Business

Marketers formally adjust petrol pump price to N170-N190/litre

Premium Motor Spirit popularly known as petrol will now be sold between N170/litre and N190/litre in filling stations across the country, following what is believed to be a subtle agreement between Federal Government officials and oil marketers.

Findings by The PUNCH on Sunday revealed that the development was the outcome of a meeting between the Nigerian Midstream and Downstream Petroleum Regulatory Authority and oil marketers on Thursday.

Sources privy to the meeting said it was agreed that the pump price of petrol should be increased by N10 per litre.

A market survey on Sunday revealed that price display boards at some petrol stations in Lagos reflected new prices starting between N170 per litre and N175 per litre.

However, some other filling stations sold above these prices, with some selling as high as N185/litre.

Oil marketers denied holding a meeting with the NMDPRA on the subject matter but sources close to the matter confirmed to our correspondent that the meeting actually held.

The officials said the NMDPRA agreed marketers could increase their pump price to N165-N175/litre for filling stations inside towns, and a maximum of N190/litre for those on the outskirts.

READ ALSO:

- Woman with drugs in fetish bowls intercepted at Lagos airport

- How Infighting Caused APC’s Defeat In Osun

- Zamfara Gov Suspends Emir For Turbaning Bandit As Sarkin Fulani

“The meeting was held and everybody was told to keep mum. A band of N165-N175/litre was approved for the filling stations inside towns, while N189 was approved for those outside towns,” our source said.

The NMDPRA could not verify this claim as of press time on Sunday.

The spokesman for the NMDPRA, Kimchi Apollo, did not respond to several calls made to his telephone line.

However, marketers under the aegis of the Independent Petroleum Marketers Association of Nigeria confirmed the fuel pump price hike to our correspondent.

The National Operations Controller, IPMAN, Mike Osatuyi, explained the reasons behind the fuel pump price hike.

Osatuyi, who also denied that a meeting held between oil marketers and the Federal Government on Thursday, however, disclosed that there was a fresh increase, describing it as a “market fundamentally determined price.”

“Petrol now sells between N175-N180 per litre depending on the area, ‘’ he said.

“Petrol is now available and as you can see, the queues in Lagos and Abuja have disappeared. We are businessmen and it’s impossible for us to run at a loss. Marketers are allowed to sell at a minimum price of N170 and a maximum of N180. There’s something we call market fundamentals; this is what came into play here. This is because it is impossible to bring the product into your station at N170 and sell at N165,” he added.

When asked if there was a circular from the NMDPRA to the effect, he responded “no”, adding, “there was no meeting but what you saw was simply an increase due to market forces.”

Explaining further, he said the Pipelines and Product Marketing Company’s price template, which has the current official price of N165/litre, was arrived at about 12 ago.

“The template is 12 years old when the dollar was still N175 and diesel was sold at N200/litre. Now, diesel is around N850. Even major oil marketers have changed their price boards to reflect the new band. It’s no more hidden. It is better for fuel to be available at N180 or N185 than buying at N250 from black marketeers. Now, no more boys going around with jerry cans, you can drive in and buy with ease”, he said.

Meanwhile, findings showed on Sunday that fuel queues at petrol stations in Lagos and Abuja, which had lingered since February, suddenly disappeared over the weekend following the latest development.

Meanwhile, economist and Chief Executive Officer of the Centre for the Promotion of Private Enterprise, Dr. Muda Yusuf, told The PUNCH that the current price is not sustainable.

According to him, the government is in the best position to control the prices of petrol if it cannot control diesel prices.

He said, “Already, National Bureau of Statistics reports make us understand that except for Lagos, Abuja and other big cities, petrol prices are already above N165/litre. That is the market reality, except the government doesn’t want private entities to get involved in the market because these guys are there to do business and not to run at a loss. These marketers share their figures with everybody. Most of these guys are based in Lagos and they transport their products in trucks that run on diesel. Can the government control the prices of diesel? If they can’t then, they should hand off regulating prices. They should first resolve the surging diesel prices and challenges at the depots before pouncing on marketers. Otherwise, their businesses will close down, and black marketers will take over the business – that’s when we will see more adulterated products capable of burning down houses and cars,” he said.

