrast to the previous practices that plagued the then NNPC.

The human rights group emphasized that NNPCL’s release of its audited financials, which showed a 28% increase in profit from the previous year, is a testament to the company’s resolve to operate with integrity and transparency. “This is a remarkable achievement that reflects the positive changes implemented since NNPC transitioned to NNPCL. The company’s ability to post such impressive returns amidst the challenges in the operational and economic environment is commendable,” HURIWA stated.

HURIWA highlighted that the NNPCL’s progress in financial transparency is directly linked to the leadership of Mele Kyari, who assumed the role of Group Managing Director in 2019. The organization pointed out that Kyari’s tenure has been marked by a series of transformative reforms aimed at improving the efficiency and profitability of NNPCL. “Since taking office, Mele Kyari has demonstrated an unwavering commitment to repositioning NNPCL as a transparent and accountable entity.His leadership has ushered in a new era of corporate responsibility, which has now culminated in the remarkable financial performance recorded in 2023,” HURIWA noted.

READ ALSO:

- One abductor killed, two captured during rescue operation of 20 medical students

- My Presidency would have brought prosperity, Atiku replies Bode George

- Lady beats, strips friend naked for allegedly sleeping with boyfriend + Videos

The human rights group also praised the NNPCL Board for its role in driving the company’s success. The approval of a final dividend of N2.1 trillion by the company’s shareholders, as announced by NNPCL Board Chairman, Chief Pius Akinyelure, was described by HURIWA as a reflection of the confidence reposed in the company’s management. “The decision to declare such a substantial dividend underscores the commitment of the NNPCL Board and Management to delivering value to shareholders and contributing to Nigeria’s economic growth,” HURIWA remarked.

Furthermore, HURIWA underscored the significance of the Petroleum Industry Act (PIA) 2021 in enabling NNPCL’s transformation. The group argued that the PIA has provided the necessary framework for the company to operate more efficiently and transparently, thereby enhancing its ability to achieve sustained profitability. “The PIA 2021 has played a crucial role in creating an enabling environment for NNPCL to thrive. The Act’s provisions have empowered the company to implement strategic initiatives that have resulted in the impressive financial outcomes we are witnessing today,” HURIWA observed.

However, while commending NNPCL’s progress, HURIWA also issued a stern reminder that the company must remain vigilant in safeguarding its newfound transparency and accountability. The organization urged NNPCL to resist any attempts to revert to the practices of the past, which were characterized by corruption, inefficiency, and a lack of transparency. “NNPCL must never return to the days of the locusts, when the then NNPC was synonymous with corruption and mismanagement. The company must continue to build on its recent successes by strengthening its capacity for transparency, accountability, and operational efficiency,” HURIWA warned.

READ ALSO:

- CEO of Telegram Pavel Durov arrested in France

- Kidnap: Heavily pregnant Lagos woman travels 334 kilometres to deliver ransom

- JTF arrests forgers linked to illegal crude oil trade

In addition, HURIWA called on NNPCL to implement measures that will further enhance its financial reporting and governance practices. The group stressed the importance of maintaining a culture of transparency across all levels of the company’s operations, including its dealings with stakeholders and the general public. “NNPCL must ensure that its commitment to transparency and accountability is institutionalized. This requires continuous improvement in its financial reporting processes, as well as a proactive approach to engaging with stakeholders and addressing any concerns that may arise,” HURIWA advised.

The human rights group also expressed hope that NNPCL’s transparency and accountability will set a positive example for other government-owned enterprises in Nigeria. HURIWA urged other state-owned entities to emulate NNPCL’s approach to corporate governance, particularly in the areas of financial reporting and stakeholder engagement. “NNPCL has set a high standard for transparency and accountability, which other government-owned enterprises should strive to meet. We believe that adopting similar practices will contribute to the overall improvement of Nigeria’s public sector,” HURIWA concluded.

