Business

Naira gains further against dollar at official window, parallel market

Naira gains further against dollar at official window, parallel market

On Monday, the naira gained to N1,120 per dollar in the parallel part of the foreign currency (FX) market.

The current FX rate is a 9.67% reduction from the N1,240/$ recorded on April 3.

Bureau de change (BDC) operators, popularly known as street traders, in Lagos quoted the local currency’s buying rate at N1,100 and selling rate at N1,120, leaving a profit of N20.

The local currency rose 1.63 percent to N1,230.61/$ on Monday, from N1251.05/$ on April 5.

FMDQ Exchange, a platform that oversees the Nigerian Autonomous Foreign Exchange Market (NAFEM), also known as the official window, reported a turnover of $125.55 million.

At the end of trading, the gap between the parallel market and the official window rates stood at N110.61.

READ ALSO:

- BREAKING: NLC sacks Peter Obi ally, Abure’s NWC

- FG launches app for Nigerians to track ministers’ performances

- Police nab suspected armed robbery kingpin, 4 others in Abuja

Meanwhile, on March 10, Goldman Sachs had predicted that the naira would appreciate to N1,200 against the dollar in the next 12 months.

“We thus see reason for the Naira to be undervalued, and we see it appreciating to 1200 within the next 12 months,” Goldman Sachs said.

Goldman Sachs said Nigeria is “turning the corner” following its recent currency crisis.

The naira has been depreciating amid the Central Bank of Nigeria’s (CBN) intervention in the foreign exchange market.

In February, CBN sold $20,000 to each BDC at the rate of N1,301/$. However, in March, the apex bank sold $10,000 to each BDC at the rate of N1,251/$.

The rate CBN sold dollars to BDC operators was further reduced to N1,101/$1 on Monday when the apex bank announced plans to sell $10,000 to the BDCs.

Naira gains further against dollar at official window, parallel market

Business

Forex: FG to delist naira from P2P platforms

Forex: FG to delist naira from P2P platforms

The Federal Government is set to delist the naira from all Peer-to-Peer platforms to reduce the manipulation of the local currency value in the foreign exchange market.

Director General of the Securities and Exchange Commission, Emomotimi Agama, made this known on Monday at a virtual conference with blockchain stakeholders.

The goal of this resolution is to combat manipulation of the value of the local currency in the foreign exchange market.

In past months, the nation’s regulatory bodies have started looking into and closely examining cryptocurrency exchanges.

This is part of a number of regulations to be rolled out in the coming days.

He said, “That is one of the things that must be done to save this space. The delisting of the naira from the P2P platforms to avoid the level of manipulation that is currently happening.

“I want your cooperation in dealing with this as we roll out regulations in the coming days.”

The SEC DG decried how some market players were manipulating the value of the naira.

This, he said, was why the commission was “seeking collaboration and help in making sure that the crypto environment is respected globally”.

Business

Ikeja Electric cuts tariff for Band A customers

Ikeja Electric cuts tariff for Band A customers

The Ikeja Electricity Distribution Company has announced a reduction in the tariff for customers under Band A classification from N225 per kilowatt-hour to N206.80kw/h

This is coming about a month after the Nigerian Electricity Regulatory Commission (NERC) approved an increase in electricity tariff for customers under the Band A category to N225 per kwh — from N66.

The commission has clarified that customers under Band A receive between 20 and 24 hours of electricity supply daily.

Ikeja Electric said in a circular on Monday the cut in the new tariff rate would take effect from May 6, 2024.

Business

Finally, NERC unbundles TCN, creates new system operator

Finally, NERC unbundles TCN, creates new system operator

The Nigerian Electricity Regulatory Commission (NERC) has set up the Nigerian Independent System Operator of Nigeria Limited (NISO) as it unbundles the Transmission Company of Nigeria (TCN).

The transmission leg of the power sector has over the years been seen as weakest link with obsolete equipment.

The unbundling announcement is contained in an Order dated April 30, 2023 and jointly signed by NERC chairman, Sanusi Garba, and vice chairman, Musiliu Oseni.

By this order, the TCN is expected to transfer all market and system operation functions to the new company.

The commission had previously issued transmission service provider (TSP) and system operations (SO) licences to the TCN, in accordance with the Electric Power Sector Reform Act.

The Electricity Act 2023, which came into effect on June 9, provided clearer guidelines for the incorporation and licensing of the independent system operator (ISO), as well as the transfer of assets and liabilities of TCN’s portion of the ISO.

In the circular, the commission ordered the Bureau of Public Enterprises (BPE) to incorporate, unfailingly on May 31, a private company limited by shares under the Companies and Allied Matters Act (CAMA), 2020.

NERC said the company is expected “to carry out the market and system operation functions stipulated in the Electricity Act and the terms and conditions of the system operation licence issued to the TCN.

“The name of the company shall, subject to availability at Corporate Affairs Commission, be the Nigerian Independent System Operator of Nigeria Limited (“NISO”),” NERC said.

Citing the object clause of the NISO’s memorandum of association (MOU) as provided in the Electricity Act, NERC said the company would “hold and manage all assets and liabilities pertaining to market and system operation on behalf of market participants and consumer groups or such stakeholders as the Commission may specify.”

-

Sports2 days ago

Sports2 days agoRonaldo’s hat-trick leads Al Nassr to 6-0 victory over Al Wehda

-

International2 days ago

International2 days agoGaza: Thousands rally for hostage deal as ceasefire talks continue

-

Entertainment2 days ago

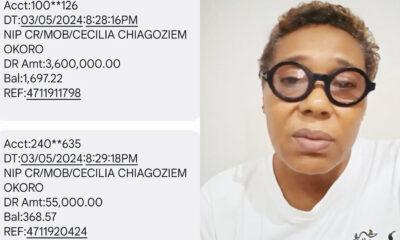

Entertainment2 days agoNollywood veteran Shan George weeps as fraudster clears ₦3.6m from her account (VIDEO)

-

metro1 day ago

metro1 day agoDSS seals Plateau clinic over patient’s death

-

News3 days ago

News3 days agoDon’t host US, French military bases in Nigeria, northern leaders warn Tinubu

-

Politics1 day ago

Politics1 day agoPDP: Sule Lamido blames court for mass resignation from party

-

News2 days ago

News2 days agoUpdated: NNPC blames fuel scarcity on panic buying, hoarding, marketers disagree

-

metro3 days ago

metro3 days agoEx-FCMB manager sentenced to 121-year imprisonment