Also, a former Chairman of the Major Oil Marketers of Nigeria, Tunji Oyebanji, declined to comment on the new price but told The PUNCH that the Federal Government’s price template was old and needed to be updated.

He said, “Nobody had any meeting with the NMDPRA. The only thing we have continued to say is that N165/litre is not sustainable because the template with which that price was arrived at made all the elements therein fixed and unchanged. Elements such as coastal, NPA, NIMASA jetty throughput, storage and financing, which were used to arrive at the ex-depot price were all based on the old dollar and old diesel prices.

“All the items on the template have currently gone up because of the exchange rate which impacted our operating costs due to the high cost of diesel. As of the time when the template was done, diesel was N130/litre, now it is N800 which allows for an operating cost of N4.00. That is why N165/litre cannot work. Nobody is saying price should be this or that, but that government should come to our aid.”

According to him, if the price is not increased, marketers will soon go out of business.

Also reacting, a former Group Chairman/Chief Executive Officer, International Energy Services Limited, Dr Diran Fawibe, said, “The whole process is not transparent. If we had allowed market forces to determine prices, we wouldn’t be in the dilemma that we are currently in. Everybody is just throwing up figures and at the end of the day; it’s the consumers that will pay for it. But as long as the government keeps giving subsidies, marketers will expect subsidies to keep increasing, and until we start to refine products in-country, the whole business will not just be murky but will soon turn into a monkey business.”

Business

Ban on Sachet Alcohol Will Trigger Job Losses, Smuggling — NECA Warns

Ban on Sachet Alcohol Will Trigger Job Losses, Smuggling — NECA Warns

The Nigeria Employers’ Consultative Association (NECA) has cautioned that a blanket ban on sachet alcoholic beverages would amount to economic suicide, warning that such a policy could worsen unemployment, encourage smuggling, and overstretch already burdened security and regulatory agencies.

Speaking with journalists on the ongoing debate over alcohol regulation in Nigeria, NECA’s Director-General, Mr. Smatt-Adewale Oyerinde, said prohibiting the production or sale of sachet alcohol would fail to address the root causes of alcohol abuse, particularly among young people, while inflicting serious economic and security consequences.

Oyerinde questioned the effectiveness of prohibition in a country with porous borders and limited enforcement capacity.

“If children under 18 are consuming alcohol, whose fault is it? Is it the parents, the schools, or the producers? Alcohol is not evil; abuse is the problem. Banning one product while others remain legal will not solve it,” he said.

He disclosed that more than ₦800 billion has been invested in the alcohol and allied industries, which employ thousands of Nigerians directly and indirectly. According to him, a sudden ban would lead to massive job losses, business closures, and loan defaults, further aggravating Nigeria’s unemployment crisis.

READ ALSO:

- One Feared Dead, Five Trapped as Rice Mill Collapses in Kebbi Capital

- Peter Obi Defects to ADC, Unveils Opposition Coalition Ahead of 2027 Elections

- UNN Students Reject 100% Fee Hike, Insist on Maximum 25% Increase

“We seem unconcerned about rising unemployment and the message such policies send to investors. If someone invests a billion dollars today, what assurance do they have that a policy will not abruptly shut down their business in a few years?” Oyerinde asked.

The NECA Director-General warned that scarcity created by a ban would only drive up prices and fuel illegal trade.

“When you ban a product you cannot effectively police, you simply create a thriving market for smugglers,” he noted, adding that unregulated foreign alcohol products had already flooded the market during the recent festive season.

He also argued that banning alcohol consumption in public places would merely shift consumption elsewhere.