Looking ahead, HURIWA expressed confidence in NNPCL’s ability to sustain its profitability and achieve its production targets. The organization noted the company’s ambition to reach 2 million barrels per day of crude oil production by December 2024, as outlined by NNPCL’s Executive Vice President, Upstream, Mrs. Oritsemeyiwa Eyesan. HURIWA acknowledged that this goal, if achieved, would further enhance Nigeria’s energy security and economic stability.

In conclusion, HURIWA reaffirmed its support for NNPCL’s ongoing reforms and urged the company to remain committed to its principles of transparency, accountability, and operational excellence. The organization reiterated that NNPCL’s transformation is a testament to the positive impact of good leadership and sound governance, and called on all stakeholders to continue supporting the company’s efforts to build a brighter future for Nigeria’s petroleum industry.

HURIWA applauds NNPCL’s transparency, accountability in 2023 financial report

Railway

NRC to revive Lagos 2pm MTTS train as Opeifa tours districts

NRC to revive Lagos 2pm MTTS train as Opeifa tours districts

The Nigerian Railwaiy Corporation (NRC) will soon revive its Lagos 2pm mass transit train service (MTTS) in line with the demands of passengers.

Managing Director of the NRC, Dr Kayode Opeifa, disclosed in Lagos, assuring Nigerians of the readiness of the corporation to serve them better.

He spoke at the Iddo Train Station, while addressing train passengers commuting daily from Ijoko and other border communities in Ogun State to Iddo and Idumota axis of the Lagos Island.

A statement by the Deputy Director of Public Relations at the NRC, Mahmood Yakubu, quoted the MD as saying, “NRC management being aware of the centrality of the MTT Kajola to Iddo rail line to the continued prosperity of the Iddo, Idumota and some other big markets in Lagos will not only continue to sustain the line, but work to add addition service after careful commercial market viability and sustainability studies.”

Opeifa was at Iddo Station to assess the available space in preparation for upcoming developmental and revitalization initiatives.

According to him, the transformation of the Iddo Terminal is central to the corporation’s goal to significantly improve the terminal’s infrastructure, optimize its capacity and elevate the passenger experience

He also said the management would urgently embark on the rehabilitation of the coaches to improve the ambience of the interior of the trains and the Iddo stations for better customer experience and patronage.

Opeifa said he would not hesitate to terminate the contract of any contractor not willing or ready to add value to the corporation’s service.

The managing director, who spent some time going round the Iddo Station, also directed the installation of solar panels around the station to better improve the lightening condition, even as he sent the signal that a comprehensive review of all land leases around the station is underway.

Opeifa was nostalgic about the several interesting monuments and railway relics.

He called on corporate organisations and other philanthropists to support the corporation in the area of provision of conveniences for train passengers as part of their corporate social responsibility.

The Railway District Manager (RDM), Engr Augustine Arisa, and District Superintendent, Mrs Chidinma Mba, also informed the MD that the prosperity of the Idumota market is also related to the operations of the MTT line as any day the train does not run, the market feels it.

The NRC MD had earlier commenced his maiden tour of the NRC districts across the country, with a tour to the Running Shed of the corporation at Ebute Metta, which he learnt was a hub to other districts.

He expressed delight at the industry of ironmen (women engineers and technicians) working in the corporation who are competing with their male counterparts in ensuring that all the nation’s rolling assets are in serviceable conditions.

The tour took him to the store, where Opeifa directed that the management must commence the painting of several legacy buildings of the corporation across the country.

He added that the corporation was determined to improve its image as a frontline mobility service provider and the hub for logistics services in the country.

Opeifa who observed that there are no scraps in the railway, reiterated earlier calls on Nigerians to beware of anyone vandalizing the rail materials across the country, adding that security agencies especially the Nigeria Security and Civil Defence Corps (NSCDC) had been directed to prosecute anyone caught vandalizing any rail assets.

He said the corporation would put back to shape as many narrow gauge locomotives still serviceable and would deploy them across the country to serve passenger traffic anywhere the corporation had existing train lines just as the Federal Government would aggressively continue to invest and expand the national standard gauge corridor.

