News

Islamic banks serving Nigerians well, more coming – CBN gov

Islamic banks serving Nigerians well, more coming – CBN gov

The Central Bank of Nigeria on Sunday expressed relief that Nigerians have fully embraced the introduction of Islamic banking years after speculations made the round that it was an attempt to Islamise the country

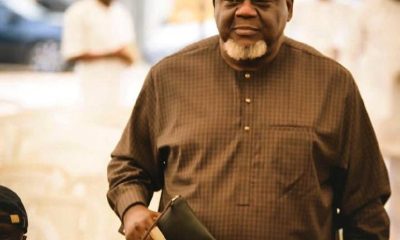

This was disclosed by the CBN Governor, Yemi Cardoso, at a reception organised to honour the Secretary-General, Organisation of Islamic Cooperation Arbitration Centre, Dr Umar Oseni in Abuja.

Cardoso, who was represented by the CBN Director of Legal Services, Kofo Salam-Alada, hinted that more shariah-compliant banks are being considered due to the immense benefits it has brought to the citizens, especially those into small and medium-scale businesses.

The apex bank governor further noted that he was quite impressed that Islamic financial institutions like Jaiz, Tajj, and Alternate Bank have stood the test of time since their establishment.

He said, “Some years back, the Central Bank of Nigeria started a journey for the introduction of the Islamic Banking and Financing in Nigeria. It came when a young man was appointed governor of CBN. But most people never knew that the first person who spearheaded the journey was to be a pastor of the church.

READ ALSO:

- Maldives bans Israeli passport holders over war on Gaza

- Mbappe agrees to five-year Real Madrid deal

- US hopeful Israel, Hamas will accept Gaza ceasefire plan

“He was also a part-time pastor when this journey started. So it was never an attempt to Islamise Nigeria or Islamise financing in Nigeria. When the Prince (Emir Sanusi) came, he continued the journey.

And that journey saw some of us, one of you, who is standing before you today, that started the transaction documents that started the relationship with one institution that Dr. Umar Oseni headed for about eight years.

“I am not advertising, but I can say we are proud of Jaiz, Tajj, and Alternate Bank and I believe many more will come. We are happy to drive on roads financed by Sukkuk in Nigeria and more billions will still come. So many products are on the card and Central Bank of Nigeria will not rest until financing gets to the grassroots.”

Reacting, Dr Oseni appreciated the audience who turned up at the event to celebrate his new appointment, saying they are the reason he has come far in life.

The OIC chief also expressed conviction that Islamic banking has come to stay in the country.

“We are living in a world where we are all interconnected. Let us ensure that we make a positive impact on anybody that comes our way. Touch the person positively without expecting appreciation.

“The focus of the OIC Arbitration Centre basically is on investment, financing, and commercial dispute resolution. So, in all the bilateral treaties Nigeria is entering into with other countries, we are going to ensure that there is a clause for dispute settlements,” he assured.

Islamic banks serving Nigerians well, more coming – CBN gov

News

Nigeria Customs Service begins 2025 recruitment [How to apply]

Nigeria Customs Service begins 2025 recruitment [How to apply]

The Nigeria Customs Service (NCS) has announced the commencement of its recruitment exercise, assuring Nigerians that the process is entirely free and fair.

The agency has cautioned the public to be vigilant against scammers who may attempt to exploit unsuspecting applicants during the recruitment period.

Applications are invited for positions in the Superintendent, Inspector, and Customs Assistant cadres as part of the Service’s plan to recruit 3,927 officers in 2025.

This initiative is aimed at enhancing trade facilitation and supporting Nigeria’s economic recovery efforts.

“Our recruitment is entirely free and fair. At no stage do we charge fees. Anyone requesting payment is a scammer,” the agency emphasized, urging applicants to be wary of fraudulent schemes.

READ ALSO:

- Dangote, Tinubu, Lookman, Badenoch named among 100 most influential Africans in 2024

- Heavy security in Ilesa as ex-Osun deputy gov emerges new Owa-Obokun

- Hacker has stolen N180m from my NGO account – VeryDarkMan cries out

The NCS outlined eligibility criteria, stating that applicants must be Nigerian citizens by birth, possess a valid National Identification Number (NIN), and have no criminal record or ongoing investigations.

Academic qualifications for the three cadres are as follows:

Superintendent Cadre: A university degree or Higher National Diploma (HND) along with an NYSC discharge or exemption certificate.

Inspectorate Cadre: A National Diploma (ND) or Nigeria Certificate in Education (NCE) from an accredited institution.

Customs Assistant Cadre: At least an O’Level certificate (WAEC or NECO).