“If people cannot drink on the streets, they will drink at home. If not at home, then in their cars. So what exactly have we solved?” he queried.

Oyerinde stressed that agencies such as the Nigeria Police, Customs, and other regulatory bodies would be overwhelmed by the additional burden of enforcing a ban, insisting that policy decisions must consider the broader economic impact.

Rather than imposing a blanket ban, NECA called for targeted and coordinated solutions, including stronger institutions, improved regulation, and innovative enforcement strategies such as random checks and sobriety testing, as practiced in other countries.

“A blanket ban is a lazy approach. What Nigeria needs is thoughtful and dynamic policymaking that tackles abuse, protects young people, and preserves jobs without damaging the wider economy,” he said.

He added that NECA was willing to collaborate with government agencies, including NAFDAC, to develop practical and sustainable solutions to alcohol abuse in Nigeria.

Ban on Sachet Alcohol Will Trigger Job Losses, Smuggling — NECA Warns

Aviation

VAT on Aircraft, Spare Parts Threatens Survival of Nigerian Airlines, says Allen Onyema

VAT on Aircraft, Spare Parts Threatens Survival of Nigerian Airlines, says Allen Onyema

The Air Peace CEO, Allen Onyema, has warned that Nigeria’s new tax laws threaten the survival of local airlines, arguing that the legislation reinstates taxes removed under the 2020 reforms. The taxes include customs duties on imported aircraft, aircraft parts, engines, and Value Added Tax (VAT) on tickets, which Onyema says will impose unsustainable financial burdens on airlines.

Speaking in an interview with Arise News on Sunday, Onyema stressed the high cost implications for airline operators.

“There is VAT on the importation of aircraft. For an aircraft worth $80 million, you are supposed to pay 7.5 percent. With bank loan interest rates at 30–35 percent, plus VAT on spare parts, it is unsustainable,” Onyema said. “If we implement that tax reform, Nigerian airlines will go down in three months.”

The Air Peace CEO also announced that the airline industry will no longer tolerate unruly passengers starting January 1, 2026. Onyema cited instances of disruptive behaviour by passengers on flights, including smuggling alcohol into the cabin, forcing upgrades to business class without payment, and threatening fellow travellers.

READ ALSO:

- Train Derailment in Southern Mexico Kills 13, Injures Nearly 100 in Oaxaca

- Tragedy in Lekki as Lexus SUV Crashes Into Children, One Feared Dead, Four Injured

- Presidency Intervenes in Akume, Alia Political Dispute in Benue

He referenced a recent incident on a flight diverted to Manchester, UK, due to bad weather, where passengers staged a viral video accusing Air Peace of misconduct, despite British authorities confirming that over 200 flights were diverted that day.

Onyema emphasised that airlines will now enforce stricter measures, including blacklisting unruly passengers, asserting that the behaviour is currently being “supported by the system unnecessarily.”

The statement comes amid growing concerns over rising domestic airfares. On December 10, the Senate summoned the Aviation Minister, Festus Keyamo, and industry stakeholders over soaring ticket prices. Subsequently, on December 11, the House of Representatives called on the federal government to reduce aviation taxes by 50 percent to ease costs for travellers.

Onyema’s comments highlight both the financial pressures on Nigerian airlines due to aviation taxes and the sector’s new stance on passenger discipline to safeguard safety and service standards.

VAT on Aircraft, Spare Parts Threatens Survival of Nigerian Airlines, says Allen Onyema

Auto

Changan CS55, Kia Seltos take top SUV honours at 2025 NAJA Auto Awards

Changan CS55, Kia Seltos take top SUV honours at 2025 NAJA Auto Awards

Changan CS55 and Kia Seltos have clinched top honours at the 2025 Nigeria Auto Journalists Association (NAJA) International Auto Awards, winning Midsize SUV of the Year and Compact SUV of the Year, respectively.