The tour also took the managing director to the Battery Room, as well as the laboratory, an inspection of all the mechanical fluids which was a crucial facility responsible for analyzing the quality and integrity of mechanical fluids used in NRC rail operations.

He assured the laboratory that the management under his watch would continue to support their growth and development as he himself trained and once worked as an analytical chemist.

The tour also took Opeifa to Agege Station where he had a closed door meeting with officials from the Lagos Metropolitan Area Transport Authority (LAMATA), led by the Director Rail Services Engr Olasunkanmi Okusaga, on how to firm up security challenges between the two stations Babatunde Raji Fashola Station and the Lagos State Train Station at Agege Station.

Opeifa who was led round by the Agege Station Manager, Mrs Ese Asowata, went round to check the station’s conveniences, the VIP Lounge, the control room, the ticketing lounge and administrative sections among others.

The managing director took time to address the concerns of some train passengers, one of them, Olatunde Apata, who complained of what could be done for any passenger who missed his train. Apata, who was heading to the Prof. Wole Soyinka Station, in Abeokuta, Ogun State, had missed his train because he went to pray.

Addressing all challenges Opeifa directed that under no circumstances should the ticket not work to relief passengers with disability access the train.

He equally said efforts were being made to see how the issue of those missing their train would be addressed even as he disclosed that the NRC and LAMATA were working at how to ensure passengers could co-switch and access the metro train to continue their journey from the stations.

Auto

KIA, Access Bank launch special finance scheme for vehicle ownership

KIA, Access Bank launch special finance scheme for vehicle ownership

KIA Motors Nigeria in partnership with Access Bank Plc has unveiled a new finance scheme designed to increase vehicle ownership and affordability in the country.

The deal, according to a statement by the auto firm, offers flexible and affordable financing alternatives, enabling individuals, women, and businesses to own cars with ease.

The scheme features the all-new Kia Rio 2023, with repayment plans spanning five to seven years.

Marketing Manager, KIA Motors Nigeria, Omolade Akinyode, said, ”Dana Motors has been at the forefront of Nigeria’s automotive industry since 2002, providing exceptional automotive solutions and presently leading the charge for luxury electric cars, CNG cars and buses.

“Our partnership with Access Bank reinforces our commitment to supporting Nigeria’s economic growth, individuals, and women.”

She also said, ”Our core competitive edge in the auto industry is the offering of best in class vehicles at affordable prices and this retail financing scheme is a significant step towards promoting vehicle ownership in Nigeria.

”With a flexible repayment option of up to 48 months, equity contribution as low as 10% and over N6m discount and we are proud to be at the forefront of this initiative to make owning the all-new Kia Rio 2023 a dream come through for our Nigerian Customers.”

KIA stated that the car in the package, Rio 2023, is an award winning five-seater sedan, a fun car with a reputation for durability, reliability, comfort and fuel efficiency.

With safety features which include stability control, traction control, and multiple airbags, the all new KIA Rio 2023 is an excellent choice for customers who prioritize dependability in vehicle options,” it stated.