In addition to these qualifications, the NCS stressed that all applicants must be physically and mentally fit, providing evidence of medical fitness from a recognized government hospital.

Nigeria Customs Service begins 2025 recruitment [How to apply]

News

Tinubu to critics: I won’t reduce my cabinet size

Tinubu to critics: I won’t reduce my cabinet size

President Bola Tinubu on Monday unequivocally responded to critics who described his cabinet as “bloated” by saying he is unprepared to reduce the size of his 48-man cabinet.

“I am not ready to shrink” the size of my cabinet, Tinubu said during a media chat at his Bourdillon residence in the highbrow Ikoyi area of Lagos State.

“I am not prepared to bring down the size of my cabinet,” the former Lagos governor said, arguing that “efficiency” has been at the core of his selection of ministers.

The president also said he has no regret removing the petrol subsidy in May 2023, saying Nigeria cannot continue to be Father Christmas to neighbouring countries.

READ ALSO:

- Kolawole Erinle: Appeal court affirms sentence for ex-convict over $1.4m fraud

- We’ve forced Lakurawa terrorists back to Mali, says FG

- Petrol: MRS enforces N935 per litre nationwide

“I don’t have any regrets whatsoever in removing petrol subsidy. We are spending our future, we were just deceiving ourselves, that reform was necessary,” he told reporters.

Tinubu appointed 48 ministers in August 2023, three months after his inauguration. The Senate immediately screened and confirmed the ministers. One of the ministers, Betta Edu, was suspended in January while another, Simon Lalong, moved to the Senate.

There were calls for the President to reshuffle his cabinet as many Nigerians have not been impressed by the performance of some of the ministers, especially in the face of unprecedented inflation, excruciating economic situation and rising insecurity.

In October 2024, Tinubu re-assigned 10 ministers to new ministerial portfolios and appointed seven new ministers for Senate confirmation. He also sacked five of his ministers but critics insist that the President’s cabinet remains large, especially with the creation of a Livestock Ministry with a minister.

Tinubu to critics: I won’t reduce my cabinet size

News

Tinubu: Food stampede incidents, grave error

Tinubu: Food stampede incidents, grave error

..Don’t publicise gifts distribution if you don’t have enough

President Bola Tinubu has described the recent three stampede incidents during distribution of relief materials to children and others as a grave error.

He told people to be more organised and stay away from giving palliative or publicity of the giving if they had insufficient materials.

He stated this during his first presidential media chat on Monday.

The President said he had been sharing palliatives in his Lagos residence for 25 years without any incident and blamed the recent food stampedes in the country on poor organisation.

A total of 35 children died on December 18 during a stampede that happened at a funfair event in Ibadan, Oyo State.

10 people, including children, also died on December 21 in another stampede at the Holy Trinity Catholic Church in the Maitama district of Abuja during the distribution of palliatives.

Another 22 people were reported dead during a rice distribution event at Amaranta Stadium in Ojika, Ihiala LGA, on the same day.

“It’s unfortunate and very sad, but we will continue to learn from our mistakes. I see this as a grave error on the part of the organisers,” he said.

But the President insisted that the incidents should not dampen the “happiness of the season”.

“It is very sad that people are not well organised. We just have to be more disciplined in our society. Condolences to those who lost members, but it is good to give,” Tinubu said.

“I’ve been giving out foodstuff and commodities, including envelopes in Bourdillon, for the last 25 years, and I’ve never experienced this kind of incident because we are organised and disciplined.

“If you know you won’t have enough to give, don’t attempt to give or publicise it.”

The President compared the situation to food banks in countries such as the United States of America (USA) and Britain, noting their structured approach.

“Every society, even in America, has food banks. They have hungry people. In Britain, they have food banks and warehouses, and they are organised. They take turns m lining up and collect,” he added.

-

Business3 days ago

Business3 days agoBe creative, monarch, others challenge Muslim professionals on economic revival

-

Auto2 days ago

Auto2 days agoLSM MD extols founder’s qualities after latter posthumous industry award

-

Entertainment2 days ago

Entertainment2 days agoMultiChoice announces free access to all DSTV channels for 3 days

-

metro2 days ago

metro2 days agoJigawa State governor loses son 24 hours after mother’s death

-

News1 day ago

News1 day agoNigeria Customs Service begins 2025 recruitment [How to apply]

-

metro1 day ago

metro1 day agoHeavy security in Ilesa as ex-Osun deputy gov emerges new Owa-Obokun

-

metro1 day ago

metro1 day agoLagos Imam to Tinubu: You haven’t disappointed us

-

metro1 day ago

metro1 day agoDangote, Tinubu, Lookman named among 100 most influential Africans in 2024 (Full list)