The awards were announced at a recent well-attended ceremony held at the Oriental Hotel, Victoria Island, Lagos, which brought together key stakeholders across Nigeria’s automotive value chain to celebrate excellence, resilience and innovation in the industry.

Changan CS55’s latest recognition comes after its impressive performance at last year’s 17th edition of the awards, where it was crowned Nigeria’s New Car of the Year.

At the 2025 ceremony, the compact crossover SUV edged out strong contenders such as the Kia Sonet and Chery Tiggo to secure the coveted Midsize SUV title.

Changan vehicles are marketed and assembled in Nigeria by Mikano Motors, reinforcing the growing impact of local assembly in the country’s automotive sector.

In the Compact SUV category, the Kia Seltos emerged winner, beating notable competitors such as the Toyota Prado, Changan CS55 and Chery Tiggo.

READ ALSO:

- Ojuelegba Bridge Gridlock as Container Truck Overturns in Surulere, Lagos

- Troops Foil Kidnapping on Otukpo–Enugu Expressway, Rescue Passengers in Benue

- Davido Joins Accord Party, Aligns With Uncle, Osun Governor Ademola Adeleke

Industry analysts have described the Seltos as a compelling blend of practicality and style, praising its bold design, versatility and appeal to modern drivers.

Other corporate winners at the event are the Mikano Group, which was named Auto Company of the Year; Iron Products Industries (IPI) Limited, honoured as Truck Assembler/Body Builder of the Year; Lanre Shittu Motors (JAC), awarded Truck Plant of the Year; and Innoson Vehicle Manufacturing (IVM), which won Passenger Car Assembly Plant of the Year.

These recognitions highlighted the depth and growing strength of indigenous participation in Nigeria’s automotive industry.

Speaking at the ceremony, the Director-General of the National Automotive Design and Development Council (NADDC), Otunba Joseph Osanipin, commended NAJA for sustaining a credible platform promoting excellence and accountability within the sector.

In his welcome address, NAJA Chairman Mr Theodore Opara described the awards as a benchmark for performance in Nigeria’s evolving automotive ecosystem, noting that the industry continues to adapt amid policy reforms, technological advancements and changing consumer expectations.

The 2025 NAJA International Auto Awards once again underscored the critical role of leading brands in strengthening Nigeria’s transportation and industrial backbone, while celebrating outstanding achievements across the nation’s automotive landscape.

Changan CS55, Kia Seltos take top SUV honours at 2025 NAJA Auto Awards

-

metro3 days ago

metro3 days agoNiger Delta Crackdown: Army Seizes ₦150m Stolen Oil, Arrests 19 Suspects

-

Sports3 days ago

Sports3 days agoCristiano Ronaldo Wins Best Middle East Player at 2025 Globe Soccer Awards in Dubai

-

Sports3 days ago

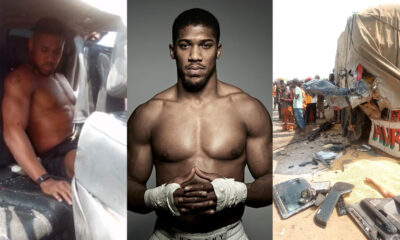

Sports3 days agoAnthony Joshua injured as two die in fatal Lagos-Ibadan Expressway crash (plus photos)

-

metro2 days ago

metro2 days agoMrs. Regina Akume Urges SGF George Akume to Return to Christianity Amid New Marriage

-

metro2 days ago

metro2 days agoTwo Close Aides of Anthony Joshua Identified as Victims of Fatal Crash

-

metro2 days ago

metro2 days agoOgun Man Arrested After ₦4,000 Debt Dispute Claims Stepbrother’s Life

-

metro2 days ago

metro2 days agoMalami, Son, Wife Remanded Over ₦Billions Money Laundering Charges

-

metro2 days ago

metro2 days agoTinubu Condoles Anthony Joshua After Ogun Crash That Killed Two Associates