Auto

NADDC DG hails Kojo Motors for establishing CNG conversion centre in Owerri

NADDC DG hails Kojo Motors for establishing CNG conversion centre in Owerri

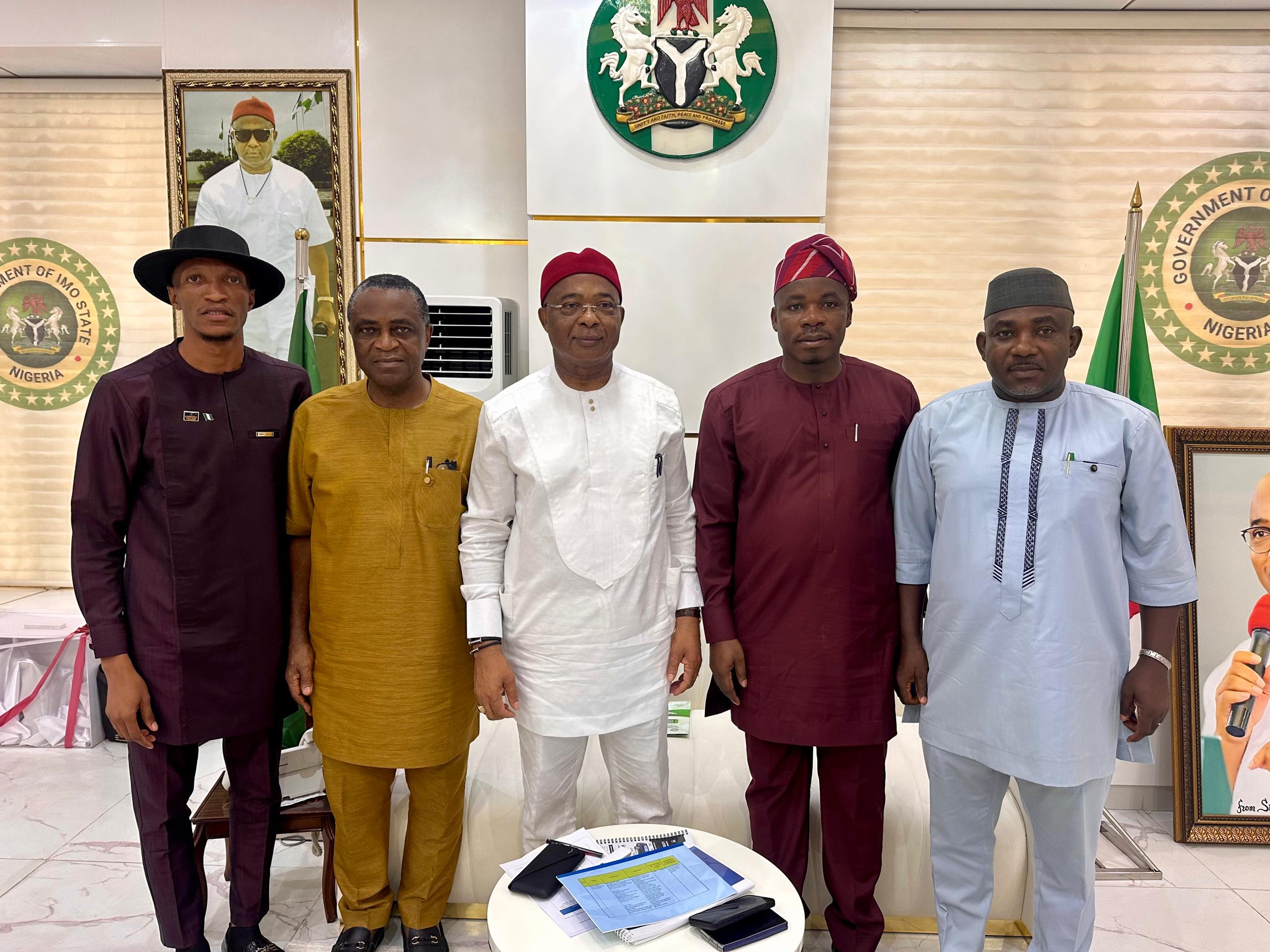

Kojo Motors has partnered the National Automotive Design and Development Council (NADDC) in setting up the vehicle Compressed Natural Gas conversion centre in Owerri, lmo State.

Director-General of the NADDC, Joseph Osanipin, during an empowerment and awareness summit on Wednesday, March 19, 2025, commended the auto firm for the monumental project.

“Today, we are gathered here for Compressed Natural Gas (CNG) Empowerment and Awareness Summit 2025 with the theme ‘Building a youth-based nation through cleaner energy’,” he said.

Osanipin said that the the purpose of the summit was to create awareness and sensitize the public to safety, standards and regulation in the use of the CNG as a better alternative source of energy for mobility.

NADDC, he said, was equipping technicians with the knowledge, skills and competencies required to safely and efficiently convert vehicles to run on CNG.

“The Council is a parastatal of the Federal Government under the Federal Ministry of Industry, Trade and Investment,” he added.

“It has the regulatory oversight on the Nigerian Automotive Industry to initiate, recommend, supervise and regulate policies and programmes for locally manufactured vehicles and components in Nigeria.

The NADDC boss noted that the Council had worked tirelessly to ensure the survival and growth of this sector with a view to enhancing its contribution to the national economy.

As part of the CNG conversion programme, 60 technicians will be receiving hands-on training in converting vehicles to run on CNG which would run for five days from the March 17 to 21,2025.

Osanipin emphasized the importance of using certified conversion kits and specialized workshops to ensure safety during the process.

“The cylinders used in CNG vehicles are fortified, making them safer than traditional vehicle fuel tanks,” he said.

Also speaking during the event, Professor Anoka Njan, representative of the Minister of Industry Trade and Investment, praised the NADDC and Kojo Motors efforts, stating that the ministry fully supported the initiative as part of broader efforts to alleviate challenges in the auto industry and empower the youth.

Imo State Commissioner for Youth Development, Dr. Emeka Mandela Ukaegbu, who spoke at the summit on behalf of Governor Hope Uzodinma, emphasised the immense potential of the CNG in easing Nigeria’s transportation challenges and improving the economy.

“CNG offers a safer, cleaner, and cheaper alternative to the hardships many face in the country,” Dr. Madela said.

The administration is partnering with NADDC and automotive industry bodies to establish conversion workshops and CNG refilling stations across Imo State, ensuring that the state plays a key role in this important shift toward greener energy solutions.

The event marks a significant step in NADDC’s ongoing efforts to transform Nigeria’s automotive industry, making it more sustainable while creating new opportunities for skilled technicians and local communities.

Chinedu Oguegbu, Managing Director of OMAA, which is the vehicle brand promoting the petrol-powered to CNG conversion project, highlighted the economic benefits of running vehicles on CNG instead of petrol.

He listed the economic advantages to include savings up to 60 percent in the cost of fuel relative to dirtier options like diesel and petrol.

According to him, there is up to 90 percent reduction in knocks and carbon emission, and it is found to be healthier, cleaner and more environmentally friendly.

Besides savings in foreign exchange (FX) with abundance of gas locally, there is also massive resources in-country over 203 tcf of proven reserves that requires no refining and relatively lower investment for processing.

Nigeria has an estimated 15-20 million vehicles in operation that can be converted to dual-fuel or bi-fuel.

The OMAA boss reiterated the crucial need to provide an alternative to existing fuel system with the abundance of CNG as an option.

Delivering his goodwill message, Chino Ogwumike, the National Sales Manager at Kojo Motors, thanked the DG of NADDC for partnering with Kojo in this laudable project in Owerri, the heartland of the South-East of Nigeria and the government of Imo State for accepting to provide the land for building the CNG hub in the state capital.

Ogwumike stated that the flourishing automotive dealership with branches spread across the country under the visionary leadership of the founder and Executive Chairman, Ikenna Oguegbu, is strongly committed to contributing its quota towards the progress and development of Nigeria’s automotive sector and the economy.

-

International3 days ago

International3 days agoUK announces new passport application fees starting April 2025

-

metro1 day ago

metro1 day ago‘We’re not hiring,’ NNPC denies viral recruitment adverts

-

metro18 hours ago

metro18 hours agoNatasha: Court blocks recall attempt, stops INEC

-

Sports19 hours ago

Sports19 hours agoOdegbami speaks on Osimhen breaking his 44-year goals record

-

metro2 days ago

metro2 days agoMore trouble brews in Rivers as Ijaw congress considers self-determination option

-

metro3 days ago

metro3 days agoCourt lifts order stopping Senate probe on Natasha Akpoti

-

metro3 days ago

metro3 days agoTanker explodes on Abuja bridge, many feared dead, 30 vehicles burnt

-

metro3 days ago

metro3 days agoMohbad’s brother, Adura, arrested by police in Lagos